19+ Money laundering regulations 2017 risk assessment information

Home » money laundering idea » 19+ Money laundering regulations 2017 risk assessment informationYour Money laundering regulations 2017 risk assessment images are available in this site. Money laundering regulations 2017 risk assessment are a topic that is being searched for and liked by netizens now. You can Get the Money laundering regulations 2017 risk assessment files here. Download all free photos.

If you’re searching for money laundering regulations 2017 risk assessment pictures information linked to the money laundering regulations 2017 risk assessment keyword, you have come to the right site. Our website frequently gives you hints for viewing the highest quality video and image content, please kindly search and find more informative video articles and images that match your interests.

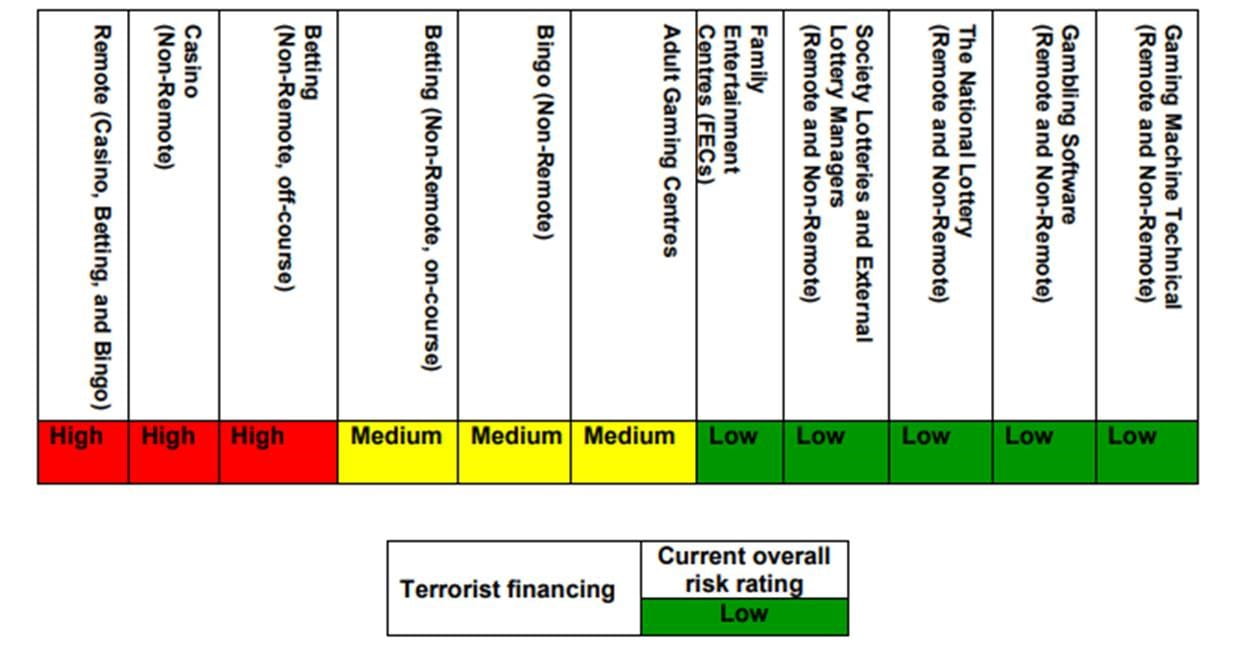

Money Laundering Regulations 2017 Risk Assessment. Assist you in developing policies procedures and controls to mitigate the risk of money laundering. The most important part is that you properly identify and assess the risk of money laundering or terrorist financing and that your assessment is documented. Client Due Diligence CDD 8. The 2017 national risk assessment NRA is the second comprehensive assessment of money laundering and terrorist financing risk in the UK.

Finalization Of The 4th Anti Money Laundering Directive Bankinghub From bankinghub.eu

Finalization Of The 4th Anti Money Laundering Directive Bankinghub From bankinghub.eu

CHECKLIST FOR COMPLIANCE WITH MONEY LAUNDERING REGULATIONS 2017 MLR17 Contents 1. The 2017 MLRs have been informed by the responses submitted and. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Firms risk assessment 3. The underpinning of this risk based approach is a risk assessment flowing from a country level risk assessment at government level through to supervisory body risk assessments.

You had a whole weekend to review the final version since they were published last Friday.

You had a whole weekend to review the final version since they were published last Friday. Anti Money Laundering And Counter Terrorism Financing. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. Client risks Do our clients or those associated with our clients have attributes known to be frequently used by money launderers or terrorist financiers. Client Due Diligence CDD 8. The underpinning of this risk based approach is a risk assessment flowing from a country level risk assessment at government level through to supervisory body risk assessments.

Source: researchgate.net

Source: researchgate.net

You had a whole weekend to review the final version since they were published last Friday. Apply a Risk Based Approach to ensure that measures to prevent. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The money laundering regulations 2017 require risk assessments to be carried out. UK National Risk Assessment of Money Laundering and Terrorist Financing 2017.

