17+ Money laundering regulations 2017 eu info

Home » money laundering Info » 17+ Money laundering regulations 2017 eu infoYour Money laundering regulations 2017 eu images are ready. Money laundering regulations 2017 eu are a topic that is being searched for and liked by netizens today. You can Get the Money laundering regulations 2017 eu files here. Find and Download all royalty-free photos and vectors.

If you’re searching for money laundering regulations 2017 eu images information related to the money laundering regulations 2017 eu interest, you have come to the right blog. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Money Laundering Regulations 2017 Eu. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 came into force on 26 June 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. Essentially those covered by MLR 2017 remain the same as under the previous rules.

Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 the IFA must approve all beneficial owners officers and managers BOOMs in our supervised firms. Here are some take-aways. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering. The 2017 MLRs have been informed by the responses submitted and reflect the. The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 came into force on 26 June 2017.

The 2017 MLRs have been informed by the responses submitted and reflect the.

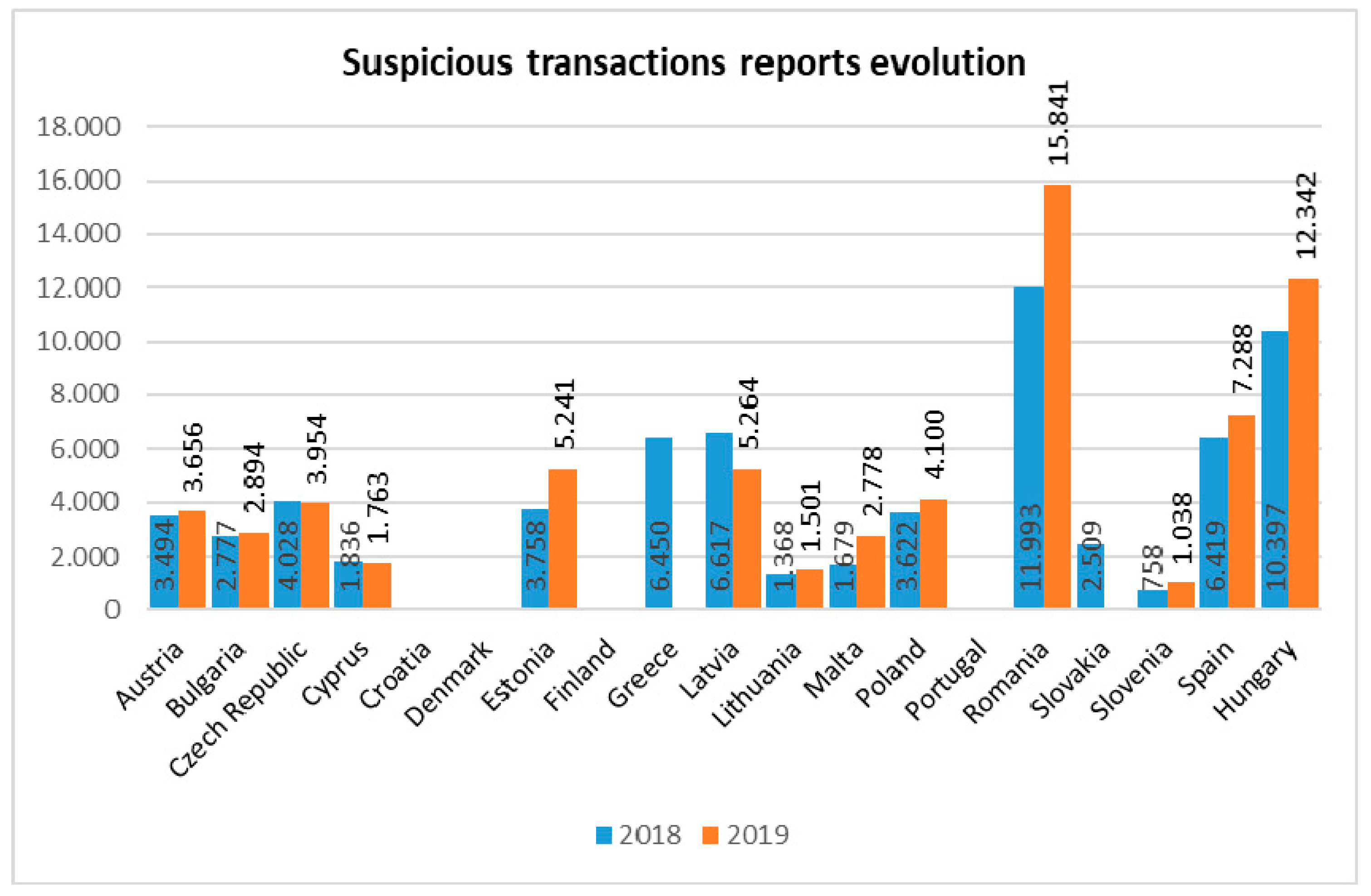

The aim is to improve the detection of suspicious transactions and activities and close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system. There were some major moments on the EU anti-money laundering AML scene in 2017 on the legislative and regulatory front highlights included the Fourth 4AMLD and Fifth 5AMLD Anti-Money Laundering Directives as well as recommendations from the PANA Committee Panama Papers Committee. On 20 December 2017 EU ambassadors confirmed the political agreement reached between the presidency and the European Parliament on strengthened EU rules to prevent money laundering and terrorist financing. Implementing the EUs Fourth Money Laundering Directive. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations replaced the Money Laundering Regulations 2007 with updated provisions that implement in part the EU Fourth Money Laundering Directive which in turn applied the latest Financial Action Task Force FATF standards. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Source: mdpi.com

