13++ Money laundering regulations 2017 data retention ideas

Home » money laundering idea » 13++ Money laundering regulations 2017 data retention ideasYour Money laundering regulations 2017 data retention images are available in this site. Money laundering regulations 2017 data retention are a topic that is being searched for and liked by netizens now. You can Get the Money laundering regulations 2017 data retention files here. Get all royalty-free photos and vectors.

If you’re looking for money laundering regulations 2017 data retention images information linked to the money laundering regulations 2017 data retention interest, you have visit the right blog. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Money Laundering Regulations 2017 Data Retention. - Portuguese Data Protection Authoritys Guidelines dated 27 July 2017 on retention deadlines in electronic communications - Regulation EC No 19072006 of the European Parliament and of the Council of 18 December 2006. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. Download the Ultimate Guide to Electronic Records Management today. Guidelines of CTIF-CFI of 15 August 2020 for obliged entities referred to in Article 5 of the Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash regarding the reporting of information to CTIF-CFI.

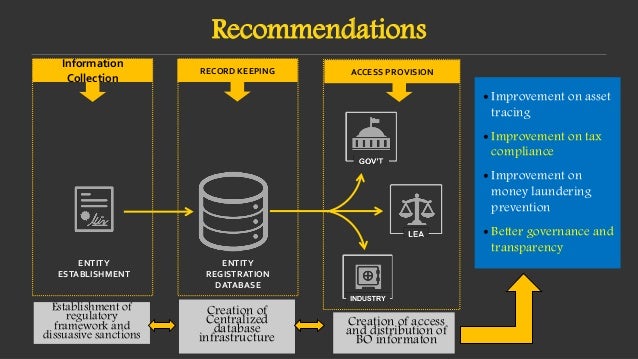

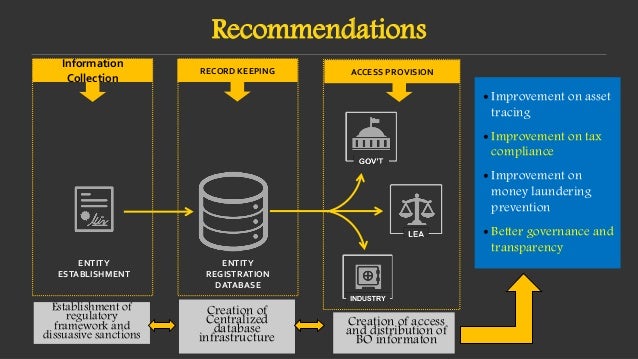

Aml Ctf Risk Assessment On Legal Person And Gap Analysis On Ultimate From slideshare.net

Aml Ctf Risk Assessment On Legal Person And Gap Analysis On Ultimate From slideshare.net

5 Once the period referred to in paragraph or if applicable paragraph 4 has expired the relevant person must delete any personal data obtained for the purposes of these Regulations unless. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. Guidelines of CTIF-CFI of 15 August 2020 for obliged entities referred to in Article 5 of the Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash regarding the reporting of information to CTIF-CFI. The data subject has consented to the retention. If not has it registered with an anti-money laundering AML supervisor.

5 Once the period referred to in paragraph or if applicable paragraph 4 has expired the relevant person must delete any personal data obtained for the purposes of these Regulations unless.

Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. New requirements under the Money Laundering Regulations 2017. F Approval of beneficial owners officers or managers of supervised firms Regulation 26 Under MLR 2017 no one can be a beneficial owner officer or manager of a supervised. If not has it registered with an anti-money laundering AML supervisor. The retention period of ten years referred to above is reduced to seven years for transactions carried out in 2017 and to eight and nine years for transactions carried out in 2018 and 2019 respectively see Article 60 second paragraph of the Law. Data retention policies need to.

Source:

A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. This practice note explains the risk assessment aspects of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 including the steps that have to be followed by relevant entities or persons. Download the Ultimate Guide to Electronic Records Management today. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. If not has it registered with an anti-money laundering AML supervisor.

Source: in.pinterest.com

Source: in.pinterest.com

ICAEW is the automatic supervisory authority for ICAEW member firms. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. Data retention policies need to. It covers the prevention of money laundering and the countering of terrorist financing.

