18+ Money laundering regulations 2017 trusts info

Home » money laundering Info » 18+ Money laundering regulations 2017 trusts infoYour Money laundering regulations 2017 trusts images are available in this site. Money laundering regulations 2017 trusts are a topic that is being searched for and liked by netizens now. You can Download the Money laundering regulations 2017 trusts files here. Find and Download all royalty-free photos.

If you’re searching for money laundering regulations 2017 trusts images information linked to the money laundering regulations 2017 trusts keyword, you have visit the right site. Our website frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Money Laundering Regulations 2017 Trusts. This Practice Note considers the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 and were amended by the Money Laundering and. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Persons covered by the new regulations are the same as under the previous rules however now the entire gambling industry is in the scope of MLR 2017 and trustees have greater obligations relating to transparency of beneficiaries in their trusts.

Specifically the consultation seeks views on whether. This guidance focuses mainly on the Money Laundering Terrorist Financing and Transfer of Funds information on the Payer Regulations 2017. This Practice Note considers the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 and were amended by the Money Laundering and. Following Treasurys initial consultation on how to implement MLD4 in September 2016 it has now published the feedback to that consultation and the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 have been laid before ParliamentThese Regulations replace the Money Laundering Regulations 2007 and the Transfer of Funds Information on the Payer Regulations 2007 with updated provisions implementing the Fourth Money Laundering Directive. Regulation 3 General interpretation.

The 4th Money Laundering Regulations which have been in force since June 2017 required all trusts that had a tax implication or consequence to be registered with HMRC.

692 MLRs 2017 Introductory Text. Specifically the consultation seeks views on whether. In the second edition of Board Agenda Nottingham chartered accountants Clayton Brewill explains the changes. They transpose into UK Law the requirements of the Fourth Money Laundering Directive in which the European Union has updated standards in the fight against money laundering. 19 The Regulations set out what relevant businesses such as trust or company service providers must do to prevent the use of their services for money laundering or terrorist financing purposes. This Practice Note considers the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 and were amended by the Money Laundering and.

Source: ft.lk

Source: ft.lk

They implement the requirements of the EUs Fourth Money Laundering Directive 4MLD into UK. UPDATED Money Laundering Regulations 2017impact on trustees Practice notes. The Regulations should deliver an up-to. Regulation 3 General interpretation. 1-7 Regulation 1 Citation and commencement.

Source: gov.si

Source: gov.si

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 have been laid before ParliamentThese Regulations replace the Money Laundering Regulations 2007 and the Transfer of Funds Information on the Payer Regulations 2007 with updated provisions implementing the Fourth Money Laundering Directive. 19 The Regulations set out what relevant businesses such as trust or company service providers must do to prevent the use of their services for money laundering or terrorist financing purposes. UPDATED Money Laundering Regulations 2017impact on trustees Practice notes. Chapter 4 of the consultation sets out proposals relating to the formation of limited partnerships and the reporting of discrepancies in beneficial ownership information. Private Client Share Incentives.

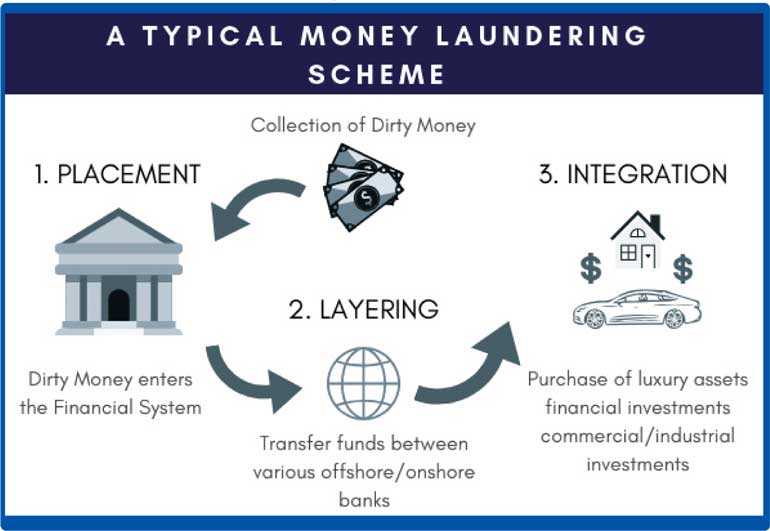

Source: shuftipro.com

Source: shuftipro.com

Regulation 4 Meaning of business relationship. The 2017 MLRs have been informed by the responses submitted and reflect the. On 26 June 2017 changes were made to UK anti-money laundering measures to help prevent money laundering and terrorist financing as well as increasing the transparency of who owns and controls companies in the UK. Regulation 2 Prescribed regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the 2017 Regulations came into force on 26 June 2017.

19 The Regulations set out what relevant businesses such as trust or company service providers must do to prevent the use of their services for money laundering or terrorist financing purposes. 2 These Regulations come into force on 26th. This was achieved via their website or downloadable forms. Part 1 Introduction regs. Persons covered by the new regulations are the same as under the previous rules however now the entire gambling industry is in the scope of MLR 2017 and trustees have greater obligations relating to transparency of beneficiaries in their trusts.

