11++ Money laundering risk factors ideas in 2021

Home » money laundering idea » 11++ Money laundering risk factors ideas in 2021Your Money laundering risk factors images are ready in this website. Money laundering risk factors are a topic that is being searched for and liked by netizens today. You can Download the Money laundering risk factors files here. Download all royalty-free vectors.

If you’re looking for money laundering risk factors images information related to the money laundering risk factors topic, you have pay a visit to the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

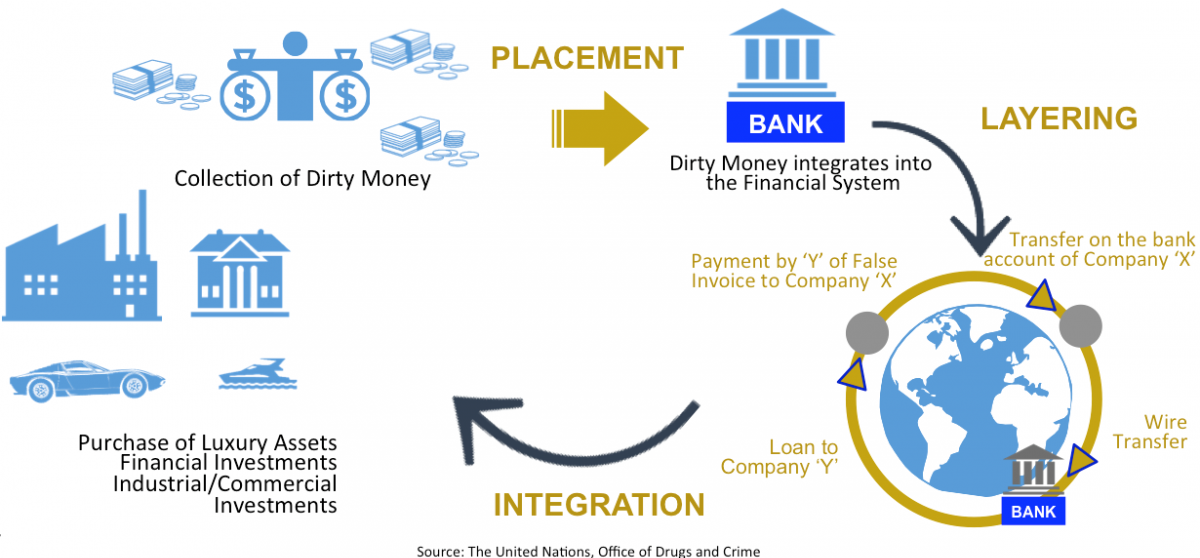

Money Laundering Risk Factors. A trade entity or its owners or senior managers appear in negative news eg. Get alerts by email or via your next login. Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. It is an Excel-based model that enables countries to identify the main drivers of MLTF risks.

Evaluating The Risk Based Approach Acams Today From acamstoday.org

Evaluating The Risk Based Approach Acams Today From acamstoday.org

When building up a list of high-risk areas a bank may determine appropriate risk factors based on the practices of branches or subsidiaries and its needs. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. A trade entity maintains a minimal number of working staff inconsistent with. On 1 March 2021 the EBA published its final report setting out revised guidelines on customer due diligence CDD and the factors credit and financial institutions should consider when assessing money laundering ML and terrorist financing TF risk associated with business relationships and occasional transactions under Articles 17 and 184 of Fourth Money Laundering Directive EU. Risk-based approach means an approach whereby competent authorities and firms. A trade entity or its owners or senior managers appear in negative news eg.

It provides a methodological process based on the understanding of the causal relations among money laundering risk factors and variables relating to the regulatory institutional and economic environment.

Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. Get alerts by email or via your next login. Because non-PEP customers may be a risk for corruption-related money laundering depending on these factors reporting institutions should take steps to understand such risk outside the context of identifying and monitoring PEPs. Past money laundering schemes fraud tax evasion other criminal activities or ongoing or past investigations or convictions. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. CLEAR delivers up-to-the minute full due diligence reportsthat red flag criminal and court records and any changes to business ownership foreign assets and more.