Client Due Diligence CDD 8. Under regulation 18 you must carry out a written risk assessment to identify and assess the risk of money laundering and terrorist financing that your firm faces. The underpinning of this risk based approach is a risk assessment flowing from a country level risk assessment at government level through to supervisory body risk assessments. You had a whole weekend to review the final version since they were published last Friday. The money laundering regulations 2017 require risk assessments to be carried out.

Source: pideeco.be

Source: pideeco.be

Anti Money Laundering And Counter Terrorism Financing. The draft CCAB sector guidance suggests that five aspects are assessed. In 2015 the UK published its. The 2017 national risk assessment NRA is the second comprehensive assessment of money laundering and terrorist financing risk in the UK. The overall risk assessment of a small firm may be quite succinct.

Source: bankinghub.eu

Source: bankinghub.eu

This practice note explains the risk assessment aspects of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 including the steps that have to be followed by relevant entities or persons. In 2015 the UK published its. Under regulation 18 you must carry out a written risk assessment to identify and assess the risk of money laundering and terrorist financing that your firm faces. Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist. The overall risk assessment of a small firm may be quite succinct.

The most important part is that you properly identify and assess the risk of money laundering or terrorist financing and that your assessment is documented. Apply a Risk Based Approach to ensure that measures to prevent. 1 A relevant person must take appropriate steps to identify and assess the risks of money laundering and terrorist financing to which its business is subject. Httpswwwgovukgovernmentuploadssystemuploadsattachment_datafile655198National_risk_assessm ent_of_money_laundering_and_terrorist_financing_2017_pdf_webpdf Accessed 27 Dec. Identify assess and understand the ML and TF risks for the country and should take action including designating an authority or mechanism to coordinate actions to assess risks and apply resources aimed at ensuring the risks are mitigated effectively.

Source: portal.ieu-monitoring.com

Source: portal.ieu-monitoring.com

Client risks Do our clients or those associated with our clients have attributes known to be frequently used by money launderers or terrorist financiers. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Firms risk assessment 3. Client Due Diligence CDD 8. In carrying out the risk assessment a relevant person must take into account information made available to.

Source: bi.go.id

Source: bi.go.id

The most important part is that you properly identify and assess the risk of money laundering or terrorist financing and that your assessment is documented. You had a whole weekend to review the final version since they were published last Friday. Monday 26 June saw the 2017 Money Laundering Regulations or the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 to give them their full title come into force. 2 In carrying out the risk. In 2015 the UK published its.

Source: bi.go.id

Source: bi.go.id

The 2017 national risk assessment NRA of money laundering and terrorist financing comes amidst the most significant period for the UKs anti-money laundering AML and counter-terrorist financing CTF regime for over a decade. Anti Money Laundering And Counter Terrorism Financing. Assist you in developing policies procedures and controls to mitigate the risk of money laundering. HM Treasury Home Office. Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist.

Source: lexology.com

Source: lexology.com

Httpswwwgovukgovernmentuploadssystemuploadsattachment_datafile655198National_risk_assessm ent_of_money_laundering_and_terrorist_financing_2017_pdf_webpdf Accessed 27 Dec. The money laundering regulations 2017 require risk assessments to be carried out. C the extent to which that risk. Client Due Diligence CDD 8. This has been a legal requirement since 26 June 2017.

Source: bi.go.id

Source: bi.go.id

In carrying out the risk assessment a relevant person must take into account information made available to. The underpinning of this risk based approach is a risk assessment flowing from a country level risk assessment at government level through to supervisory body risk assessments. C the extent to which that risk. The most important part is that you properly identify and assess the risk of money laundering or terrorist financing and that your assessment is documented. The regulations accept that the nature of the risk assessment will depend on the size and nature of your firm.

Source: bi.go.id

Source: bi.go.id

Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist. Under regulation 18 you must carry out a written risk assessment to identify and assess the risk of money laundering and terrorist financing that your firm faces. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. You had a whole weekend to review the final version since they were published last Friday.

Source: complyadvantage.com

Source: complyadvantage.com

Assist you in developing policies procedures and controls to mitigate the risk of money laundering. Client risks Do our clients or those associated with our clients have attributes known to be frequently used by money launderers or terrorist financiers. Under regulation 18 you must carry out a written risk assessment to identify and assess the risk of money laundering and terrorist financing that your firm faces. HM Treasury Home Office. The 2017 national risk assessment NRA of money laundering and terrorist financing comes amidst the most significant period for the UKs anti-money laundering AML and counter-terrorist financing CTF regime for over a decade.

Source: gov.si

Source: gov.si

HM Treasury Home Office. The most important part is that you properly identify and assess the risk of money laundering or terrorist financing and that your assessment is documented. The money laundering regulations 2017 require risk assessments to be carried out. Monday 26 June saw the 2017 Money Laundering Regulations or the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 to give them their full title come into force. Firms that are within scope of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the money laundering regulations must have a written firm-wide risk assessment in place.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.