11+ Money laundering regulations 2017 id requirements ideas in 2021

Home » money laundering idea » 11+ Money laundering regulations 2017 id requirements ideas in 2021Your Money laundering regulations 2017 id requirements images are ready in this website. Money laundering regulations 2017 id requirements are a topic that is being searched for and liked by netizens today. You can Download the Money laundering regulations 2017 id requirements files here. Get all free photos.

If you’re searching for money laundering regulations 2017 id requirements pictures information related to the money laundering regulations 2017 id requirements keyword, you have come to the right site. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Money Laundering Regulations 2017 Id Requirements. Consultation has commenced on proposed areas for reform and is open until 14 October 2021. There is a suspicious financial transaction related to money laundering and terrorism funding. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP.

Get Our Sample Of Anti Money Laundering Policy Template Policy Template Money Laundering Policies From pinterest.com

Get Our Sample Of Anti Money Laundering Policy Template Policy Template Money Laundering Policies From pinterest.com

The lawyer is doubting the validity of the information that is reported by the client. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. Regulation 30A requirement to report discrepancies in registers should be amended so that relevant persons would have an ongoing obligation to report to the registrar of companies any discrepancies between the information they hold about the beneficial owners of companies as a result of CDD measures and the information recorded on the public register at Companies House. Amending Regulations are proposed to be laid in Spring 2022. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. The MLR 2017 has expanded its definition to include domestic PEPs.

Conducting the business activities with the client.

There is a suspicious financial transaction related to money laundering and terrorism funding. Consultation has commenced on proposed areas for reform and is open until 14 October 2021. Conducting the business activities with the client. Amending Regulations are proposed to be laid in Spring 2022. The regulations were effective from 26 June 2017. Legal Structure Information Required Individual ID Required Non-Listed company including a UK LLP name registered number registered office and principal place of business copy Certificate of Incorporation company names of the board of directors or equivalent body names of the senior person responsible for its operations.

Source: bi.go.id

Source: bi.go.id

Information for bidders and buyers on AML ID Requirements Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the ML Regulations we are obliged to carry out more extensive verification checks than has previously been the case. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. The regulations were effective from 26 June 2017. One of these forms of ID must be a photographic ID document eg. The lawyer is doubting the validity of the information that is reported by the client.

Source: shuftipro.com

Source: shuftipro.com

The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. Consultation has commenced on proposed areas for reform and is open until 14 October 2021. The lawyer is doubting the validity of the information that is reported by the client. One of these forms of ID must be a photographic ID document eg.

Source: bi.go.id

Source: bi.go.id

Consultation has commenced on proposed areas for reform and is open until 14 October 2021. As noted in the consultation. They also confirm firms may outsource CDD but. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. The MLR 2017 has expanded its definition to include domestic PEPs.

Source: bi.go.id

Amending Regulations are proposed to be laid in Spring 2022. However you should be aware that the presence of one or. As noted in the consultation. Consultation has commenced on proposed areas for reform and is open until 14 October 2021. The requirements of the directive and FTR must come into effect through national law by 26 June 2017 in line with Article 67 of the directive and Article 27 of the FTR.

Source: in.pinterest.com

Source: in.pinterest.com

The amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 is afoot. The MLR 2017 has expanded its definition to include domestic PEPs. The amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 is afoot. The proof of address ID must be no older than 3 months and must be for where you are currently residing. They also confirm firms may outsource CDD but.

Source: bi.go.id

Source: bi.go.id

Amending Regulations are proposed to be laid in Spring 2022. The MLR 2017 has expanded its definition to include domestic PEPs. Conducting the business activities with the client. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. Information for bidders and buyers on AML ID Requirements Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the ML Regulations we are obliged to carry out more extensive verification checks than has previously been the case.

Source: pinterest.com

Source: pinterest.com

The amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 is afoot. UKs government has commenced the consultation process for further amendments to the Money Laundering Regulations 2017. However you should be aware that the presence of one or. As noted in the consultation. The proof of address ID must be no older than 3 months and must be for where you are currently residing.

Source: bi.go.id

Source: bi.go.id

Information for bidders and buyers on AML ID Requirements Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the ML Regulations we are obliged to carry out more extensive verification checks than has previously been the case. Regulation 30A requirement to report discrepancies in registers should be amended so that relevant persons would have an ongoing obligation to report to the registrar of companies any discrepancies between the information they hold about the beneficial owners of companies as a result of CDD measures and the information recorded on the public register at Companies House. There is a suspicious financial transaction related to money laundering and terrorism funding. Amending Regulations are proposed to be laid in Spring 2022. Consultation has commenced on proposed areas for reform and is open until 14 October 2021.

Source: nl.pinterest.com

Source: nl.pinterest.com

This guidance helps estate agency and property related businesses meet their requirements for money laundering supervision including. The lawyer is doubting the validity of the information that is reported by the client. Amending Regulations are proposed to be laid in Spring 2022. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. Regulation 30A requirement to report discrepancies in registers should be amended so that relevant persons would have an ongoing obligation to report to the registrar of companies any discrepancies between the information they hold about the beneficial owners of companies as a result of CDD measures and the information recorded on the public register at Companies House.

