11++ Money laundering regulations 2017 fca info

Home » money laundering idea » 11++ Money laundering regulations 2017 fca infoYour Money laundering regulations 2017 fca images are available. Money laundering regulations 2017 fca are a topic that is being searched for and liked by netizens now. You can Download the Money laundering regulations 2017 fca files here. Get all royalty-free photos and vectors.

If you’re looking for money laundering regulations 2017 fca pictures information linked to the money laundering regulations 2017 fca interest, you have come to the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Money Laundering Regulations 2017 Fca. Money Laundering Regulations the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. The Regulations identify the firms we supervise and impose on us a duty to take measures to secure those firms compliance with the Regulations requirements. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime.

Pin On Forex From pinterest.com

Pin On Forex From pinterest.com

B regularly review and update the policies controls and procedures established under sub-paragraph a. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. Previous FCA action has focussed on imposing fines for breaches and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime. Who needs to report. EG 19141 01032016 RP.

The Regulations require firms to take specified steps to detect and prevent both money laundering and terrorist financing.

The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations. Money laundering registration. Money Laundering Regulations 2017 The Money Laundering Regulations 2017 SI 2017692 transpose the requirements of the Third Fourth Money Laundering Directive into UK law. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. A draft of the Money Laundering Regulations 2017 MLRs.

Source: fi.pinterest.com

Source: fi.pinterest.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Regulations identify the firms we supervise and impose on us a duty to take measures to secure those firms compliance with the Regulations requirements. B regularly review and update the policies controls and procedures established under sub-paragraph a. Money Laundering Regulations 2017 The Money Laundering Regulations 2017 SI 2017692 transpose the requirements of the Third Fourth Money Laundering Directive into UK law. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime.

Source: pinterest.com

Source: pinterest.com

The FCA will now be able to use the requirements under the new regulations to refuse registration of an Annex 1 firm where. Previous FCA action has focussed on imposing fines for breaches and. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations give the FCA responsibility for supervising the anti-money laundering controls of businesses that offer certain services. B regularly review and update the policies controls and procedures established under sub-paragraph a.

Source: pinterest.com

Source: pinterest.com

Previous FCA action has focussed on imposing fines for breaches and. Money laundering registration. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities.

Source: sumsub.com

A establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment undertaken by the relevant person under regulation 181. Money Laundering Regulations the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. Who needs to report. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. FCA supervision and enforcement.

Source: br.pinterest.com

Source: br.pinterest.com

The FCA will now be able to use the requirements under the new regulations to refuse registration of an Annex 1 firm where. Money laundering registration. B regularly review and update the policies controls and procedures established under. B regularly review and update the policies controls and procedures established under sub-paragraph a. Previous FCA action has focussed on imposing fines for breaches and.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. FCA supervision and enforcement. Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities. Previous FCA action has focussed on imposing fines for breaches and. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 119.

Source: sk.pinterest.com

Source: sk.pinterest.com

EG 19141 01032016 RP. The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations. B regularly review and update the policies controls and procedures established under. B regularly review and update the policies controls and procedures established under sub-paragraph a. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations.

Source: skillcast.com

Source: skillcast.com

Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities. Who needs to report. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. B regularly review and update the policies controls and procedures established under.

Source: biia.com

Source: biia.com

Who needs to report. Who needs to report. A draft of the Money Laundering Regulations 2017 MLRs. Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities. The Regulations identify the firms we supervise and impose on us a duty to take measures to secure those firms compliance with the Regulations requirements.