Source: tr.pinterest.com

Source: tr.pinterest.com

This guidance focuses mainly on the Money Laundering Terrorist Financing and Transfer of Funds information on the Payer Regulations 2017. Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the 2017 Regulations came into force on 26 June 2017. This Practice Note considers the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 and were amended by the Money Laundering and. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

19 The Regulations set out what relevant businesses such as trust or company service providers must do to prevent the use of their services for money laundering or terrorist financing purposes. 19 The Regulations set out what relevant businesses such as trust or company service providers must do to prevent the use of their services for money laundering or terrorist financing purposes. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. On 26 June 2017 changes were made to UK anti-money laundering measures to help prevent money laundering and terrorist financing as well as increasing the transparency of who owns and controls companies in the UK. In the second edition of Board Agenda Nottingham chartered accountants Clayton Brewill explains the changes.

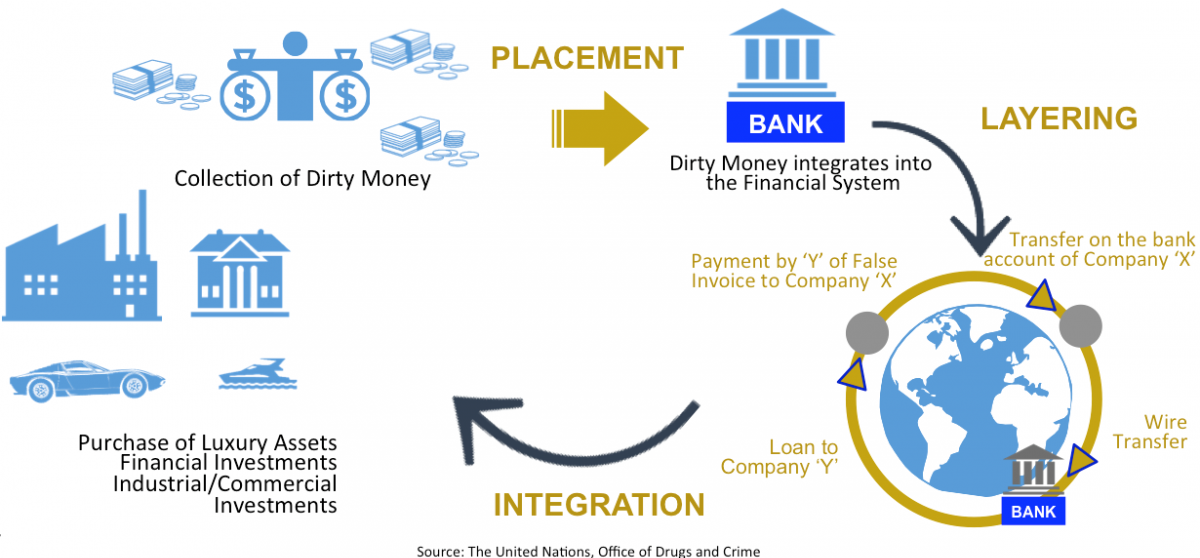

Source: mdpi.com

Source: mdpi.com

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. 692 MLRs 2017 Introductory Text. They implement the requirements of the EUs Fourth Money Laundering Directive 4MLD into UK. Regulation 2 Prescribed regulations. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

