17++ Money laundering risk assessment template for estate agents ideas

Home » money laundering idea » 17++ Money laundering risk assessment template for estate agents ideasYour Money laundering risk assessment template for estate agents images are ready. Money laundering risk assessment template for estate agents are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering risk assessment template for estate agents files here. Find and Download all royalty-free vectors.

If you’re searching for money laundering risk assessment template for estate agents pictures information connected with to the money laundering risk assessment template for estate agents interest, you have pay a visit to the ideal site. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

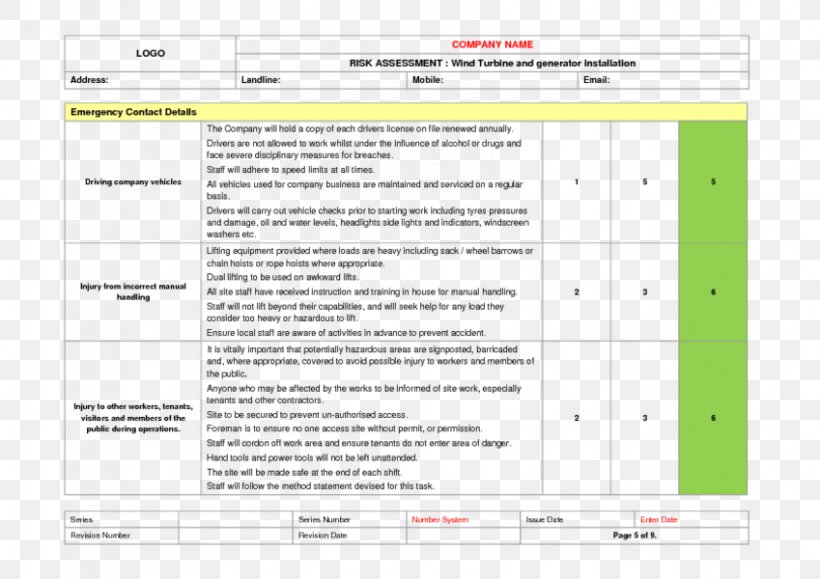

Money Laundering Risk Assessment Template For Estate Agents. This template should be read in conjunction with our Estate Agency Firm Wide Risk Assessment and our Estate Agency Customer Identification and Risk Assessment Form. Responses should be provided in the designated spaces in the questionnaire. Lettings agents who only carry out lettings work. The purpose of our relationship with our customers is to act as an Agent for the sale of property.

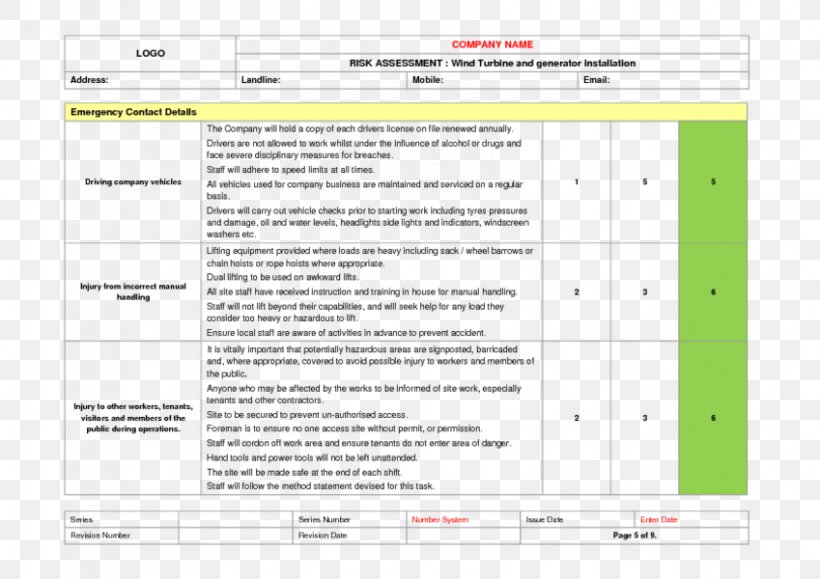

Risk Assessment Computer Software Architectural Engineering Template Png 849x600px Risk Assessment Architectural Engineering Area Computer Software From favpng.com

