14+ Money laundering regulations 2017 transaction monitoring ideas in 2021

Home » money laundering Info » 14+ Money laundering regulations 2017 transaction monitoring ideas in 2021Your Money laundering regulations 2017 transaction monitoring images are available. Money laundering regulations 2017 transaction monitoring are a topic that is being searched for and liked by netizens today. You can Download the Money laundering regulations 2017 transaction monitoring files here. Find and Download all royalty-free photos and vectors.

If you’re looking for money laundering regulations 2017 transaction monitoring pictures information linked to the money laundering regulations 2017 transaction monitoring topic, you have pay a visit to the ideal site. Our site always gives you hints for downloading the highest quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Money Laundering Regulations 2017 Transaction Monitoring. In the past few years transaction monitoring has become a vital part of anti-money laundering AML procedures. In the current draft of the 2017 Money Laundering Regulations the wording relevant to transaction monitoring will remain the same as in the Money Laundering Regulations 2007 but move from Section 82a to Section 2811a. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The regulations will make transaction monitoring TM compulsory.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Automatically boost transaction rates without increasing chargebacks or friendly fraud. If not has it registered with an anti-money laundering AML supervisor. The transposed version appears differently than in the Directive and will. Regulation 37 of the MLR 2017 allows you to carry out simplified due diligence SDD where youre satisfied that the business relationship or transaction presents a low risk of money laundering or terrorist financing. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017.

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive.

In the UK 4MLD is being transposed via the Money Laundering Regulation 2017. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. As stated the job which FinCEN created for itself that. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: researchgate.net

Source: researchgate.net

In the past few years transaction monitoring has become a vital part of anti-money laundering AML procedures. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations were published in 2017 after the POCA. Ad Automated tools to reduce chargeback rates and boost business profits in record time. In the UK 4MLD is being transposed via the Money Laundering Regulation 2017.

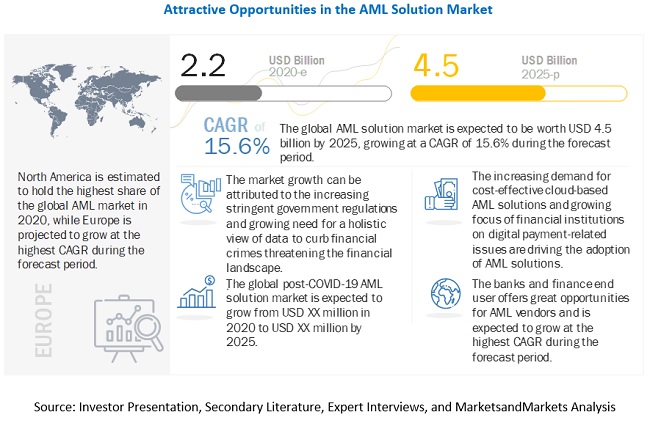

Source: marketsandmarkets.com

Source: marketsandmarkets.com

Ad Automated tools to reduce chargeback rates and boost business profits in record time. On September 16 2020 the Financial Crimes Enforcement Network FinCEN issued an Advance Notice of Proposed Rulemaking ANPRM soliciting public comment on what it describes as a wide range of questions pertaining to potential regulatory amendments under the Bank Secrecy Act BSA. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. These new regulations need to be carefully considered along with the accompanying guidance. Automatically boost transaction rates without increasing chargebacks or friendly fraud.

Source: bi.go.id

Source: bi.go.id

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. As stated the job which FinCEN created for itself that. The transposed version appears differently than in the Directive and will. Regulation 37 of the MLR 2017 allows you to carry out simplified due diligence SDD where youre satisfied that the business relationship or transaction presents a low risk of money laundering or terrorist financing. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory.

Source: acamstoday.org

Source: acamstoday.org

MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. Xxxx2020 10 THE FIRM Y N Na Comments 11 Is the firm a member firm in accordance with the disciplinary byelaws. Commission of money laundering and terrorist financing and that they will include the monitoring of transactions and the identification and scrutiny of complex or large transactions unusual patterns of transactions that hav e no apparent economic or visible lawful purpose and any other activity that the. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the.

In the past few years transaction monitoring has become a vital part of anti-money laundering AML procedures. In the current draft of the 2017 Money Laundering Regulations the wording relevant to transaction monitoring will remain the same as in the Money Laundering Regulations 2007 but move from Section 82a to Section 2811a. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Automatically boost transaction rates without increasing chargebacks or friendly fraud.

Source: pideeco.be

Source: pideeco.be

This Practice Note explains the ongoing monitoring requirements contained in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI. ICAEW is the automatic supervisory authority for ICAEW member firms. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Ad Automated tools to reduce chargeback rates and boost business profits in record time. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017.

Source: planetcompliance.com

Source: planetcompliance.com

Ad Automated tools to reduce chargeback rates and boost business profits in record time. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. All banks and other financial institutions should have some form of transaction monitoring in place in order to keep an eye out for any suspicious transactions to and from existing customers. In the past few years transaction monitoring has become a vital part of anti-money laundering AML procedures. Any personal data obtained for the purposes of complying with the MLR 2017 may only be processed for the purposes of preventing money laundering and terrorist financing.

Source: bankinghub.eu

Source: bankinghub.eu

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Customer due diligence measures. Regulation 37 of the MLR 2017 allows you to carry out simplified due diligence SDD where youre satisfied that the business relationship or transaction presents a low risk of money laundering or terrorist financing. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive.

Source: bi.go.id

Source: bi.go.id

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the. Thus according to the State Financial Monitoring Service of Ukraine the number of reports of suspicious financial transactions recorded in 2017 was 8013500 by 268 more than in. Customer due diligence measures.

