19++ Money laundering risk categorisation ideas in 2021

Home » money laundering idea » 19++ Money laundering risk categorisation ideas in 2021Your Money laundering risk categorisation images are available in this site. Money laundering risk categorisation are a topic that is being searched for and liked by netizens today. You can Download the Money laundering risk categorisation files here. Download all free images.

If you’re searching for money laundering risk categorisation images information connected with to the money laundering risk categorisation interest, you have pay a visit to the right blog. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

Money Laundering Risk Categorisation. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management. While on the one hand the financial and non-financial sectors are required to apply some basic pre-vention rules on the other hand they are supposed to have their own approaches to risk assessment and hence to the reporting of suspicious transactions. The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in. The customer profile contains information relating to customers identity socialfinancial status nature of business activity information about his clients business and their location etc.

Kri Loss Events And Estimating Operational Risk Capital An Example Risk Management Case Study Risk From pinterest.com

Kri Loss Events And Estimating Operational Risk Capital An Example Risk Management Case Study Risk From pinterest.com

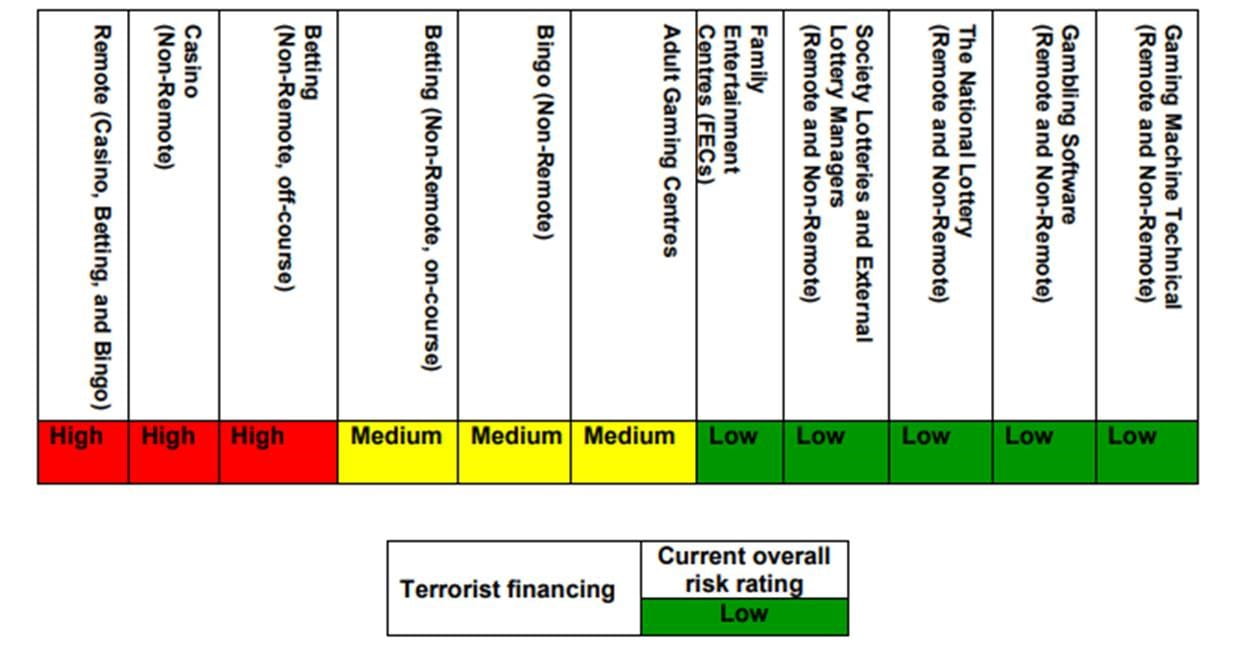

Cryptocurrencies and blockchains are set to be a key compliance theme of 2019 with the upcoming Fifth Money Laundering Directive setting out to regulate cryptocurrencies. Such risk categorisation is provided in Annexure I. Customers in these categories can pose an inherently high risk for money laundering. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products. You can decide which areas of. Sector with the challenges of detecting trade -based money laundering.

The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products.

