17+ Money laundering risk definition ideas

Home » money laundering Info » 17+ Money laundering risk definition ideasYour Money laundering risk definition images are available in this site. Money laundering risk definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering risk definition files here. Get all free photos.

If you’re looking for money laundering risk definition images information linked to the money laundering risk definition keyword, you have come to the ideal site. Our site always provides you with hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Money Laundering Risk Definition. Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of terrorism risks related to life insurance transactions. Banks may also provide currency to ISOs under a lending agreement which exposes those banks to various risks including reputation and credit risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. However it can also be the Achilles heel of criminal activity.

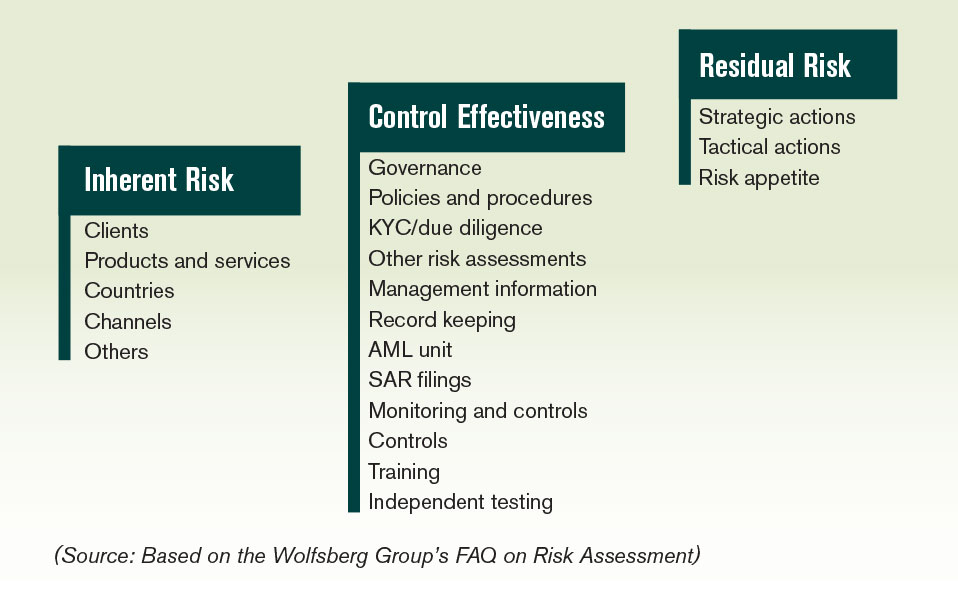

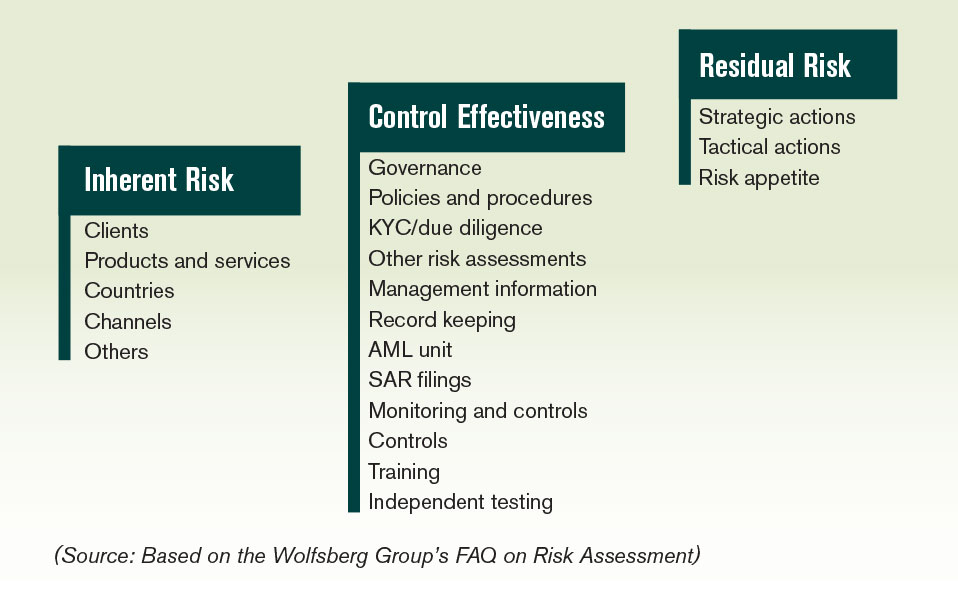

Financial Crime Risk Assessment Acams Today From acamstoday.org

Financial Crime Risk Assessment Acams Today From acamstoday.org

Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of terrorism risks related to life insurance transactions. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer. Money laundering is a threat to the good functioning of a financial system. These guidelines describe how banks should include risks related to money laundering and financing of terrorism within their overall risk management framework. Advance cash payment of large amounts for future transactions or fees. Prudent management of these risks together with effective supervisory oversight is critical in protecting the safety and soundness of banks as well as the integrity of the financial.

