12++ Money laundering risk assessment checklist ideas in 2021

Home » money laundering idea » 12++ Money laundering risk assessment checklist ideas in 2021Your Money laundering risk assessment checklist images are ready in this website. Money laundering risk assessment checklist are a topic that is being searched for and liked by netizens now. You can Get the Money laundering risk assessment checklist files here. Download all royalty-free vectors.

If you’re looking for money laundering risk assessment checklist images information linked to the money laundering risk assessment checklist keyword, you have pay a visit to the ideal site. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

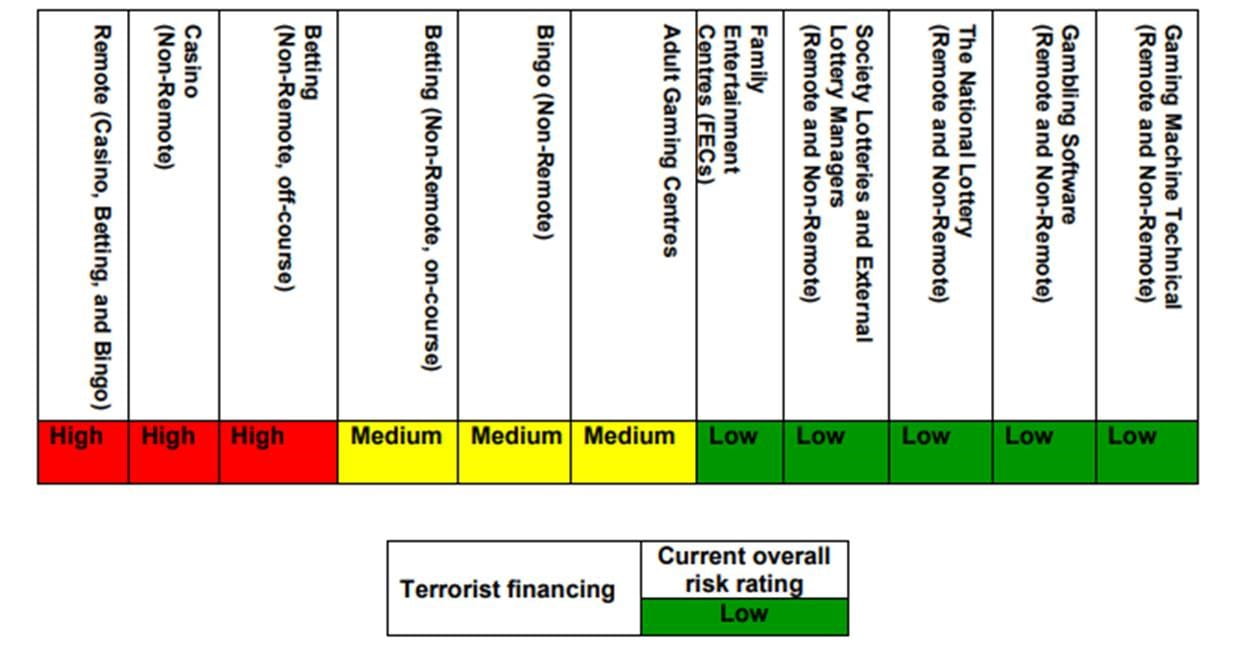

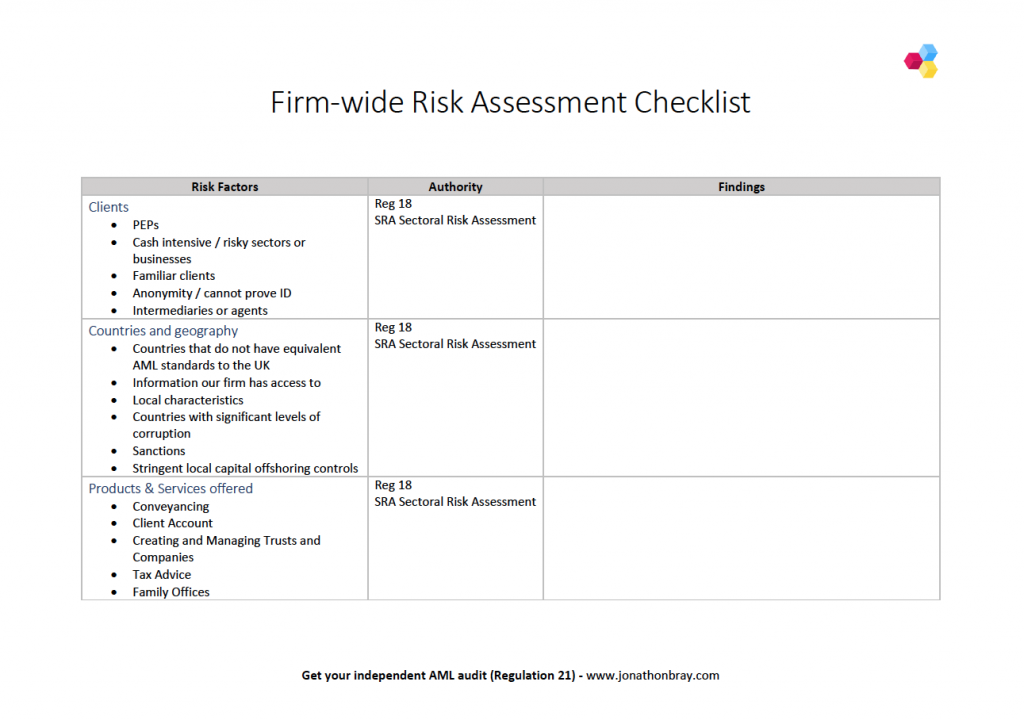

