10++ Money laundering risk from customer need not be reviewed information

Home » money laundering Info » 10++ Money laundering risk from customer need not be reviewed informationYour Money laundering risk from customer need not be reviewed images are ready in this website. Money laundering risk from customer need not be reviewed are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering risk from customer need not be reviewed files here. Download all free photos.

If you’re looking for money laundering risk from customer need not be reviewed images information connected with to the money laundering risk from customer need not be reviewed interest, you have come to the ideal blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Money Laundering Risk From Customer Need Not Be Reviewed. The six step 360 Degree Risk-Based Investigations Model provides consistency of approach and applies critical thinking thought processes by anti-money laundering AML investigators conducting their investigations to determine if the transactional activity or attempted activity under review is suspicious or not. Not All Customers Are Created Equal. Customer Risk Categorization Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. They are intended to be.

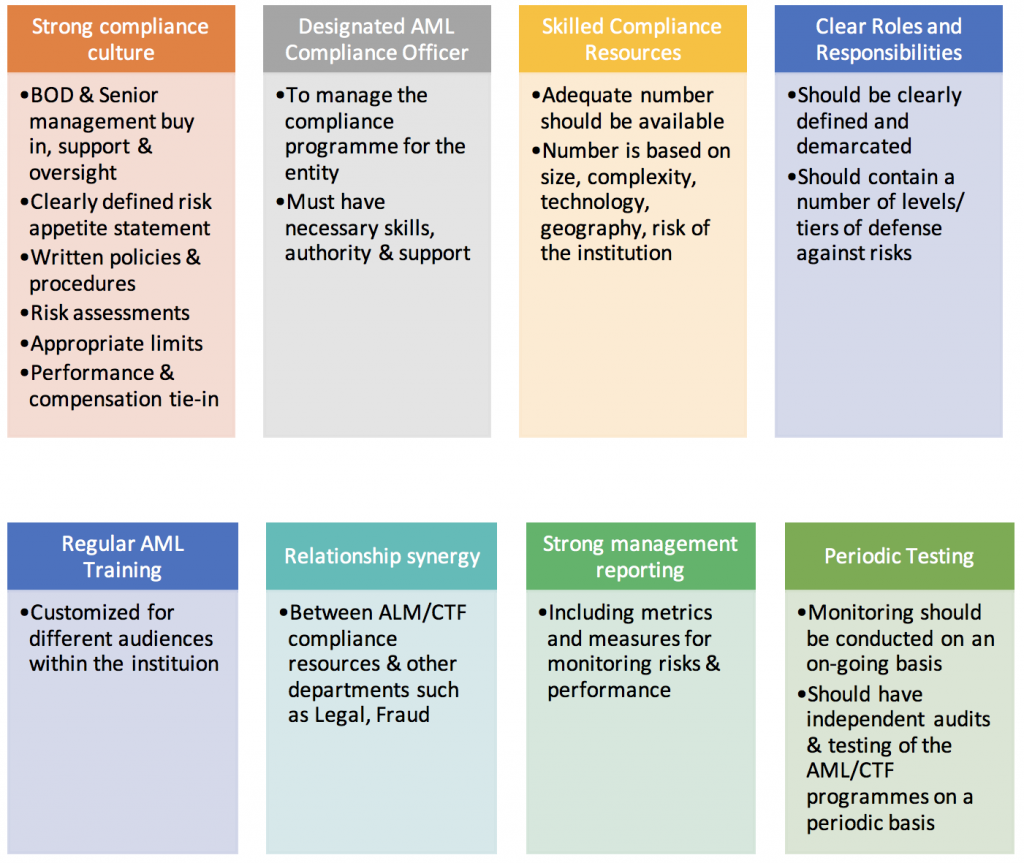

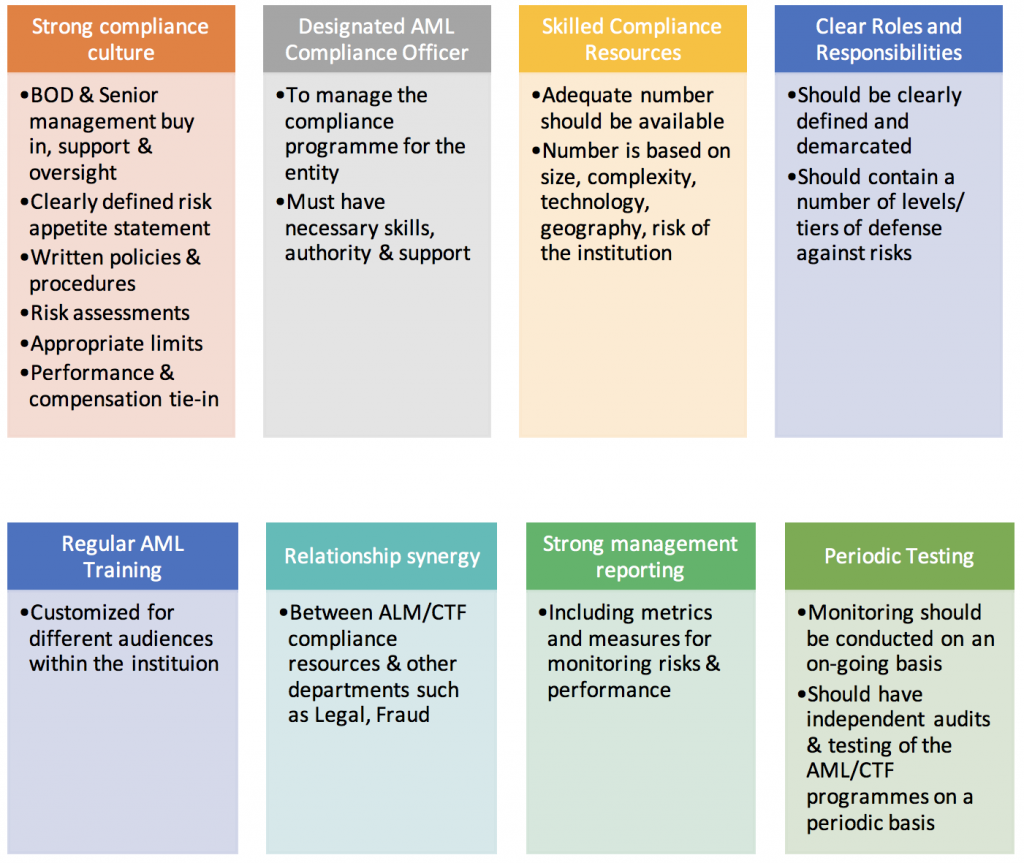

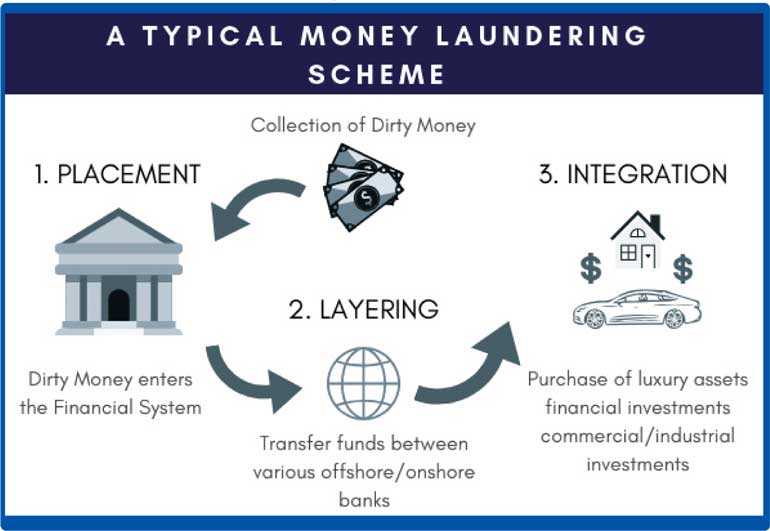

Anti Money Laundering Programmes Systems Financetrainingcourse Com From financetrainingcourse.com

