19+ Money laundering risk categories information

Home » money laundering Info » 19+ Money laundering risk categories informationYour Money laundering risk categories images are available. Money laundering risk categories are a topic that is being searched for and liked by netizens today. You can Download the Money laundering risk categories files here. Download all royalty-free photos and vectors.

If you’re searching for money laundering risk categories images information connected with to the money laundering risk categories interest, you have come to the right site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

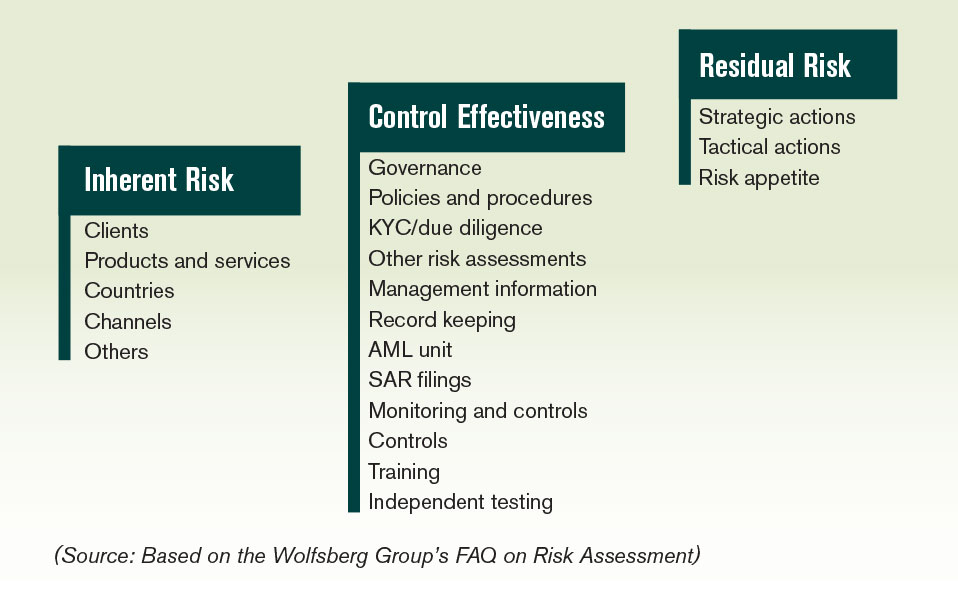

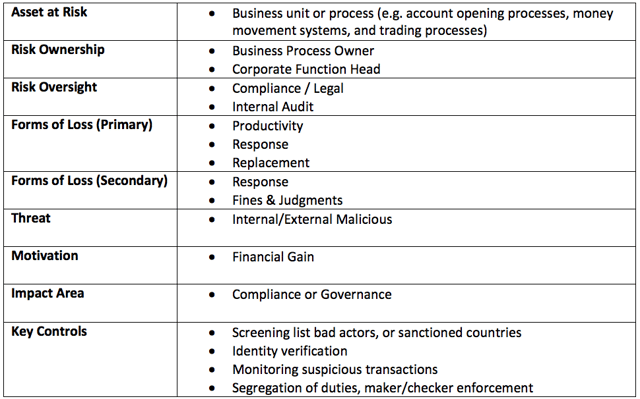

Money Laundering Risk Categories. New customers carrying out large one-off transactions a customer whos been introduced to you -. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. Falling in the high-risk category of b the sub-sector displays a higher level of inherent structural risk exposure. Financial institutions must be able to respond to threats on a contextual basis to balance efficiency and cost needs with compliance obligations.

Latest Innovations Of The Major Categories Wesrch Regulatory Development Business Presentation From in.pinterest.com

Latest Innovations Of The Major Categories Wesrch Regulatory Development Business Presentation From in.pinterest.com

Lack of specific training relative to the risk of money laundering and terrorist financing in connection with cash transactions or with transactions carried out by cash-intensive businesses. Based on the above the risk classification should in theory include at least two risk categories high and standard risk and possibly a third one low risk. The premise behind the effort is clear. Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. Your business might be at risk of money laundering from.

Russias overall risk score has fallen from 575 to 560 out of 10 where 10 equals the highest assessed risk of MLTF.

Citizens and governments lose over 110 billion to financial crime and 2 to 5 of global GDP is estimated to be laundered every year. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. Despite significant regulatory attention on emerging financial crime risks related to crypto assets gold remains a prevalent money laundering risk. Part of an institutions risk assessment must include a periodic review of their AML compliance regime. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. Falling in the high-risk category of b the sub-sector displays a higher level of inherent structural risk exposure.

Source: imtconferences.com

Source: imtconferences.com

New customers carrying out large one-off transactions a customer whos been introduced to you -. Lack of specific training relative to the risk of money laundering and terrorist financing in connection with cash transactions or with transactions carried out by cash-intensive businesses. Based on the above the risk classification should in theory include at least two risk categories high and standard risk and possibly a third one low risk. Your business might be at risk of money laundering from. National Risk Assessment of Money Laundering and Terrorist Financing.

