14++ Money laundering regulations 2017 requirements ideas in 2021

Home » money laundering Info » 14++ Money laundering regulations 2017 requirements ideas in 2021Your Money laundering regulations 2017 requirements images are available in this site. Money laundering regulations 2017 requirements are a topic that is being searched for and liked by netizens today. You can Download the Money laundering regulations 2017 requirements files here. Find and Download all free photos.

If you’re looking for money laundering regulations 2017 requirements images information related to the money laundering regulations 2017 requirements topic, you have pay a visit to the ideal site. Our website frequently gives you suggestions for seeking the highest quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

Money Laundering Regulations 2017 Requirements. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of. The Money Laundering Regulations 2017 require relevant businesses to.

Why Do Most Aml Programs Fail From pideeco.be

Why Do Most Aml Programs Fail From pideeco.be

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering. As before the approach should be risk based and appropriate to the size and nature of the business. Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302. 9 Prescribed forms for annual report under section 60 of Act. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. It provides guidance which is of general application.

Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302.

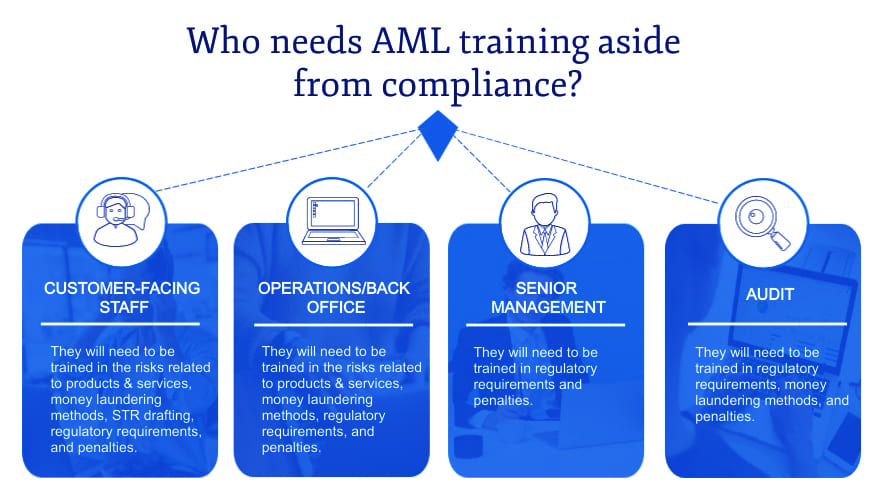

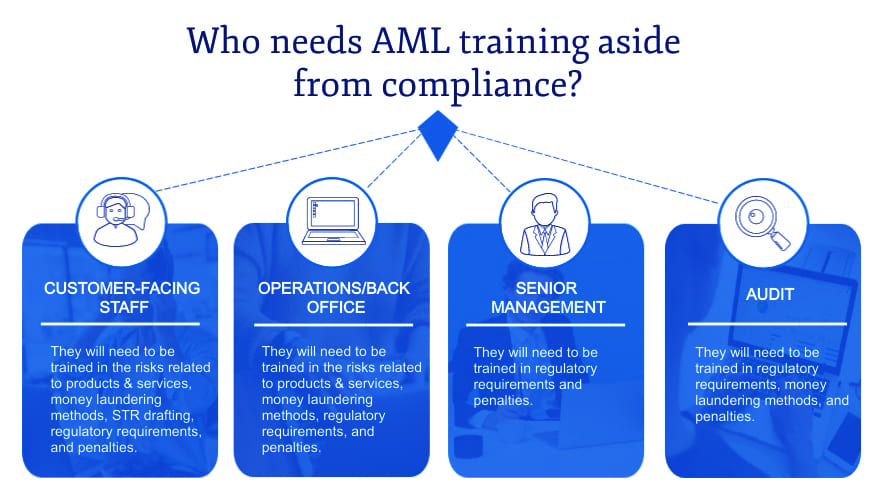

The underpinning of this risk based approach is a risk. Make employees aware of the laws relating to money laundering and terrorist financing Regularly provide training on how to recognise and deal with transactions and other activities which may be related to money laundering or terrorist financing What is a relevant business. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. As expected MLR 2017 require much more compliance to be evidenced in writing and place more emphasis on risk assessment. Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing. A Anti-money laundering AML risk assessment for the business to be evidenced in writing Regulation 18.

Source: bi.go.id

Source: bi.go.id

You must also have written policies controls and procedures that enable you to effectively manage. A Anti-money laundering AML risk assessment for the business to be evidenced in writing Regulation 18. Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering.