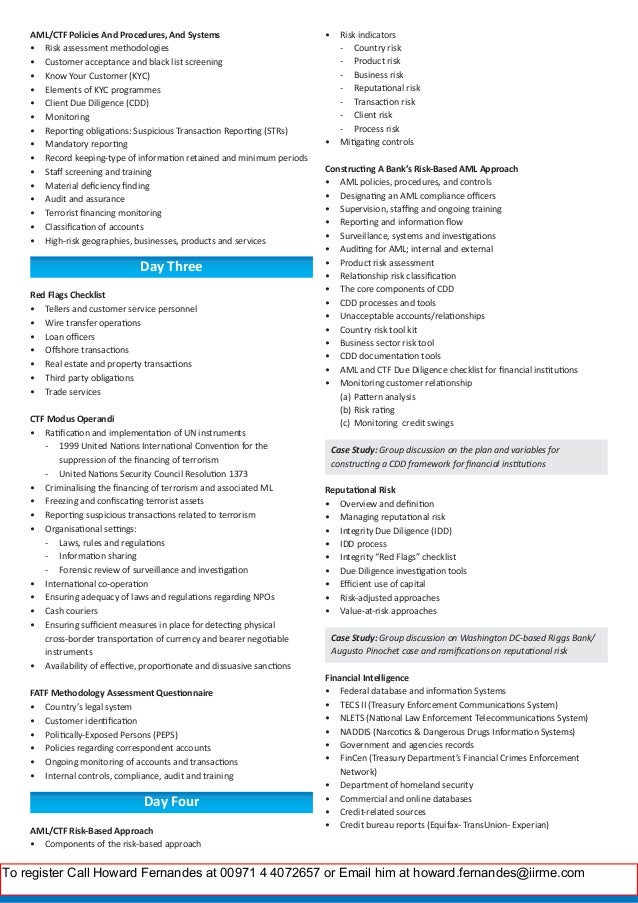

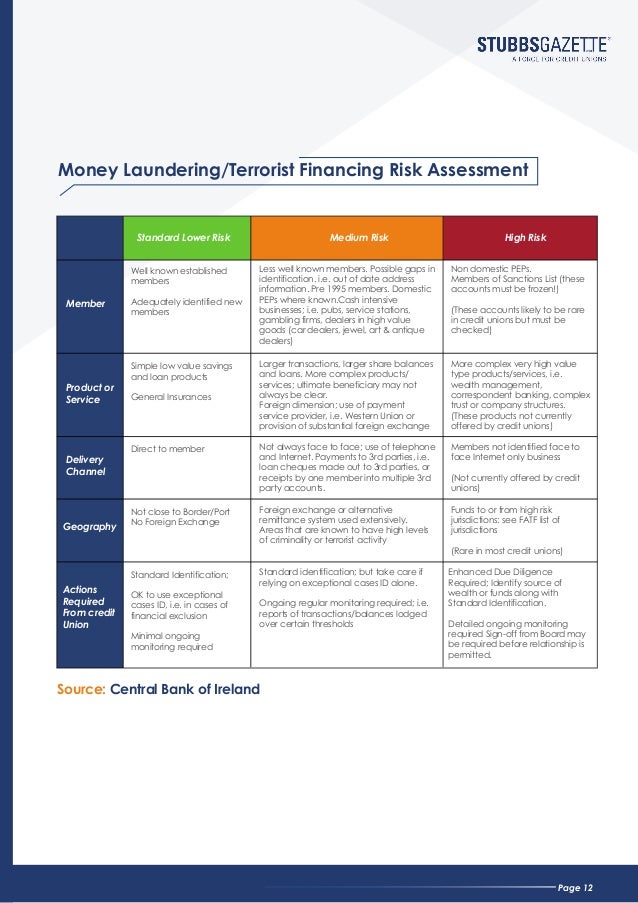

Money Laundering Risk Assessment Checklist. A formal risk assessment allows a business to consider and identify the risk factors that it may be exposed to and take steps to mitigate. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. The types of customer you have. Nominated Officer of the firm.