Source: mdpi.com

PART 2 Implementation of EU law. The Fourth Money Laundering Directive 4MLD published by the European Parliament and the Council of the European Union incorporates developments of the Financial Action Task Force agenda for anti- money laundering AML and counter-terrorist financing CTF. It is part of the Commissions commitment to protect EU citizens and the EUs financial system from money laundering and terrorist financing. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Strengthening transparency rules to prevent the large-scale concealment of funds.

Source: euronews.com

Source: euronews.com

Identify and verify the identity of clients monitor transactions and report suspicious transactions. The Money Laundering Regulations 2017 are now in force are you compliant. Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. The underpinning of this risk based approach is a risk assessment flowing from a country level risk assessment at government level through to supervisory body risk assessments e. Here are some take-aways.

It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. In doing so they did not represent a wholesale upheaval of the existing legislation but instead were aimed at improving the 2007 regulations. Identify and verify the identity of clients monitor transactions and report suspicious transactions. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 came into force on 26 June 2017.

From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. From June 26th the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force requiring firms who are subject to the MLR 2017 regulations to apply a comprehensive risk based approach to the risks of money laundering and terrorism financing. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. Identify and verify the identity of clients monitor transactions and report suspicious transactions. Implementing the EUs Fourth Money Laundering Directive.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

By 26 June 2017 the ESAs shall issue guidelines addressed to competent authorities and the credit institutions and financial institutions in accordance with Article 16 of Regulations EU No 10932010 EU No 10942010 and EU No 10952010 on the risk factors to be taken into consideration and the measures to be taken in situations where enhanced customer due diligence measures are appropriate. The 2017 Regulations largely apply to the same entities and individuals as the 2007 Regulations including accountancy services. Strengthening transparency rules to prevent the large-scale concealment of funds. The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. PART 2 Implementation of EU law.

Source: skillcast.com

Source: skillcast.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 came into force on 26 June 2017. The underpinning of this risk based approach is a risk assessment flowing from a country level risk assessment at government level through to supervisory body risk assessments e. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering.

Source: ec.europa.eu

Source: ec.europa.eu

The Money Laundering Regulations 2017 are now in force are you compliant. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. Amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Strengthening transparency rules to prevent the large-scale concealment of funds.

Source: ceps.eu

Source: ceps.eu

The European Unions Fourth Anti-Money Laundering Directive came into force on 26th June 2017. On 20 December 2017 EU ambassadors confirmed the political agreement reached between the presidency and the European Parliament on strengthened EU rules to prevent money laundering and terrorist financing. PART 2 Implementation of EU law. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations replaced the Money Laundering Regulations 2007 with updated provisions that implement in part the EU Fourth Money Laundering Directive which in turn applied the latest Financial Action Task Force FATF standards. Essentially those covered by MLR 2017 remain the same as under the previous rules.

Source: ft.com

Source: ft.com

On 20 December 2017 EU ambassadors confirmed the political agreement reached between the presidency and the European Parliament on strengthened EU rules to prevent money laundering and terrorist financing. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations replaced the Money Laundering Regulations 2007 with updated provisions that implement in part the EU Fourth Money Laundering Directive which in turn applied the latest Financial Action Task Force FATF standards. By 26 June 2017 the ESAs shall issue guidelines addressed to competent authorities and the credit institutions and financial institutions in accordance with Article 16 of Regulations EU No 10932010 EU No 10942010 and EU No 10952010 on the risk factors to be taken into consideration and the measures to be taken in situations where enhanced customer due diligence measures are appropriate. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: pin-magazine.paysafecard.com

Source: pin-magazine.paysafecard.com

Essentially those covered by MLR 2017 remain the same as under the previous rules. The Money Laundering Regulations 2017 are now in force are you compliant. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 implemented the European Unions fourth directive on money laundering. Implementing the EUs Fourth Money Laundering Directive. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: bankinghub.eu

Source: bankinghub.eu

There were some major moments on the EU anti-money laundering AML scene in 2017 on the legislative and regulatory front highlights included the Fourth 4AMLD and Fifth 5AMLD Anti-Money Laundering Directives as well as recommendations from the PANA Committee Panama Papers Committee. The 2017 Regulations largely apply to the same entities and individuals as the 2007 Regulations including accountancy services. The Anti-Money Laundering Regulations 2017 is the latest EU Directive on Anti-Money Laundering it supersedes the Money-Laundering Regulations 2007 and the EUs Third Anti-Money Laundering Directive. The Directive includes some fundamental changes to the anti-money laundering procedures including changes to CDD a central register for beneficial owners and a focus on risk assessments. However it should be noted that the 2017 regulations have raised the base level for.

Source: pinterest.com

Source: pinterest.com

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. The 2017 MLRs have been informed by the responses submitted and reflect the. Amendment of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Implementing the EUs Fourth Money Laundering Directive. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 eu by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.