Source: researchgate.net

Source: researchgate.net

It is unrealistic that an organisation would operate in a completely risk-free environment in. Understanding risk within the Recommendation 12 context is important for two reasons. It promotes crime and corruption that weaken our economies and damage social wellbeing. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. National Risk Assessment of Money Laundering and Terrorist Financing.

Source: pinterest.com

Source: pinterest.com

On November 20 2019 AUSTRAC Australias anti money-laundering AML and counter-terrorism financing CTF regulator initiated an action in the Federal Court of Australia seeking civil penalty orders against Westpac Banking Corporation Westpac Australias second largest retail bank alleging systemic failures to comply with Australias AML-CTF laws. It promotes crime and corruption that weaken our economies and damage social wellbeing. However proposed definitions in this guidance paper focus on three main components namely threat vulnerability and consequences. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. Falling in the high-risk category of b the sub-sector displays a higher level of inherent structural risk exposure.

Source: regtechconsulting.net

Source: regtechconsulting.net

There clearly is not one single methodology to apply to these risk categories and the application of these risk categories is intended to provide a strategy for managing potential money laundering risks associated with potentially high risk. On November 20 2019 AUSTRAC Australias anti money-laundering AML and counter-terrorism financing CTF regulator initiated an action in the Federal Court of Australia seeking civil penalty orders against Westpac Banking Corporation Westpac Australias second largest retail bank alleging systemic failures to comply with Australias AML-CTF laws. There is no single clear definition of Money Laundering or Terrorist Financing Risk adopted at the international level. Risk of potential money laundering is discretionary with each institution. National Risk Assessment of Money Laundering and Terrorist Financing.

Source: acamstoday.org

Source: acamstoday.org

Money laundering ML or terrorist financing TF risk is the risk that an organisation or a product or service offered by an organisation may be used to facilitate MLTF. However proposed definitions in this guidance paper focus on three main components namely threat vulnerability and consequences. New customers carrying out large one-off transactions a customer whos been introduced to you -. National Risk Assessment of Money Laundering and Terrorist Financing. Your business might be at risk of money laundering from.

Source: fairinstitute.org

Source: fairinstitute.org

Understanding risk within the Recommendation 12 context is important for two reasons. Financial institutions must be able to respond to threats on a contextual basis to balance efficiency and cost needs with compliance obligations. Despite significant regulatory attention on emerging financial crime risks related to crypto assets gold remains a prevalent money laundering risk. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. However proposed definitions in this guidance paper focus on three main components namely threat vulnerability and consequences.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

It promotes crime and corruption that weaken our economies and damage social wellbeing. Lack of specific training relative to the risk of money laundering and terrorist financing in connection with cash transactions or with transactions carried out by cash-intensive businesses. Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5 Geography risks.

Source: researchgate.net

Source: researchgate.net

There is no single clear definition of Money Laundering or Terrorist Financing Risk adopted at the international level. It promotes crime and corruption that weaken our economies and damage social wellbeing. However proposed definitions in this guidance paper focus on three main components namely threat vulnerability and consequences. Falling in the high-risk category of b the sub-sector displays a higher level of inherent structural risk exposure. Part of an institutions risk assessment must include a periodic review of their AML compliance regime.

Source: ec.europa.eu

Source: ec.europa.eu

Understanding risk within the Recommendation 12 context is important for two reasons. Despite significant regulatory attention on emerging financial crime risks related to crypto assets gold remains a prevalent money laundering risk. Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. Based on the above the risk classification should in theory include at least two risk categories high and standard risk and possibly a third one low risk.

Source:

Based on the above the risk classification should in theory include at least two risk categories high and standard risk and possibly a third one low risk. Money laundering ML or terrorist financing TF risk is the risk that an organisation or a product or service offered by an organisation may be used to facilitate MLTF. Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes. Money laundering ML has devastating consequences. Despite significant regulatory attention on emerging financial crime risks related to crypto assets gold remains a prevalent money laundering risk.

Source: in.pinterest.com

Source: in.pinterest.com

Part of an institutions risk assessment must include a periodic review of their AML compliance regime. National Risk Assessment of Money Laundering and Terrorist Financing. It is unrealistic that an organisation would operate in a completely risk-free environment in. There clearly is not one single methodology to apply to these risk categories and the application of these risk categories is intended to provide a strategy for managing potential money laundering risks associated with potentially high risk. Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes.

Source: nbb.be

Source: nbb.be

First Recommendation 12 requires a reporting entity to have òappropriate ó risk management. Globally governments have narrowed key risk indicators to five primary divisions of 1 Nature size and complexity of a business 2 Customer types including B2B and B2C 3 the types of products and services provided to customers 4 method of on-boarding new customers and ongoing communications with existing customers and finally 5 Geography risks. National Risk Assessment of Money Laundering and Terrorist Financing. Specifically AUSTRAC alleges over 23. Based on the above the risk classification should in theory include at least two risk categories high and standard risk and possibly a third one low risk.

Source: service.betterregulation.com

Source: service.betterregulation.com

Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. Citizens and governments lose over 110 billion to financial crime and 2 to 5 of global GDP is estimated to be laundered every year. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk categories by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.