A trade entity or its owners or senior managers appear in negative news eg. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. A trade entity or its owners or senior managers appear in negative news eg. A trade entity maintains a minimal number of working staff inconsistent with. The source of the customers wealth the nature of the customers business and the extent to which the customers business history presents an increased risk for money laundering and terrorist financing.

Source: gov.si

Source: gov.si

It provides a methodological process based on the understanding of the causal relations among money laundering risk factors and variables relating to the regulatory institutional and economic environment. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. Money Laundering is not an independent crime it depends upon another crime predicate offence the proceeds of which is the subject matter of the crime in money laundering. Nature of the customers wealth and the customers business. On its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering.

Source: shuftipro.com

Source: shuftipro.com

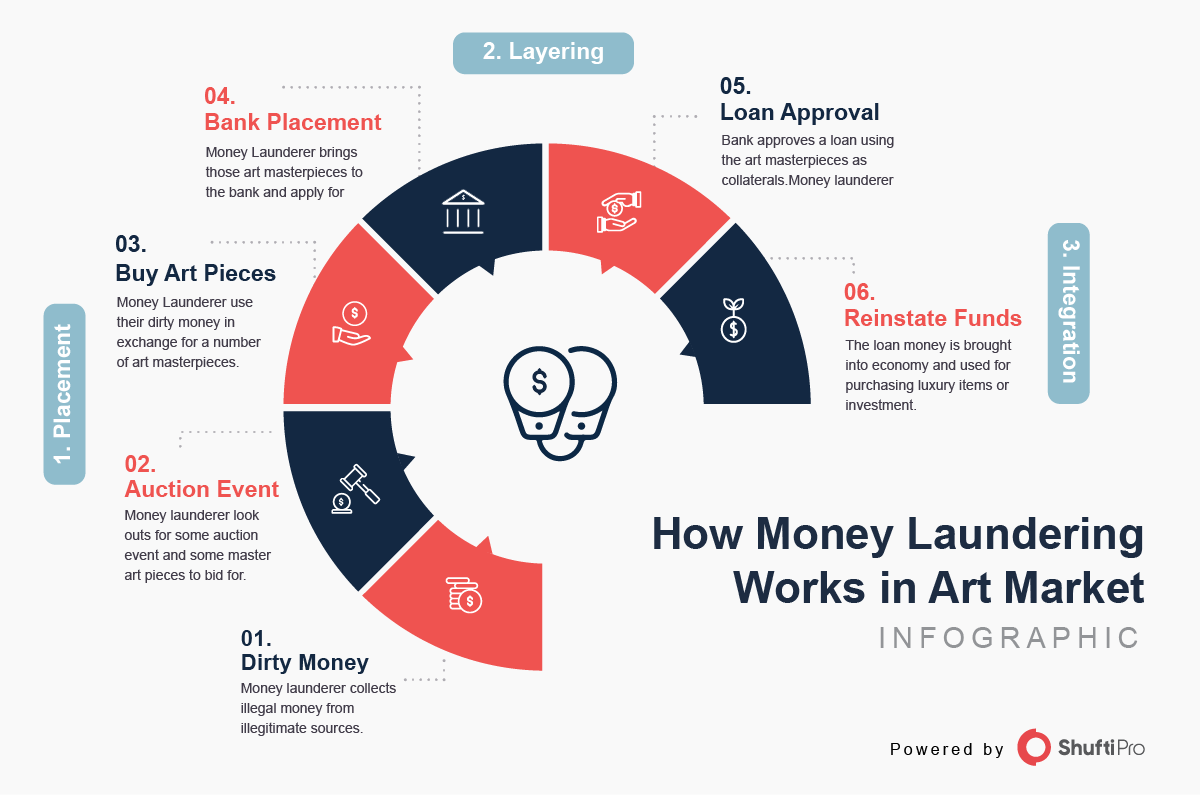

On its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Money Launderers accumulate enormous profits through drug trafficking international frauds arms dealing etc. The MLTF risks identified by the EBA include those that are applicable to the entire financial system for instance the use of innovative financial services while others affect specific sectors such as de-risking. CLEAR delivers up-to-the minute full due diligence reportsthat red flag criminal and court records and any changes to business ownership foreign assets and more. Past money laundering schemes fraud tax evasion other criminal activities or ongoing or past investigations or convictions.

