13+ Money laundering regulations 2017 employee screening info

Home » money laundering Info » 13+ Money laundering regulations 2017 employee screening infoYour Money laundering regulations 2017 employee screening images are available. Money laundering regulations 2017 employee screening are a topic that is being searched for and liked by netizens now. You can Download the Money laundering regulations 2017 employee screening files here. Find and Download all free photos.

If you’re searching for money laundering regulations 2017 employee screening images information connected with to the money laundering regulations 2017 employee screening interest, you have pay a visit to the ideal site. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Money Laundering Regulations 2017 Employee Screening. More prescriptive than previous legislation. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. Geographic areas of operation customers the types of services and. Carrying out screening of all relevant employees and agents both before appointment and at.

How To Protect Your Business From Money Laundering Activities Cri Group From crigroup.com

How To Protect Your Business From Money Laundering Activities Cri Group From crigroup.com

The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. The 2017 Regulations specify a number of factors which must now be considered during these risk assessments including. Relevant Persons must conduct screening of relevant employees and agents both before appointment and at regular intervals during the course of the appointment. This Practice Note sets out the requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in relation to screening of relevant employees together with best practice in relation to staff vetting for roles in anti-money laundering compliance whether the provisions of the MLR 2017 apply to your firm or not. The 2017 Regulations require firms in the regulated sector to implement AML compliance programs with the following components. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 require firms subject to the regulations to carry out screening of relevant employees where it is appropriate having regard to.

The 2017 Regulations specify a number of factors which must now be considered during these risk assessments including.

The 2017 Regulations will create an obligation on larger firms to conduct initial and periodic screening of relevant employees Regulation 211b 2017 Regulations. Relevant to the firms compliance with any requirement in. A relevant employee is defined as anyone whose work is. This Practice Note sets out the requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in relation to screening of relevant employees together with best practice in relation to staff vetting for roles in anti-money laundering compliance whether the provisions of the MLR 2017 apply to your organisation or not. Regulation 21 sets out a requirement for the screening of relevant employees. Under the Regulations a relevant employee defined.