Criminals use money laundering to conceal their crimes and the.

In terms of money laundering risk assessment âœcompliance function is the second line of defenseâ CO1. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of terrorism risks related to life insurance transactions. All the actors involved in the prevention of money laundering governments law enforcement agencies public authorities banks and professionals have been asked to shift from a rule-based paradigm to a risk-based approach allocating their AML. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer.

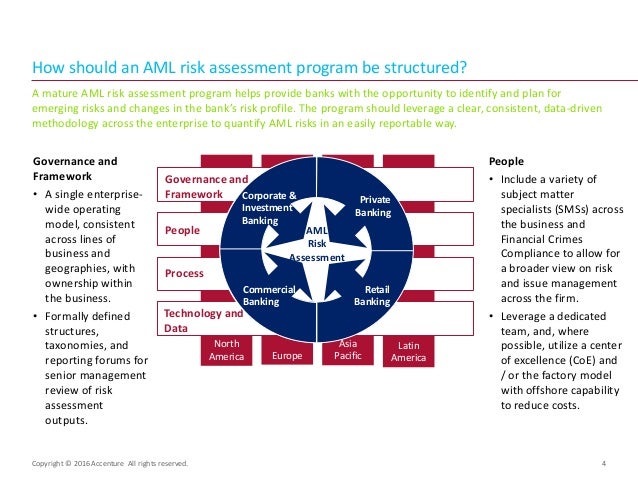

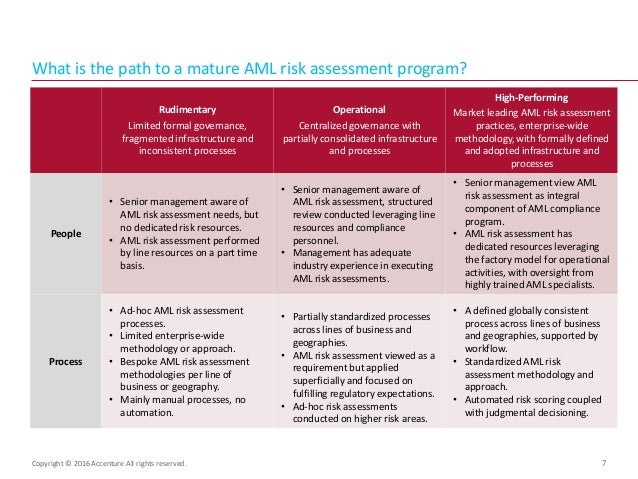

Source: slideshare.net

Source: slideshare.net

To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved. Over the past 12 years the concept of risk has become central to the anti-money laundering AML hereinafter debate worldwide. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer. Money laundering can occur through privately owned ATMs when an ATM is replenished with illicit currency that is. Money laundering is a threat to the good functioning of a financial system.

Source: tookitaki.ai

Source: tookitaki.ai

However it can also be the Achilles heel of criminal activity. It is a crime in many jurisdictions with varying definitions. Definition of money laundering risk. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Over the past 12 years the concept of risk has become central to the anti-money laundering AML hereinafter debate worldwide.

