10++ Money laundering regulations offence information

Home » money laundering Info » 10++ Money laundering regulations offence informationYour Money laundering regulations offence images are available. Money laundering regulations offence are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering regulations offence files here. Find and Download all free images.

If you’re looking for money laundering regulations offence images information connected with to the money laundering regulations offence topic, you have visit the right blog. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

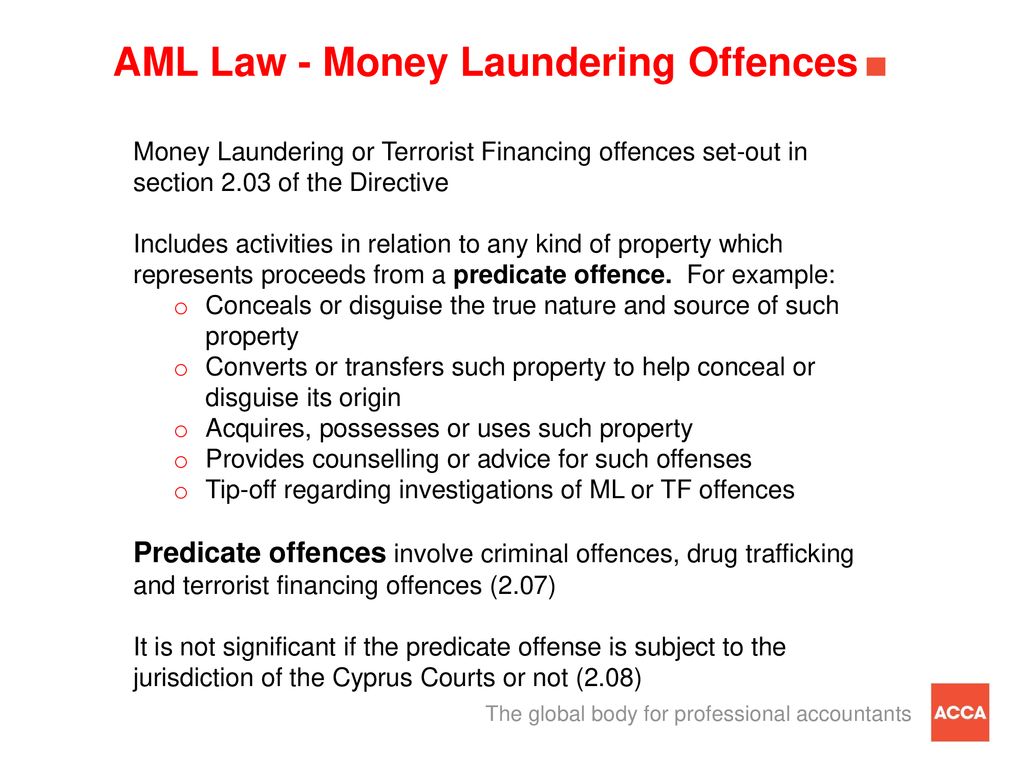

Money Laundering Regulations Offence. This is punishable by a fineup to 2 years imprisonment. In accordance with sections 3308 and 3317 of the Proceeds of Crime Act 2002 section 21A6 of the Terrorism Act 2000 and Regulation 862b of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the court is required to consider compliance with this guidance in assessing whether a person committed an offence or took all reasonable steps and exercised all due diligence to avoid committing the offence. The offence of money laundering is directed at persons who. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec.

Environmental Crimes Money Laundering From pideeco.be

Environmental Crimes Money Laundering From pideeco.be

He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and. Qualification status for obligated parties under money laundering law. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. But lets take it one step at a time. Conspiracy to commit the offence of money laundering. 1 A person may be convicted of a money laundering.

He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and.

This is punishable by a fineup to 2 years imprisonment. He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and. Any individual who recklessly makes a statement which is false or misleading in the context of a money laundering investigation commits an offence. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017. 1 A person may be convicted of a money laundering.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The offence of money laundering. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

