14++ Money laundering risk assessment template for accountants ideas in 2021

Home » money laundering Info » 14++ Money laundering risk assessment template for accountants ideas in 2021Your Money laundering risk assessment template for accountants images are available in this site. Money laundering risk assessment template for accountants are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering risk assessment template for accountants files here. Find and Download all free vectors.

If you’re searching for money laundering risk assessment template for accountants pictures information related to the money laundering risk assessment template for accountants topic, you have visit the ideal blog. Our site frequently gives you suggestions for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

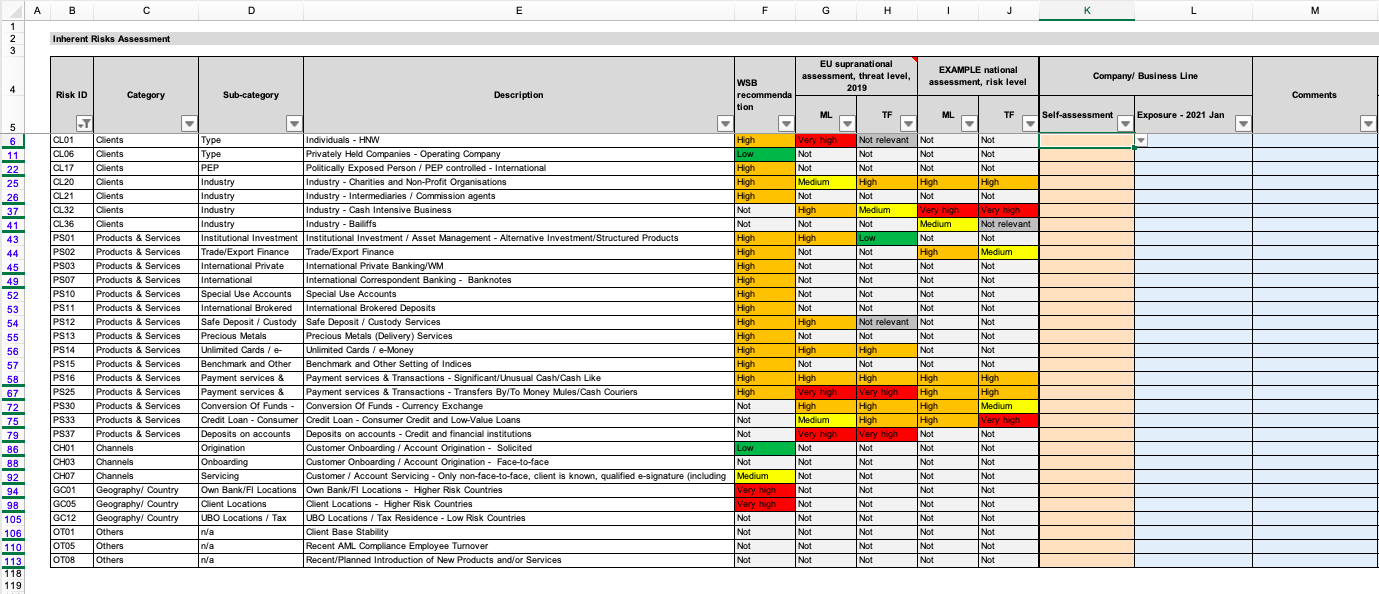

Money Laundering Risk Assessment Template For Accountants. Money laundering risk assessment template. A template will include any comments on answers as well. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. From 1 October 2018 Accountants that provide certain types of services will need to comply with the AMLCFT Act.

