19++ Money laundering risk classification ideas in 2021

Home » money laundering Info » 19++ Money laundering risk classification ideas in 2021Your Money laundering risk classification images are ready in this website. Money laundering risk classification are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering risk classification files here. Find and Download all free photos.

If you’re searching for money laundering risk classification pictures information linked to the money laundering risk classification interest, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Money Laundering Risk Classification. There clearly is not one single methodology to apply to these risk categories and the application of these risk categories. What are considered higher risk customer types for money laundering. SAS Anti-Money Laundering provides all of these capabilities. Identify the highest priority cases to be investigated based on a customers risk classification.

Https Hddavii Eventos Cimat Mx Sites Hddavii Files Miguel Villalobos Pdf From

What are considered higher risk customer types for money laundering. From this perspective it should be noted that in accordance with Article 4 of the NBB Regulation financial institutions should ensure that the risk categories they define enable them if necessary to classify a customer in a risk category other than that in which he should in theory be classified if they identify in the context of the individual risk assessment carried out in accordance with Article 19 2 of the Anti-Money Laundering Law cases of high risk or cases of low risk. Classification of the customers is done under three risk categories viz. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF. In appendix 2 and 3 to the Act on Money Laundering are listed a number of risk factors that may cause to limited and increased risk respectively. Risk classification is an important parameter of the risk based kyc approach.

Combine multiple scenarios and risk factors to generate high-quality alerts.

Classification of the customers is done under three risk categories viz. For the purposes of this document when a Money Laundering ML risk assessment is referred to it is generally understood to include Terrorist Financing Sanctions and Bribery Corruption. In appendix 2 and 3 to the Act on Money Laundering are listed a number of risk factors that may cause to limited and increased risk respectively. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF. Identify the highest priority cases to be investigated based on a customers risk classification.

Source: actico.com

Source: actico.com

In addition a comparison of different money laundering risk classification is done in relation to VC from the perspective of different actors in the financial market. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore. SAS Anti-Money Laundering provides all of these capabilities. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. From this perspective it should be noted that in accordance with Article 4 of the NBB Regulation financial institutions should ensure that the risk categories they define enable them if necessary to classify a customer in a risk category other than that in which he should in theory be classified if they identify in the context of the individual risk assessment carried out in accordance with Article 19 2 of the Anti-Money Laundering Law cases of high risk or cases of low risk.

Source: calert.info

Source: calert.info

Purpose of committing money laundering ML offences and related predicate offences including corruption and bribery as well as conducting activity related to terrorist financing TF. SAS Anti-Money Laundering provides all of these capabilities. Start Banking Money Laundering Process work method Risk classification Customer due diligence measures shall be adapted based on an assessment of the extent of the risk of being used for money laundering and terrorist financing. Identify the highest priority cases to be investigated based on a customers risk classification. Institutions can create an enterprisewide view of customer relationships and risks monitor activity using multiple detection methods adapt that monitoring as appropriate for each customers risk classification investigate and document suspicious.

Source: taxguru.in

Source: taxguru.in

Institutions can create an enterprisewide view of customer relationships and risks monitor activity using multiple detection methods adapt that monitoring as appropriate for each customers risk classification investigate and document suspicious. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. Subsequently customers can be classified into high low and medium risk by the customerevaluatings. There clearly is not one single methodology to apply to these risk categories and the application of these risk categories. Purpose of committing money laundering ML offences and related predicate offences including corruption and bribery as well as conducting activity related to terrorist financing TF.

