13++ Money laundering regulations 2017 independent audit info

Home » money laundering Info » 13++ Money laundering regulations 2017 independent audit infoYour Money laundering regulations 2017 independent audit images are available in this site. Money laundering regulations 2017 independent audit are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering regulations 2017 independent audit files here. Download all free vectors.

If you’re searching for money laundering regulations 2017 independent audit pictures information connected with to the money laundering regulations 2017 independent audit interest, you have pay a visit to the ideal site. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

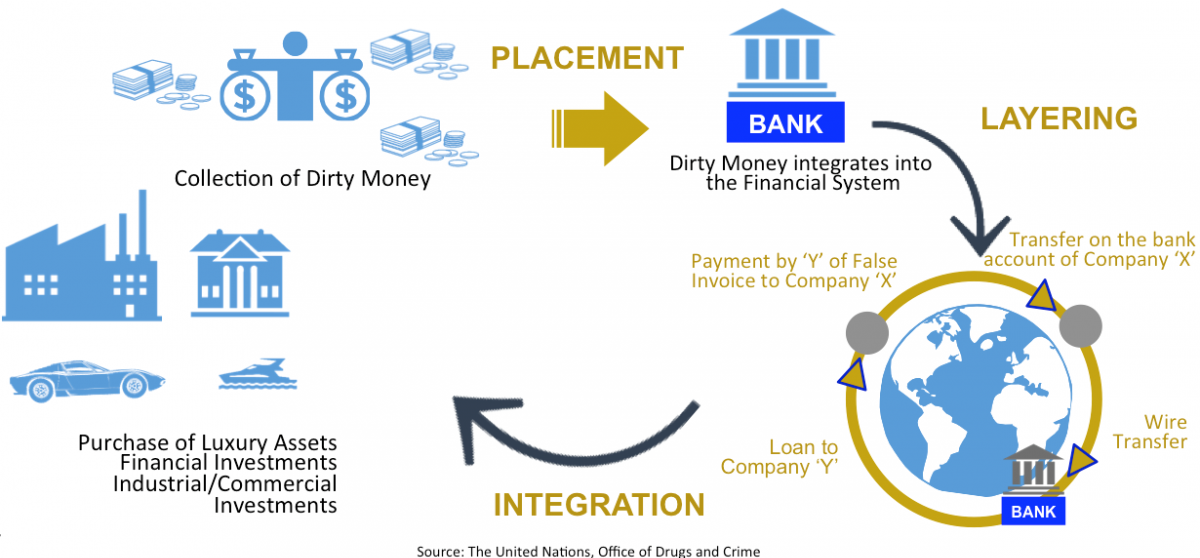

Money Laundering Regulations 2017 Independent Audit. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain firms to establish an independent audit function to audit their compliance with the MLR 2017. Updated Guidance provides more on the approach to independent audit including reviewing and making recommendations requiring file remediation as required and reporting AML suspicions to the MLRO. Those firms which have concluded that they are not required to have an independent audit under Regulation 21 of The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 should keep a written record to justify to the SRA how and why they do not meet this requirement considering how the firm. Solicitors have gone to prison.

Anti Money Laundering Policy Pdf From pdfprof.com

Anti Money Laundering Policy Pdf From pdfprof.com

Those firms which have concluded that they are not required to have an independent audit under Regulation 21 of The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 should keep a written record to justify to the SRA how and why they do not meet this requirement considering how the firm. Ii to make recommendations in relation to those policies controls and procedures. An independent audit function is a requirement of Regulation 21 of the Money Laundering Regulations 2017. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. AML policies procedures and internal controls. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 require certain organisations to establish an independent audit function to examine and evaluate the adequacy and effectiveness of the policies controls and procedures adopted by the organisation to comply with MLR 2017.

The Dos and Donts of Independent Anti-Money Laundering Audits When the 4th Anti-Money Laundering Directive was introduced in 2017 it fundamentally changed the way businesses handle money and one part of this directive which is often overlooked is the need for an independent audit of AML processes to be carried out on a regular basis.

Trust or company services. Those firms which have concluded that they are not required to have an independent audit under Regulation 21 of The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 should keep a written record to justify to the SRA how and why they do not meet this requirement considering how the firm. More prescriptive than previous legislation. Ii to make recommendations in relation to those policies controls and procedures. Quite simply if you get anti-money laundering compliance wrong you could commit an offence. This subtopic provides guidance on establishing an independent audit function together with Precedents for use in connection with the establishment and responsibilities of the independent audit.

Source: researchgate.net

Source: researchgate.net

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 require certain firms to establish an independent audit function to examine and evaluate the adequacy and effectiveness of the policies controls and procedures adopted by the firm to comply with the MLR 2017. Fines can be imposed for failures and the SRA is taking a tough line on firms in breach. More prescriptive than previous legislation. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Achieving these goals can be a challenge due to the complexities of conducting the audit review itself.

Source: gov.si

Source: gov.si

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 require certain firms to establish an independent audit function to examine and evaluate the adequacy and effectiveness of the policies controls and procedures adopted by the firm to comply with the MLR 2017. The regulations were effective from 26 June 2017. This subtopic provides guidance on establishing an independent audit function together with Precedents for use in connection with the establishment and responsibilities of the independent audit. As a result the firms first barrier is determining if they are of sufficient size and character to require one. Quite simply if you get anti-money laundering compliance wrong you could commit an offence.

