13++ Money laundering regulations 2017 scotland ideas in 2021

Home » money laundering Info » 13++ Money laundering regulations 2017 scotland ideas in 2021Your Money laundering regulations 2017 scotland images are ready in this website. Money laundering regulations 2017 scotland are a topic that is being searched for and liked by netizens today. You can Get the Money laundering regulations 2017 scotland files here. Download all free vectors.

If you’re looking for money laundering regulations 2017 scotland images information linked to the money laundering regulations 2017 scotland keyword, you have pay a visit to the right site. Our website always gives you hints for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

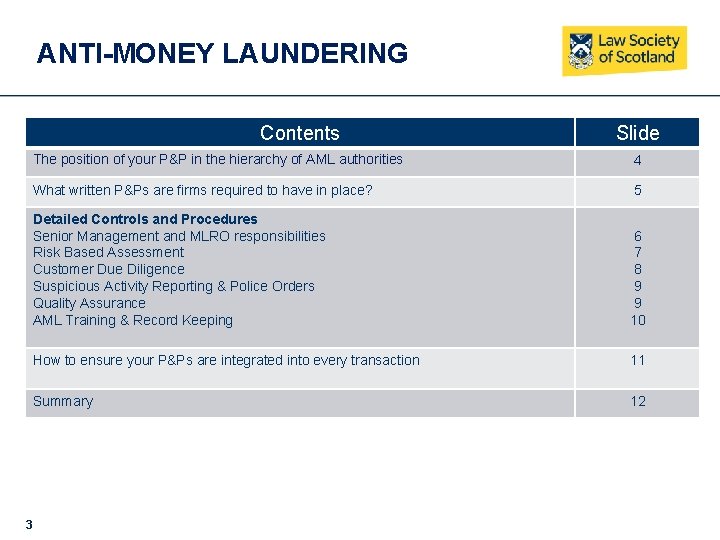

Money Laundering Regulations 2017 Scotland. To any financial crime professional SLPs are clearly a major concern. The regulations require legal accountancy financial and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 have been amended by statutory instrument to take account of changes imposed by the EUs 5th Money Laundering Directive with effect from 10 January 2020. Rule B6 Duty of Co Operation Rule B6 is formed of a clear obligation upon Society Members to co-operate with the Society in a open timely and co-operative manner.

Money Laundering Professor Nicholas Ryder Ppt Download From slideplayer.com

Money Laundering Professor Nicholas Ryder Ppt Download From slideplayer.com

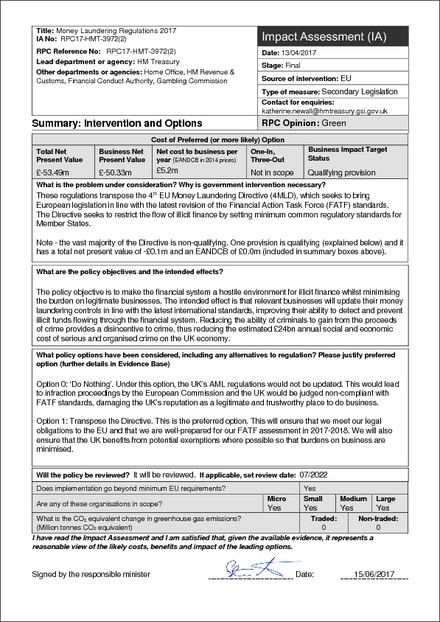

20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. When in July 2017 new legislation came into force meaning SLPs would have to specify the persons behind their companies known as The Scottish Partnerships Register of People with Significant Control Regulations 2017 we all for a very short while became hopeful. 692 b the following shall be added after the definition of regulated person. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. 2 These Regulations come into force on 26th.

692 b the following shall be added after the definition of regulated person.

POCA 2002 sets out the main money laundering offences and provides for the confiscation and civil recovery of the proceeds of crime. When in July 2017 new legislation came into force meaning SLPs would have to specify the persons behind their companies known as The Scottish Partnerships Register of People with Significant Control Regulations 2017 we all for a very short while became hopeful. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: pinterest.com

Source: pinterest.com

The Act has effect in England Northern Ireland Scotland and Wales. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. Confirm with their anti-money laundering supervisory authority whether their activities require supervision under the 2017 Regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 S.

Source: slidetodoc.com

Source: slidetodoc.com

New Money Laundering Regulations 2017 On 26 June 2017 the new Money Laundering Regulations 2017 came into force the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Law Society of Scotland is working with representatives from across the UKs legal sector to update anti-money laundering AML guidance following changes brought about by the Money Laundering Regulations Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which have come into effect this week. The Regulations make significant changes to the AMLCTF regime in the UK and below is an outline of some of these. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. 123 Regulation 11d of the 2017 Regulations defines tax adviser to include both direct and indirect provision of material.

Source: slidetodoc.com

Source: slidetodoc.com

1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. Confirm with their anti-money laundering supervisory authority whether their activities require supervision under the 2017 Regulations. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor.

Source: slideplayer.com

Source: slideplayer.com

Rule B6 Duty of Co Operation Rule B6 is formed of a clear obligation upon Society Members to co-operate with the Society in a open timely and co-operative manner. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Rule B6 Duty of Co Operation Rule B6 is formed of a clear obligation upon Society Members to co-operate with the Society in a open timely and co-operative manner.