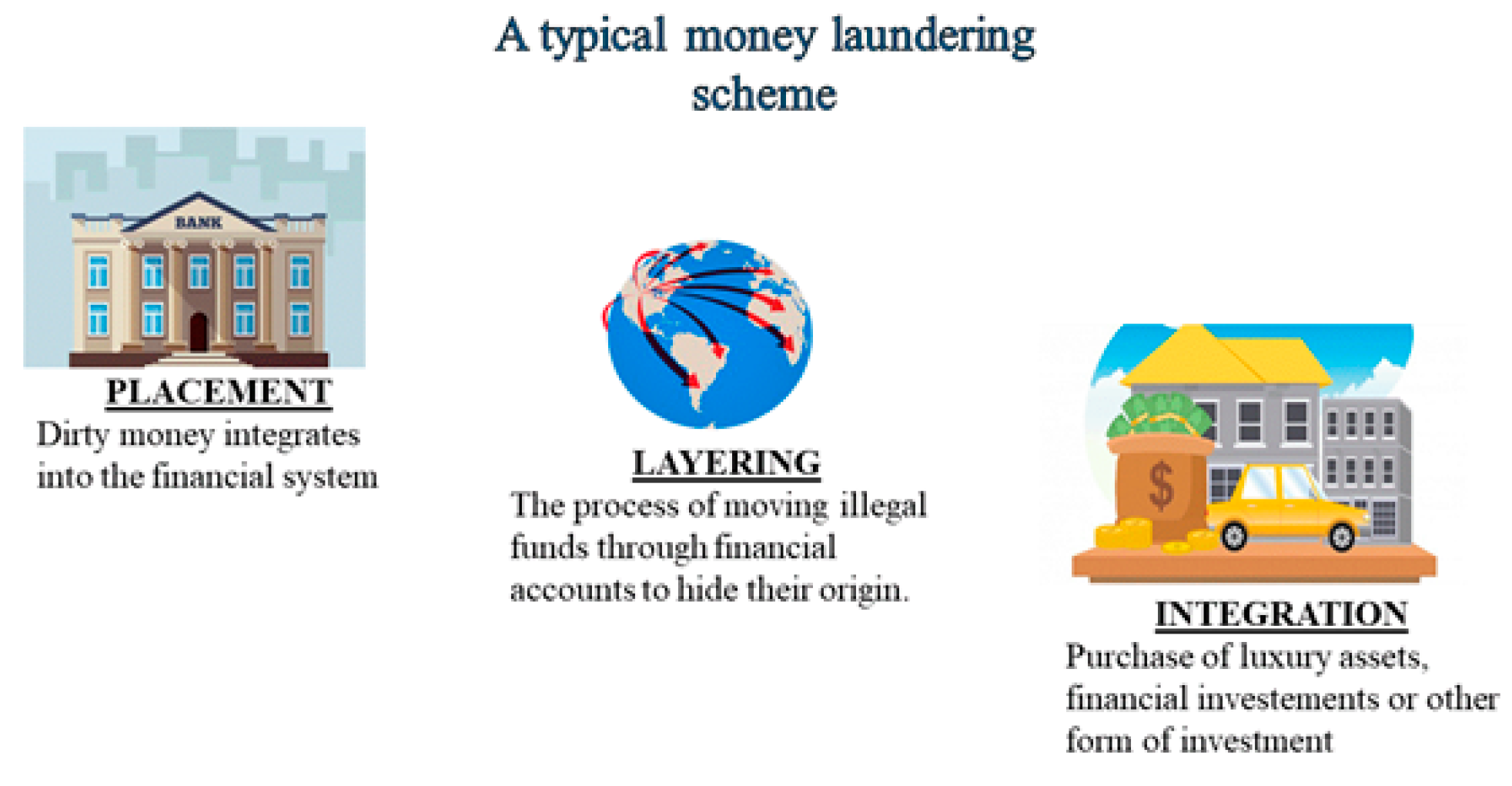

Source: in.pinterest.com

Source: in.pinterest.com

On 26 June 2017 changes were made to UK anti-money laundering measures to help prevent money laundering and terrorist financing as well as increasing the transparency of who owns and controls companies in the UK. This Practice Note considers the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 and were amended by the Money Laundering and. UPDATED Money Laundering Regulations 2017impact on trustees Practice notes. Regulation 2 Prescribed regulations. These Regulations are prescribed for the purposes of sections 1684b appointment of.

Source: pinterest.com

Source: pinterest.com

On 26 June 2017 changes were made to UK anti-money laundering measures to help prevent money laundering and terrorist financing as well as increasing the transparency of who owns and controls companies in the UK. On 26 June 2017 changes were made to UK anti-money laundering measures to help prevent money laundering and terrorist financing as well as increasing the transparency of who owns and controls companies in the UK. Regulation 3 General interpretation. Regulation 2 Prescribed regulations. Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to.

Source: researchgate.net

Source: researchgate.net

Under the Money Laundering Regulations a trust or company service provider is any company or sole practitioner whose business is to. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. 19 The Regulations set out what relevant businesses such as trust or company service providers must do to prevent the use of their services for money laundering or terrorist financing purposes. Time is now running short and the legislation must be in force by 26 June. 692 MLRs 2017 Introductory Text.

Source: researchgate.net

Source: researchgate.net

They transpose into UK Law the requirements of the Fourth Money Laundering Directive in which the European Union has updated standards in the fight against money laundering. They implement the requirements of the EUs Fourth Money Laundering Directive 4MLD into UK. 2 These Regulations come into force on 26th June 2017. The 2017 MLRs have been informed by the responses submitted and reflect the. Following Treasurys initial consultation on how to implement MLD4 in September 2016 it has now published the feedback to that consultation and the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017.

Source: landlordsguild.com

Source: landlordsguild.com

This guidance focuses mainly on the Money Laundering Terrorist Financing and Transfer of Funds information on the Payer Regulations 2017. This Practice Note considers the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 and were amended by the Money Laundering and. Specifically the consultation seeks views on whether. The 2017 MLRs have been informed by the responses submitted and reflect the. This guidance focuses mainly on the Money Laundering Terrorist Financing and Transfer of Funds information on the Payer Regulations 2017.

Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017 No. They transpose into UK Law the requirements of the Fourth Money Laundering Directive in which the European Union has updated standards in the fight against money laundering. 692 MLRs 2017 Introductory Text. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. 2 These Regulations come into force on 26th.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 trusts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.