17++ Money laundering risk concentration info

Home » money laundering idea » 17++ Money laundering risk concentration infoYour Money laundering risk concentration images are ready in this website. Money laundering risk concentration are a topic that is being searched for and liked by netizens now. You can Get the Money laundering risk concentration files here. Find and Download all royalty-free photos and vectors.

If you’re looking for money laundering risk concentration pictures information linked to the money laundering risk concentration keyword, you have pay a visit to the ideal blog. Our site frequently provides you with hints for downloading the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

Money Laundering Risk Concentration. Geographic and country risk entities and clients risks and lastly product and transactions risk. Money Laundering is one of the major regulatory challenge in this sector. Organized criminals know that. The study of money laundering risk should be based on three main types of risk.

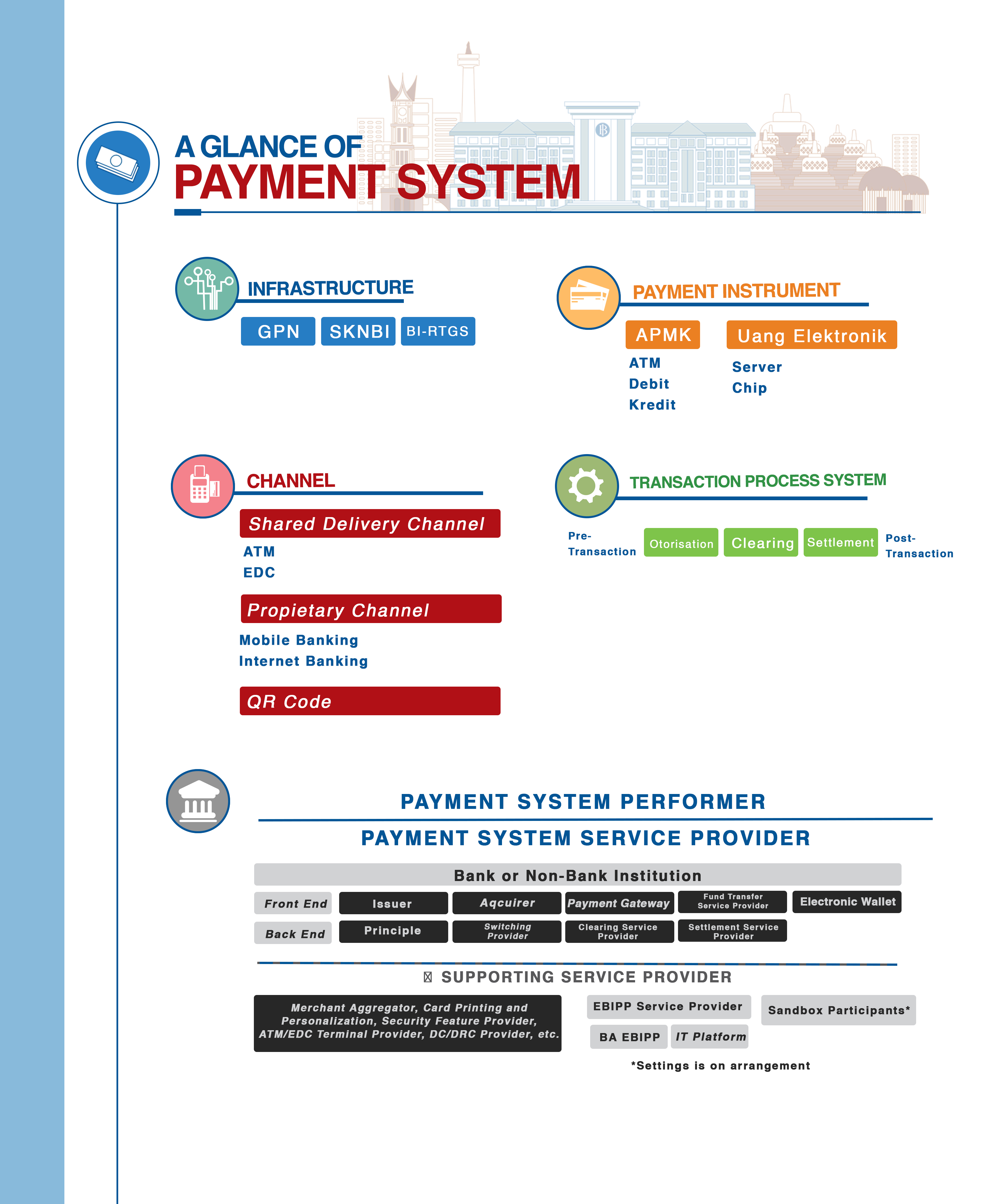

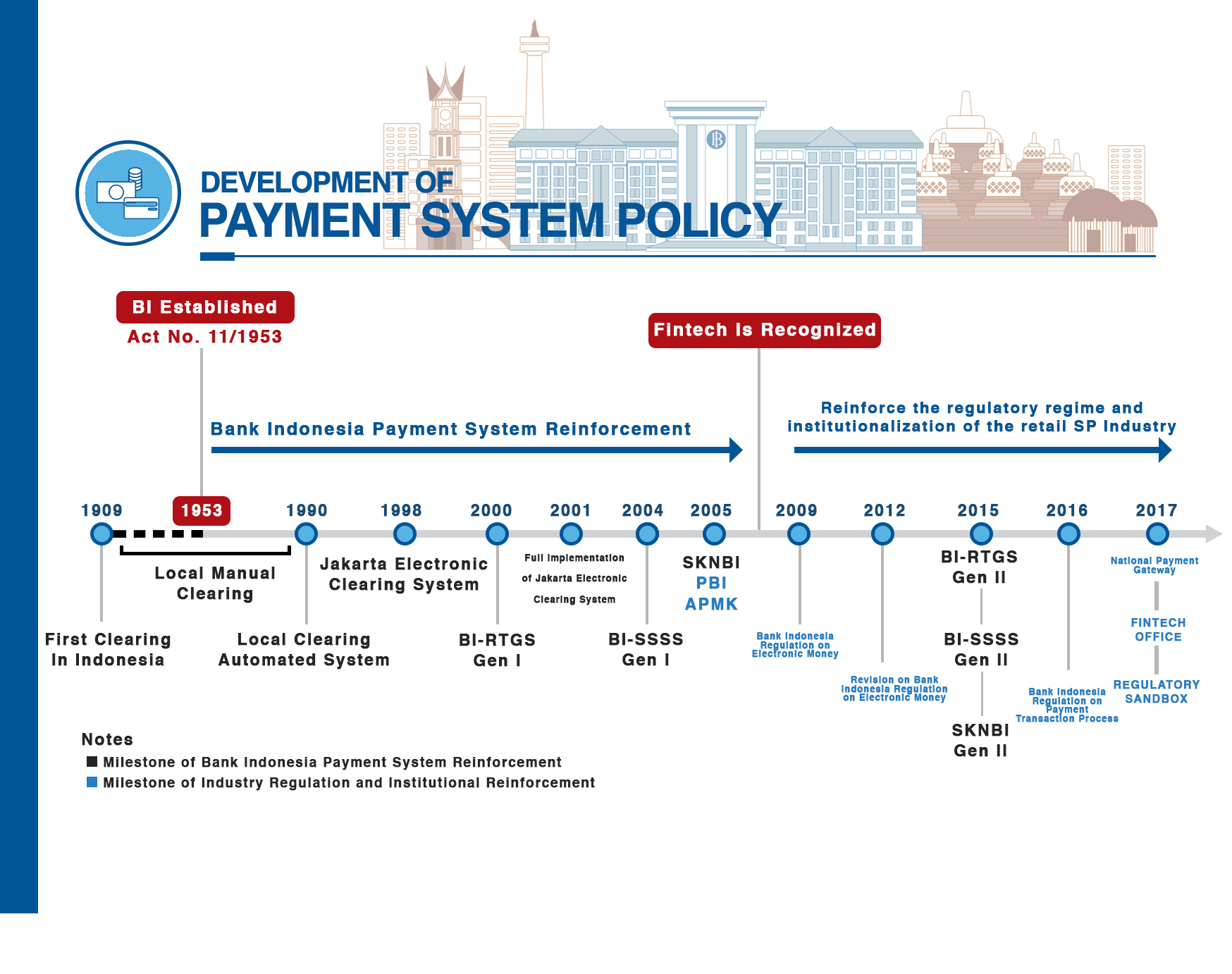

Payment System And Rupiah Currency Management From bi.go.id

Payment System And Rupiah Currency Management From bi.go.id

Banks that use concentration accounts should. Organized criminals know that. Its a process by which soiled cash is converted into clear money. It also concluded that while effective anti-money laundering and countering the financing of terrorism. In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers. Loss of profitable business Liquidity problems through withdrawal of funds Termination of correspondent banking facilities Investigation costs and fines.

If separation occurs the audit trail is lost and accounts may be misused or administered improperly.