Source: greenclimate.fund

Source: greenclimate.fund

The MLTF risks identified by the EBA include those that are applicable to the entire financial system for instance the use of innovative financial services while others affect specific sectors such as de-risking. The fact is any customer can devolve to become a risk. It provides a methodological process based on the understanding of the causal relations among money laundering risk factors and variables relating to the regulatory institutional and economic environment. The source of the customers wealth the nature of the customers business and the extent to which the customers business history presents an increased risk for money laundering and terrorist financing. Nature of the customers wealth and the customers business.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

It is an Excel-based model that enables countries to identify the main drivers of MLTF risks. Money Laundering is not an independent crime it depends upon another crime predicate offence the proceeds of which is the subject matter of the crime in money laundering. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. You should consider whether you understand how.

Source: redalyc.org

Source: redalyc.org

Past money laundering schemes fraud tax evasion other criminal activities or ongoing or past investigations or convictions. EBA publishes final revised Guidelines on money laundering and terrorist financing risk factors. On its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Risk-based approach means an approach whereby competent authorities and firms. The used risk factors include data on organised crime investments beneficial owners and confidential information from the Dutch Tax Office on anomalies in tax declarations by companies.

Source: pinterest.com

Source: pinterest.com

Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. Our results indicate that casinos hotels and the art and entertainment sector have the highest money laundering risks in the Netherlands. The following factors should be considered when identifying risk characteristics of private banking customers. EBA publishes final revised Guidelines on money laundering and terrorist financing risk factors. The source of the customers wealth the nature of the customers business and the extent to which the customers business history presents an increased risk for money laundering and terrorist financing.

Source: redalyc.org

Source: redalyc.org

Geographic and country risk entities and clients risks and lastly product and transactions risk. A bank should identify geographic areas that are exposed to higher MLTF risks. Because non-PEP customers may be a risk for corruption-related money laundering depending on these factors reporting institutions should take steps to understand such risk outside the context of identifying and monitoring PEPs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Money Laundering is not an independent crime it depends upon another crime predicate offence the proceeds of which is the subject matter of the crime in money laundering.

Source: pideeco.be

Source: pideeco.be

On its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Risk-based approach means an approach whereby competent authorities and firms. Get alerts by email or via your next login. Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. The MLTF risks identified by the EBA include those that are applicable to the entire financial system for instance the use of innovative financial services while others affect specific sectors such as de-risking.

Source: kyc2020.com

Source: kyc2020.com

These Guidelines are central to the EBAs work to lead coordinate and monitor the fight against money laundering and terrorist financing MLTF. Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. A bank should identify geographic areas that are exposed to higher MLTF risks. EBA publishes final revised Guidelines on money laundering and terrorist financing risk factors. Banking institution are the most frequently used instruments by money launderer due to several factors including multiple services provided by financial institutions including deposits loans and foreign exchange Idowu Obasan 2012.

Source: acamstoday.org

Source: acamstoday.org

The tool comprises several interrelated modules. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. A trade entity maintains a minimal number of working staff inconsistent with. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks.