Source: slideplayer.com

Source: slideplayer.com

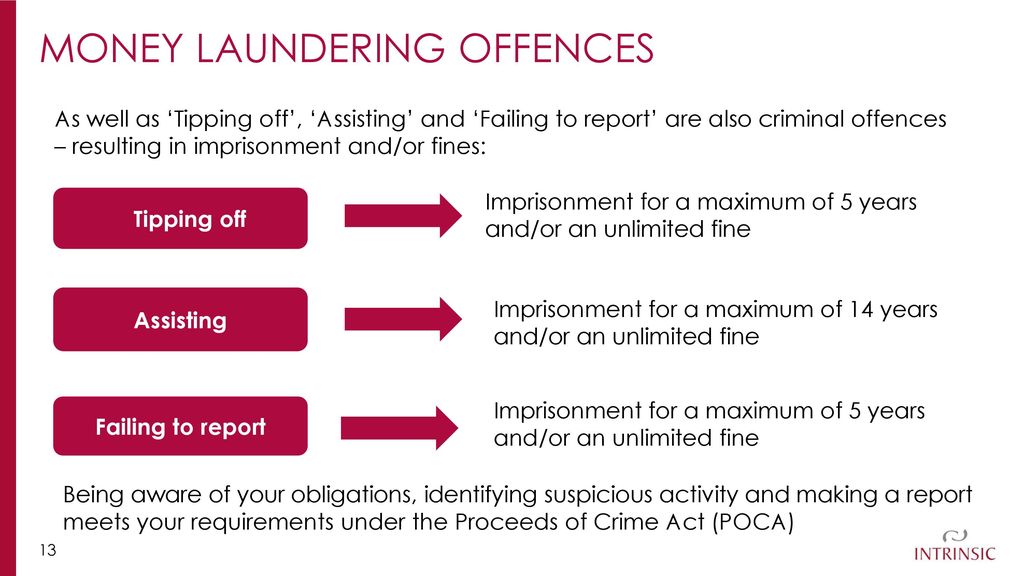

To ensure your business follows the correct money laundering procedures lets discuss the most up-to-date money laundering regulations and the associated. Money laundering means doing any act which constitutes an offence under section 47 or 48 of the Misuse of Drugs Law 2014 Revision sections 19 to 22 of the Terrorism Law 2015 Revision or sections 32 to 34 of the Law or in. A conviction for money laundering under Proceeds of Crime Act section 327 to 329 can result in a prison sentence of up to 14 years a fine or both. This page highlights some specific new areas that firms need to comply with. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016.

Source: slideplayer.com

Source: slideplayer.com

1 A person may be convicted of a money laundering. The increase in money laundering offences is likely to lead to a considerable increase in reporting requirements. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016.

Source: slidetodoc.com

Source: slidetodoc.com

Engages in money laundering is guilty of an offence and is liable- 0 on summary conviction before a Resident Magis- trate in the case of an individual to a fine not exceeding one million dollars or to imprison- The inclusion of thir page is iuthorizcd by LN. Money laundering means doing any act which constitutes an offence under section 47 or 48 of the Misuse of Drugs Law 2014 Revision sections 19 to 22 of the Terrorism Law 2015 Revision or sections 32 to 34 of the Law or in. Engages in money laundering is guilty of an offence and is liable- 0 on summary conviction before a Resident Magis- trate in the case of an individual to a fine not exceeding one million dollars or to imprison- The inclusion of thir page is iuthorizcd by LN. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. In accordance with sections 3308 and 3317 of the Proceeds of Crime Act 2002 section 21A6 of the Terrorism Act 2000 and Regulation 862b of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the court is required to consider compliance with this guidance in assessing whether a person committed an offence or took all reasonable steps and exercised all due diligence to avoid committing the offence.

Source: slideplayer.com

Source: slideplayer.com

These Regulations replace the Money Laundering Regulations 2007 SI. A new criminal offence is created under the MLR 2017. 20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the. Any individual who recklessly makes a statement which is false or misleading in the context of a money laundering investigation commits an offence. In the UK money laundering legislations are taken very seriously.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

Money laundering is a type of fraud that involves multiple stages and can be associated with other forms of organised crime such as drugs and human trafficking. He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering.

Source: slideplayer.com

Source: slideplayer.com

These Regulations replace the Money Laundering Regulations 2007 SI. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. Money laundering regulations penalty for failure to report. Any individual who recklessly makes a statement which is false or misleading in the context of a money laundering investigation commits an offence.

Source: complyadvantage.com

Source: complyadvantage.com

In the UK money laundering legislations are taken very seriously. Maximum penalty is a HK 5000000 fine and 14-year imprisonment. Offences under the Money Laundering Regulations 2017 MLR 2017 The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 Money Laundering Regulations 2017 or MLR 2017 SI 2017692 came into force on 26 June 2017. 1 A person may be convicted of a money laundering. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive.

Source: pideeco.be

Source: pideeco.be

However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. Money laundering offences penalties. But lets take it one step at a time. 1 A person may be convicted of a money laundering. He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and.

Source: delta-net.com

Source: delta-net.com

The offence of money laundering is directed at persons who. The increase in money laundering offences is likely to lead to a considerable increase in reporting requirements. Maximum penalty is a HK 5000000 fine and 14-year imprisonment. This guide will help you to decide if you need to register with HMRC under the regulations. He knows or suspects or has reasonable grounds for knowing or suspecting that another person is engaged in money laundering and.

Source: slideplayer.com

Source: slideplayer.com

Money laundering means exchanging money or assets. Engages in money laundering is guilty of an offence and is liable- 0 on summary conviction before a Resident Magis- trate in the case of an individual to a fine not exceeding one million dollars or to imprison- The inclusion of thir page is iuthorizcd by LN. A new criminal offence is created under the MLR 2017. In accordance with sections 3308 and 3317 of the Proceeds of Crime Act 2002 section 21A6 of the Terrorism Act 2000 and Regulation 862b of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the court is required to consider compliance with this guidance in assessing whether a person committed an offence or took all reasonable steps and exercised all due diligence to avoid committing the offence. 1 A person may be convicted of a money laundering.

Source: researchgate.net

Source: researchgate.net

Where there is a Level One issue risk of loss the FSA can fine the licence holder up to 5 of relevant income. With a newly regulated paragraph 4 the draft law provides for an increase in punishment to a minimum term of imprisonment of three months for anyone who commits an offense under Section 261 of the German Criminal Code as an obligated party under the Anti-Money Laundering Act. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. This guide will help you to decide if you need to register with HMRC under the regulations. Any individual who recklessly makes a statement which is false or misleading in the context of a money laundering investigation commits an offence.

Source: bi.go.id

Source: bi.go.id

For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. Conspiracy to commit the offence of money laundering. This page highlights some specific new areas that firms need to comply with. The information on which his suspicion is based comes in the course of business in the regulated sector and.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations offence by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.