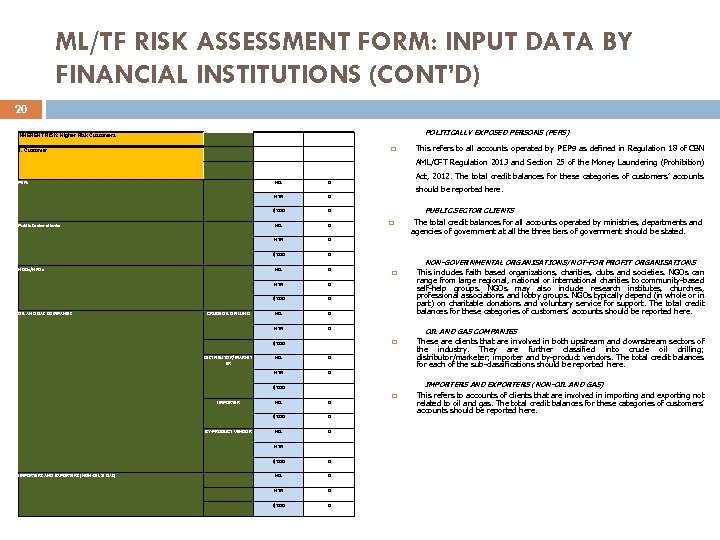

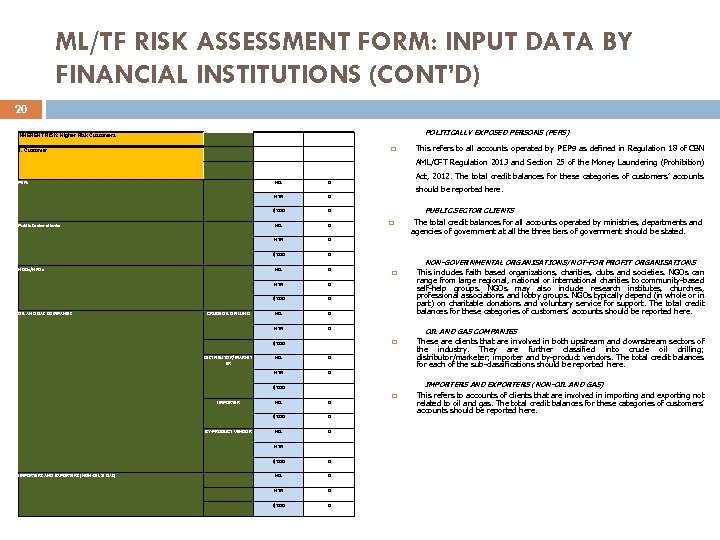

Workshop On Aml Cft Risk Based Supervision Tools For Financial From present5.com

Workshop On Aml Cft Risk Based Supervision Tools For Financial From present5.com

Nominated Officer of the firm. Risk assess the practice see below. 2 Moderate sums of money could be laundered with some reputation damage to the frim. This policy must include but isnt limited to the following. The sources of the money in actual are criminal and the money is invested in a means that makes it look like clear money. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low.

1 Very limited sums of money could be laundered and the reputational damage to the firm would be low.

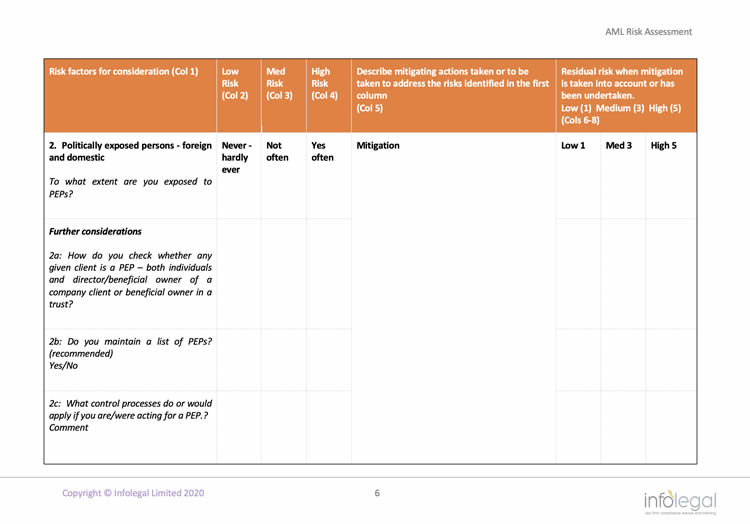

You must also have a thorough policy in place which details your firms AML policies and procedures. Carrying out AML and KYC checks is only part of your money laundering obligations. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. 0 No sums of money could be laundered in the circumstances. Laundering and terrorist financing risks. FIRM-WIDE RISK ASSESSMENT MLR17 requires firms to take appropriate steps to identify and assess the risk of money laundering and terrorist financing to which they are subject.

Source: pdfprof.com

Source: pdfprof.com

1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. It involves authenticating the user information against criminal watch lists global sanctions and Politically Exposed Person PEP lists. Reporting Procedures Tipping-Off 7. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. Again this is scored from 0 5.

