15++ Money laundering regulations 2017 suspicious activity report info

Home » money laundering Info » 15++ Money laundering regulations 2017 suspicious activity report infoYour Money laundering regulations 2017 suspicious activity report images are ready in this website. Money laundering regulations 2017 suspicious activity report are a topic that is being searched for and liked by netizens now. You can Download the Money laundering regulations 2017 suspicious activity report files here. Find and Download all royalty-free images.

If you’re searching for money laundering regulations 2017 suspicious activity report images information connected with to the money laundering regulations 2017 suspicious activity report keyword, you have visit the right site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

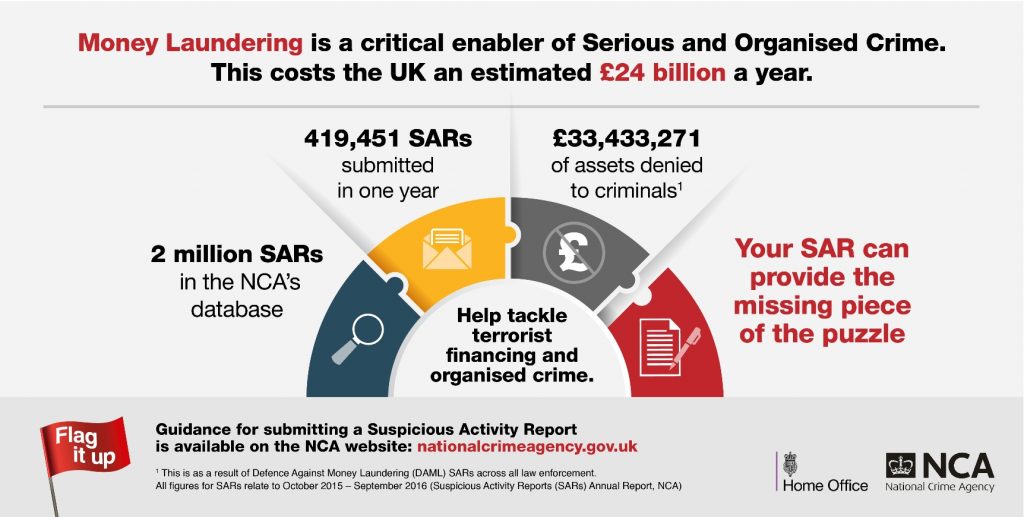

Money Laundering Regulations 2017 Suspicious Activity Report. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. POCA criminalises all forms of money laundering and creates offences concerning failure to report suspicion of money laundering. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. Joint SAR FAQs Final 508pdf 23203 KB.

Anti Money Laundering A Practical Guide For Firms From slidetodoc.com

Anti Money Laundering A Practical Guide For Firms From slidetodoc.com

Suspicious Activity Reports SARs Annual Report 2017 7 There has been a huge increase in the number of defence against money laundering DAML requests. The Importance of Customer Due Dilligence. Xxxx2020 10 THE FIRM Y N Na Comments 11 Is the firm a member firm in accordance with the disciplinary byelaws. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. Anyone in your business must report any suspicious transaction or activity they become aware of to the nominated officer. SARs are made by financial institutions and.

Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations.

The policy can easily be edited to suite your law firm or organisation your industry and staff. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. Money laundering under part 7 of the Proceeds of Crime Act 2002 POCA terrorist financing under part 3 of the Terrorism Act 2000 TACT. A suspicious activity report SAR is a disclosure made to the National Crime Agency NCA about known or suspected. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. The main purpose of this edition is to provide guidance on suspicious transaction reporting.

Source: slideplayer.com

Source: slideplayer.com

Firms must also appoint a nominated officer Money Laundering Reporting Officer MLRO to receive internal suspicious activity reports and who assesses whether a suspicious activity report should be made to the National Crime Agency. Anyone in your business must report any suspicious transaction or activity they become aware of to the nominated officer. Where operators know or have suspicion that a person is engaged in money laundering they are obliged to submit a suspicious activity report SAR. Money laundering under part 7 of the Proceeds of Crime Act 2002 POCA terrorist financing under part 3 of the Terrorism Act 2000 TACT. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: actico.com

Source: actico.com

Firms must also appoint a nominated officer Money Laundering Reporting Officer MLRO to receive internal suspicious activity reports and who assesses whether a suspicious activity report should be made to the National Crime Agency. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. In addition as 2017 has proved to be an extremely busy year in terms of Anti-Money Laundering and Countering the Financing of Terrorism AMLCFT. Due diligence should form part of a firms risk assessment. 2 The total over 18 months was 27893.