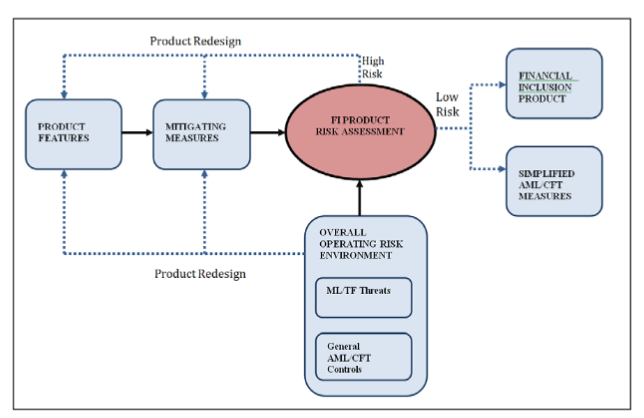

What are the 3 main factors to consider in determining AML risk. Sector with the challenges of detecting trade -based money laundering. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in. The primary characteristic of the money laundering prevention system based on risk assessment is that it is complex and necessarily resilient. The Project on developing a risk-based methodology for an automatic anti-money launderingcounter terrorist financing risk categorisation for supervised entities in Portugal is one of the four projects implemented under the overall CoEEU TSI programme.

Source: aml360software.com

Source: aml360software.com

C For the purpose of risk categorisation individuals other than High Net Worth and entities whose identities and sources of wealth can be easily identified and transactions in whose accounts by and large conform to the known profile may be categorised as low risk. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. What is money laundering risk assessment.

Source: service.betterregulation.com

Source: service.betterregulation.com

1 products and services 2 customers and entities and 3 geographic location. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Into money laundering including market manipulation and insider trading. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. 1 products and services 2 customers and entities and 3 geographic location.

Source: ec.europa.eu

Source: ec.europa.eu

Customers in these categories can pose an inherently high risk for money laundering. Understanding risk within the Recommendation 12 context is important for two reasons. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. Inherent BSAAML risk falls into three main categories.

Source: acamstoday.org

Source: acamstoday.org

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. 1 products and services 2 customers and entities and 3 geographic location. The primary characteristic of the money laundering prevention system based on risk assessment is that it is complex and necessarily resilient. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Understanding risk within the Recommendation 12 context is important for two reasons.

Source: ec.europa.eu

Source: ec.europa.eu

Understanding risk within the Recommendation 12 context is important for two reasons. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. Understanding risk within the Recommendation 12 context is important for two reasons. While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering.

Source: pinterest.com

Source: pinterest.com

While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products. The primary characteristic of the money laundering prevention system based on risk assessment is that it is complex and necessarily resilient.

Source: lexology.com

Source: lexology.com

While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. Sector with the challenges of detecting trade -based money laundering. The primary characteristic of the money laundering prevention system based on risk assessment is that it is complex and necessarily resilient. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. What are the 3 main factors to consider in determining AML risk.

Source: pinterest.com

Source: pinterest.com

What is money laundering risk assessment. What are the 3 main factors to consider in determining AML risk. Such risk categorisation is provided in Annexure I. While on the one hand the financial and non-financial sectors are required to apply some basic pre-vention rules on the other hand they are supposed to have their own approaches to risk assessment and hence to the reporting of suspicious transactions. C For the purpose of risk categorisation individuals other than High Net Worth and entities whose identities and sources of wealth can be easily identified and transactions in whose accounts by and large conform to the known profile may be categorised as low risk.

Source: service.betterregulation.com

Source: service.betterregulation.com

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. Firms processes and monitoring tools are generally not designed to detect the typologies employed by this form of market abuse. Into money laundering including market manipulation and insider trading. While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. The premise behind the effort is clear.

Source: taxguru.in

Source: taxguru.in

The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. Into money laundering including market manipulation and insider trading. C For the purpose of risk categorisation individuals other than High Net Worth and entities whose identities and sources of wealth can be easily identified and transactions in whose accounts by and large conform to the known profile may be categorised as low risk. What are the 3 main factors to consider in determining AML risk. What is money laundering risk assessment.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. The premise behind the effort is clear. Customers in these categories can pose an inherently high risk for money laundering. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering.

Source: favpng.com

Source: favpng.com

What is money laundering risk assessment. Cryptocurrencies and blockchains are set to be a key compliance theme of 2019 with the upcoming Fifth Money Laundering Directive setting out to regulate cryptocurrencies. Into money laundering including market manipulation and insider trading. What is money laundering risk assessment. Input into the overall money laundering risk assessment.

Source: pinterest.com

Source: pinterest.com

While the first and most common cryptocurrency is Bitcoin there are now close to 2000 in existence with the number continuing to grow. The nature and extent of due diligence will depend on the risk perceived by the Company. The primary characteristic of the money laundering prevention system based on risk assessment is that it is complex and necessarily resilient. Understanding risk within the Recommendation 12 context is important for two reasons. Sector with the challenges of detecting trade -based money laundering.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk categorisation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.