17+ Money laundering regulations 2007 fca info

Home » money laundering idea » 17+ Money laundering regulations 2007 fca infoYour Money laundering regulations 2007 fca images are available in this site. Money laundering regulations 2007 fca are a topic that is being searched for and liked by netizens now. You can Download the Money laundering regulations 2007 fca files here. Get all free photos.

If you’re looking for money laundering regulations 2007 fca pictures information connected with to the money laundering regulations 2007 fca keyword, you have come to the right site. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

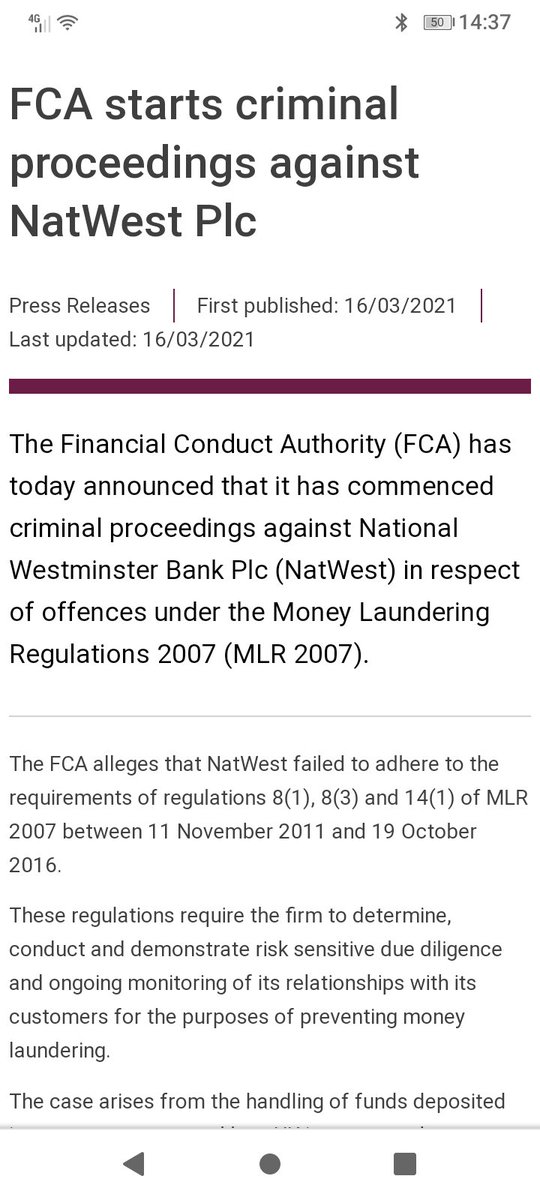

Money Laundering Regulations 2007 Fca. The Money Laundering Regulations 2007 SI 20072157 transposed the Third Money Laundering Directive into UK law. The FCA Financial Conduct Authority has announced that it has commenced a criminal prosecution against NatWest Bank Plc under the Money Laundering Regulations 2007 2007 Regulations. The reporting and detection of suspected money laundering to the NCA via a SAR. 2 These Regulations are prescribed for the purposes of sections 1684b appointment of persons to carry out investigations in particular cases and.

Money Laundering Wikiwand From wikiwand.com

Money Laundering Wikiwand From wikiwand.com

MLR 2007 requires certain firms including those regulated by the FCA to maintain adequate and effective anti-money laundering systems and controls. The Money Laundering Regulations 2007 were revoked and replaced by the Money Laundering Regulations 2017. 20033075 with updated provisions which implement in part Directive 200560EC OJ No L 309 25112005 p15 of the European Parliament and of the Council on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. These Regulations replace the Money Laundering Regulations 2003 SI. FCTR 414 G 13122018. Money Laundering Regulations 2017.

The Money Laundering Regulations 2007 SI 20072157 transposed the Third Money Laundering Directive into UK law.

TheFSAwrote a short report on automated Anti-Money Laundering Transaction Monitoring Systems in July 2007. The Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business. This was in anticipation of the fact that transaction monitoring would become compulsory following the implementation of the Money Laundering Regulations 2007. 2 These Regulations are prescribed for the purposes of sections 1684b appointment of persons to carry out investigations in particular cases and. Last week the FCA announced criminal proceedings against NatWest for alleged breaches of regulations 81 83 and 141 of the Money Laundering Regulations 2007 MLR 2007. The Money Laundering Regulations 2007.

Source: lawyer-monthly.com

Source: lawyer-monthly.com

The focus of the fines was also correspondent banking relationshipsFCA has adopted a unique approach to penalty calculation. Last week the FCA announced criminal proceedings against NatWest for alleged breaches of regulations 81 83 and 141 of the Money Laundering Regulations 2007 MLR 2007. The focus of the fines was also correspondent banking relationshipsFCA has adopted a unique approach to penalty calculation. The Regulations require firms to take specified steps to detect and prevent both money laundering and terrorist financing. Money Laundering Regulations 2017.

Source: slideplayer.com

Source: slideplayer.com

ML Regulations means the Money Laundering Regulations 2007 which were in force in respect of conduct from 15 December 2007 to 25 June 2017 inclusive. 20033075 with updated provisions which implement in part Directive 200560EC OJ No L 309 25112005 p15 of the European Parliament and of the Council on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. Much has been written about the Financial Conduct Authoritys FCA recent decision to commence criminal proceedings against National Westminster Bank PLC NatWest for offences under the Money Laundering Regulations 2007 MLR. 20033075 with updated provisions which implement in part Directive 200560EC OJ No L 309 25112005 p15 of the European Parliament and of the Council on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. The Joint Money Laundering Steering Group JMLSG 5.

