18++ Money laundering regulations 2017 reliance on third parties info

Home » money laundering Info » 18++ Money laundering regulations 2017 reliance on third parties infoYour Money laundering regulations 2017 reliance on third parties images are ready. Money laundering regulations 2017 reliance on third parties are a topic that is being searched for and liked by netizens today. You can Get the Money laundering regulations 2017 reliance on third parties files here. Get all free images.

If you’re looking for money laundering regulations 2017 reliance on third parties images information related to the money laundering regulations 2017 reliance on third parties topic, you have pay a visit to the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

Money Laundering Regulations 2017 Reliance On Third Parties. The regulations were effective from 26 June 2017. Compared to the Money Laundering Regulations 2007 there has been a significant expansion of the third parties that can be relied upon with the proposed regulations now allowing reliance on all. The scope of third parties whom can be relied upon has increased in comparison to MLR 2007 now covering all of the regulated sector. Guidance is provided by the Joint Money Laundering Steering Group JMLSG and the Financial Conduct Authority FCA has published Financial Crime - A Guide for Firms which provides indications of good and poor practice.

Guidance is provided by the Joint Money Laundering Steering Group JMLSG and the Financial Conduct Authority FCA has published Financial Crime - A Guide for Firms which provides indications of good and poor practice. The scope of third parties whom can be relied upon has increased in comparison to MLR 2007 now covering all of the regulated sector. MLR 2017 is more prescriptive on risk mitigation procedures monitoring on Politically Exposed Persons PEPs and conditions for reliance on third parties for customer due diligence. If you are relying on a third party you must obtain copies of all relevant documentation. In a third-party reliance scenario the third party should be subject to CDD and record-keeping requirements in line with Recommendations 10 and 11 and be regulated supervised or monitored. Offering minimal impact on your working day covering the hottest topics and bringing the industrys experts to you whenever and wherever you choose LexisNexis Webinars offer the ideal solution for your training needs.

It should be noted that MLR 2017 will not apply to firms with a turnover of less than 100000 which is an increase from MLR 2007 in which firms with a turnover of less than 64000 were exempt.

It also requires the third party to retain copies of the data and documents for five years as required by the Money Laundering Regulations 2017 MLR 2017 regulation 39. If you place reliance on the CDD of a third party or if a third party places reliance on your CDD you need to be aware of the changes under the regulations. Criminal Offence Chapter 3. The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. This Recommendation does not apply to outsourcing or agency relationships. The third party will be obliged to provide copies of CDD documents upon request.

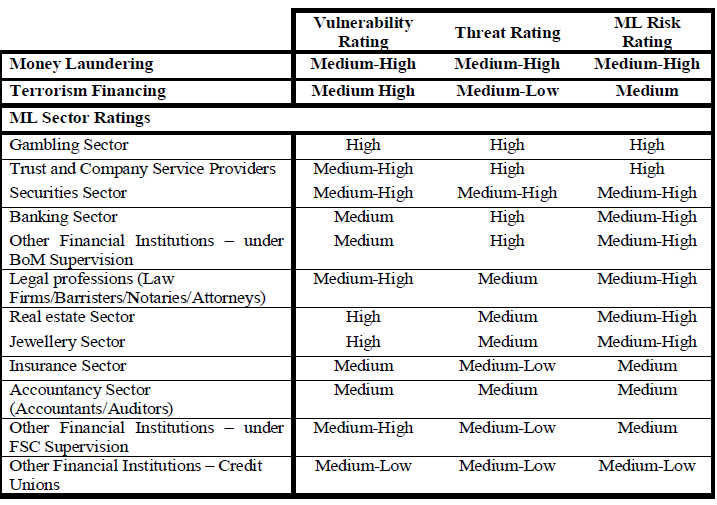

Source: elibrary.imf.org

Source: elibrary.imf.org

This Precedent reflects the requirements of the MLR 2017 as amended. Criminal Offence Chapter 3. Compared to the Money Laundering Regulations 2007 there has been a significant expansion of the third parties that can be relied upon with the proposed regulations now allowing reliance on all. The regulations were effective from 26 June 2017. Reliance on third parties s39 The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law.

Source: bom.mu

Source: bom.mu

In a third-party reliance scenario the third party should be subject to CDD and record-keeping requirements in line with Recommendations 10 and 11 and be regulated supervised or monitored. The Fourth Money Laundering Directive3 the Bar Council supported change to the existing regime for reliance on third parties for the completion of Customer Due Diligence by an obliged person. The scope of third parties whom can be relied upon has increased in comparison to MLR 2007 now covering all of the regulated sector. Reliance on Third Parties Regulation 39 Under the MLR 2017 any estate agent who relies on the third party to conduct CDD must enter into a written arrangement with that third party. Criminal Offence Chapter 3 The MLR 2017 creates an offence of prejudicing investigations.

