13++ Money laundering regulations 2017 solicitors information

Home » money laundering Info » 13++ Money laundering regulations 2017 solicitors informationYour Money laundering regulations 2017 solicitors images are ready in this website. Money laundering regulations 2017 solicitors are a topic that is being searched for and liked by netizens today. You can Get the Money laundering regulations 2017 solicitors files here. Download all royalty-free vectors.

If you’re looking for money laundering regulations 2017 solicitors pictures information related to the money laundering regulations 2017 solicitors interest, you have pay a visit to the right site. Our site always provides you with hints for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

Money Laundering Regulations 2017 Solicitors. The Legal Sector Affinity Group which represents the legal sector AML supervisors and includes the Law Society and the Solicitors Regulation Authority SRA has developed the anti-money laundering AML guidance for the legal sector. The underpinning of this risk based approach is a risk. The Regulations implement the EUs 4th Directive on Money Laundering often called 4MLD which replaces the Money Laundering Regulations of 2007. Solicitors Regulatory Authority website.

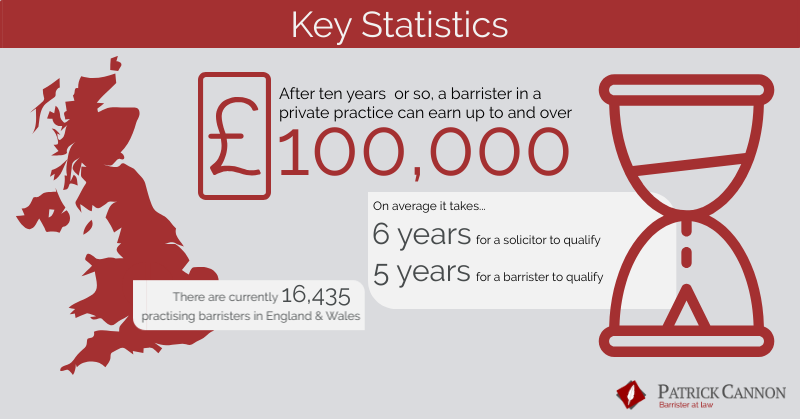

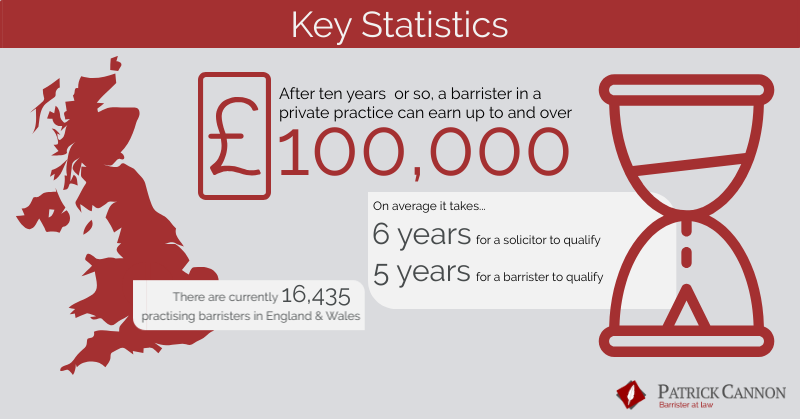

Uk Barristers Vs Solicitors Statistics Key Facts Patrick Cannon From patrickcannon.net

Uk Barristers Vs Solicitors Statistics Key Facts Patrick Cannon From patrickcannon.net

The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. Law Society England and Wales website. The Legal Sector Affinity Group which represents the legal sector AML supervisors and includes the Law Society and the Solicitors Regulation Authority SRA has developed the anti-money laundering AML guidance for the legal sector. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. June 2017 saw the introduction of the Money Laundering Regulations 2017 which replace the Money Laundering Regulations 2007 MLRs 2007. Money Laundering Regulations 2017.

Money Laundering Regulations 2017 Money laundering is particularly problematic for solicitors and other professionals for whom compliance with regulations can be a huge challenge.

Solicitors Regulatory Authority website. The underpinning of this risk based approach is a risk. In common with all professional practices and financial institutions we are required to obtain verification of your identity and address to comply with the Money Laundering Regulations if you are a new client or if we have not taken instructions from you for some time. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. In a case brought by the Solicitors Regulation Authority SRA the partners of Clyde and Co solicitors admitted they allowed a client account to be used as a banking facility acting against SRA accounting rules and in breach of existing obligations under the then-current money laundering regulations 2007. The government enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017 on 26 June 2017.