Source: slideshare.net

Source: slideshare.net

It covers the prevention of money laundering and the countering of terrorist financing. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the customer or its beneficial owner and agrees to keep records for the periods the MLR 2017. This guidance is based on the law and regulations as of 26 June 2017. Ad Learn how to reduce the cost of compliance with electronic records management. The 2017 MLRs have been informed by the responses submitted and.

Source: pinterest.com

Source: pinterest.com

Guidelines of CTIF-CFI of 15 August 2020 for obliged entities referred to in Article 5 of the Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash regarding the reporting of information to CTIF-CFI. MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document.

Source: ec.europa.eu

Source: ec.europa.eu

MONEY LAUNDERING REGULATIONS 2017 COMPLIANCE REVIEW Issued. It is intended to be read by anyone who provides audit accountancy tax advisory insolvency or trust and company services in the United Kingdom and has been approved and adopted by the UK. If not has it registered with an anti-money laundering AML supervisor. The retention period of ten years referred to above is reduced to seven years for transactions carried out in 2017 and to eight and nine years for transactions carried out in 2018 and 2019 respectively see Article 60 second paragraph of the Law. Download the Ultimate Guide to Electronic Records Management today.

Source: pinterest.com

Source: pinterest.com

Guidelines of CTIF-CFI of 15 August 2020 for obliged entities referred to in Article 5 of the Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash regarding the reporting of information to CTIF-CFI. Guidelines of CTIF-CFI of 15 August 2020 for obliged entities referred to in Article 5 of the Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash regarding the reporting of information to CTIF-CFI. Download the Ultimate Guide to Electronic Records Management today. On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017. It covers the prevention of money laundering and the countering of terrorist financing.

Source:

The retention period of ten years referred to above is reduced to seven years for transactions carried out in 2017 and to eight and nine years for transactions carried out in 2018 and 2019 respectively see Article 60 second paragraph of the Law. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. It is intended to be read by anyone who provides audit accountancy tax advisory insolvency or trust and company services in the United Kingdom and has been approved and adopted by the UK. The 2017 MLRs have been informed by the responses submitted and. If not has it registered with an anti-money laundering AML supervisor.

Source:

Download the Ultimate Guide to Electronic Records Management today. The 2017 MLRs have been informed by the responses submitted and. 5 Once the period referred to in paragraph or if applicable paragraph 4 has expired the relevant person must delete any personal data obtained for the purposes of these Regulations unless. See the reference texts on the website of the Data Protection Authority. Specifically the consultation seeks views on whether.

Source: www2.deloitte.com

Source: www2.deloitte.com

MLR 2017 retains the five years rule for record keeping after the relationship has been terminated. It is intended to be read by anyone who provides audit accountancy tax advisory insolvency or trust and company services in the United Kingdom and has been approved and adopted by the UK. Xxxx2020 10 THE FIRM Y N Na Comments 11 Is the firm a member firm in accordance with the disciplinary byelaws. However you should be aware that the presence of one or. It covers the prevention of money laundering and the countering of terrorist financing.

Source:

On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017. However you should be aware that the presence of one or. The 2017 MLRs have been informed by the responses submitted and. Specifically the consultation seeks views on whether. If not has it registered with an anti-money laundering AML supervisor.

Source: pinterest.com

Source: pinterest.com

Ad Learn how to reduce the cost of compliance with electronic records management. The data subject has consented to the retention. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. - Portuguese Data Protection Authoritys Guidelines dated 27 July 2017 on retention deadlines in electronic communications - Regulation EC No 19072006 of the European Parliament and of the Council of 18 December 2006. However you should be aware that the presence of one or.

Source: iclg.com

Source: iclg.com

Ad Learn how to reduce the cost of compliance with electronic records management. Guidelines of CTIF-CFI of 15 August 2020 for obliged entities referred to in Article 5 of the Law of 18 September 2017 on the prevention of money laundering and terrorist financing and on the restriction of the use of cash regarding the reporting of information to CTIF-CFI. Data retention policies need to. This guidance is based on the law and regulations as of 26 June 2017. On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017.

Source: slidetodoc.com

Source: slidetodoc.com

On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017. On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017. See the reference texts on the website of the Data Protection Authority. The 2017 MLRs have been informed by the responses submitted and. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the customer or its beneficial owner and agrees to keep records for the periods the MLR 2017.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering regulations 2017 data retention by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.