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

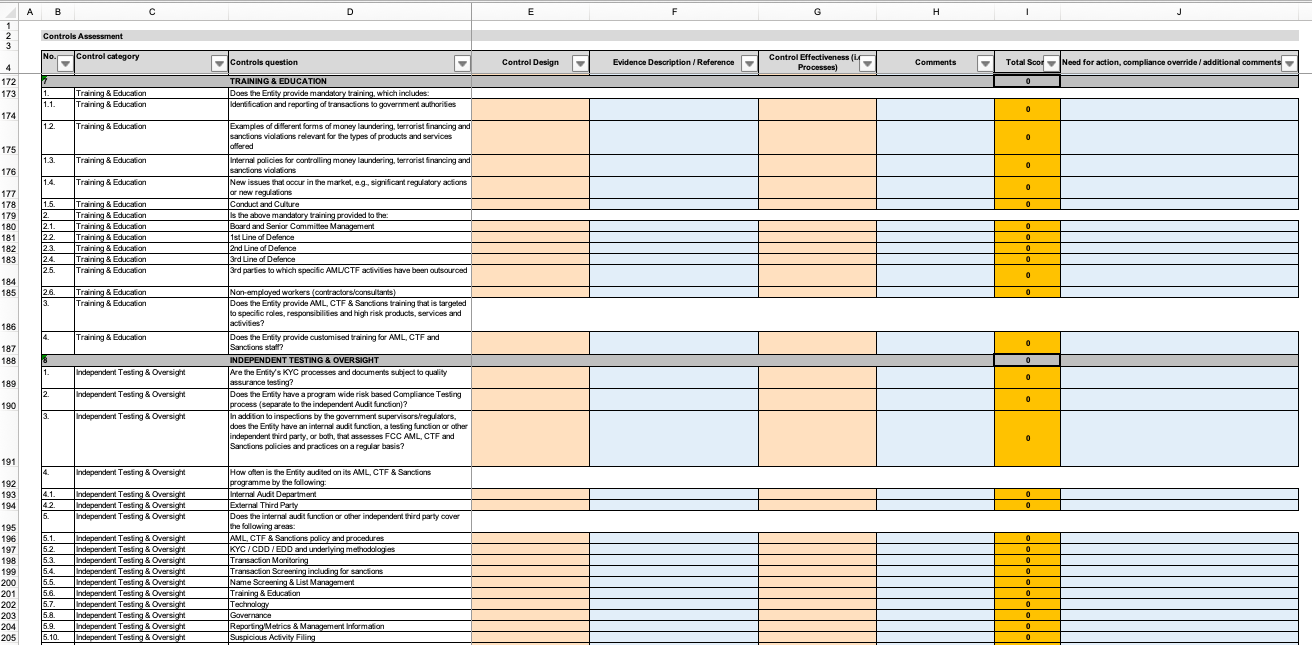

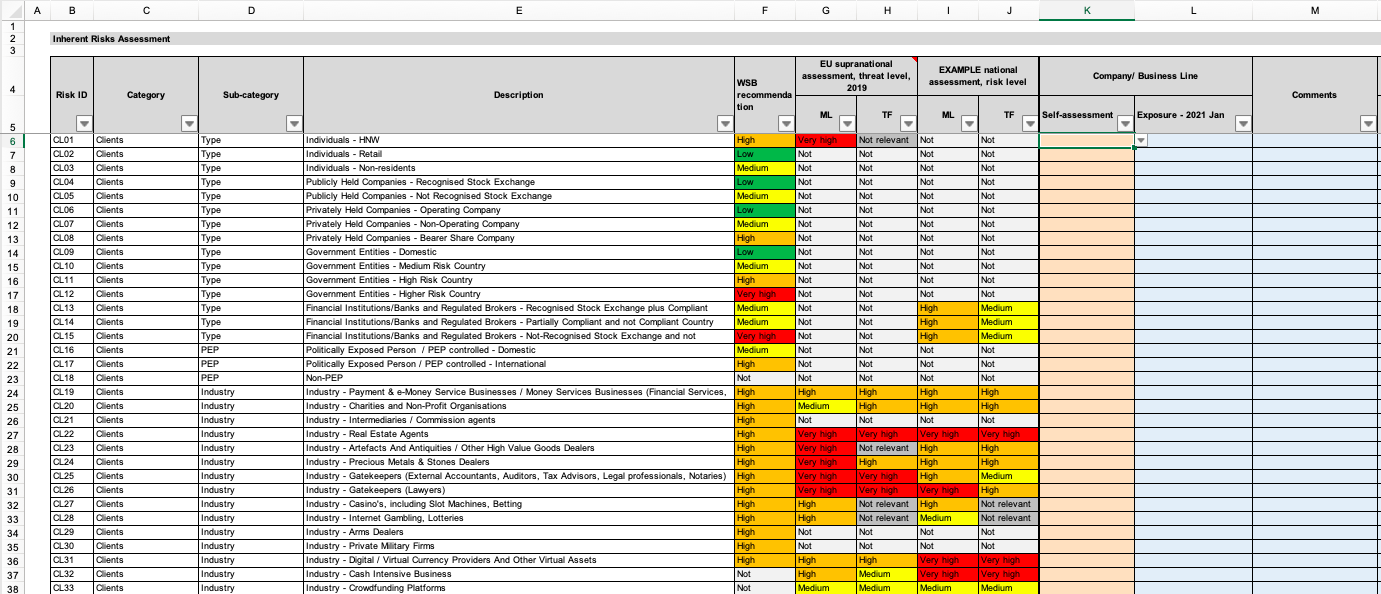

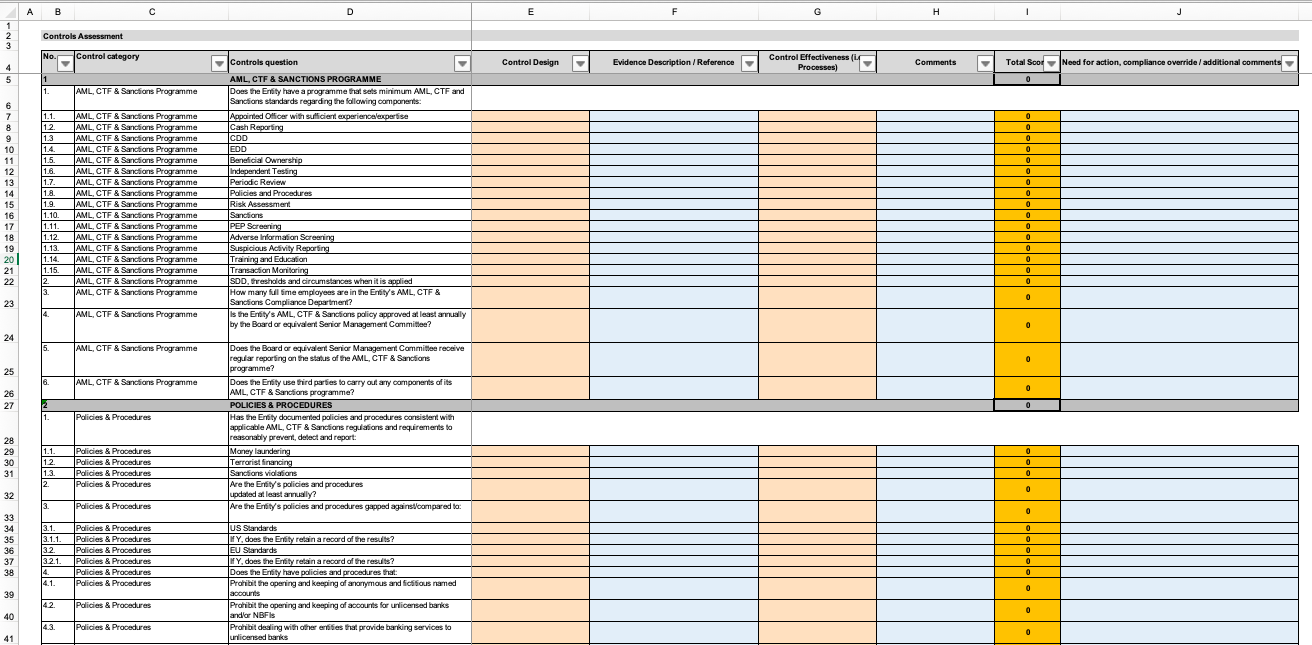

Carry out a detailed risk assessment of your business focusing on customer behaviour delivery channels and so on. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. Assessment For Ireland and FATF Guidance for a Risk-Based Approach for the Accounting Profession. Stay aware of the current AML risks and download a guide showing what a risk assessment might look like. Identify the money laundering risks faced by the different areas of your business and the clients and markets you serve. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low.

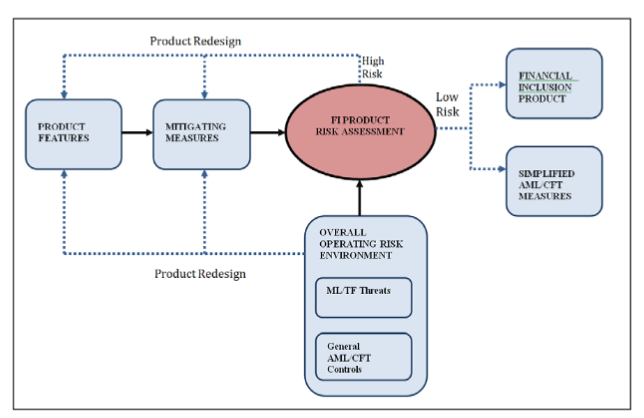

This guidance highlights the need for a sound assessment of the MLTF risks that accountants face so that the policies procedures and ongoing CDD measures mitigate these risks.

Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. You understand your business better than anyone else. Stay aware of the current AML risks and download a guide showing what a risk assessment might look like. From 1 October 2018 Accountants that provide certain types of services will need to comply with the AMLCFT Act. 0 No sums of money could be laundered in the circumstances. Practice Risk Assessment Template UK Practice Risk Assessment Template UK Mac Version Your assessment must take into account information made available by your supervisory authority.

Source: rur.senecvks.pw

Source: rur.senecvks.pw

2 Moderate sums of money could be laundered with some reputation damage to the frim. Identify the money laundering risks that are relevant to your business. The risk-based approach is central to the effective implementation of the FATF Recommendations to fight money laundering and terrorist financing. Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. We subscribe to the SWAT Practice assurance manual which contains a Firm level Risk Assessment however.

