11++ Money laundering risk assessment form ideas

Home » money laundering Info » 11++ Money laundering risk assessment form ideasYour Money laundering risk assessment form images are available. Money laundering risk assessment form are a topic that is being searched for and liked by netizens now. You can Get the Money laundering risk assessment form files here. Get all free images.

If you’re looking for money laundering risk assessment form pictures information related to the money laundering risk assessment form topic, you have visit the right site. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

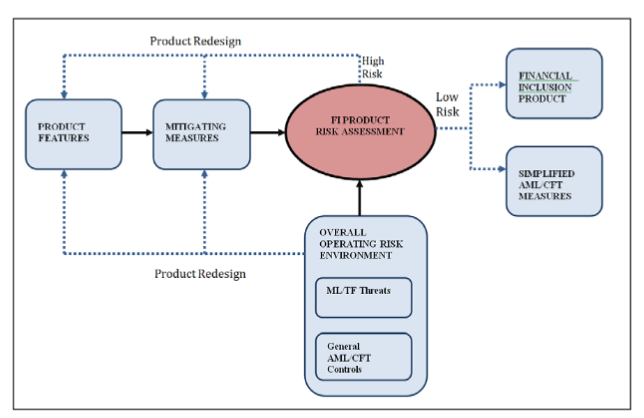

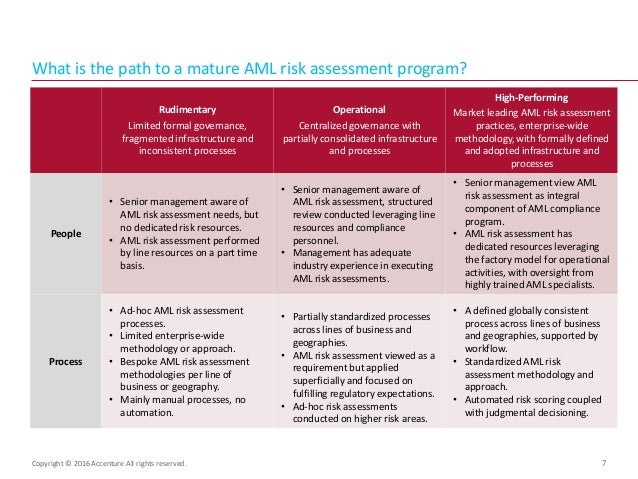

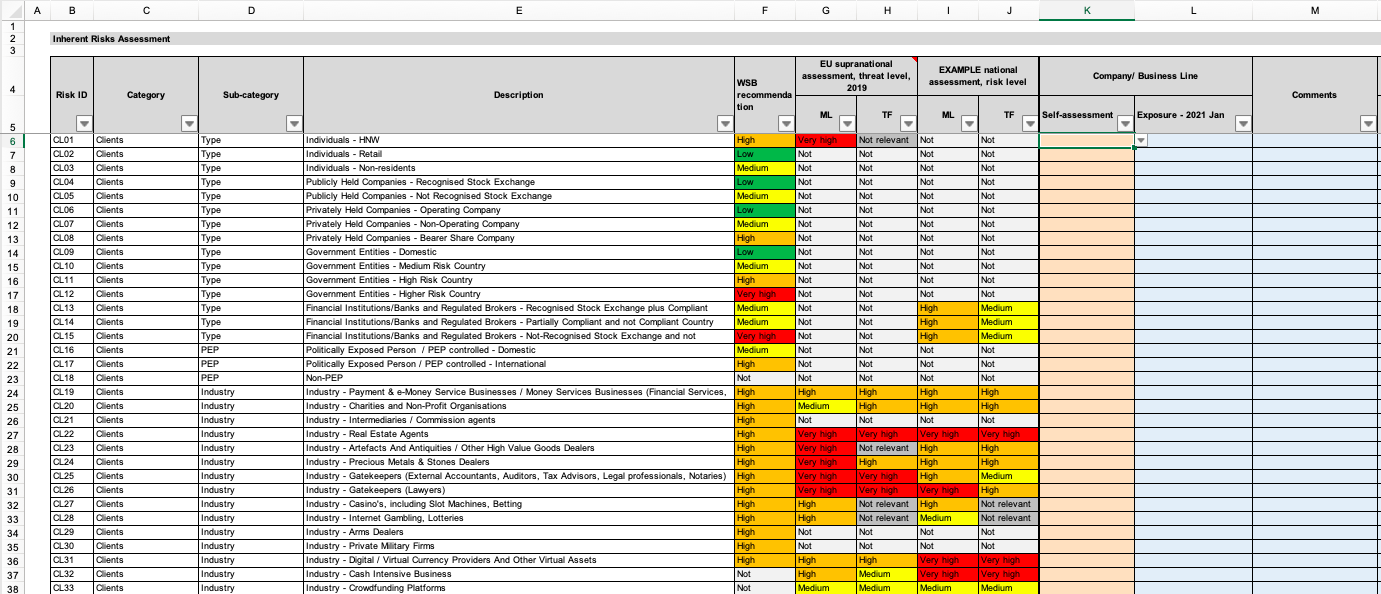

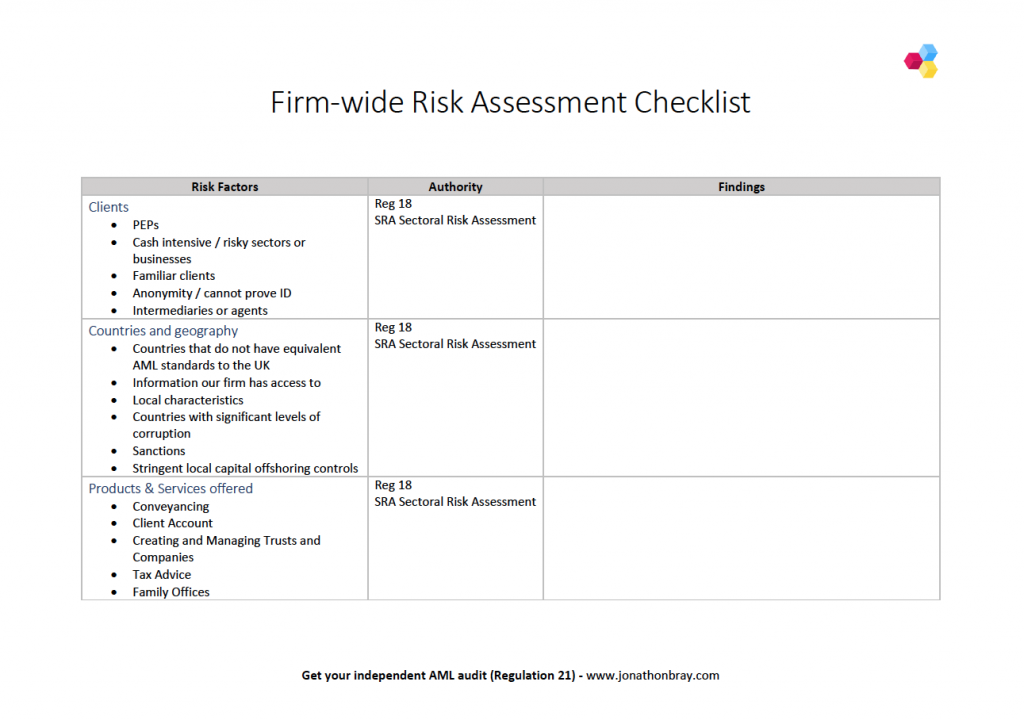

Money Laundering Risk Assessment Form. Legal Persons and Legal. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. You can decide which areas of.

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

All UK businesses have a responsibility to prevent money laundering and other forms of financial crime. This form can also be used to verify the other. Risk assessments are a key component of any firms anti-money laundering AML tool kit and can help businesses to measure the likelihood that they will. New Technologies Risk Assessment 2019. évaluation des risques Securities dealer. Many countries have chosen to publish information about the MLTF risks to their financial system in the form of a national money laundering and terrorist financing risks assessment.

You are best placed to.

Click here to view. You are best placed to. This form can also be used to verify the other. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. It is also compulsory for supervisory authorities to assess the risks associated with money laundering and terrorist financing. In the UK The Joint Money Laundering Steering Group Guidance Notes outline some of the considerations that should be taken into account when conducting a risk assessment the application of a risk based approach being a core theme4 For the purposes of this document when a Money Laundering ML risk assessment is referred to it is.

