16++ Money laundering regulations 2017 pep info

Home » money laundering Info » 16++ Money laundering regulations 2017 pep infoYour Money laundering regulations 2017 pep images are ready in this website. Money laundering regulations 2017 pep are a topic that is being searched for and liked by netizens today. You can Download the Money laundering regulations 2017 pep files here. Find and Download all free photos and vectors.

If you’re looking for money laundering regulations 2017 pep images information related to the money laundering regulations 2017 pep topic, you have visit the ideal blog. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Money Laundering Regulations 2017 Pep. On 26 June 2017 the Money Laundering Regulations 2017 the 2017 Regulations will come into force transposing into UK law the Fourth Money Laundering Directive EU 2015849 MLD4. The client is a politically exposed person PEP 35 MLR 2017 or a family member or known close associate of a PEP. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any. Politically exposed persons PEP Reliance on third parties s39 The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law.

Anti Money Laundering A Beginners Guide By Rebecca Partridge From prezi.com

Anti Money Laundering A Beginners Guide By Rebecca Partridge From prezi.com

The client is a politically exposed person PEP 35 MLR 2017 or a family member or known close associate of a PEP. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. The EUs Fourth Money Laundering Directive implemented in the UK by the Money Laundering Regulations 2017 MLR 2017 introduced a risk-based approach to tackling money laundering and terrorist. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Similarly Money Laundering Regulations MLR 2017 refers to PEP as an individual who is entrusted with prominent public functions other than as a middle-ranking or more junior official. The MLR 2017 has expanded its definition to include domestic PEPs.

The MLR 2017 has expanded its definition to include domestic PEPs.

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The client is a politically exposed person PEP 35 MLR 2017 or a family member or known close associate of a PEP. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures.

Source: bankinghub.eu

Source: bankinghub.eu

Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them. The 2017 MLRs have been informed by the responses submitted and. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Under the amendments to the Proceeds of Crime Money Laundering and Terrorist Financing Act that came into effect in 2016 a politically exposed person now also includes all domestic PEPs and Heads of International Organisations HIOs. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017.

Source: bi.go.id

Source: bi.go.id

The MLR 2017 has expanded its definition to include domestic PEPs. The 2017 MLRs have been informed by the responses submitted and. Canada considers all foreign PEPs to pose a money laundering and terrorist financing risk. The EUs Fourth Money Laundering Directive implemented in the UK by the Money Laundering Regulations 2017 MLR 2017 introduced a risk-based approach to tackling money laundering and terrorist. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017.

Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any. Canada considers all foreign PEPs to pose a money laundering and terrorist financing risk. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. Similarly Money Laundering Regulations MLR 2017 refers to PEP as an individual who is entrusted with prominent public functions other than as a middle-ranking or more junior official. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them.

Source: bi.go.id

Source: bi.go.id

The EUs Fourth Money Laundering Directive implemented in the UK by the Money Laundering Regulations 2017 MLR 2017 introduced a risk-based approach to tackling money laundering and terrorist. The 2017 MLRs have been informed by the responses submitted and. On 26 June 2017 the Money Laundering Regulations 2017 the 2017 Regulations will come into force transposing into UK law the Fourth Money Laundering Directive EU 2015849 MLD4. Under the amendments to the Proceeds of Crime Money Laundering and Terrorist Financing Act that came into effect in 2016 a politically exposed person now also includes all domestic PEPs and Heads of International Organisations HIOs. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any.

We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Under the amendments to the Proceeds of Crime Money Laundering and Terrorist Financing Act that came into effect in 2016 a politically exposed person now also includes all domestic PEPs and Heads of International Organisations HIOs. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: slideshare.net

Source: slideshare.net

The client is a politically exposed person PEP 35 MLR 2017 or a family member or known close associate of a PEP. AML and counter-terrorist financing CTF. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. The MLR 2017 has expanded its definition to include domestic PEPs. In this regard it is clear that the Ghanaian King is a PEP by virtue of him being a King in Ghana to whom his people entrust their affairs.

Source: pideeco.be

Source: pideeco.be

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. The European Commission introduced MLD4 as not a fundamental re-calibration of the anti-money laundering rules but rather a refinement of the rules. The current regime as per theMoney Laundering Regulations 2007 requires firms to apply extra measures called enhanced due diligence when dealing with those who are. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any. The 2017 MLRs have been informed by the responses submitted and.

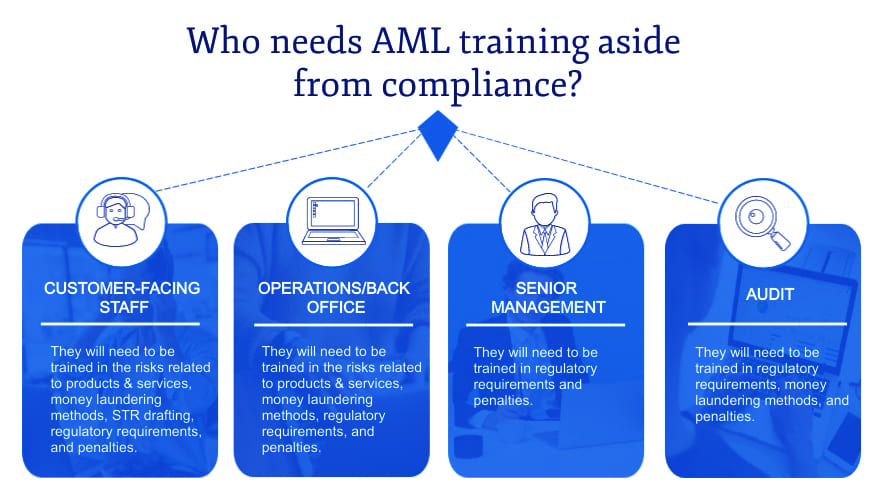

Source: camsafroza.com

Source: camsafroza.com

Similarly Money Laundering Regulations MLR 2017 refers to PEP as an individual who is entrusted with prominent public functions other than as a middle-ranking or more junior official. Similarly Money Laundering Regulations MLR 2017 refers to PEP as an individual who is entrusted with prominent public functions other than as a middle-ranking or more junior official. The 2017 MLRs have been informed by the responses submitted and. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory.

Source: complyadvantage.com

Source: complyadvantage.com

We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures.

Source: bi.go.id

Source: bi.go.id

The MLR 2017 has expanded its definition to include domestic PEPs. Payer Regulations 2017 March 2017 1 Consultation Background 11 The term politically exposed persons PEPs refers to people who hold high public office. The current regime as per theMoney Laundering Regulations 2007 requires firms to apply extra measures called enhanced due diligence when dealing with those who are. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: prezi.com

Source: prezi.com

This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. Canada considers all foreign PEPs to pose a money laundering and terrorist financing risk. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment they undertake and to keep a written record of them. On 26 June 2017 the Money Laundering Regulations 2017 the 2017 Regulations will come into force transposing into UK law the Fourth Money Laundering Directive EU 2015849 MLD4.

As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. Under the amendments to the Proceeds of Crime Money Laundering and Terrorist Financing Act that came into effect in 2016 a politically exposed person now also includes all domestic PEPs and Heads of International Organisations HIOs. Regulation 33 MLR 2017 You will need to apply EDD on a risk-sensitive basis where. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Money Laundering Regulations 2017 came into force on 26 June 2017. The current regime as per theMoney Laundering Regulations 2007 requires firms to apply extra measures called enhanced due diligence when dealing with those who are.

Source: bi.go.id

Source: bi.go.id

The 2017 MLRs have been informed by the responses submitted and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Regulation 19 obliges firms to establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 pep by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.