Anti Money Laundering Programmes Systems Financetrainingcourse Com From financetrainingcourse.com

Customers inevitably including some criminals see London as a convenient and increasingly important centre for conducting financial transactions. Sound risk assessment and whether they are -based and risk proportionate given the countrys MLTF risks. They include new guidance on MLTF risk assessments customer due diligence for. These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more. The types of customer you have. Being estimated at between US800 billion to US2 trillion every year money laundering is a serious problem for the global economy.

While regulators and financial institutions are working hard to prevent and reduce the crime launderers are becoming increasingly.

High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. Need for New Customer Risk Rating Models. Their inclusion in this Paper does not amount to an endorsement by FATF. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. Banks should apply enhanced due diligence measures based on the risk assessment thereby requiring intensive due diligence for higher risk customers especially those for whom the sources of funds are not.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

This overall risk rating is normally a cumulative average of the. If you are only offering fixed sum credit with deferred payments of. Most of the examples have not yet been reviewed by a FATFFSRB mutual evaluation. Assess the adequacy of the banks systems to manage the risks associated with lending activities and managements ability to implement effective due diligence monitoring and reporting systems. Where you and your customers are based.

Source: pideeco.be

Source: pideeco.be

The ability to differentiate legitimate from suspicious activity will become more of a. These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more. The six step 360 Degree Risk-Based Investigations Model provides consistency of approach and applies critical thinking thought processes by anti-money laundering AML investigators conducting their investigations to determine if the transactional activity or attempted activity under review is suspicious or not. While regulators and financial institutions are working hard to prevent and reduce the crime launderers are becoming increasingly. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation.

Source: pinterest.com

Source: pinterest.com

Assess the adequacy of the banks systems to manage the risks associated with lending activities and managements ability to implement effective due diligence monitoring and reporting systems. Anti-money laundering AML rules in the Handbook for these firms set out in SYSC 6366310 including the requirements for most consumer credit firms other than sole practitioners and limited permission firms to appoint a money laundering reporting officer MLRO. Need for New Customer Risk Rating Models. Lending activities include but are not. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Source: ft.lk

Source: ft.lk

Most of the examples have not yet been reviewed by a FATFFSRB mutual evaluation. Not All Customers Are Created Equal. Customer Risk Categorization Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. Lending activities include but are not. The types of customer you have.

Source: pinterest.com

Source: pinterest.com

Most of the examples have not yet been reviewed by a FATFFSRB mutual evaluation. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Grow private banks operating out of the UK should be more vigilant about the risk of money laundering. The ability to differentiate legitimate from suspicious activity will become more of a. Anti-money laundering AML rules in the Handbook for these firms set out in SYSC 6366310 including the requirements for most consumer credit firms other than sole practitioners and limited permission firms to appoint a money laundering reporting officer MLRO.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