Source: slidetodoc.com

Source: slidetodoc.com

Rule B6 Duty of Co Operation Rule B6 is formed of a clear obligation upon Society Members to co-operate with the Society in a open timely and co-operative manner. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 have been amended by statutory instrument to take account of changes imposed by the EUs 5th Money Laundering Directive with effect from 10 January 2020. The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. 2 These Regulations come into force on 26th. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: slidetodoc.com

Source: slidetodoc.com

The 2017 MLRs have been informed by the responses submitted and reflect the. 2 These Regulations come into force on 26th. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. The regulations require legal accountancy financial and. As defined in regulation 31 of the Money Laundering Regulations reporting period the 12 month period running from 1 January to 31 December or such other period as the Council may prescribe supervised person a relevant person for which the Society is the supervisory authority in terms of the Money Laundering Regulations.

Source: researchgate.net

Source: researchgate.net

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The regulations require legal accountancy financial and. The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

Source: legislation.gov.uk

Source: legislation.gov.uk

1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. 123 Regulation 11d of the 2017 Regulations defines tax adviser to include both direct and indirect provision of material. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. They also confirm firms may outsource CDD but. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

123 Regulation 11d of the 2017 Regulations defines tax adviser to include both direct and indirect provision of material. These Regulations replace the Money Laundering Regulations 2007 SI. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 S. New Money Laundering Regulations 2017 On 26 June 2017 the new Money Laundering Regulations 2017 came into force the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: integrity-asia.com

Source: integrity-asia.com

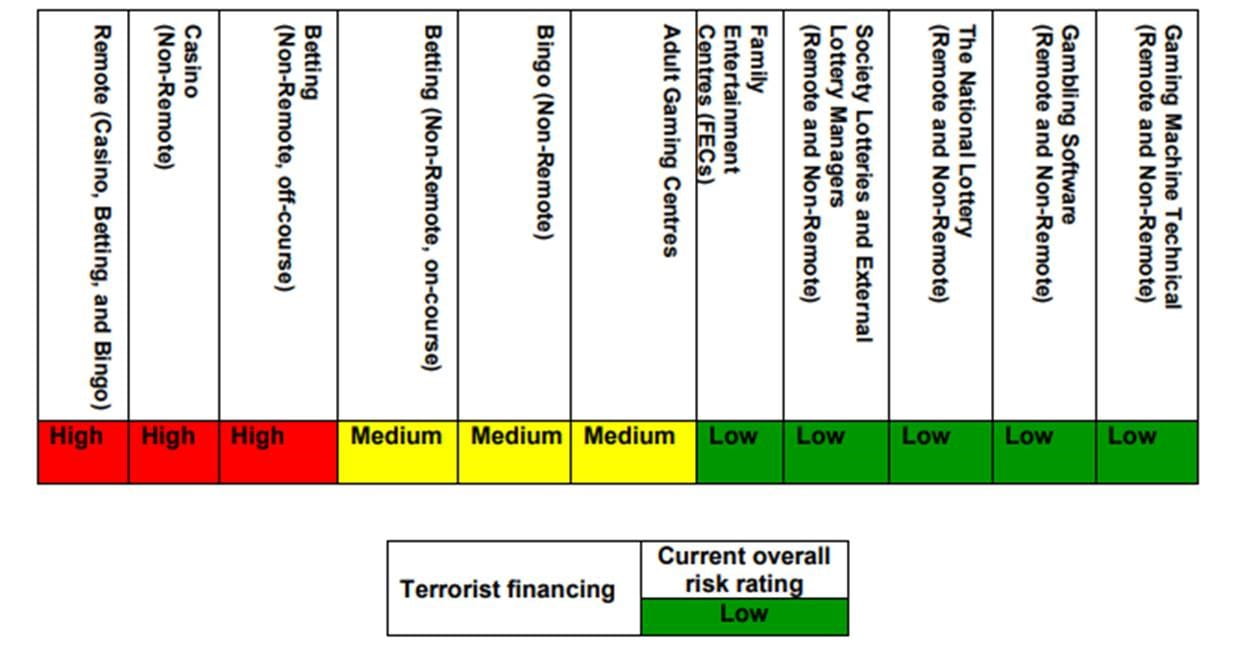

The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 have been amended by statutory instrument to take account of changes imposed by the EUs 5th Money Laundering Directive with effect from 10 January 2020. Transfer of Funds Regulations 2017 the regulations and the Terrorism Act 2000. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. POCA 2002 sets out the main money laundering offences and provides for the confiscation and civil recovery of the proceeds of crime.

Source: slidetodoc.com

Source: slidetodoc.com

The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. They also confirm firms may outsource CDD but. To any financial crime professional SLPs are clearly a major concern. The Regulations make significant changes to the AMLCTF regime in the UK and below is an outline of some of these. The 2017 MLRs have been informed by the responses submitted and reflect the.

Source: lexology.com

Source: lexology.com

The Act has effect in England Northern Ireland Scotland and Wales. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 S. POCA 2002 sets out the main money laundering offences and provides for the confiscation and civil recovery of the proceeds of crime. The 2017 Money Laundering Regulations dictate that where there is more than one supervisory authority for a relevant person the supervisory authorities may agree that one of them will act as the supervisory authority for that person. The regulations require legal accountancy financial and.

Source: legislation.gov.uk

Source: legislation.gov.uk

123 Regulation 11d of the 2017 Regulations defines tax adviser to include both direct and indirect provision of material. New Money Laundering Regulations 2017 On 26 June 2017 the new Money Laundering Regulations 2017 came into force the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. To any financial crime professional SLPs are clearly a major concern. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Transfer of Funds Regulations 2017 the regulations and the Terrorism Act 2000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 scotland by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.