Source: sfo.gov.uk

Source: sfo.gov.uk

2017 No 35 Anti-Money Laundering and Countering Financing of. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. Tities to report suspicious activities and protection of persons making suspicious activity reports. The online system through the NCA website provides instant acknowledgement and a reference number. A suspicious activity report SAR is a disclosure made to the National Crime Agency NCA about known or suspected.

Source: slidetodoc.com

Source: slidetodoc.com

Due diligence should form part of a firms risk assessment. The legislation covers all criminal property where the alleged offender knows or suspects the property constitutes or represents benefit from any criminal conduct. Anti-Money Laundering Bulletin Welcome to this edition of the Anti-Money Laundering Bulletin. A suspicious activity report SAR is a disclosure made to the National Crime Agency NCA about known or suspected. SARs are made by financial institutions and.

Source: nationalcrimeagency.gov.uk

Source: nationalcrimeagency.gov.uk

Firms must also appoint a nominated officer Money Laundering Reporting Officer MLRO to receive internal suspicious activity reports and who assesses whether a suspicious activity report should be made to the National Crime Agency. Money laundering under part 7 of the Proceeds of Crime Act 2002 POCA terrorist financing under part 3 of the Terrorism Act 2000 TACT. The legislation covers all criminal property where the alleged offender knows or suspects the property constitutes or represents benefit from any criminal conduct. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. The online system through the NCA website provides instant acknowledgement and a reference number.

Source: issuu.com

Source: issuu.com

However compared to the previous SARs Annual Report there has been an increase of 2403 from 14672 in 2014-15 to 18198 between October 2015 and. Meet the requirements of the Money Laundering Regulations 2017 Use due diligence to detect suspicious activity Recognise the red flags of money laundering Report suspicious activity Seek further advice and guidance. Xxxx2020 10 THE FIRM Y N Na Comments 11 Is the firm a member firm in accordance with the disciplinary byelaws. Tities to report suspicious activities and protection of persons making suspicious activity reports. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing.

Source: vinciworks.com

Source: vinciworks.com

In light of the new Money Laundering Regulations having come into full effect in June VinciWorks has made available a free anti-money laundering and counter-terrorist financing policy template. Anti-Money Laundering Bulletin Welcome to this edition of the Anti-Money Laundering Bulletin. Did the engagement team make a suspicious activity report to the MLRO. 2 The total over 18 months was 27893. 2017 No 35 Anti-Money Laundering and Countering Financing of.

Source: fincen.gov

Source: fincen.gov

The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. POCA criminalises all forms of money laundering and creates offences concerning failure to report suspicion of money laundering. 2 The total over 18 months was 27893. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations.

Source: slidetodoc.com

Source: slidetodoc.com

The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. 2 The total over 18 months was 27893. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. Did the engagement team make a suspicious activity report to the MLRO. Due diligence should form part of a firms risk assessment.

Source: securitiesanalytics.com

Source: securitiesanalytics.com

The main purpose of this edition is to provide guidance on suspicious transaction reporting. If your business is registered for money laundering supervision. 18th October 2017. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. Did the engagement team make a suspicious activity report to the MLRO.

Source: slidetodoc.com

Source: slidetodoc.com

If not has it registered with an anti-money laundering AML. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. Due diligence should form part of a firms risk assessment.

Source: actico.com

Source: actico.com

Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. 2017 No 35 Anti-Money Laundering and Countering Financing of. The Importance of Customer Due Dilligence. Due diligence should form part of a firms risk assessment. 18th October 2017.

Source: slidetodoc.com

Source: slidetodoc.com

If not has it registered with an anti-money laundering AML. If your business is registered for money laundering supervision. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations. 2 In section 45a replace suspicious transaction reports with the reporting of suspicious activities and prescribed transactions. 18th October 2017.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 suspicious activity report by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.