14+ Money laundering regulations 2017 plc info

Home » money laundering Info » 14+ Money laundering regulations 2017 plc infoYour Money laundering regulations 2017 plc images are ready. Money laundering regulations 2017 plc are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering regulations 2017 plc files here. Find and Download all free vectors.

If you’re searching for money laundering regulations 2017 plc pictures information connected with to the money laundering regulations 2017 plc interest, you have come to the ideal site. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

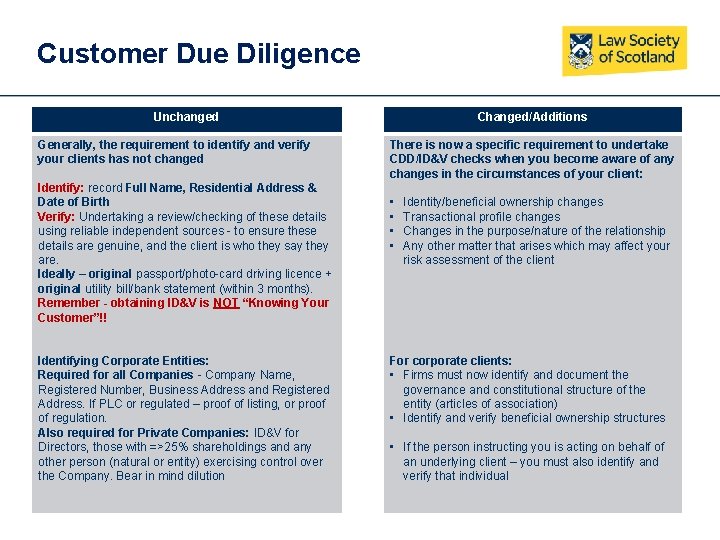

Money Laundering Regulations 2017 Plc. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them. The underpinning of this risk based approach is a risk. The government is grateful for all the responses received. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations.

Aml Roadshow 2017 The New Ml Regulations What From slidetodoc.com

Aml Roadshow 2017 The New Ml Regulations What From slidetodoc.com

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. On Monday 26 June 2017 by the skin of its teeth the UK enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs 2017. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. A relevant employee is defined as anyone whose work is. On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017.

1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

The government is grateful for all the responses received. Relevant to the firms compliance with any requirement in the Money Laundering Regulations. Specifically the consultation seeks views on whether. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. 2 These Regulations come into force on 26th. Chapter 4 of the consultation sets out proposals relating to the formation of limited partnerships and the reporting of discrepancies in beneficial ownership information.

Source: slidetodoc.com

Source: slidetodoc.com

1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. On Monday 26 June 2017 by the skin of its teeth the UK enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs 2017. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017.

Source: pinterest.com

Source: pinterest.com

The GOOD news about the 2017 Money Laundering Regulations If you are already working in the regulated sector ie. On Monday 26 June 2017 by the skin of its teeth the UK enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs 2017. Specifically the consultation seeks views on whether. UKs government has commenced the consultation process for further amendments to the Money Laundering Regulations 2017. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them.

Source: in.pinterest.com

Source: in.pinterest.com

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. 2 These Regulations come into force on 26th. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Specifically the consultation seeks views on whether. The GOOD news about the 2017 Money Laundering Regulations If you are already working in the regulated sector ie.

Source: bloomsburyprofessional.com

Source: bloomsburyprofessional.com

In addition the Section 24 of MLRs 2017 creates an obligation to make the relevant employees aware of the laws relating to money laundering and terrorist financing as. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Chapter 4 of the consultation sets out proposals relating to the formation of limited partnerships and the reporting of discrepancies in beneficial ownership information. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing.

Source: fr.pinterest.com

Source: fr.pinterest.com

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Dragging its heels somewhat unusually for UK Plc there were a few tweaks but no real surprises between the draft MLRs and the final version with five key changes made. Transactional corporate probate tax advice etc you are probably already doing most of what you need to do under the 2017 Money Laundering Regulations. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: pinterest.com

Source: pinterest.com

Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them. 2 These Regulations come into force on 26th. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: iclg.com

Source: iclg.com

Those dealerships based in the United States are subject to differing legislative requirements to. These include carrying out customer due diligence measures to check that your. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Policy has been revised following The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 coming into force on 26 June 2017. The GOOD news about the 2017 Money Laundering Regulations If you are already working in the regulated sector ie.

Source: pinterest.com

Source: pinterest.com

Transactional corporate probate tax advice etc you are probably already doing most of what you need to do under the 2017 Money Laundering Regulations. Citation and commencement 1. The final regulations were laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

Source: cz.pinterest.com

Source: cz.pinterest.com

Those dealerships based in the United States are subject to differing legislative requirements to. The underpinning of this risk based approach is a risk. Dragging its heels somewhat unusually for UK Plc there were a few tweaks but no real surprises between the draft MLRs and the final version with five key changes made. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations.

Source: lexology.com

Source: lexology.com

Dragging its heels somewhat unusually for UK Plc there were a few tweaks but no real surprises between the draft MLRs and the final version with five key changes made. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. On Monday 26 June 2017 by the skin of its teeth the UK enacted the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the MLRs 2017. Policy has been revised following The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 coming into force on 26 June 2017. 2 These Regulations come into force on 26th.

Source: pinterest.com

Source: pinterest.com

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Specifically the consultation seeks views on whether. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. Those dealerships based in the United States are subject to differing legislative requirements to.

Source: responsibleartmarket.org

Source: responsibleartmarket.org

1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. This note explains the criminal offences under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 MLR 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 the defences available and the sentences that may be imposed on conviction. Specifically the consultation seeks views on whether. These include carrying out customer due diligence measures to check that your.

Source: researchgate.net

Source: researchgate.net

From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Those dealerships based in the United States are subject to differing legislative requirements to. The 2017 Regulations will create an obligation on larger firms to conduct initial and periodic screening of relevant employees Regulation 21 1 b 2017 Regulations.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 plc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.