Source: researchgate.net

Source: researchgate.net

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the. Commission of money laundering and terrorist financing and that they will include the monitoring of transactions and the identification and scrutiny of complex or large transactions unusual patterns of transactions that hav e no apparent economic or visible lawful purpose and any other activity that the. This Practice Note explains the ongoing monitoring requirements contained in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI.

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

In the UK 4MLD is being transposed via the Money Laundering Regulation 2017. The 2017 MLRs have been informed by the responses submitted and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Commission of money laundering and terrorist financing and that they will include the monitoring of transactions and the identification and scrutiny of complex or large transactions unusual patterns of transactions that hav e no apparent economic or visible lawful purpose and any other activity that the.

Source: bi.go.id

Source: bi.go.id

Regulation 37 of the MLR 2017 allows you to carry out simplified due diligence SDD where youre satisfied that the business relationship or transaction presents a low risk of money laundering or terrorist financing. Thus according to the State Financial Monitoring Service of Ukraine the number of reports of suspicious financial transactions recorded in 2017 was 8013500 by 268 more than in. Xxxx2020 10 THE FIRM Y N Na Comments 11 Is the firm a member firm in accordance with the disciplinary byelaws. Commission of money laundering and terrorist financing and that they will include the monitoring of transactions and the identification and scrutiny of complex or large transactions unusual patterns of transactions that hav e no apparent economic or visible lawful purpose and any other activity that the. In the UK 4MLD is being transposed via the Money Laundering Regulation 2017.

Source: bi.go.id

Source: bi.go.id

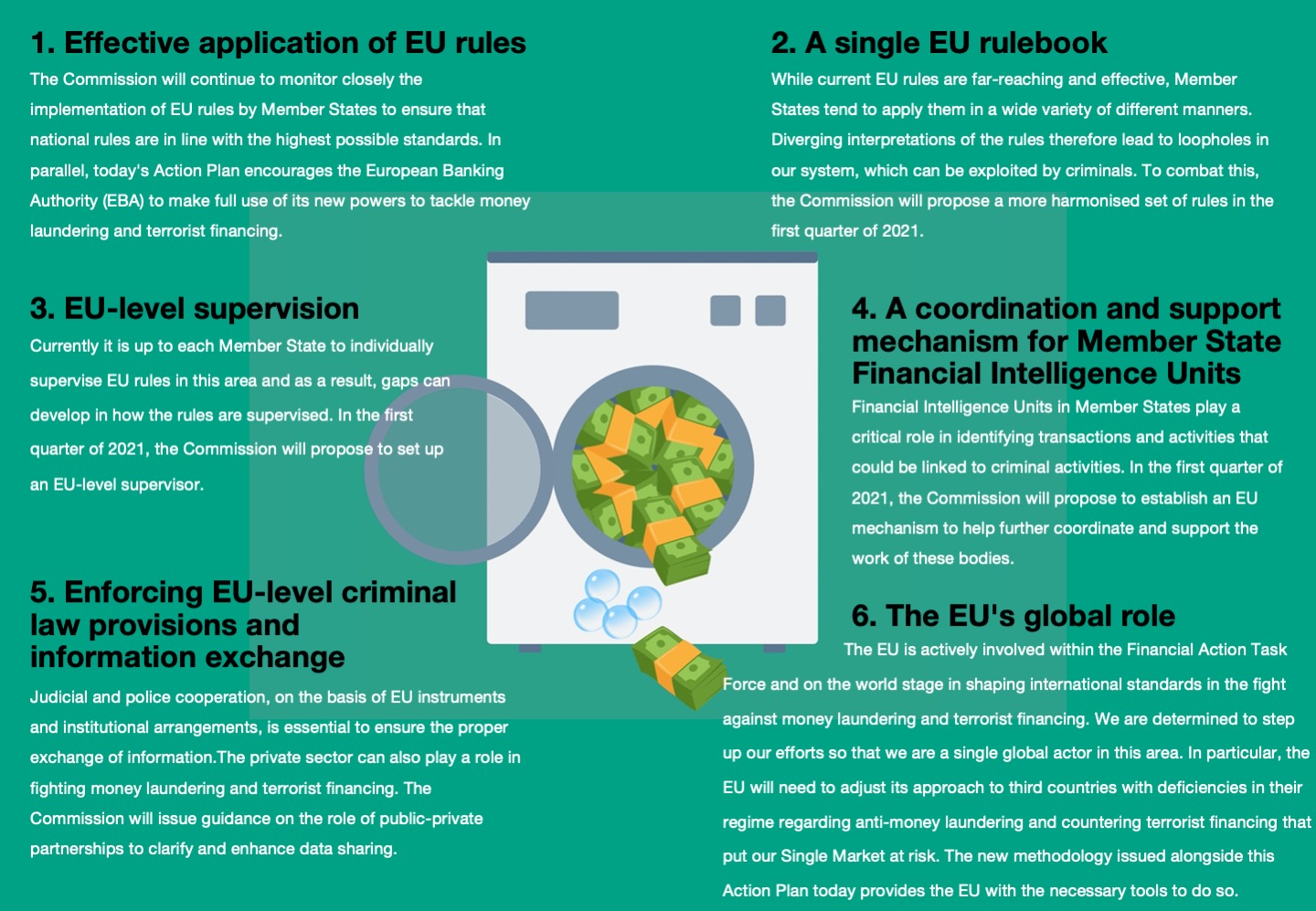

Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the. Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the. European Union incorporates developments of the Financial Action Task Force agenda for anti- money laundering AML and counter-terrorist financing CTF. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Automatically boost transaction rates without increasing chargebacks or friendly fraud.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 transaction monitoring by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.