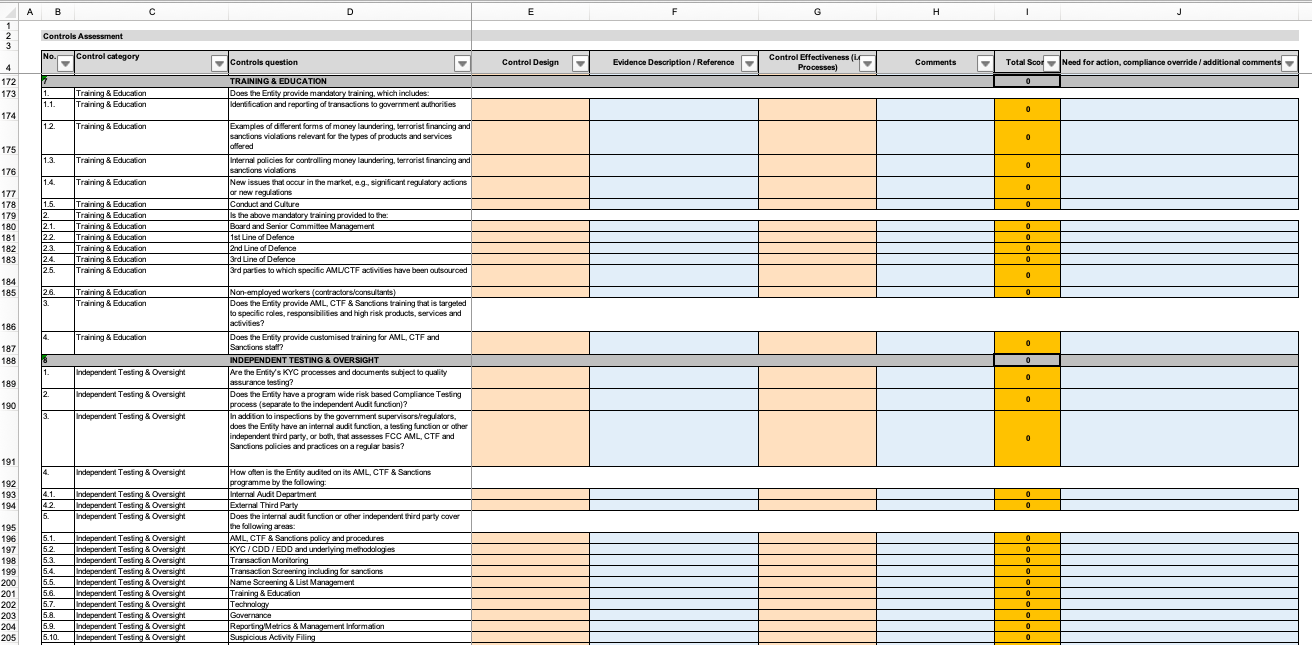

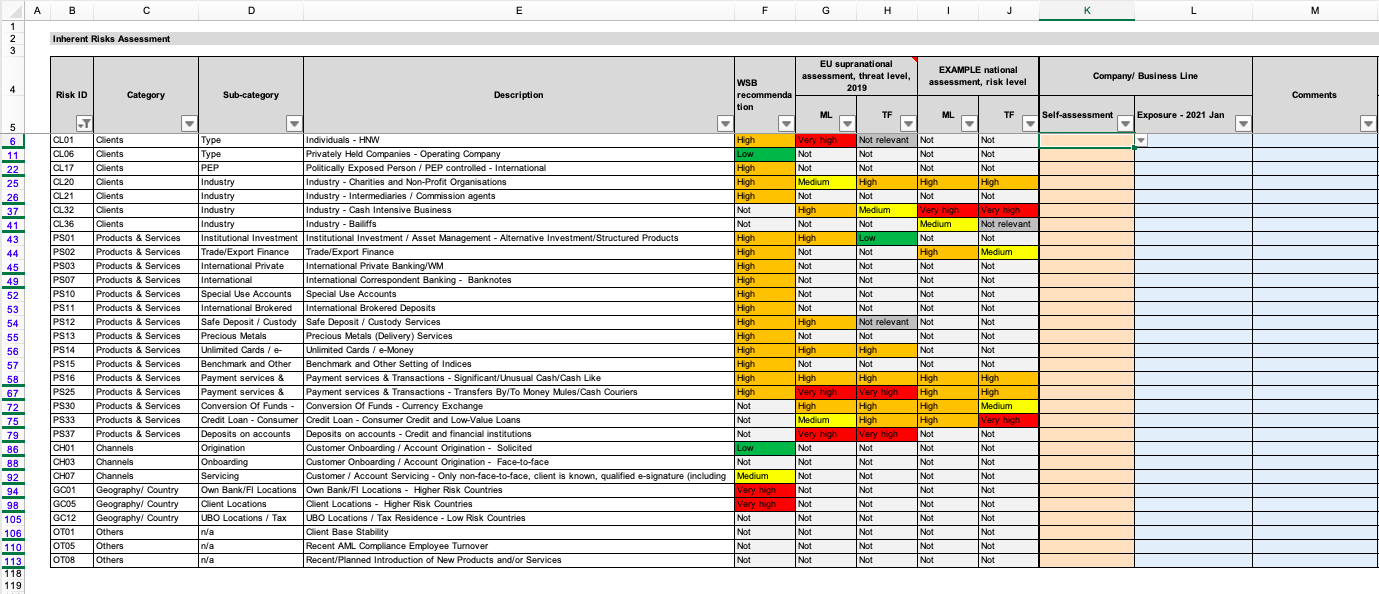

Source: eloquens.com

Source: eloquens.com

Home Risk Assessments. This Lettings Agency Client Identification and Risk Assessment Form is for use by a lettings agency dealing with high value residential lettings at a monthly rent of 10000 euros or more when checking the identity of a new client for Anti-Money Laundering purposes from the 10 January 2020. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Legal Persons and Legal. You are best placed to.

Source:

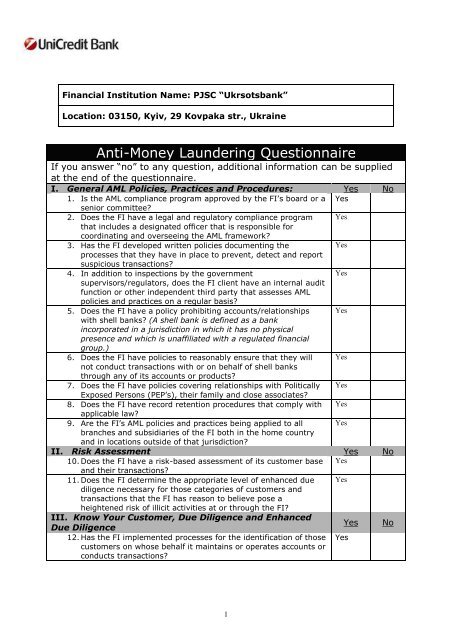

Money laundering risk assessment file note This should be completed at the beginning of the transaction during the transaction if anything changes and just before the transaction is completed. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry. This form can also be used to verify the other. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. Home Risk Assessments.