Source: fi.pinterest.com

Source: fi.pinterest.com

Last updated 16 March 2021. The government enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017 on 26 June 2017. You will be required to provide this. Money Laundering Regulations 2017. The MLR 2017 has expanded its definition to include domestic PEPs.

Source: ar.pinterest.com

Source: ar.pinterest.com

The MLR 2017 has expanded its definition to include domestic PEPs. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. The regulations replace the Money Laundering Regulations 2007 MLRs 2007. On 15 March 2017 the Government published its response to the September consultation together with the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017. Money Laundering Regulations 2017 By painsmith 23rd May 2017 On 26th June 2017 the Fourth Anti-Money Laundering Directive 4MLD will come into effect.

Source: ar.pinterest.com

Source: ar.pinterest.com

The MLR 2017 has expanded its definition to include domestic PEPs. The Legal Sector Affinity Group which represents the legal sector AML supervisors and includes the Law Society and the Solicitors Regulation Authority SRA has developed the anti-money laundering AML guidance for the legal sector. The Directive replaces the Third Anti-Money Laundering Directive which was implemented in the UK by way of the Money Laundering Regulations 2007. The regulations replace the Money Laundering Regulations 2007 MLRs 2007. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing.

Source: br.pinterest.com

Source: br.pinterest.com

The Directive replaces the Third Anti-Money Laundering Directive which was implemented in the UK by way of the Money Laundering Regulations 2007. The regulations replace the Money Laundering Regulations 2007 MLRs 2007. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. You had a whole weekend to review the final version since they were published last Friday. They also confirm firms may outsource CDD but.

Source: pinterest.com

Source: pinterest.com

The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. You will be required to provide this. June 2017 saw the introduction of the Money Laundering Regulations 2017 which replace the Money Laundering Regulations 2007 MLRs 2007. This makes them attractive targets for criminals and funders of terrorism who want to launder money. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: ar.pinterest.com

Source: ar.pinterest.com

This Treasury-approved guidance provides more detail about the MLR 2017 and what is expected of firms and should be read with this quick guide. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The underpinning of this risk based approach is a risk. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. On 15 March 2017 the Government published its response to the September consultation together with the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017.

Source: youtube.com

Source: youtube.com

They also confirm firms may outsource CDD but. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations transpose the EUs fourth money laundering directive 4MLD and commenced on 26 th June 2017. These are based on the same principles as the pre-existing rules but contain significant changes which affect how regulated organisations must structure their anti-money laundering AML functions and carry out checks. Money Laundering Regulations 2017. You had a whole weekend to review the final version since they were published last Friday.

Source: bookshop.lawsociety.org.uk

Source: bookshop.lawsociety.org.uk

The MLR 2017 has expanded its definition to include domestic PEPs. The regulations replace the Money Laundering Regulations 2007 MLRs 2007. Monday 26 June saw the 2017 Money Laundering Regulations or the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 to give them their full title come into force. Money Laundering Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: bdo.co.uk

Source: bdo.co.uk

The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. Keeping money launderers out of legal services has long been a priority of ours. The MLR 2017 has expanded its definition to include domestic PEPs. Last updated 16 March 2021. Those organisations covered by the 2007 Regulations are also covered by the 2017 Regulations.

Source: pinterest.com

Source: pinterest.com

The Legal Sector Affinity Group which represents the legal sector AML supervisors and includes the Law Society and the Solicitors Regulation Authority SRA has developed the anti-money laundering AML guidance for the legal sector. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. The Directive replaces the Third Anti-Money Laundering Directive which was implemented in the UK by way of the Money Laundering Regulations 2007. On 26 June 2017 the Money Laundering Regulations 2017 came into force. Last updated 16 March 2021.

Source: patrickcannon.net

Source: patrickcannon.net

Law Society England and Wales website. On 26 June 2017 the Money Laundering Regulations 2017 came into force. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. Solicitors Regulatory Authority website. The government enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017 on 26 June 2017.

Source: id.pinterest.com

Source: id.pinterest.com

Law Society England and Wales website. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. These are based on the same principles as the pre-existing rules but contain significant changes which affect how regulated organisations must structure their anti-money laundering AML functions and carry out checks. The regulations replace the Money Laundering Regulations 2007 MLRs 2007. On 15 March 2017 the Government published its response to the September consultation together with the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017.

Source: pinterest.com

Source: pinterest.com

You will be required to provide this. Last updated 16 March 2021. They also confirm firms may outsource CDD but. On 15 March 2017 the Government published its response to the September consultation together with the draft Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLR 2017. You will be required to provide this.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 solicitors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.