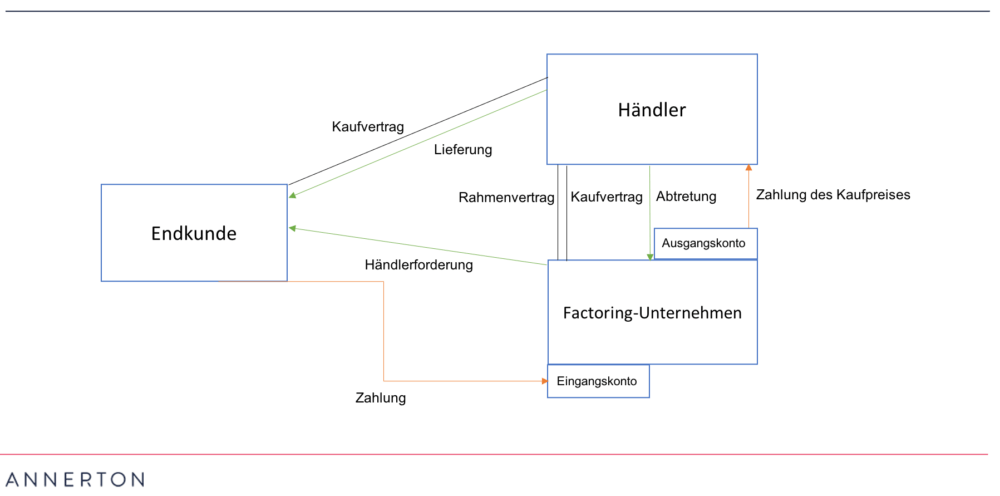

Source: paytechlaw.com

Source: paytechlaw.com

Classification of the customers is done under three risk categories viz. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Classification of the customers is done under three risk categories viz. Risk of potential money laundering is discretionary with each institution. Combine multiple scenarios and risk factors to generate high-quality alerts.

Source:

Low medium and high. The potential risks associated with PEPs justify the. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF. Context of Money Laundering based on Naive Bayes Classification Method that allows a customer to be subjected to Monitoring on Anti Money Laundering system from the timeof the bank account is opened. Purpose of committing money laundering ML offences and related predicate offences including corruption and bribery as well as conducting activity related to terrorist financing TF.

Source: pinterest.com

Source: pinterest.com

Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Low medium and high.

Source: in.pinterest.com

Source: in.pinterest.com

The listed factors and documentation in Appendix 2 and 3 indicate situations which potentially pose a limited or involve an increased risk. You can decide which areas of. There clearly is not one single methodology to apply to these risk categories and the application of these risk categories. Purpose of committing money laundering ML offences and related predicate offences including corruption and bribery as well as conducting activity related to terrorist financing TF. Because non-PEP customers may be a risk for corruption-related money laundering depending on these factors reporting institutions should take steps to understand such risk outside the context of identifying and monitoring PEPs.