Source: eloquens.com

Source: eloquens.com

The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering. Assessment For Ireland and FATF Guidance for a Risk-Based Approach for the Accounting Profession. A risk assessment is the first step a business must take before developing an AMLCFT programme. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. This guidance gives an introduction to crypto-assets for accountants and how members may encounter clients with these assets.

Source:

Based on the foregoing Nigeria conducted her maiden National Risk Assessment NRA on Money LaunderingTerrorist Financing in 2016 the assessment covered the period between 2010- June 2016. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. ACCA has created a template with some hints and tips to aid members and their clients in completing a firm-wide risk assessment. 0 No sums of money could be laundered in the circumstances. It involves identifying and assessing the risks the reporting entity reasonably expects to face from money laundering and terrorism financing.

Source: advisoryhq.com

Source: advisoryhq.com

The firm wide risk assessment should be reviewed and updated on an annual basis. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. Money laundering risk assessment template. Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. ACCA has created a template with some hints and tips to aid members and their clients in completing a firm-wide risk assessment.

Source:

Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. A risk assessment is the first step a business must take before developing an AMLCFT programme. A template will include any comments on answers as well. Below we have created a template.

Source: researchgate.net

Source: researchgate.net

It has been highlighted in our Practice Assurance visit that we are required to have a firm wide AML risk assessment along side our documented office proceedures does anyone know of a simpe template for this. It involves identifying and assessing the risks the reporting entity reasonably expects to face from money laundering and terrorism financing. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. Assess each identified risk by considering the likelihood of it.

Source: advisoryhq.com

Source: advisoryhq.com

Trends and risks within money laundering is constantly changing. Assess each identified risk by considering the likelihood of it. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. We subscribe to the SWAT Practice assurance manual which contains a Firm level Risk Assessment however. Based on the foregoing Nigeria conducted her maiden National Risk Assessment NRA on Money LaunderingTerrorist Financing in 2016 the assessment covered the period between 2010- June 2016.

Source: eloquens.com

Source: eloquens.com

This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. From 1 October 2018 Accountants that provide certain types of services will need to comply with the AMLCFT Act. The template answers can then be edited to match the precise risk profile of that particular client. Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. The risk-based approach is central to the effective implementation of the FATF Recommendations to fight money laundering and terrorist financing.

Source: jonathonbray.com

Source: jonathonbray.com

Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. ACCA has created a template with some hints and tips to aid members and their clients in completing a firm-wide risk assessment. It involves identifying and assessing the risks the reporting entity reasonably expects to face from money laundering and terrorism financing. Stay aware of the current AML risks and download a guide showing what a risk assessment might look like. A template will include any comments on answers as well.

Source: service.betterregulation.com

Source: service.betterregulation.com

Money laundering regulations require accountants to disclose any relevant suspicions and failure to follow the required steps can also amount to a criminal offence. It has been highlighted in our Practice Assurance visit that we are required to have a firm wide AML risk assessment along side our documented office proceedures does anyone know of a simpe template for this. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. Identify the money laundering risks that are relevant to your business. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act.

Source: eloquens.com

Source: eloquens.com

Once a risk assessment is completed a reporting entity must then put in place an AMLCFT programme that manages and mitigates these risks. It has been highlighted in our Practice Assurance visit that we are required to have a firm wide AML risk assessment along side our documented office proceedures does anyone know of a simpe template for this. We subscribe to the SWAT Practice assurance manual which contains a Firm level Risk Assessment however. Based on the foregoing Nigeria conducted her maiden National Risk Assessment NRA on Money LaunderingTerrorist Financing in 2016 the assessment covered the period between 2010- June 2016. The firm wide risk assessment should be reviewed and updated on an annual basis.

Source: service.betterregulation.com

Source: service.betterregulation.com

The selection of a set of template answers will fill the answers to the client risk assessment. Assess each identified risk by considering the likelihood of it. The report findings revealed that the risk posed by Accounting firm rated is medium-high in Nigeria. 0 No sums of money could be laundered in the circumstances. The Proceeds of Organised Crime Act POCA not only includes offences for individuals directly involved in money laundering but also makes it a crime if you fail to disclose knowledge or suspicion of money laundering.

Source: eloquens.com

Source: eloquens.com

This guidance gives an introduction to crypto-assets for accountants and how members may encounter clients with these assets. Below we have created a template. This guidance highlights the need for a sound assessment of the MLTF risks that accountants face so that the policies procedures and ongoing CDD measures mitigate these risks. ACCA has created a template with some hints and tips to aid members and their clients in completing a firm-wide risk assessment. 2 Moderate sums of money could be laundered with some reputation damage to the frim.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering risk assessment template for accountants by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.