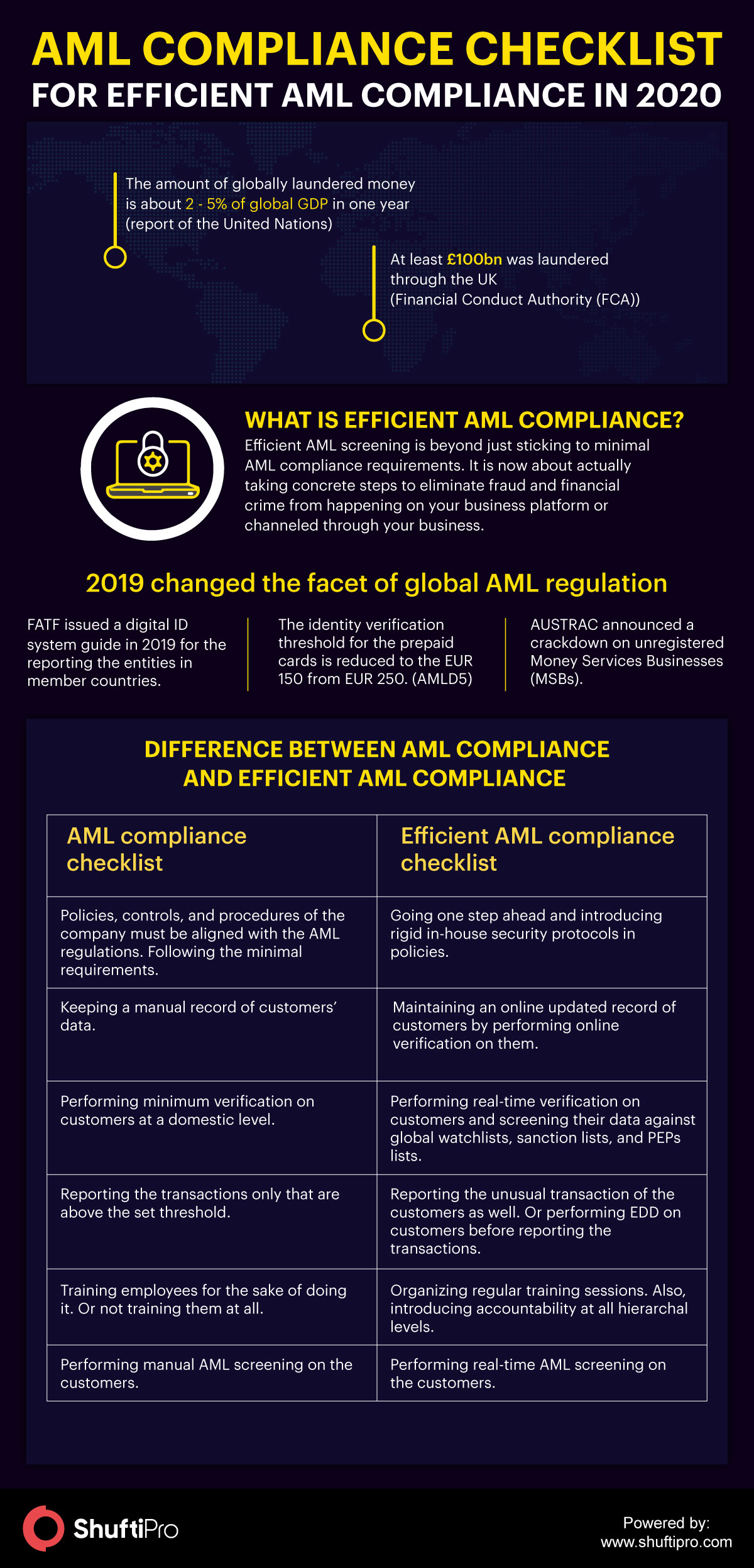

Source: shuftipro.com

Source: shuftipro.com

The 2017 Regulations specify a number of factors which must now be considered during these risk assessments including. Employee screening and training. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures. Relevant to the firms compliance with any requirement in.

Source:

A relevant employee is defined as anyone whose work is. Regulation 21 sets out a requirement for the screening of relevant employees. Appointing a board member as the person responsible for compliance with the MLR 2017. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law.

Source: shuftipro.com

Source: shuftipro.com

This Practice Note sets out the requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in relation to screening of relevant employees together with best practice in relation to staff vetting for roles in anti-money laundering compliance whether the provisions of the MLR 2017 apply to your organisation or not. The requirement is not absolute and is tempered by applying only where appropriate with regard to the size and nature of your business. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. A relevant employee is defined as anyone whose work is. Firms must take steps to identify and assess money laundering risks which usually includes keeping a written.

Source:

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. Carrying out screening of all relevant employees and agents both before appointment and at. More prescriptive than previous legislation. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. The MLR 2017 is clear that screening includes an assessment of the skills knowledge and expertise of the.

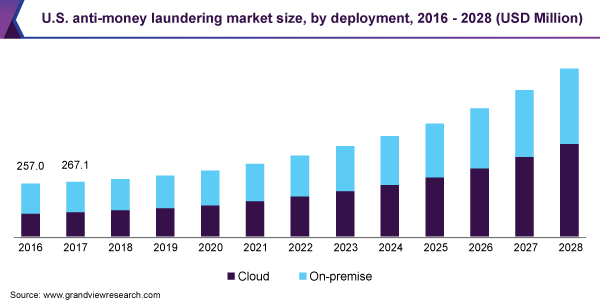

Source: grandviewresearch.com

Source: grandviewresearch.com

Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. This Practice Note sets out the requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in relation to screening of relevant employees together with best practice in relation to staff vetting for roles in anti-money laundering compliance whether the provisions of the MLR 2017 apply to your firm or not. One new area however is found in regulation 21 which introduces a requirement to screen employees both before their employment starts and periodically afterwards. The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. Employee screening and training.

Source: shuftipro.com

Source: shuftipro.com

Relevant to the firms compliance with any requirement in. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. Relevant Persons must conduct screening of relevant employees and agents both before appointment and at regular intervals during the course of the appointment. Geographic areas of operation customers the types of services and. The 2017 Regulations will create an obligation on larger firms to conduct initial and periodic screening of relevant employees Regulation 211b 2017 Regulations.

Source: shuftipro.com

Source: shuftipro.com

The MLR 2017 is clear that screening includes an assessment of the skills knowledge and expertise of the. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. The regulations were effective from 26 June 2017. This Practice Note sets out the requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in relation to screening of relevant employees together with best practice in relation to staff vetting for roles in anti-money laundering compliance whether the provisions of the MLR 2017 apply to your organisation or not. The 2017 Regulations require firms in the regulated sector to implement AML compliance programs with the following components.