Source: pdfprof.com

Source: pdfprof.com

An independent audit function is a requirement of Regulation 21 of the Money Laundering Regulations 2017. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. The regulations were effective from 26 June 2017. Achieving these goals can be a challenge due to the complexities of conducting the audit review itself. Audits can be undertaken internally from within the Firm using someone who has knowledge of the Money Laundering Regulations but has not already been involved in the formulation or day to.

Source: pinterest.com

Source: pinterest.com

Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 effective on 26 June 2017 replaced the 2007 Regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain firms to establish an independent audit function to audit their compliance with the MLR 2017. Achieving these goals can be a challenge due to the complexities of conducting the audit review itself. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain organisations to establish an independent audit function to audit their compliance with the MLR 2017. The regulations were effective from 26 June 2017.

Source: pdfprof.com

Source: pdfprof.com

Working within an agreed budget we will plan and carry out an independent audit as required by Regulation 21 of MLR 2017 which covers a detailed review and evaluation of the following areas. Working within an agreed budget we will plan and carry out an independent audit as required by Regulation 21 of MLR 2017 which covers a detailed review and evaluation of the following areas. The regulations were effective from 26 June 2017. Money Laundering Regulations 2017independent audit function. AML policies procedures and internal controls.

Source: researchgate.net

Source: researchgate.net

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain organisations to establish an independent audit function to audit their compliance with the MLR 2017. Solicitors have gone to prison. The Dos and Donts of Independent Anti-Money Laundering Audits When the 4th Anti-Money Laundering Directive was introduced in 2017 it fundamentally changed the way businesses handle money and one part of this directive which is often overlooked is the need for an independent audit of AML processes to be carried out on a regular basis. Or related services such as tax advice audit or. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain firms to establish an independent audit function to audit their compliance with the MLR 2017.

Source: researchgate.net

Source: researchgate.net

More prescriptive than previous legislation. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain organisations to establish an independent audit function to audit their compliance with the MLR 2017. Trust or company services. Solicitors have gone to prison. Or related services such as tax advice audit or.

Source: researchgate.net

Source: researchgate.net

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. As a result the firms first barrier is determining if they are of sufficient size and character to require one. This subtopic provides guidance on establishing an independent audit function together with Precedents for use in connection with the establishment and responsibilities of the independent audit. Solicitors have gone to prison. The Dos and Donts of Independent Anti-Money Laundering Audits When the 4th Anti-Money Laundering Directive was introduced in 2017 it fundamentally changed the way businesses handle money and one part of this directive which is often overlooked is the need for an independent audit of AML processes to be carried out on a regular basis.

Source: pdfprof.com

Source: pdfprof.com

AML policies procedures and internal controls. The 2017 Regulations largely apply to the same entities and individuals as the 2007 Regulations including accountancy services. C establish an independent audit function with the responsibility i to examine and evaluate the adequacy and effectiveness of the policies controls and procedures adopted by the relevant person to comply with the requirements of these Regulations. Audits can be undertaken internally from within the Firm using someone who has knowledge of the Money Laundering Regulations but has not already been involved in the formulation or day to. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain firms to establish an independent audit function to audit their compliance with the MLR 2017.

Source: landlordsguild.com

Source: landlordsguild.com

AML policies procedures and internal controls. This Precedent sets out the purpose scope activities and duties of the independent AML and CTF audit function which certain firms may be required to establish under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. AML policies procedures and internal controls. Regulation 21 of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR states that- Where appropriate with regard to the size and nature of its business a relevant person must Establish an independent audit function with the responsibility. This means the designated AML compliance officer or anyone on his or her staff cannot conduct the independent audit.

Source: pdfprof.com

Source: pdfprof.com

As a result the firms first barrier is determining if they are of sufficient size and character to require one. Achieving these goals can be a challenge due to the complexities of conducting the audit review itself. This Precedent sets out the purpose scope activities and duties of the independent AML and CTF audit function which certain firms may be required to establish under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. The regulations were effective from 26 June 2017. An AML audit may be conducted by members of the companys staff who are independent of any areas that are exposed to potential money laundering risks or by an outside party.

Source: researchgate.net

Source: researchgate.net

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Trust or company services. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Quite simply if you get anti-money laundering compliance wrong you could commit an offence. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 require certain firms to establish an independent audit function to examine and evaluate the adequacy and effectiveness of the policies controls and procedures adopted by the firm to comply with the MLR 2017.

Source: mdpi.com

Source: mdpi.com

This Precedent sets out the purpose scope activities and duties of the independent AML and CTF audit function which certain firms may be required to establish under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. An independent audit function is a requirement of Regulation 21 of the Money Laundering Regulations 2017. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 introduced a requirement for certain firms to establish an independent audit function to audit their compliance with the MLR 2017. Working within an agreed budget we will plan and carry out an independent audit as required by Regulation 21 of MLR 2017 which covers a detailed review and evaluation of the following areas.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 independent audit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.