15+ Money laundering regulations 2017 customer due diligence info

Home » money laundering Info » 15+ Money laundering regulations 2017 customer due diligence infoYour Money laundering regulations 2017 customer due diligence images are ready in this website. Money laundering regulations 2017 customer due diligence are a topic that is being searched for and liked by netizens today. You can Get the Money laundering regulations 2017 customer due diligence files here. Get all royalty-free vectors.

If you’re looking for money laundering regulations 2017 customer due diligence pictures information related to the money laundering regulations 2017 customer due diligence keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Money Laundering Regulations 2017 Customer Due Diligence. A identify the customer. A a politically exposed person a PEP. A identify the customer. Request your PitchBook free trial to see how our global data will benefit you.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

1 This regulation applies when a relevant person is required by regulation 27 to apply customer due diligence measures. Enhanced customer due diligence. Ad Learn how to better vet companies and investors. Money Laundering Regulations 2017customer due diligence. Money laundering regulations 2017 customer due diligence. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI.

Money Laundering Regulations 2017 part 2.

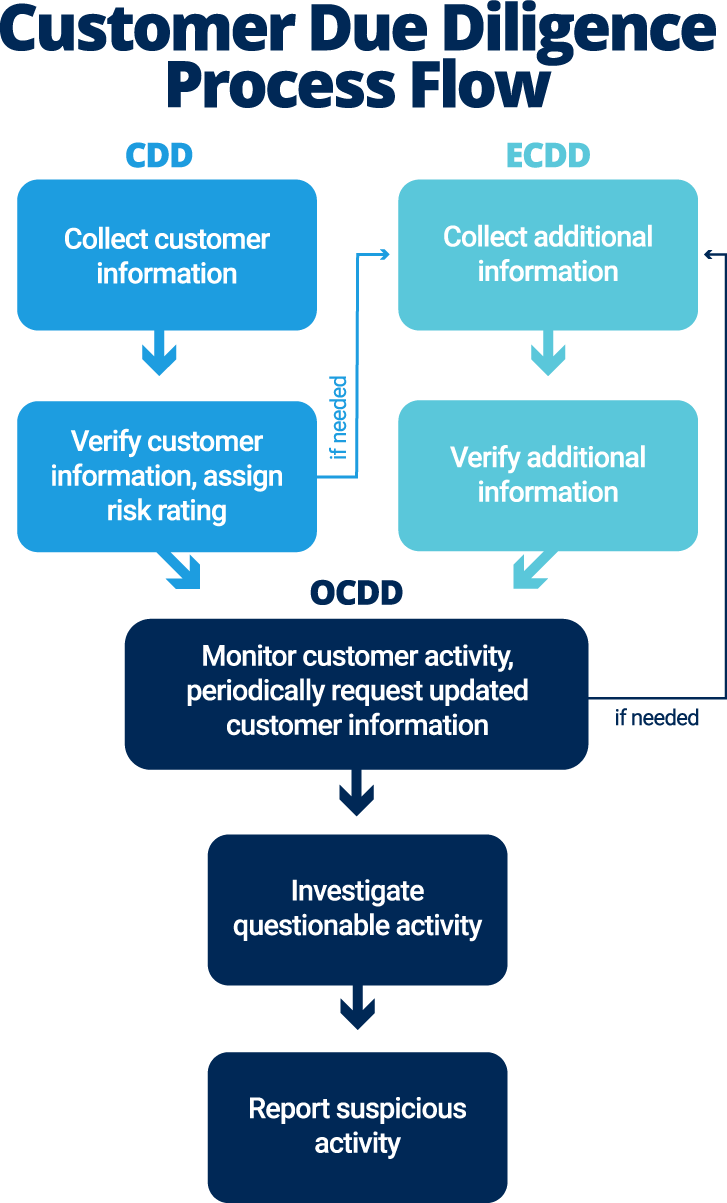

This Practice Note provides guidance on customer due diligence CDD which is a central pillar of the anti-money laundering AML and counter-terrorist financing CTF regime. Enhanced customer due diligence. Request your PitchBook free trial to see how our global data will benefit you. Enhanced customer due diligence required. Quickly validate potential targets. 1 A relevant person must have in place appropriate risk-management systems and procedures to determine whether a customer or the beneficial owner of a customer is.

Source: gaffarcolaw.com

Source: gaffarcolaw.com

Comply with new customer due diligence enhanced due diligence and simplified due diligence requirements Customer due diligence CDD Under the MLR 2017 you are required to. Obligation to apply enhanced customer due diligence. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. These include carrying out customer due diligence measures to. Enhanced customer due diligence at payout.