Risk Assessment Computer Software Architectural Engineering Template Png 849x600px Risk Assessment Architectural Engineering Area Computer Software From favpng.com

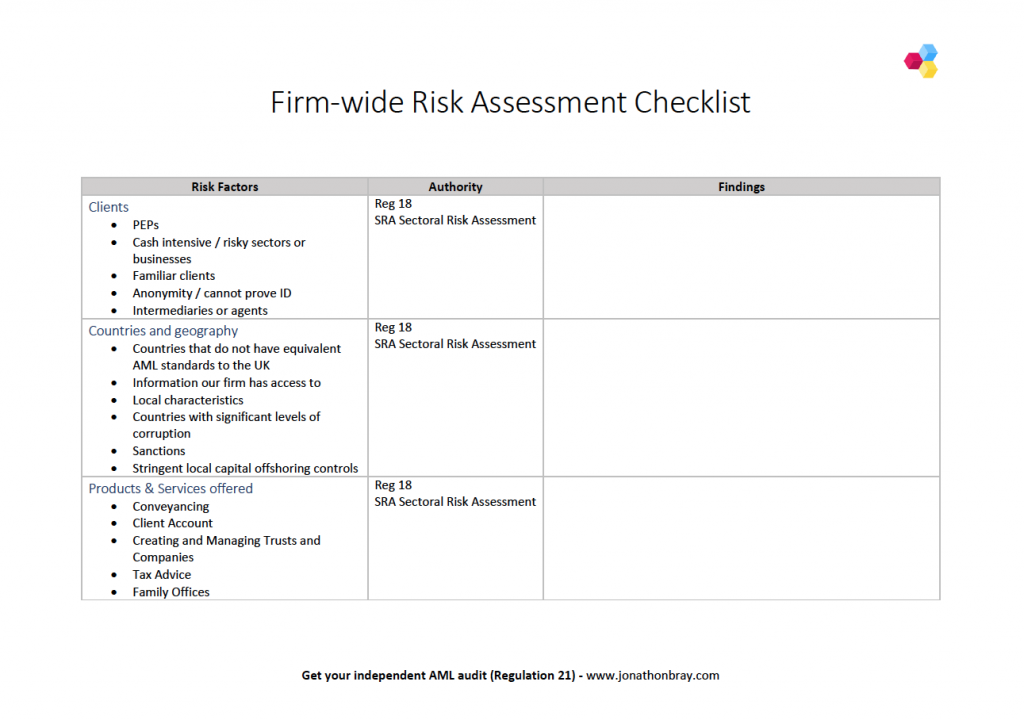

This guidance is designed to help Real Estate Agents REAs and High Value Goods Dealers to include Potential High Value Goods Dealers and High Risk Dealers HVGDs to carry out a money laundering and terrorism financing MLTF risk assessment of their business. New anti-money laundering risk assessment form available to firms. Through the risk assessment estate agents can deal with money laundering and financing risks of terrorism and solutions to deal with them. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry. The Designated Non-Financial Businesses and Professions and Casinos Sector Risk Assessment DNFBP SRA is a review of the characteristics of the sectors covered by the AMLCFT Act - lawyers conveyancers accountants real estate agents high. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms.

Starting with our standard Anti-Money Laundering Policy which includes extensive content for HMRC FCA and other supervisory body compliance.

The form can also be used to verify the other contracting party andor any beneficial owners. Updated Money Laundering Risk Assessments for Estate Agents and Letting Agents. Which we operate we have chosen to assess our risk or susceptibility to money laundering as HIGH. National Money Laundering Risk Assessment 06 12 2015. Your risk assessment will determine the approach you take to CDD in general and ongoing monitoring. MONEY LAUNDERING POLICY 2019 Money Laundering Policy for Daniel James Estate Agents Limited.