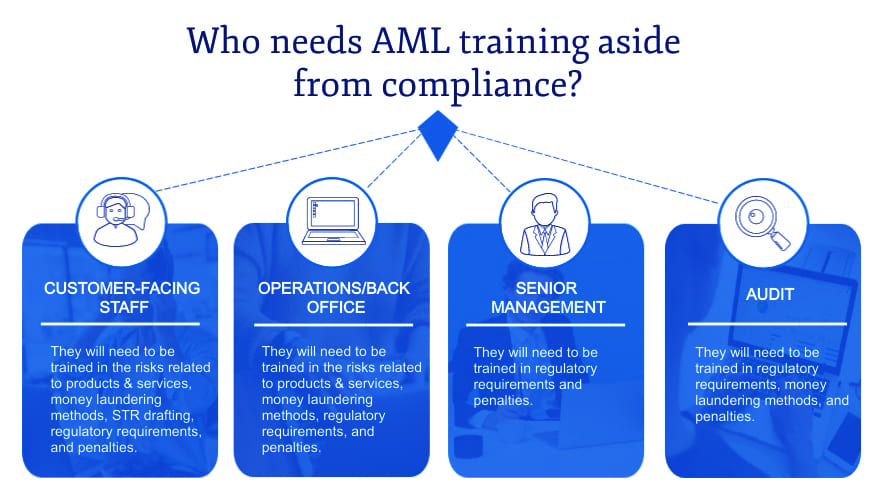

Being estimated at between US800 billion to US2 trillion every year money laundering is a serious problem for the global economy. Money laundering risk from customer need not be reviewed. Drug cartels have been known to attempt to launder money via gambling centers. Need for New Customer Risk Rating Models. This overall risk rating is normally a cumulative average of the.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Drug cartels have been known to attempt to launder money via gambling centers. The ability to differentiate legitimate from suspicious activity will become more of a. Banks should apply enhanced due diligence measures based on the risk assessment thereby requiring intensive due diligence for higher risk customers especially those for whom the sources of funds are not. While regulators and financial institutions are working hard to prevent and reduce the crime launderers are becoming increasingly. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks.

Source: bi.go.id

Source: bi.go.id

The ability to differentiate legitimate from suspicious activity will become more of a. The determination or conclusion is in the context of suspecting based on. These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more. Banks should apply enhanced due diligence measures based on the risk assessment thereby requiring intensive due diligence for higher risk customers especially those for whom the sources of funds are not. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to.

Source: bi.go.id

The six step 360 Degree Risk-Based Investigations Model provides consistency of approach and applies critical thinking thought processes by anti-money laundering AML investigators conducting their investigations to determine if the transactional activity or attempted activity under review is suspicious or not. Money laundering risk from customer need not be reviewed. If you are only offering fixed sum credit with deferred payments of. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. To identify geographic risks review where the customer wants to do business along with the place the funds are coming from or going to.

Source: pinterest.com

Source: pinterest.com

Anti-money laundering AML rules in the Handbook for these firms set out in SYSC 6366310 including the requirements for most consumer credit firms other than sole practitioners and limited permission firms to appoint a money laundering reporting officer MLRO. Customers that are likely to pose a higher than average risk to the bank should be categorised as medium or high risk depending on customers background nature and location of activity country of origin sources of funds and his client profile etc. They are intended to be. These revised guidelines on MLTF risk factors take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs implementation reviews and in the ESAs 2019 Joint Opinion on MLTF risks. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

Source: acamstoday.org

Source: acamstoday.org

The ability to differentiate legitimate from suspicious activity will become more of a. Their inclusion in this Paper does not amount to an endorsement by FATF. These revised guidelines on MLTF risk factors take into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs implementation reviews and in the ESAs 2019 Joint Opinion on MLTF risks. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. They include new guidance on MLTF risk assessments customer due diligence for.

Source: bi.go.id

Source: bi.go.id

This risk is based on the risk perceptions associated with the parameters comprising a customers profile and the risk associated with the product and channel being used by him. Also take into account your location and the customers location. The overall goal of customer risk assessment is to generate a single overall customer risk rating of low medium or high. This overall risk rating is normally a cumulative average of the. These are just some examples of money-laundering risk categories for your firm to consider and there are certainly more.

Source: complyadvantage.com

Source: complyadvantage.com

Being estimated at between US800 billion to US2 trillion every year money laundering is a serious problem for the global economy. Risks Associated with Money Laundering and Terrorist Financing. While regulators and financial institutions are working hard to prevent and reduce the crime launderers are becoming increasingly. Customer Risk Categorization Customer risk in the present context refers to the money laundering risk associated with a particular customer from a banks perspective. Customers that are likely to pose a higher than average risk to the bank should be categorised as medium or high risk depending on customers background nature and location of activity country of origin sources of funds and his client profile etc.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk from customer need not be reviewed by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.