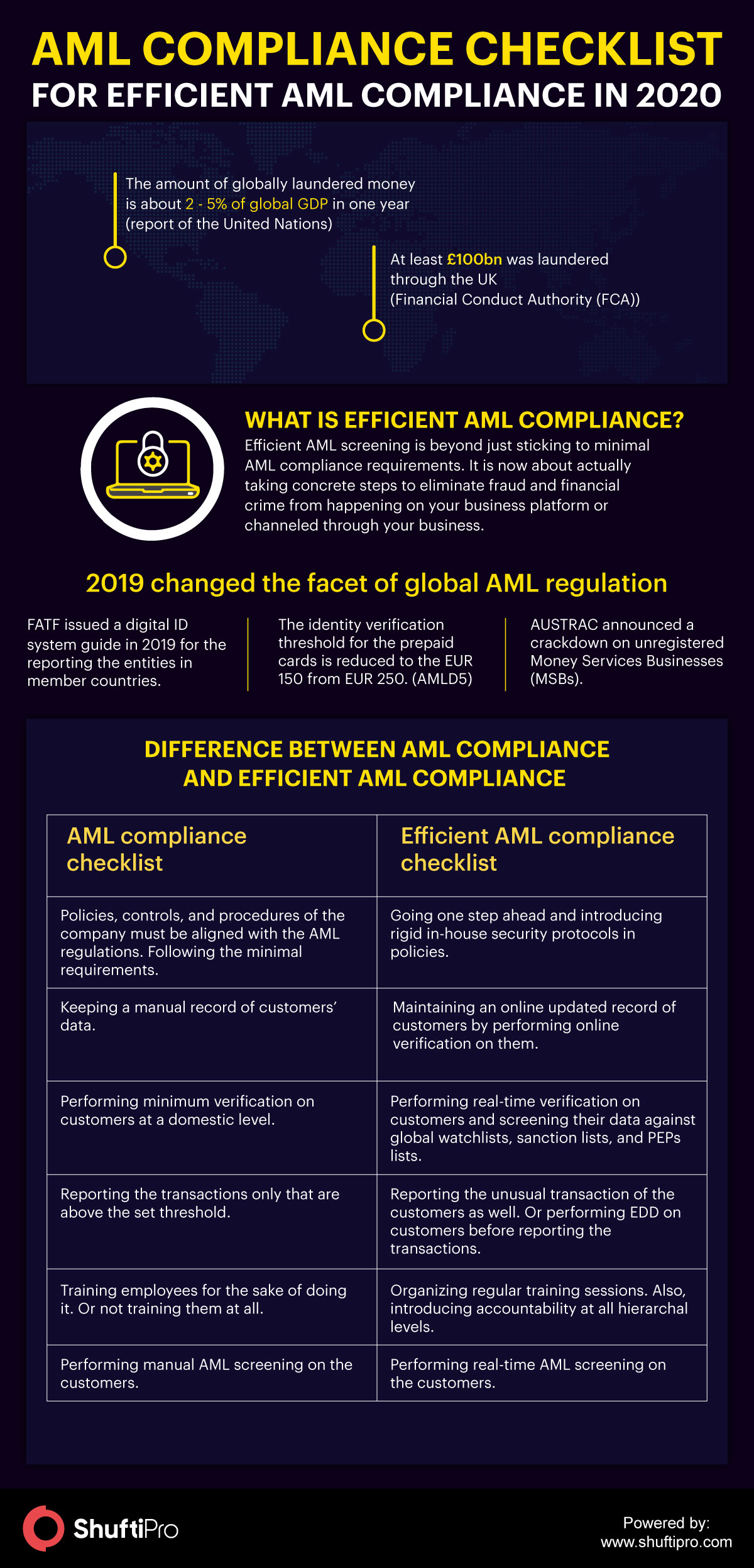

Source: shuftipro.com

Source: shuftipro.com

A formal risk assessment allows a business to consider and identify the risk factors that it may be exposed to and take steps to mitigate. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. We have developed a set of questions about management responsibilities reports a risk-based approach training suspicious activities and identifying customers. The form is designed to help firms in assessing AML risks posed at both client and transactional level. Wayne Barnett President of Wayne Barnett Software has contributed a RiskAnalysis Checklist for BSA and AML Its a list of factors for you to consider when deciding whether a given customer should be considered to bring more money-laundering risk to the bank and therefore be subjected to increased.

Source: rur.senecvks.pw

Source: rur.senecvks.pw

Further information is available in Chapter 4 of the CCAB guidance and in the Firm-wide risk assessment methodology guidance. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. 0 No sums of money could be laundered in the circumstances. CHECKLIST FOR COMPLIANCE WITH MONEY LAUNDERING REGULATIONS 2017 MLR17 Contents 1. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

Source: infolegal.co.uk

Source: infolegal.co.uk

Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist. CHECKLIST FOR COMPLIANCE WITH MONEY LAUNDERING REGULATIONS 2017 MLR17 Contents 1. This includes a risk assessment and customer identification checklist. Laundering and terrorist financing risks. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1.