Source: pinterest.com

Source: pinterest.com

MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. It provides guidance which is of general application. Make employees aware of the laws relating to money laundering and terrorist financing Regularly provide training on how to recognise and deal with transactions and other activities which may be related to money laundering or terrorist financing What is a relevant business. The underpinning of this risk based approach is a risk. Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing.

Source: gov.si

Source: gov.si

This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing. As before the approach should be risk based and appropriate to the size and nature of the business. The Money Laundering Regulations 2017 require relevant businesses to.

Source: pideeco.be

Source: pideeco.be

Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing. On 26 June 2017 the Money Laundering Regulations 2017 the 2017 Regulations will come into force transposing into UK law the Fourth Money Laundering Directive EU 2015849 MLD4. The underpinning of this risk based approach is a risk. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing.

Source: bi.go.id

Source: bi.go.id

This Practice Note explains the regulatory requirement to implement systems and controls to mitigate and manage effectively the risks of money laundering and terrorist financing as set out in the Money Laundering Regulations 2017 as amended. You must also have written policies controls and procedures that enable you to effectively manage. In doing so they did not represent a wholesale upheaval of the existing legislation but instead were aimed at improving the 2007 regulations. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated.

Source: bi.go.id

Source: bi.go.id

This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing. A Anti-money laundering AML risk assessment for the business to be evidenced in writing Regulation 18. Make employees aware of the laws relating to money laundering and terrorist financing Regularly provide training on how to recognise and deal with transactions and other activities which may be related to money laundering or terrorist financing What is a relevant business. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering.

Source: bi.go.id

Source: bi.go.id

This Practice Note explains the regulatory requirement to implement systems and controls to mitigate and manage effectively the risks of money laundering and terrorist financing as set out in the Money Laundering Regulations 2017 as amended. In doing so they did not represent a wholesale upheaval of the existing legislation but instead were aimed at improving the 2007 regulations. 9 Prescribed forms for annual report under section 60 of Act. Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302. Implement systems policies controls and procedures to address money laundering and terrorist financing risks and meet the requirements under the MLR 2017 You must establish and maintain written policies controls and procedures to manage and mitigate the money laundering and terrorist financing risks identified in your risk assessment.

Source: bi.go.id

Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. Regulation 18 MLR 2017 CLC Practices are required to carry out and maintain a documented practice-wide risk assessment to identify and assess the risk of money laundering and terrorist financing.

Source: complyadvantage.com

Source: complyadvantage.com

A Anti-money laundering AML risk assessment for the business to be evidenced in writing Regulation 18. As expected MLR 2017 require much more compliance to be evidenced in writing and place more emphasis on risk assessment. As before the approach should be risk based and appropriate to the size and nature of the business. Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of.

Source: pinterest.com

Source: pinterest.com

It provides guidance which is of general application. The Money Laundering Regulations 2017 require relevant businesses to. However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. You must also have written policies controls and procedures that enable you to effectively manage.

Source: in.pinterest.com

Source: in.pinterest.com

MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering. The underpinning of this risk based approach is a risk. This Practice Note explains the regulatory requirement to implement systems and controls to mitigate and manage effectively the risks of money laundering and terrorist financing as set out in the Money Laundering Regulations 2017 as amended. Replaced on 1 July 2018 by regulation 6 of the Anti-Money Laundering and Countering Financing of Terrorism Requirements and Compliance Amendment Regulations 2017 LI 2017302.

Source: landlordsguild.com

Source: landlordsguild.com

However MLR 2017 also require that any personal data in the CDD information and transaction data that firms are required to retain be deleted after a maximum of. As expected MLR 2017 require much more compliance to be evidenced in writing and place more emphasis on risk assessment. In doing so they did not represent a wholesale upheaval of the existing legislation but instead were aimed at improving the 2007 regulations. Implement systems policies controls and procedures to address money laundering and terrorist financing risks and meet the requirements under the MLR 2017 You must establish and maintain written policies controls and procedures to manage and mitigate the money laundering and terrorist financing risks identified in your risk assessment. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering.

Source: pinterest.com

Source: pinterest.com

A Anti-money laundering AML risk assessment for the business to be evidenced in writing Regulation 18. This Practice Note explains the regulatory requirement to implement systems and controls to mitigate and manage effectively the risks of money laundering and terrorist financing as set out in the Money Laundering Regulations 2017 as amended. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. 9 Prescribed forms for annual report under section 60 of Act.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.