11+ Money laundering regulations risk based approach info

Home » money laundering idea » 11+ Money laundering regulations risk based approach infoYour Money laundering regulations risk based approach images are available. Money laundering regulations risk based approach are a topic that is being searched for and liked by netizens now. You can Download the Money laundering regulations risk based approach files here. Find and Download all free vectors.

If you’re searching for money laundering regulations risk based approach images information connected with to the money laundering regulations risk based approach keyword, you have pay a visit to the right blog. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

Money Laundering Regulations Risk Based Approach. The risk-based approach means a focus on outputs. The rule-based and the risk-based are two approaches to the implementation of the Anti Money Laundering and Counter Terrorist Financing AMLCFT system and to the compliance with the measures thereof. The rule-based approach requires compliance with rules irrespective of the underlying risk. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules.

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs From taxguru.in

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs From taxguru.in

Both approaches have been adopted in countries legislation and they have confronted each other in the international scenario over the last 15-20 years. Between 2007 and 2009 in order to assist both public authorities and the private sector in applying a risk-based approach the FATF has adopted a series of guidance in co-operation with relevant sectors. It is evident that the risk-based AML approach requires banks to proactively identify and seek out various outlets and changes of black money in order to find ways to control money laundering whereas the regulation-based approach only requires passive enforcement of. Cooperate in a conscientious way Thomas 2001. Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure. The rule-based and the risk-based are two approaches to the implementation of the Anti Money Laundering and Counter Terrorist Financing AMLCFT system and to the compliance with the measures thereof.

The risk-based approach means a focus on outputs.

This approach should be an essential foundation to efficient allocation of resources across the anti-money laundering and countering the. Customer transactions a fundamental component of a risk based approach. The most commonly used risk criteria are. Between 2007 and 2009 in order to assist both public authorities and the private sector in applying a risk-based approach the FATF has adopted a series of guidance in co-operation with relevant sectors. The more effective the cooperation the lower the risk of money-laundering. Purpose The current emphasis in anti-money laundering AML counter terrorist financing CTF regulation on risk-based strategies means that regulatory law enforcement and reporting agencies.

Source: acamstoday.org

Source: acamstoday.org

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The risk-based approach to anti-money laundering. The most commonly used risk criteria are. Money laundering risks may be measured using various categories which may be modified by risk variables. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations.

The risk-based approach means a focus on outputs. The most commonly used risk criteria are. In 2005 the European Commission has adopted the so called Third Directive on Anti-Money Laundering AML which was to be implemented into the national laws at the latest in December 2007. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. This approach enables resources where the risks are allocation of higher.

Source: bi.go.id

Source: bi.go.id

Between 2007 and 2009 in order to assist both public authorities and the private sector in applying a risk-based approach the FATF has adopted a series of guidance in co-operation with relevant sectors. In 2005 the European Commission has adopted the so called Third Directive on Anti-Money Laundering AML which was to be implemented into the national laws at the latest in December 2007. The most commonly used risk criteria are. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations. 2 Prioritisation is also another advantage of the RBA.

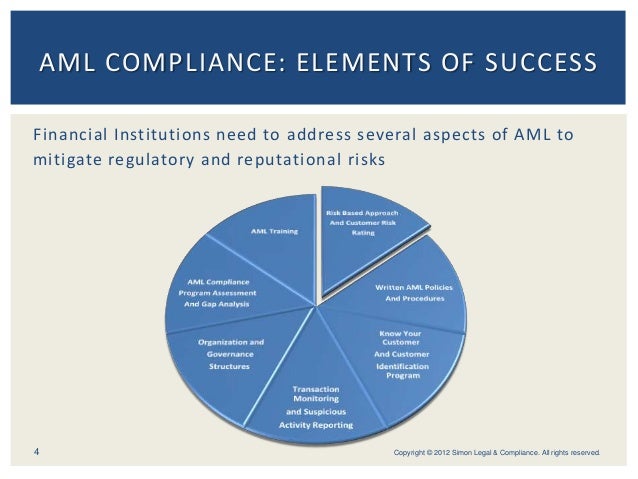

Source: slideshare.net

Source: slideshare.net

The current emphasis in antimoney laundering AML counter terrorist financing CTF regulation on riskbased strategies means that regulatory law enforcement and reporting agencies need to respond to money laundering and terroristfinancing threats in ways that are proportionate to the risks. A risk-based approach means that countries competent authorities and banks identify assess and understand the money laundering and terrorist financing risk to which they are exposed and take the appropriate mitigation measures in accordance with the level of risk. You can decide which areas of your. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations adopted in 2012.