MLR 2017 posed a strong obligation on relevant persons to adopt a more thought risk-based approach towards AML and CTF prevention in particular in how they conduct due diligence. The scope of third parties whom can be relied upon has increased in comparison to MLR 2007 now covering all of the regulated sector. Compared to the Money Laundering Regulations 2007 there has been a significant expansion of the third parties that can be relied upon with the proposed regulations now allowing reliance on all. The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. This Precedent reflects the requirements of the MLR 2017 as amended.

Compared to the Money Laundering Regulations 2007 there has been a significant expansion of the third parties that can be relied upon with the proposed regulations now allowing reliance on all. Reliance on Third Parties Regulation 39 Under the MLR 2017 any person who relies on the third party to conduct CDD must enter into a written arrangement with that third party. Criminal Offence Chapter 3. The third party will be obliged to provide copies of CDD documents upon request. This Recommendation does not apply to outsourcing or agency relationships.

If you place reliance on the CDD of a third party or if a third party places reliance on your CDD you need to be aware of the changes under the regulations. If you are relying on a third party you must obtain copies of all relevant documentation. Reliance on third parties s39 The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. The scope of third parties whom can be relied upon has increased in comparison to MLR 2007 now covering all of the regulated sector. Reliance on Third Parties Regulation 39 Under the MLR 2017 any estate agent who relies on the third party to conduct CDD must enter into a written arrangement with that third party.

Source: elibrary.imf.org

Source: elibrary.imf.org

In a third-party reliance scenario the third party should be subject to CDD and record-keeping requirements in line with Recommendations 10 and 11 and be regulated supervised or monitored. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. 1 A relevant person may rely on a person who falls within paragraph 3 the third party to apply any of the customer due diligence measures required by regulation 28 2 to. If you are relying on a third party you must obtain copies of all relevant documentation. The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers.

Source: twitter.com

Source: twitter.com

Reliance on third parties s39 The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. MLR 2017 is more prescriptive on risk mitigation procedures monitoring on Politically Exposed Persons PEPs and conditions for reliance on third parties for customer due diligence. Further to this the Bar Councils response proposed that the consent requirement within the reliance provisions of the 2007 Regulations. Compared to the Money Laundering Regulations 2007 there has been a significant expansion of the third parties that can be relied upon with the proposed regulations now allowing reliance on all. This Recommendation does not apply to outsourcing or agency relationships.

Source:

Reliance on Third Parties Regulation 39 Under the MLR 2017 any person who relies on the third party to conduct CDD must enter into a written arrangement with that third party. Reliance on Third Parties Regulation 39 Under the MLR 2017 any person who relies on the third party to conduct CDD must enter into a written arrangement with that third party. The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. The third party will be obliged to provide copies of CDD documents upon request. This Recommendation does not apply to outsourcing or agency relationships.

Source:

The scope of third parties whom can be relied upon has increased in comparison to MLR 2007 now covering all of the regulated sector. The regulations were effective from 26 June 2017. This Recommendation does not apply to outsourcing or agency relationships. Criminal Offence Chapter 3. You must also enter into a written arrangement that confirms that the firm being relied on will provide the relevant documentation immediately on request.

Source:

This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. The Money Laundering Regulations 2017 contain a number of amendments to the existing Money Laundering Regulations including changes to scope due diligence and reliance on third parties beneficial ownership PEPs and changes to the supervision bodies and enforcement powers. This Precedent reflects the requirements of the MLR 2017 as amended. MLR 2017 is more prescriptive on risk mitigation procedures monitoring on Politically Exposed Persons PEPs and conditions for reliance on third parties for customer due diligence. This Recommendation does not apply to outsourcing or agency relationships.

Source:

In a third-party reliance scenario the third party should be subject to CDD and record-keeping requirements in line with Recommendations 10 and 11 and be regulated supervised or monitored. MLR 2017 posed a strong obligation on relevant persons to adopt a more thought risk-based approach towards AML and CTF prevention in particular in how they conduct due diligence. You must also enter into a written arrangement that confirms that the firm being relied on will provide the relevant documentation immediately on request. The Money Laundering Regulations 2007 MLR implement the third Money Laundering Directive. Offering minimal impact on your working day covering the hottest topics and bringing the industrys experts to you whenever and wherever you choose LexisNexis Webinars offer the ideal solution for your training needs.

Further to this the Bar Councils response proposed that the consent requirement within the reliance provisions of the 2007 Regulations. You must also enter into a written arrangement that confirms that the firm being relied on will provide the relevant documentation immediately on request. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. MLR 2017 posed a strong obligation on relevant persons to adopt a more thought risk-based approach towards AML and CTF prevention in particular in how they conduct due diligence. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures.

Source:

Reliance on Third Parties Regulation 39 Under the MLR 2017 any estate agent who relies on the third party to conduct CDD must enter into a written arrangement with that third party. The third party will be obliged to provide copies of CDD documents upon request. Criminal Offence Chapter 3. INTERPRETIVE NOTE TO RECOMMENDATION 17 RELIANCE ON THIRD PARTIES 1. The Fourth Money Laundering Directive3 the Bar Council supported change to the existing regime for reliance on third parties for the completion of Customer Due Diligence by an obliged person.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 reliance on third parties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.