Source: eloquens.com

Source: eloquens.com

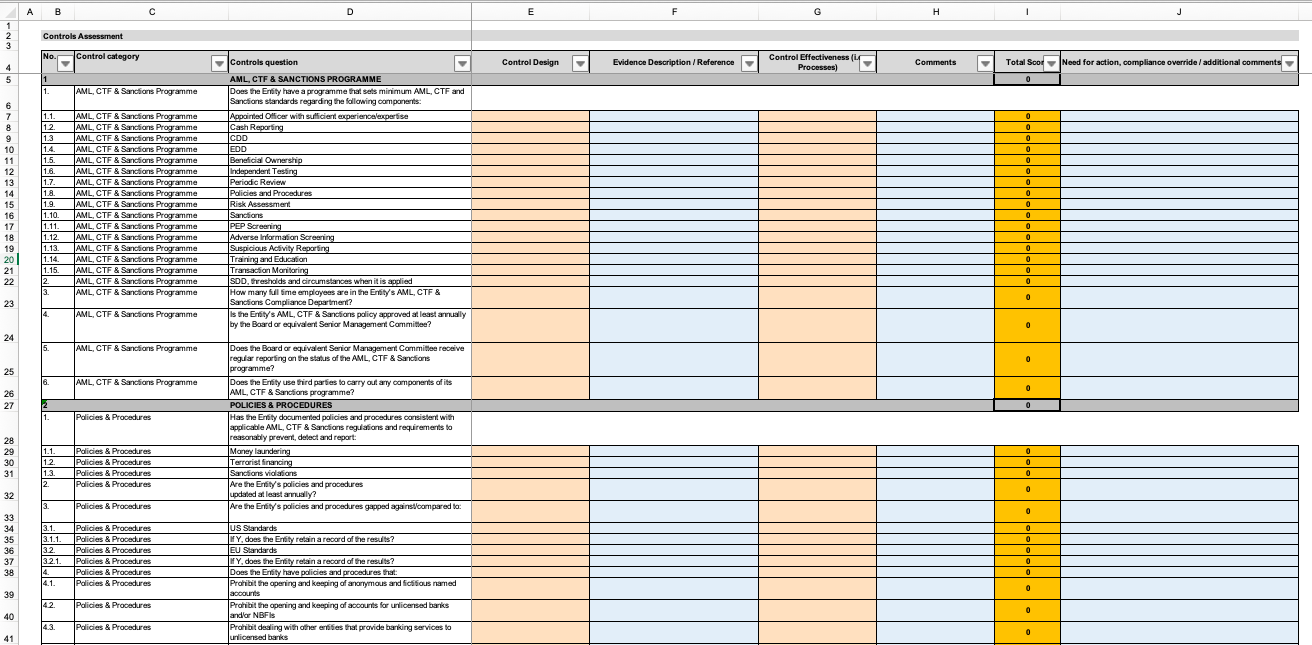

The review and documentation of potential money launderingterrorist financing risks in order to help a business establish policies procedures and controls to detect and mitigate these risks and their impact. Risk assessments are a key component of any firms anti-money laundering AML tool kit and can help businesses to measure the likelihood that they will. The publication of such a national risk assessment is not a mandatory requirement of the FATF Standards. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form. You understand your business better than anyone else.

Source: service.betterregulation.com

Source: service.betterregulation.com

Many countries have chosen to publish information about the MLTF risks to their financial system in the form of a national money laundering and terrorist financing risks assessment. You understand your business better than anyone else. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Identifying and assessing the level of money laundering and terrorism financing MLTF risk to your business or organisation is an important part of your AMLCTF program. Risk assessments are a key component of any firms anti-money laundering AML tool kit and can help businesses to measure the likelihood that they will.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. In the UK The Joint Money Laundering Steering Group Guidance Notes outline some of the considerations that should be taken into account when conducting a risk assessment the application of a risk based approach being a core theme4 For the purposes of this document when a Money Laundering ML risk assessment is referred to it is. Click here to view. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Source: service.betterregulation.com

Source: service.betterregulation.com

Click here to view. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. Legal Persons and Legal. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. The review and documentation of potential money launderingterrorist financing risks in order to help a business establish policies procedures and controls to detect and mitigate these risks and their impact.

Source: slideshare.net

Source: slideshare.net

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. In the UK The Joint Money Laundering Steering Group Guidance Notes outline some of the considerations that should be taken into account when conducting a risk assessment the application of a risk based approach being a core theme4 For the purposes of this document when a Money Laundering ML risk assessment is referred to it is. Money launderingterrorism financing risk assessment.

Source: eloquens.com

Source: eloquens.com

Risk assessments are a key component of any firms anti-money laundering AML tool kit and can help businesses to measure the likelihood that they will. Forms. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry.

Source: yumpu.com

Source: yumpu.com

Click here to view. Many countries have chosen to publish information about the MLTF risks to their financial system in the form of a national money laundering and terrorist financing risks assessment. New Technologies Risk Assessment 2019. Forms. New anti-money laundering risk assessment form available to firms.

Source: eloquens.com

Source: eloquens.com

You understand your business better than anyone else. This questionnaire is an important information-gathering exercise necessary for conducting an effective and informed assessment of Money LaunderingTerrorist Financing MLTF risks in the Real Estate Industry. Risk assessments are a key component of any firms anti-money laundering AML tool kit and can help businesses to measure the likelihood that they will. The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1.

Source: advisoryhq.com

Source: advisoryhq.com

This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. ACCA has created a template with some hints and tips. In the UK The Joint Money Laundering Steering Group Guidance Notes outline some of the considerations that should be taken into account when conducting a risk assessment the application of a risk based approach being a core theme4 For the purposes of this document when a Money Laundering ML risk assessment is referred to it is. Risk Assessments AMLCU 2020-06-02T1133280100. The review and documentation of potential money launderingterrorist financing risks in order to help a business establish policies procedures and controls to detect and mitigate these risks and their impact.

Source: lexology.com

Source: lexology.com

The publication of such a national risk assessment is not a mandatory requirement of the FATF Standards. The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those. Click here to view. It is the first thing you must do because it determines what measures you need to include in your program. Money launderingterrorism financing risk assessment.

Source:

Legal Persons and Legal. Carrying out a risk assessment will help you to. It is the first thing you must do because it determines what measures you need to include in your program. ACCA has created a template with some hints and tips. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk assessment form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.