Source: crigroup.com

Source: crigroup.com

The MLR 2017 is clear that screening includes an assessment of the skills knowledge and expertise of the. The requirement is not absolute and is tempered by applying only where appropriate with regard to the size and nature of your business. However you should be aware that the presence of one or. Relevant to the firms compliance with any requirement in the Money Laundering Regulations. Appointing a board member as the person responsible for compliance with the MLR 2017.

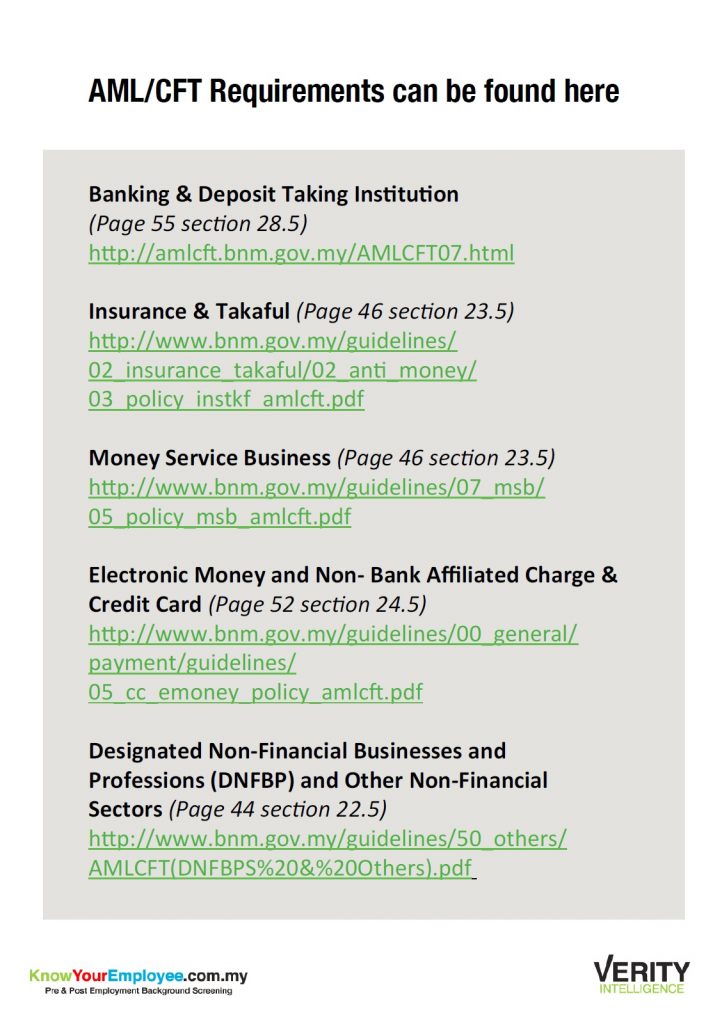

Source: pdfprof.com

Source: pdfprof.com

Under the Regulations a relevant employee defined. Geographic areas of operation customers the types of services and. The government has implemented The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 that transpose the European Unions Fourth Anti Money Laundering Directive into UK law. However you should be aware that the presence of one or. This legislation built on the 2007 regulations although there are some specific and potentially significant changes that you need to be aware of and factor into your policies and procedures.

Source:

A relevant employee is defined as anyone whose work is. Regulation 21 sets out a requirement for the screening of relevant employees. One new area however is found in regulation 21 which introduces a requirement to screen employees both before their employment starts and periodically afterwards. Relevant to the firms compliance with any requirement in the Money Laundering Regulations. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

Source: taxguru.in

Source: taxguru.in

On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. More prescriptive than previous legislation. Regulation 21 sets out a requirement for the screening of relevant employees. Relevant Persons must conduct screening of relevant employees and agents both before appointment and at regular intervals during the course of the appointment. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017.

Source:

Firms must take steps to identify and assess money laundering risks which usually includes keeping a written. One new area however is found in regulation 21 which introduces a requirement to screen employees both before their employment starts and periodically afterwards. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. Employee screening and training. Relevant Persons must conduct screening of relevant employees and agents both before appointment and at regular intervals during the course of the appointment.

Source:

The 2017 Regulations will create an obligation on larger firms to conduct initial and periodic screening of relevant employees Regulation 211b 2017 Regulations. Appointing a board member as the person responsible for compliance with the MLR 2017. Relevant to the firms compliance with any requirement in the Money Laundering Regulations. This Practice Note sets out the requirements of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 in relation to screening of relevant employees together with best practice in relation to staff vetting for roles in anti-money laundering compliance whether the provisions of the MLR 2017 apply to your organisation or not. Carrying out screening of all relevant employees and agents both before appointment and at.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 employee screening by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.