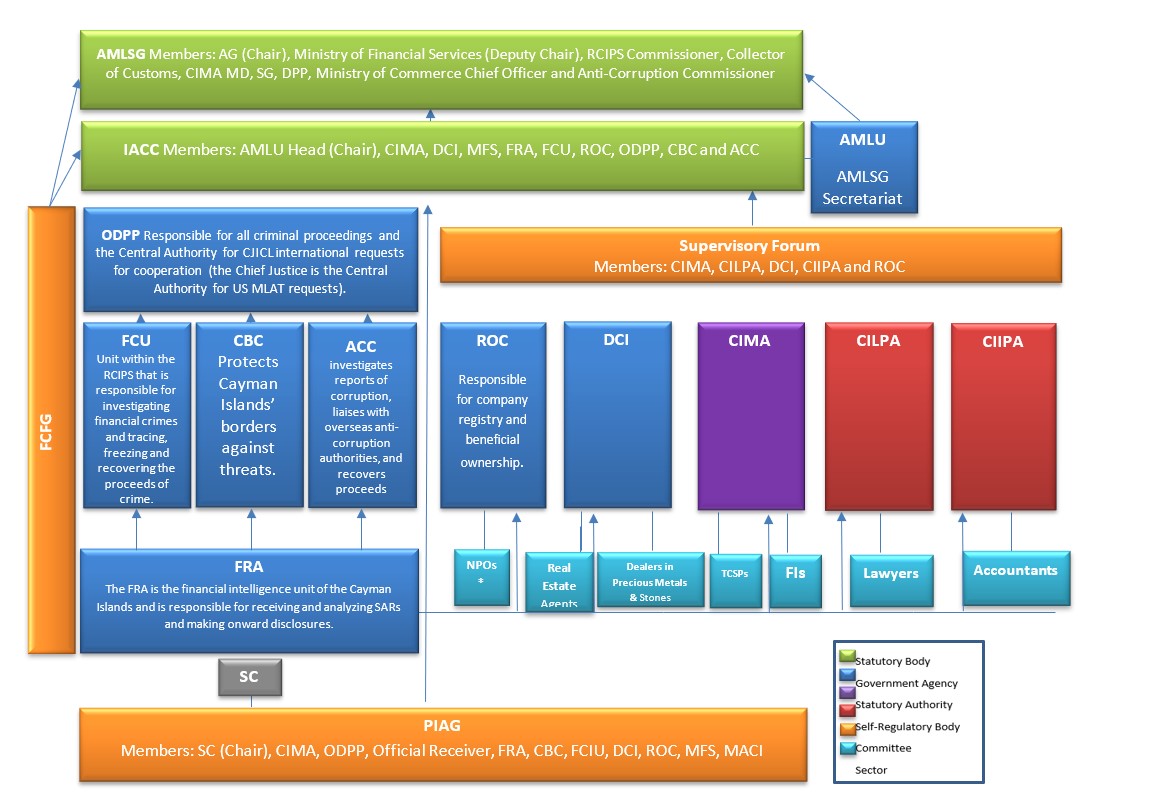

Source: cima.ky

Source: cima.ky

This is not an exhaustive list. Risk of potential money laundering is discretionary with each institution. Combine multiple scenarios and risk factors to generate high-quality alerts. Context of Money Laundering based on Naive Bayes Classification Method that allows a customer to be subjected to Monitoring on Anti Money Laundering system from the timeof the bank account is opened. Start Banking Money Laundering Process work method Risk classification Customer due diligence measures shall be adapted based on an assessment of the extent of the risk of being used for money laundering and terrorist financing.

Source: actico.com

Source: actico.com

Because non-PEP customers may be a risk for corruption-related money laundering depending on these factors reporting institutions should take steps to understand such risk outside the context of identifying and monitoring PEPs. From this perspective it should be noted that in accordance with Article 4 of the NBB Regulation financial institutions should ensure that the risk categories they define enable them if necessary to classify a customer in a risk category other than that in which he should in theory be classified if they identify in the context of the individual risk assessment carried out in accordance with Article 19 2 of the Anti-Money Laundering Law cases of high risk or cases of low risk. Classification of the customers is done under three risk categories viz. Subsequently customers can be classified into high low and medium risk by the customerevaluatings. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues.

Source: bi.go.id

Source: bi.go.id

In addition a comparison of different money laundering risk classification is done in relation to VC from the perspective of different actors in the financial market. Because non-PEP customers may be a risk for corruption-related money laundering depending on these factors reporting institutions should take steps to understand such risk outside the context of identifying and monitoring PEPs. This has been confirmed by analysis and case studies. Identify cases that are significant rather than chasing all simple alerts. Risk classification is an important parameter of the risk based kyc approach.

Source: nbb.be

Source: nbb.be

Combine multiple scenarios and risk factors to generate high-quality alerts. Identify cases that are significant rather than chasing all simple alerts. From this perspective it should be noted that in accordance with Article 4 of the NBB Regulation financial institutions should ensure that the risk categories they define enable them if necessary to classify a customer in a risk category other than that in which he should in theory be classified if they identify in the context of the individual risk assessment carried out in accordance with Article 19 2 of the Anti-Money Laundering Law cases of high risk or cases of low risk. Risk classification is an important parameter of the risk based kyc approach. Subsequently customers can be classified into high low and medium risk by the customerevaluatings.

Source: actico.com

Source: actico.com

Institutions can create an enterprisewide view of customer relationships and risks monitor activity using multiple detection methods adapt that monitoring as appropriate for each customers risk classification investigate and document suspicious. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. From this perspective it should be noted that in accordance with Article 4 of the NBB Regulation financial institutions should ensure that the risk categories they define enable them if necessary to classify a customer in a risk category other than that in which he should in theory be classified if they identify in the context of the individual risk assessment carried out in accordance with Article 19 2 of the Anti-Money Laundering Law cases of high risk or cases of low risk. Risk classification is an important parameter of the risk based kyc approach. There clearly is not one single methodology to apply to these risk categories and the application of these risk categories.

Source: bi.go.id

This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. What are considered higher risk customer types for money laundering. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF. You can decide which areas of. Risk classification is an important parameter of the risk based kyc approach.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk classification by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.