Source: slideshare.net

Source: slideshare.net

You must also have a thorough policy in place which details your firms AML policies and procedures. To complement our anti-money laundering policy for a low risk business a new company wide risk assessment and a client identification checklist have been added to the corporate portfolio of templates. CHECKLIST FOR COMPLIANCE WITH MONEY LAUNDERING REGULATIONS 2017 MLR17 Contents 1. The form is designed to help firms in assessing AML risks posed at both client and transactional level. Carrying out AML and KYC checks is only part of your money laundering obligations.

Source: present5.com

Source: present5.com

The types of customer you have. Carrying out AML and KYC checks is only part of your money laundering obligations. Its a course of by which soiled money is transformed into clear cash. When you assess the risks of money laundering that apply to your business you need to consider. Money laundering is the process and activities aimed at showing the values of the assets they obtained from the crime in a different way to hide the crimes of the people or bring a legal image to the crime income.

Source: lexology.com

Source: lexology.com

By Know Your Compliance. The types of customer you have. However it is a matter of good business practice and sensible for all businesses to consider having policies and procedures in place to identify and minimize the risks of money laundering. Anti-Money Laundering screening involves the verification of an end-user by screening them against watch lists compiled by regulatory authorities such as the FATF UN FINTRAC AUSTRAC and others. You understand your business better than anyone else.

Source: knowyourcompliance.com

Source: knowyourcompliance.com

2 Moderate sums of money could be laundered with some reputation damage to the frim. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. The form is designed to help firms in assessing AML risks posed at both client and transactional level. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. A low risk business is one that is not regulated under current legislation and therefore not required to.

Source: lexology.com

Source: lexology.com

The form is designed to help firms in assessing AML risks posed at both client and transactional level. Further information is available in Chapter 4 of the CCAB guidance and in the Firm-wide risk assessment methodology guidance. Firms risk assessment 3. It involves authenticating the user information against criminal watch lists global sanctions and Politically Exposed Person PEP lists. 0 No sums of money could be laundered in the circumstances.

Source: slideshare.net

Source: slideshare.net

February 27 2020. Carrying out AML and KYC checks is only part of your money laundering obligations. Wayne Barnett President of Wayne Barnett Software has contributed a RiskAnalysis Checklist for BSA and AML Its a list of factors for you to consider when deciding whether a given customer should be considered to bring more money-laundering risk to the bank and therefore be subjected to increased. You are best placed to. If you use a checklist for your risk assessment you must be able to provide a documented analysis of the risk that draws conclusions on your businesss vulnerabilities to MLTF and the threats it faces including the required elements referred to above.

Source: slideshare.net

Source: slideshare.net

Money laundering is the process and activities aimed at showing the values of the assets they obtained from the crime in a different way to hide the crimes of the people or bring a legal image to the crime income. To complement our anti-money laundering policy for a low risk business a new company wide risk assessment and a client identification checklist have been added to the corporate portfolio of templates. The types of customer you have. February 27 2020. If you use a checklist for your risk assessment you must be able to provide a documented analysis of the risk that draws conclusions on your businesss vulnerabilities to MLTF and the threats it faces including the required elements referred to above.

An assessment of risk. However it is a matter of good business practice and sensible for all businesses to consider having policies and procedures in place to identify and minimize the risks of money laundering. February 27 2020. When you assess the risks of money laundering that apply to your business you need to consider. Money laundering is the process and activities aimed at showing the values of the assets they obtained from the crime in a different way to hide the crimes of the people or bring a legal image to the crime income.

Source: docplayer.net

Source: docplayer.net

Nominated Officer of the firm. 0 No sums of money could be laundered in the circumstances. This includes a risk assessment and customer identification checklist. This guideline is designed to help you conduct your money laundering and terrorism financing risk assessment risk assessment under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. The types of customer you have.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering risk assessment checklist by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.