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Money laundering risks may be measured using various categories which may be modified by risk variables. Both approaches have been adopted in countries legislation and they have confronted each other in the international scenario over the last 15-20 years. Between 2007 and 2009 in order to assist both public authorities and the private sector in applying a risk-based approach the FATF has adopted a series of guidance in co-operation with relevant sectors. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations.

Source: youtube.com

Source: youtube.com

Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules. The rule-based approach requires compliance with rules irrespective of the underlying risk. In each case as modified by the risk variables as described below. The most commonly used risk criteria are.

Source: bi.go.id

Source: bi.go.id

It means that competent authorities supervisors and legal professionals should identify assess and understand the money laundering and terrorist financing MLTF risks to which are exposed and legal professionalsappropriate implement mitigation measures. The authorities can implement an AML setting using either the rule-based approach or the risk-based approach. It is evident that the risk-based AML approach requires banks to proactively identify and seek out various outlets and changes of black money in order to find ways to control money laundering whereas the regulation-based approach only requires passive enforcement of. The current emphasis in antimoney laundering AML counter terrorist financing CTF regulation on riskbased strategies means that regulatory law enforcement and reporting agencies need to respond to money laundering and terroristfinancing threats in ways that are proportionate to the risks. Financial institutions must work on an ongoing basis to understand the money laundering threats they face and deploy commensurate measures to manage their risk exposure.

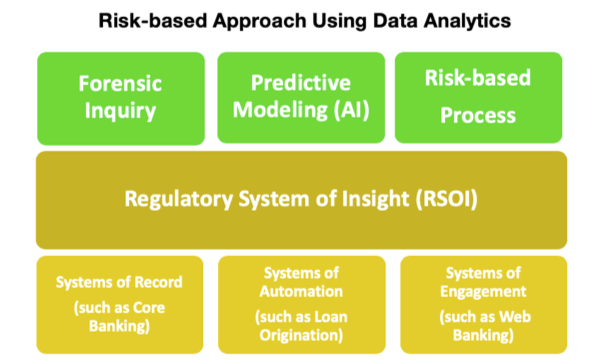

Source: amberoon.com

Source: amberoon.com

Both approaches have been adopted in countries legislation and they have confronted each other in the international scenario over the last 15-20 years. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations adopted in 2012. The rule-based approach requires compliance with rules irrespective of the underlying risk. In principle the risk-based approach shifts the focus of AML compliance from post-analysis of data to proactive judgment. The key feature that characterizes the Third Directive is the idea that the regulatory framework should be risk-based RBA.

Source: bi.go.id

Source: bi.go.id

Both approaches have been adopted in countries legislation and they have confronted each other in the international scenario over the last 15-20 years. The authorities can implement an AML setting using either the rule-based approach or the risk-based approach. The Risk-Based Approach is more flexible than the rule approach as it leaves the possibility to the financial institutions to consider the risks in their total. The key feature that characterizes the Third Directive is the idea that the regulatory framework should be risk-based RBA. In each case as modified by the risk variables as described below.

Source: taxguru.in

Source: taxguru.in

Customer transactions a fundamental component of a risk based approach. Between 2007 and 2009 in order to assist both public authorities and the private sector in applying a risk-based approach the FATF has adopted a series of guidance in co-operation with relevant sectors. You can decide which areas of your. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations. The risk-based approach RBA is central to the effective implementation of the FATF Recommendations adopted in 2012.

Source: adgm.com

Source: adgm.com

This approach enables resources where the risks are allocation of higher. And Services risk. The rule-based approach requires compliance with rules irrespective of the underlying risk. Customer transactions a fundamental component of a risk based approach. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact.

Source: globalfinance.mu

Source: globalfinance.mu

December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations. In principle the risk-based approach shifts the focus of AML compliance from post-analysis of data to proactive judgment. The key feature that characterizes the Third Directive is the idea that the regulatory framework should be risk-based RBA. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. Purpose The current emphasis in anti-money laundering AML counter terrorist financing CTF regulation on risk-based strategies means that regulatory law enforcement and reporting agencies.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Between 2007 and 2009 in order to assist both public authorities and the private sector in applying a risk-based approach the FATF has adopted a series of guidance in co-operation with relevant sectors. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules. In 2005 the European Commission has adopted the so called Third Directive on Anti-Money Laundering AML which was to be implemented into the national laws at the latest in December 2007. The risk-based approach to anti-money laundering. The most commonly used risk criteria are.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations risk based approach by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.