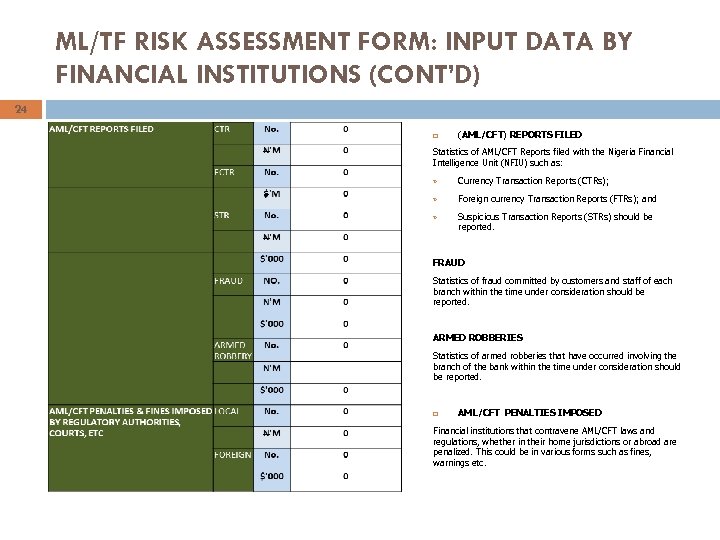

Source: present5.com

Source: present5.com

Leading a discussion of money laundering and financial crime risks at a staff meeting on date Staff were asked to furnish details of their concerns confidentially to me at any time. New anti-money laundering risk assessment form available to firms. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. National Money Laundering Risk Assessment 06 12 2015. Information about risk and emerging trends from sources including the National Risk Assessment and HMRC risk assessment should be noted and procedures should be changed as necessary.

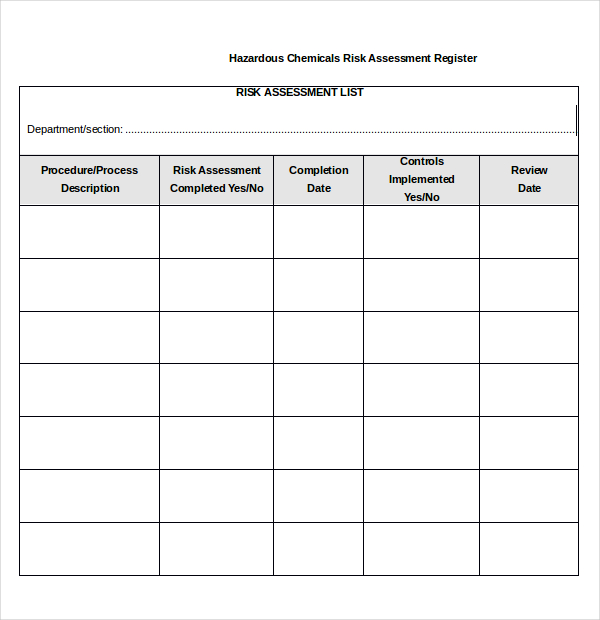

Source: omnirisk.me

Source: omnirisk.me

Enhanced Due Diligence - High Risk Matters and Clients We must carry out enhanced due diligence in any case where there is a high risk of money laundering. Updated Money Laundering Risk Assessments for Estate Agents and Letting Agents. Implementing your risk assessment 11 March 2019 6481 Views The Money Laundering Regulations require estate agents to risk assess their business relationships and apply an appropriate level of investigation to ensure that they understand who their customer is. Lettings agents who only carry out lettings work. This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject.

Source: pdfprof.com

Source: pdfprof.com

Through the risk assessment estate agents can deal with money laundering and financing risks of terrorism and solutions to deal with them. Information about risk and emerging trends from sources including the National Risk Assessment and HMRC risk assessment should be noted and procedures should be changed as necessary. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. Lettings agents who only carry out lettings work. This guidance is designed to help Real Estate Agents REAs and High Value Goods Dealers to include Potential High Value Goods Dealers and High Risk Dealers HVGDs to carry out a money laundering and terrorism financing MLTF risk assessment of their business.

Source: present5.com

Source: present5.com

Starting with our standard Anti-Money Laundering Policy which includes extensive content for HMRC FCA and other supervisory body compliance. Information about risk and emerging trends from sources including the National Risk Assessment and HMRC risk assessment should be noted and procedures should be changed as necessary. Which we operate we have chosen to assess our risk or susceptibility to money laundering as HIGH. National Money Laundering Risk Assessment 06 12 2015. Due to the nature of the Estate Agency market in.