Source: pdfprof.com

Source: pdfprof.com

The Regulations require firms to take specified steps to detect and prevent both money laundering and terrorist financing. However given that the FCA also started two insider dealing prosecutions in February 2021 does this signal. While the abuse of Standard Chartered was serious it spanned a period that began in 2009 and ended in 2014. 1The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations. The FSA wrote a short report on automated Anti-Money Laundering Transaction Monitoring Systems in July 2007.

Source: slideplayer.com

Source: slideplayer.com

FCTR 414 G 13122018. 20033075 with updated provisions which implement in part Directive 200560EC OJ No L 309 25112005 p15 of the European Parliament and of the Council on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing. The Money Laundering Regulations 2007. 2 These Regulations are prescribed for the purposes of sections 1684b appointment of persons to carry out investigations in particular cases and. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020.

Source: slideplayer.com

Source: slideplayer.com

The Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business. Until June 2017 the Money Laundering Regulations 2007 SI 20072157 MLRs formed part of the UK defences against money laundering and terrorist financingThey came into force on 15 December 2007 part implementing the Third Money Laundering Directive 200560EC MLD3 or 3MLD in the UKAlthough the MLRs applied to a wide range of businesses this note focuses on the. TheFSAwrote a short report on automated Anti-Money Laundering Transaction Monitoring Systems in July 2007. The Joint Money Laundering Steering Group JMLSG 5. MLR 2007 requires certain firms including those regulated by the FCA to maintain adequate and effective anti-money laundering systems and controls.

Source: twitter.com

Source: twitter.com

The Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business. The focus of the fines was also correspondent banking relationshipsFCA has adopted a unique approach to penalty calculation. The Money Laundering Regulations 2007. The FCA sends a strong message about its role as Gatekeeper of the Money Laundering Regulations. This is a significant landmark as the FCAs first criminal prosecution under the MLR 2007.

Source: wikiwand.com

Source: wikiwand.com

The purpose of MLR 2007 is to ensure firms take all reasonable steps to prevent their use for money laundering purposes. The focus of the fines was also correspondent banking relationshipsFCA has adopted a unique approach to penalty calculation. The Money Laundering Regulations 2007 were revoked and replaced by the Money Laundering Regulations 2017. The reporting and detection of suspected money laundering to the NCA via a SAR. However given that the FCA also started two insider dealing prosecutions in February 2021 does this signal.

The FCA Financial Conduct Authority has announced that it has commenced a criminal prosecution against NatWest Bank Plc under the Money Laundering Regulations 2007 2007 Regulations. The Money Laundering Regulations 2007. The Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business. PEP means Politically Exposed Person as defined in Regulation 145 of the ML Regulations. Accordingly the Money Laundering Regulations 2007 MLRs covered FCAs case during the relevant period.

Source: slideplayer.com

Source: slideplayer.com

This is a significant landmark as the FCAs first criminal prosecution under the MLR 2007. The FCA sends a strong message about its role as Gatekeeper of the Money Laundering Regulations. Until June 2017 the Money Laundering Regulations 2007 SI 20072157 MLRs formed part of the UK defences against money laundering and terrorist financingThey came into force on 15 December 2007 part implementing the Third Money Laundering Directive 200560EC MLD3 or 3MLD in the UKAlthough the MLRs applied to a wide range of businesses this note focuses on the. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. 1The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations.

Source: ca.movies.yahoo.com

The Money Laundering Regulations 2007. The Regulations require firms to take specified steps to detect and prevent both money laundering and terrorist financing. The Money Laundering Regulations 2007 SI 20072157 transposed the Third Money Laundering Directive into UK law. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. MLR 2007 requires certain firms including those regulated by the FCA to maintain adequate and effective anti-money laundering systems and controls.

Rejected Transaction means a transaction involving a customer of SCBs UAE. The focus of the fines was also correspondent banking relationshipsFCA has adopted a unique approach to penalty calculation. However given that the FCA also started two insider dealing prosecutions in February 2021 does this signal. A Transposition Note setting out how the main. PEP means Politically Exposed Person as defined in Regulation 145 of the ML Regulations.

Source:

The FCA sends a strong message about its role as Gatekeeper of the Money Laundering Regulations. Until June 2017 the Money Laundering Regulations 2007 SI 20072157 MLRs formed part of the UK defences against money laundering and terrorist financingThey came into force on 15 December 2007 part implementing the Third Money Laundering Directive 200560EC MLD3 or 3MLD in the UKAlthough the MLRs applied to a wide range of businesses this note focuses on the. December 2007 of the Money Laundering Regulations 2007 which introduced the risk-based approach into UK AML law by requiring all relevant persons to establish and maintain appropriate and risk-sensitive policies to enable them to comply with the various requirements of the new regulations. PEP means Politically Exposed Person as defined in Regulation 145 of the ML Regulations. Last week the FCA announced criminal proceedings against NatWest for alleged breaches of regulations 81 83 and 141 of the Money Laundering Regulations 2007 MLR 2007.

Source:

1The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations. PEP means Politically Exposed Person as defined in Regulation 145 of the ML Regulations. The Regulations require firms to take specified steps to detect and prevent both money laundering and terrorist financing. TheFSAwrote a short report on automated Anti-Money Laundering Transaction Monitoring Systems in July 2007. The Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering regulations 2007 fca by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.