Source: acamstoday.org

Source: acamstoday.org

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. These guidelines describe how banks should include risks related to money laundering and financing of terrorism within their overall risk management framework. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. The Money Laundering Regulations MLRs define estate agent as a firm or sole practitioner which carries out estate agency work within the meaning given by section 1 of the Estate Agents Act. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing.

Source: efinancemanagement.com

Source: efinancemanagement.com

Crowdfunding one of the new investment trends in the world has been introduced as a way to help small businesses and entrepreneurs looking for investment capital to remove their business ventures from scratch. Prudent management of these risks together with effective supervisory oversight is critical in protecting the safety and soundness of banks as well as the integrity of the financial. Over the past 12 years the concept of risk has become central to the anti-money laundering AML hereinafter debate worldwide. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. All the actors involved in the prevention of money laundering governments law enforcement agencies public authorities banks and professionals have been asked to shift from a rule-based paradigm to a risk-based approach allocating their AML.

Source: ft.lk

Source: ft.lk

Crowdfunding one of the new investment trends in the world has been introduced as a way to help small businesses and entrepreneurs looking for investment capital to remove their business ventures from scratch. In terms of money laundering risk assessment âœcompliance function is the second line of defenseâ CO1. These guidelines describe how banks should include risks related to money laundering and financing of terrorism within their overall risk management framework. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Crowdfunding one of the new investment trends in the world has been introduced as a way to help small businesses and entrepreneurs looking for investment capital to remove their business ventures from scratch.

Advance cash payment of large amounts for future transactions or fees. In terms of money laundering risk assessment âœcompliance function is the second line of defenseâ CO1. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible.

Source: bi.go.id

Source: bi.go.id

Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. All the actors involved in the prevention of money laundering governments law enforcement agencies public authorities banks and professionals have been asked to shift from a rule-based paradigm to a risk-based approach allocating their AML. In terms of money laundering risk assessment âœcompliance function is the second line of defenseâ CO1. Definition of money laundering risk.

Source: slideshare.net

Source: slideshare.net

The Money Laundering Regulations MLRs define estate agent as a firm or sole practitioner which carries out estate agency work within the meaning given by section 1 of the Estate Agents Act. In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer. Banks may also provide currency to ISOs under a lending agreement which exposes those banks to various risks including reputation and credit risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1.

Source: taxguru.in

Source: taxguru.in

National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Definition of money laundering risk. Over the past 12 years the concept of risk has become central to the anti-money laundering AML hereinafter debate worldwide. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money.

Source: bi.go.id

Source: bi.go.id

Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Fraud and Money Laundering Risks Crowdfunding is the funding of a project or initiative by a group of people via the internet. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer. Over the past 12 years the concept of risk has become central to the anti-money laundering AML hereinafter debate worldwide. These guidelines describe how banks should include risks related to money laundering and financing of terrorism within their overall risk management framework.

Source: slideshare.net

Source: slideshare.net

Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. You can decide which areas of your. Due to its nature the risk of money laundering in the life insurance industry is different than in other industries and so the level and type of AML and FT measures in the insurance industry should be based on the level and type of the perceived money laundering and funding of terrorism risks related to life insurance transactions.

Source: lki.lk

Source: lki.lk

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Crowdfunding one of the new investment trends in the world has been introduced as a way to help small businesses and entrepreneurs looking for investment capital to remove their business ventures from scratch. Banks may also provide currency to ISOs under a lending agreement which exposes those banks to various risks including reputation and credit risk. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. It is a crime in many jurisdictions with varying definitions.

Risks you cant ignore 3 Gathering securing and preserving evidence Technology is an essential component of almost every investigation. Assuming that money laundering risk is left undetected by the frontline officers the compliance personnel are the second layer of screening to flag out any risky customer. Assess the adequacy of the banks systems to manage the risks associated with accounts of nonbank financial institutions NBFI and managements ability to implement effective monitoring and reporting systems. Money laundering is the process of changing large amounts of money obtained from crimes such as drug trafficking into origination from a legitimate source. You can decide which areas of your.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.