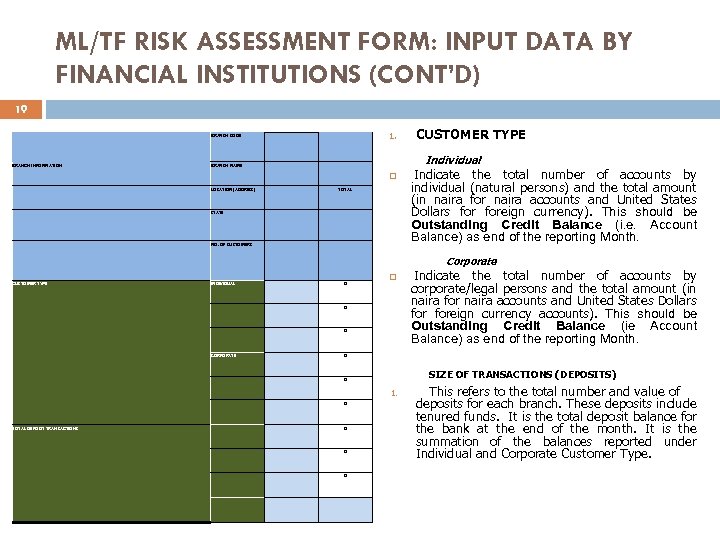

Source: docplayer.net

Source: docplayer.net

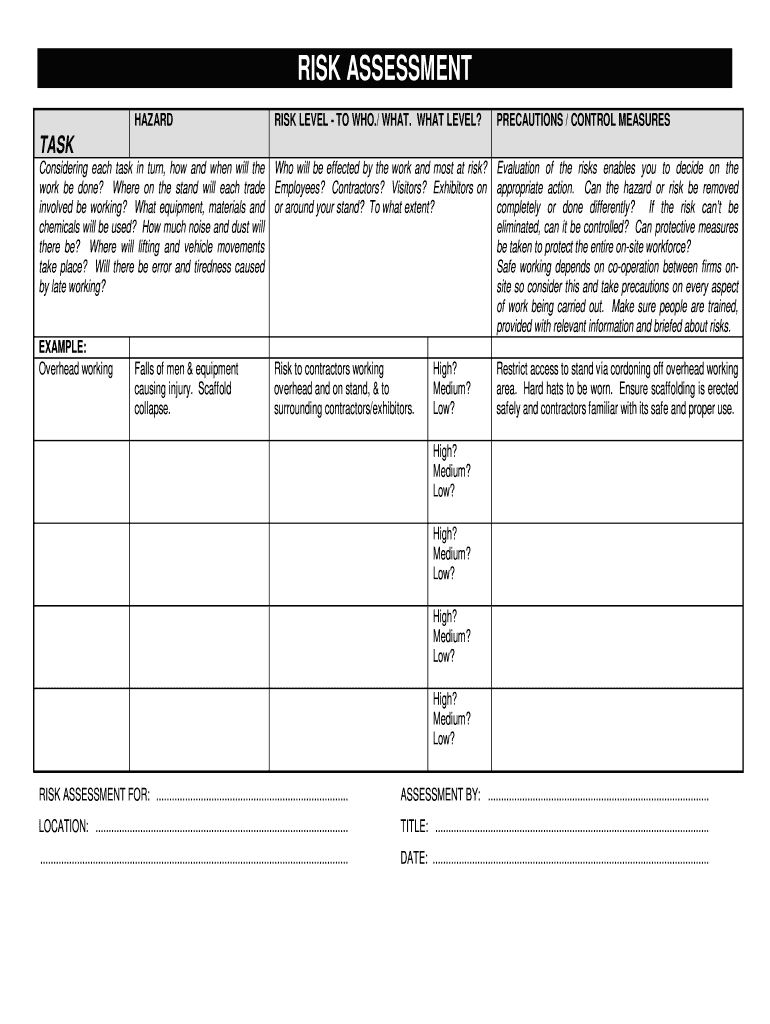

We have designed 3 main anti-money laundering template packs for firms with differing needs and scopes. This is part 1 of how deep dive into the new money laundering requirements for estate agents. Risk Assessment Guidance 11 Purpose of these Guidance Notes. Stay tuned as we cover in the upcoming release risk assessment systems and controls controls due diligence and reporting. Your risk assessment will determine the approach you take to CDD in general and ongoing monitoring.