Source: bi.go.id

As noted in the consultation. As noted in the consultation. There is a financial transaction in amount or equivalent of IDR 100000000. They also confirm firms may outsource CDD but. The MLR 2017 has expanded its definition to include domestic PEPs.

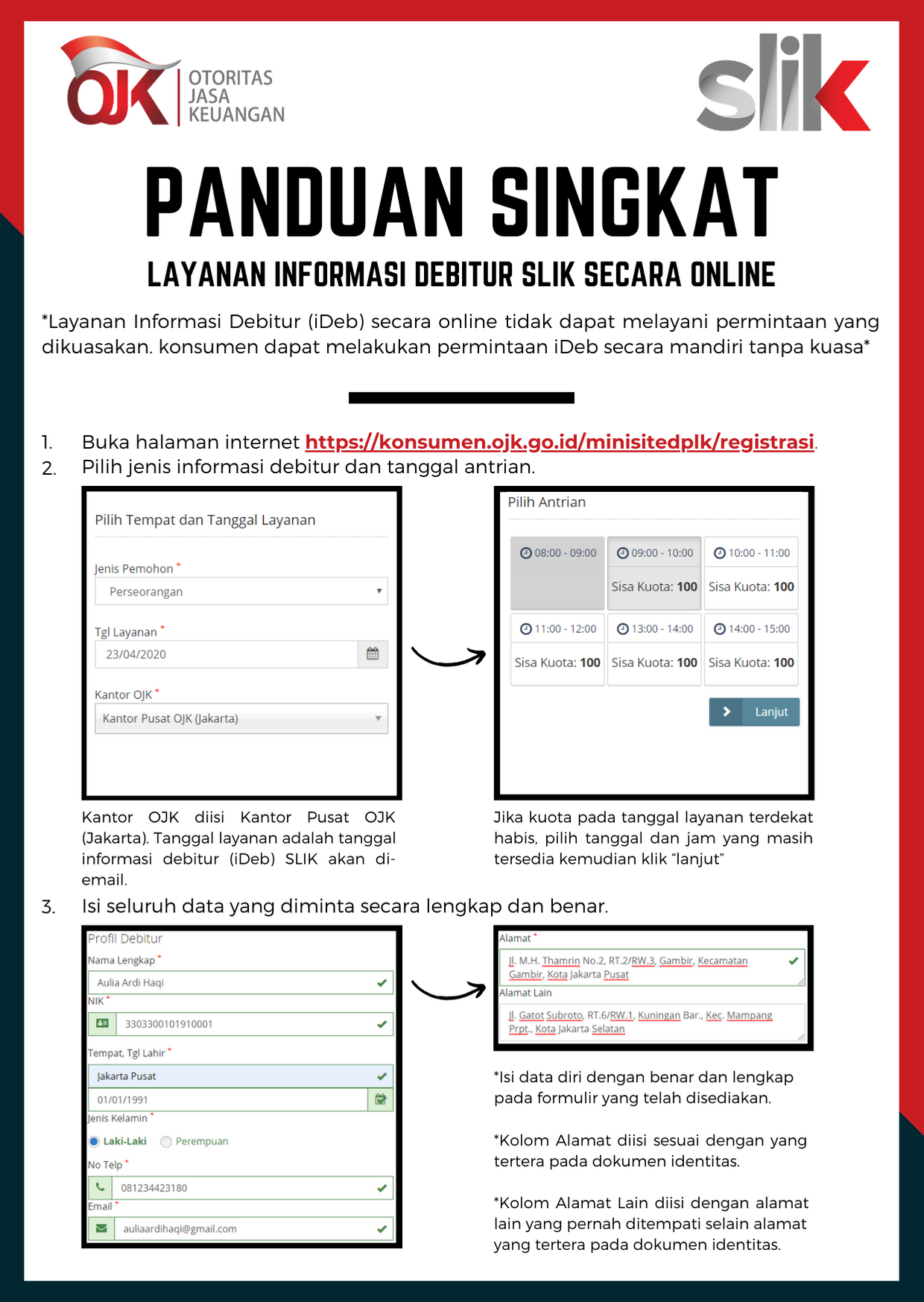

Source: ojk.go.id

Source: ojk.go.id

The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. This guidance helps estate agency and property related businesses meet their requirements for money laundering supervision including. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law.

Source: bi.go.id

Amending Regulations are proposed to be laid in Spring 2022. There is a suspicious financial transaction related to money laundering and terrorism funding. The MLR 2017 confirm that firms are permitted to rely on CDD carried out by other group companies provided these are carried out to MLD4 standards under the supervision of an appropriate MLD4 supervisor. Consultation has commenced on proposed areas for reform and is open until 14 October 2021. One of these forms of ID must be a photographic ID document eg.

Source: pinterest.com

Source: pinterest.com

As with the Money Laundering Regulations 2007 the MLR 2017 requires estate agents to have in place a public risk management system to identify if the beneficial owner is a PEP or a family member of a PEP or a known close associate of a PEP. There is a suspicious financial transaction related to money laundering and terrorism funding. Amending Regulations are proposed to be laid in Spring 2022. The regulations were effective from 26 June 2017. The lawyer is doubting the validity of the information that is reported by the client.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 id requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.