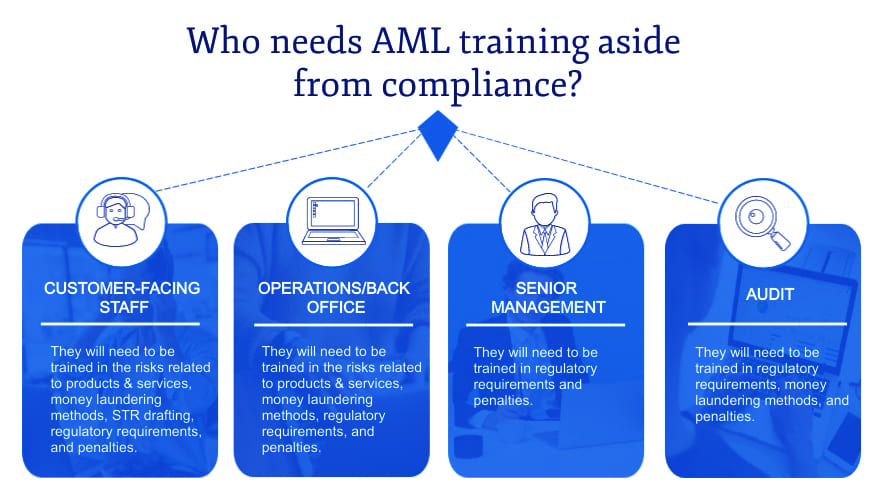

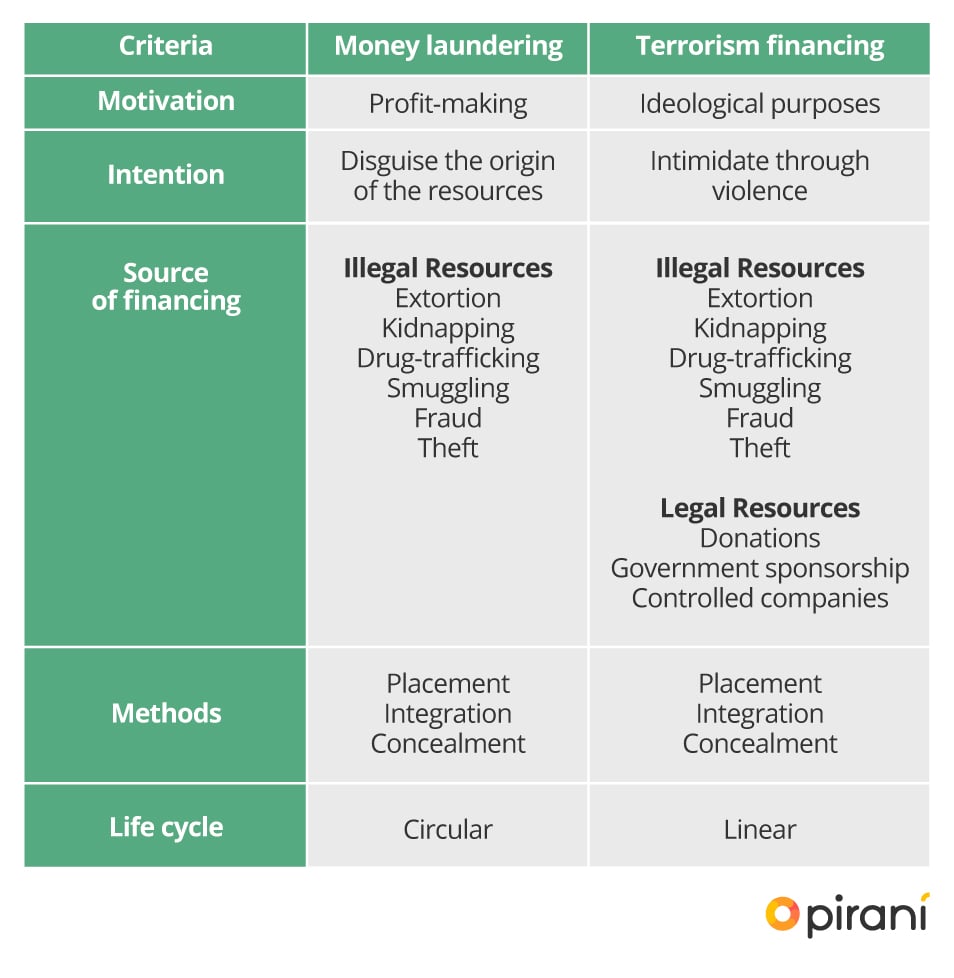

Source: piranirisk.com

Source: piranirisk.com

The European Banking Authority EBA today published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. The source of the customers wealth the nature of the customers business and the extent to which the customers business history presents an increased risk for money laundering and terrorist financing. A trade entity maintains a minimal number of working staff inconsistent with. Nature of the customers wealth and the customers business.

Source: in.pinterest.com

Source: in.pinterest.com

Our results indicate that casinos hotels and the art and entertainment sector have the highest money laundering risks in the Netherlands. Risk factors means variables that either on their own or in combination may increase or decrease the MLTF risk posed by an individual business relationship or occasional transaction. The European Banking Authority EBA today published its biennial Opinion on risks of money laundering and terrorist financing MLTF affecting the European Unions financial sector. You should consider whether you understand how. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk factors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.