The adverse consequences of money laundering are generally described as reputational operational legal and concentration risks. The concept of cash laundering is essential to be understood for those working in the financial sector. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. It also concluded that while effective anti-money laundering and countering the financing of terrorism. Loss of profitable business Liquidity problems through withdrawal of funds Termination of correspondent banking facilities Investigation costs and fines. The adverse consequences of money laundering are generally described as reputational operational and risk concentration.

Source: pinterest.com

Source: pinterest.com

What are considered higher risk customer types for money laundering. You can decide which areas of. The sources of the cash in actual are criminal and the money is invested in a manner that makes it look like clean cash and conceal. Its a process by which soiled cash is converted into clear money. By the FATF and the Egmont Group of FIUs in the course of the Trade-Based Money Laundering TBML project.

Source: bi.go.id

Source: bi.go.id

Financial institutions that have funds from crimes have additional challenges to properly manage their assets debts and operations. Are several international organizations fighting for an anti-money laundering regime. Money Laundering Risk Concentration Edit. If separation occurs the audit trail is lost and accounts may be misused or administered improperly. The adverse consequences of money laundering are generally described as reputational operational legal and concentration risks.

Source: bi.go.id

Source: bi.go.id

Risks you cant ignore 3 Gathering securing and preserving evidence Technology is an essential component of almost every investigation. Loss of profitable businesses. Its a process by which soiled cash is converted into clear money. Organized criminals know that. They are interrelated and each financial consequence such as.

Source: slidetodoc.com

Source: slidetodoc.com

To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved. By no means is this a conclusive list. Operational risk failed internal processes people and systems technology Concentration risk either side of balance sheet All risks are inter-related and together have the potential of causing serious threat to the survival of the bank. You can decide which areas of. Organized criminals know that.

Source: pinterest.com

Source: pinterest.com

Banks that use concentration accounts should. Loss of profitable business Liquidity problems through withdrawal of funds Termination of correspondent banking facilities Investigation costs and fines. The adverse consequences of money laundering are generally described as reputational operational legal and concentration risks. The risk indicators are designed to enhance the ability of public and private entities to identify suspicious activity associated with this form of money laundering. Money laundering risk can arise in concentration accounts if the customer-identifying information such as name transaction amount and account number is separated from the financial transaction.

Source: mordorintelligence.com

Source: mordorintelligence.com

By no means is this a conclusive list. In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers. The major risks for banks are. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. The sources of the cash in actual are criminal and the money is invested in a manner that makes it look like clean cash and conceal.

Source: bi.go.id

Source: bi.go.id

The study of money laundering risk should be based on three main types of risk. If separation occurs the audit trail is lost and accounts may. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Organized criminals know that. Its a process by which soiled cash is converted into clear money.

Source: pinterest.com

Source: pinterest.com

The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those. Operational risk failed internal processes people and systems technology Concentration risk either side of balance sheet All risks are inter-related and together have the potential of causing serious threat to the survival of the bank. Importance of Risk Assessment in Anti Money Laundering. The highest concentration of microfinance accounts is in India. If separation occurs the audit trail is lost and accounts may be misused or administered improperly.

Source: bi.go.id

Source: bi.go.id

In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers. The highest concentration of microfinance accounts is in India. Its a process by which soiled cash is converted into clear money. The risk indicators are designed to enhance the ability of public and private entities to identify suspicious activity associated with this form of money laundering. The study of money laundering risk should be based on three main types of risk.

Source: pinterest.com

Source: pinterest.com

Banks that use concentration accounts should. By the FATF and the Egmont Group of FIUs in the course of the Trade-Based Money Laundering TBML project. The adverse consequences of money laundering are generally described as reputational operational and risk concentration. Loss of profitable business Liquidity problems through withdrawal of funds Termination of correspondent banking facilities Investigation costs and fines. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore.

Source: pinterest.com

Source: pinterest.com

Money Laundering is one of the major regulatory challenge in this sector. The study of money laundering risk should be based on three main types of risk. Loss of profitable businesses. Some of the most important are. Importance of Risk Assessment in Anti Money Laundering.

Example of Laundering through Micro finance. By no means is this a conclusive list. Loss of profitable businesses. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Organized criminals know that.

Source: pinterest.com

Source: pinterest.com

If separation occurs the audit trail is lost and accounts may. The highest concentration of microfinance accounts is in India. By no means is this a conclusive list. Banks that use concentration accounts should. Loss of profitable businesses.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk concentration by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.