Source: docplayer.net

Source: docplayer.net

Which we operate we have chosen to assess our risk or susceptibility to money laundering as HIGH. This template should be read in conjunction with our Estate Agency Firm Wide Risk Assessment and our Estate Agency Customer Identification and Risk Assessment Form. We have designed 3 main anti-money laundering template packs for firms with differing needs and scopes. Our firm is required to keep an up-to-date record in writing of all steps it has taken to carry out the risk assessment Regulation 184. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry.

Source: pinterest.com

Source: pinterest.com

Responses should be provided in the designated spaces in the questionnaire. Risk assessment information provided to estate agency and letting agency businesses under Money Laundering Regulation 179 to assist relevant persons in carrying out their own money laundering. The Estate Agent The Customer Vendors and Purchasers and all parties involved in rental transactions of a one off value greater than 15000. Stay tuned as we cover in the upcoming release risk assessment systems and controls controls due diligence and reporting. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms.

Source: pdfprof.com

Source: pdfprof.com

This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. New anti-money laundering risk assessment form available to firms. Money Laundering In The Commercial Real Estate Industry Fincen Gov. Information about risk and emerging trends from sources including the National Risk Assessment and HMRC risk assessment should be noted and procedures should be changed as necessary. The Designated Non-Financial Businesses and Professions and Casinos Sector Risk Assessment DNFBP SRA is a review of the characteristics of the sectors covered by the AMLCFT Act - lawyers conveyancers accountants real estate agents high.

Source: pdfprof.com

Source: pdfprof.com

Risk Assessment Guidance 11 Purpose of these Guidance Notes. Lettings agents who only carry out lettings work. Money Laundering In The Commercial Real Estate Industry Fincen Gov. New anti-money laundering risk assessment form available to firms. Implementing your risk assessment 11 March 2019 6481 Views The Money Laundering Regulations require estate agents to risk assess their business relationships and apply an appropriate level of investigation to ensure that they understand who their customer is.

Source: lexology.com

Source: lexology.com

The Estate Agent The Customer Vendors and Purchasers and all parties involved in rental transactions of a one off value greater than 15000. Through the risk assessment estate agents can deal with money laundering and financing risks of terrorism and solutions to deal with them. Due to the nature of the Estate Agency market in. We have designed 3 main anti-money laundering template packs for firms with differing needs and scopes. Leading a discussion of money laundering and financial crime risks at a staff meeting on date Staff were asked to furnish details of their concerns confidentially to me at any time.

Source: favpng.com

Source: favpng.com

Responses should be provided in the designated spaces in the questionnaire. Through the risk assessment estate agents can deal with money laundering and financing risks of terrorism and solutions to deal with them. We have designed 3 main anti-money laundering template packs for firms with differing needs and scopes. New anti-money laundering risk assessment form available to firms. Lettings agents who only carry out lettings work.

Source: youtube.com

Source: youtube.com

This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. Information about risk and emerging trends from sources including the National Risk Assessment and HMRC risk assessment should be noted and procedures should be changed as necessary. Enhanced Due Diligence - High Risk Matters and Clients We must carry out enhanced due diligence in any case where there is a high risk of money laundering. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. This is part 1 of how deep dive into the new money laundering requirements for estate agents.

Source: pdfprof.com

Source: pdfprof.com

We have designed 3 main anti-money laundering template packs for firms with differing needs and scopes. New anti-money laundering risk assessment form available to firms. Our firm is required to keep an up-to-date record in writing of all steps it has taken to carry out the risk assessment Regulation 184. Stay tuned as we cover in the upcoming release risk assessment systems and controls controls due diligence and reporting. Money laundering is the process of moving illegally acquired cash through financial systems so that it appears to come from a legitimate source.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk assessment template for estate agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.