Source: icyte.com

Source: icyte.com

Ad Learn how to better vet companies and investors. Request your PitchBook free trial to see how our global data will benefit you. The circumstances in which simplified customer due diligence is permissible is more restricted under MLR 2017. Quickly validate potential targets. This is no longer the case.

Source: bi.go.id

Source: bi.go.id

Enhanced customer due diligence at payout. It provides guidance which is of general application. 1 A relevant person may rely on a person who falls within paragraph the third party to apply any of the customer due diligence measures required by regulation 282 to and but. Application of enhanced customer due diligence. 1 This regulation applies when a relevant person is required by regulation 27 to apply customer due diligence measures.

Source: bi.go.id

Source: bi.go.id

Money Laundering Regulations 2017 part 2. Request your PitchBook free trial to see how our global data will benefit you. Customer Due Diligence and more July 30 2017 by insolvencyoracle Leave a comment The objective of the MLR17 is to make the financial system a hostile environment for illicit finance while minimising the burden on legitimate businesses. This is no longer the case. 1 A relevant person may rely on a person who falls within paragraph the third party to apply any of the customer due diligence measures required by regulation 282 to and but.

Source: pdfprof.com

Source: pdfprof.com

Level of due diligence. Quickly validate potential targets. 1 A relevant person may apply simplified customer due diligence measures in relation to a particular business relationship or transaction if it determines that the business relationship or. Ad Learn how to better vet companies and investors. Ad Learn how to better vet companies and investors.

Source: bi.go.id

Source: bi.go.id

1 A relevant person may apply simplified customer due diligence measures in relation to a particular business relationship or transaction if it determines that the business relationship or. This Practice Note provides guidance on customer due diligence CDD which is a central pillar of the anti-money laundering AML and counter-terrorist financing CTF regime. The Anti-Money Laundering Regulations 2017. A identify the customer. 1 This regulation applies when a relevant person is required by regulation 27 to apply customer due diligence measures.

Source: insightsunboxed.com

Source: insightsunboxed.com

You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. Money Laundering Regulations 2017customer due diligence. Request your PitchBook free trial to see how our global data will benefit you. Quickly validate potential targets.

Source: slidetodoc.com

Source: slidetodoc.com

Application of enhanced customer due diligence. Additional requirements - politically exposed persons. Comply with new customer due diligence enhanced due diligence and simplified due diligence requirements Customer due diligence CDD Under the MLR 2017 you are required to. 1 A relevant person may rely on a person who falls within paragraph the third party to apply any of the customer due diligence measures required by regulation 282 to and but. PART VII - Politically Exposed Persons.

Source: bi.go.id

Source: bi.go.id

Comply with new customer due diligence enhanced due diligence and simplified due diligence requirements Customer due diligence CDD Under the MLR 2017 you are required to. It provides guidance which is of general application. Request your PitchBook free trial to see how our global data will benefit you. Identify your client and verify their identity on the basis of a reliable independent source such as a. 1 This regulation applies when a relevant person is required by regulation 27 to apply customer due diligence measures.

Source: smartsheet.com

Source: smartsheet.com

This is no longer the case. Money Laundering Regulations 2017 part 2. Money Laundering Regulations 2017customer due diligence. This practice note explains the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 as updated by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 and the relevant customer due diligence that is required. 1 A relevant person may rely on a person who falls within paragraph the third party to apply any of the customer due diligence measures required by regulation 282 to and but.

Source: bi.go.id

PART VI - Enhanced Customer Due Diligence. Money Laundering Regulations 2017customer due diligence. The circumstances in which simplified customer due diligence is permissible is more restricted under MLR 2017. 1 A relevant person may rely on a person who falls within paragraph the third party to apply any of the customer due diligence measures required by regulation 282 to and but. Regulation 37 of the MLR 2017 allows you to carry out simplified due diligence SDD where youre satisfied that the business relationship or transaction presents a low risk of money laundering or terrorist financing.

Source: www2.deloitte.com

Source: www2.deloitte.com

This Practice Note provides guidance on customer due diligence CDD which is a central pillar of the anti-money laundering AML and counter-terrorist financing CTF regime. It provides guidance which is of general application. Ad Learn how to better vet companies and investors. PART VI - Enhanced Customer Due Diligence. In a significant departure from MLR 2007 and as part of the risk based approach there ceases to be automatic simplified due diligence requirements.

Source: pdfprof.com

Source: pdfprof.com

1 A relevant person must have in place appropriate risk-management systems and procedures to determine whether a customer or the beneficial owner of a customer is. Quickly validate potential targets. Ad Learn how to better vet companies and investors. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. These include carrying out customer due diligence measures to.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2017 customer due diligence by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.