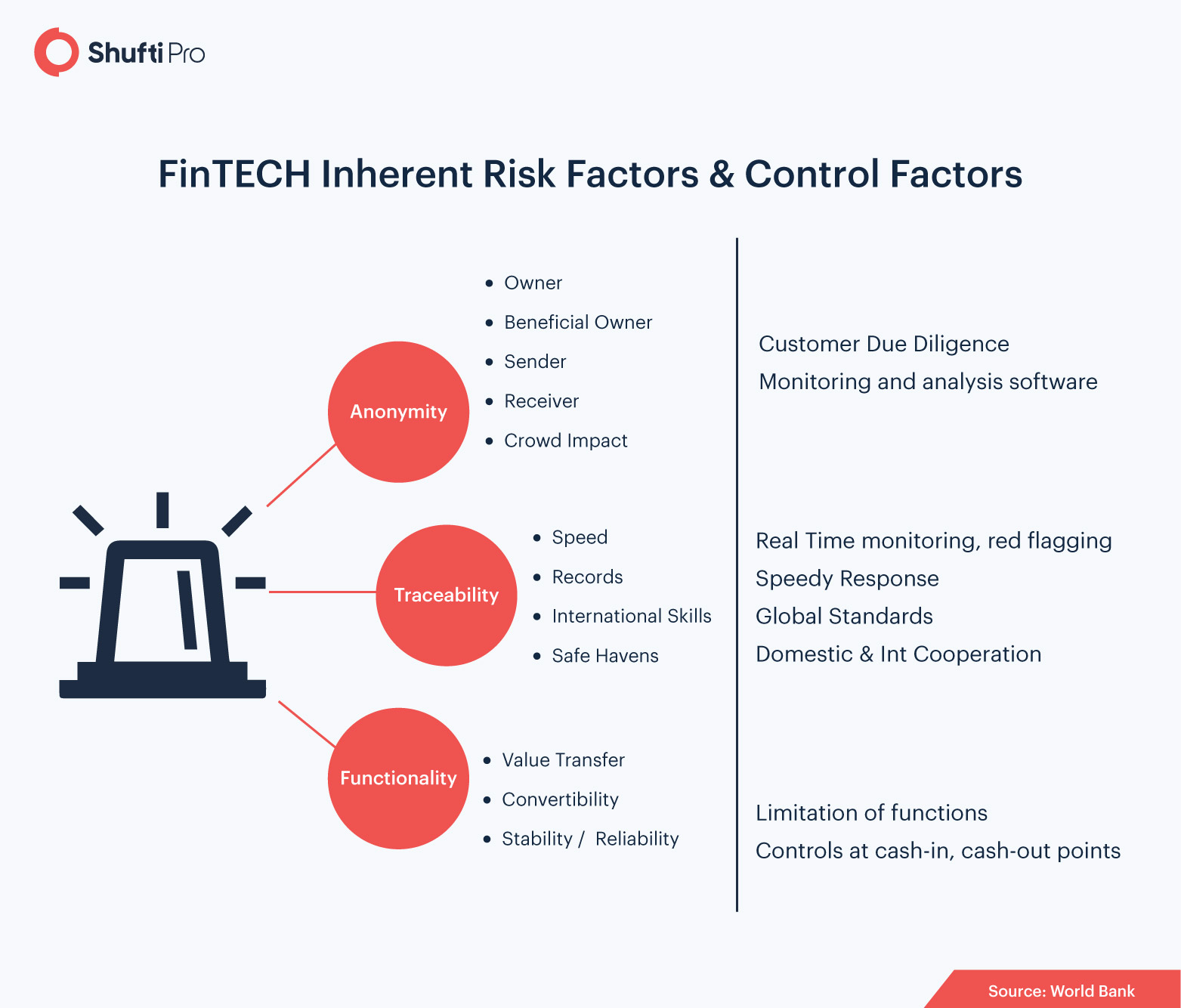

Source: shuftipro.com

Source: shuftipro.com

These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. EG 19141 01032016 RP. Who needs to report. On 18 April the Financial Conduct Authority published its 20172018 Business Plan a copy of which can be viewed hereThe FCA makes it clear that it may start prosecuting firms or individuals for serious or repeated anti-money laundering failures marking.

Source: pinterest.com

Source: pinterest.com

A establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment undertaken by the relevant person under regulation 181. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations give the FCA responsibility for supervising the anti-money laundering controls of businesses that offer certain services. A establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment undertaken by the relevant person under regulation 181. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. The Regulations identify the firms we supervise and impose on us a duty to take measures to secure those firms compliance with the Regulations requirements.

Source: idmerit.com

Source: idmerit.com

Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations give the FCA responsibility for supervising the anti-money laundering controls of businesses that offer certain services. B regularly review and update the policies controls and procedures established under sub-paragraph a. The Regulations identify the firms we supervise and impose on us a duty to take measures to secure those firms compliance with the Regulations requirements. B regularly review and update the policies controls and procedures established under. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime.

Source: claytonandbrewill.com

Source: claytonandbrewill.com

Money Laundering Regulations 2017 The Money Laundering Regulations 2017 SI 2017692 transpose the requirements of the Third Fourth Money Laundering Directive into UK law. Money Laundering Regulations the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. Under regulation 78 of the Money Laundering Regulations. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. A establish and maintain policies controls and procedures to mitigate and manage effectively the risks of money laundering and terrorist financing identified in any risk assessment undertaken by the relevant person under regulation 181.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 fca by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.