10++ Money laundering registration for accountants ideas in 2021

Home » money laundering idea » 10++ Money laundering registration for accountants ideas in 2021Your Money laundering registration for accountants images are available. Money laundering registration for accountants are a topic that is being searched for and liked by netizens now. You can Get the Money laundering registration for accountants files here. Download all free photos and vectors.

If you’re looking for money laundering registration for accountants pictures information linked to the money laundering registration for accountants topic, you have pay a visit to the ideal site. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Money Laundering Registration For Accountants. Auditors insolvency practitioners external accountants and tax advisers. AML Rules for Lawyers. To date it has not been necessary for members to be registered for anti-money laundering AML supervision when providing all of. This emphasises the need for accountants to assess every situation for possible signs of money laundering.

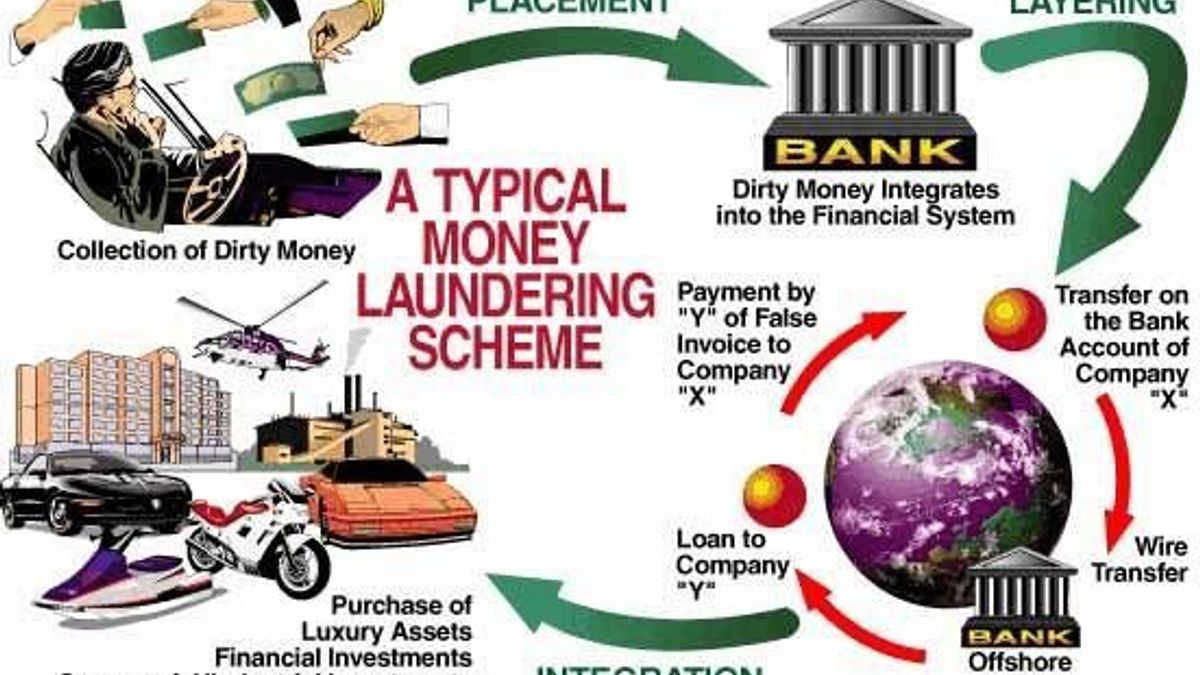

An Introduction To Aml Part 2 Methods Of Money Laundering Planet Compliance From planetcompliance.com

An Introduction To Aml Part 2 Methods Of Money Laundering Planet Compliance From planetcompliance.com

Under Money Laundering Regulations accountancy. Under Money Laundering Regulations accountancy service providers are. Further evidence of how seriously AML compliance needs to be taken by accountants comes from The Financial Conduct Authority and The National Crime Agency. The Regulations impose a statutory duty on accountants auditors and tax advisors to report any knowledge or suspicion of money laundering to the authorities to make an authorised disclosure under ss338 of POCA. Accountants who are caught by the reporting requirements of the Proceeds of Crime Money Laundering and Terrorist Financing Act must register their business with FINTRAC. It can be easy to overlook some of these but you are reminded that it is a legal requirement to be registered for anti-money laundering AML supervision if you are acting in the course of business as any of the following.

The Government advise on their website that trading while not registered is a criminal offence and may result in a penalty or prosecution.

HMRC also expect many others to play a role too. Under the Money Laundering Regulations certain businesses need to register with HMRC and these businesses will have to complete and submit form MLR100. The Regulations impose a statutory duty on accountants auditors and tax advisors to report any knowledge or suspicion of money laundering to the authorities to make an authorised disclosure under ss338 of POCA. Where a business carries on a business activity that is covered by the Money Laundering Regulations it is a legal requirement to register with the supervisor who regulates that industry sector. If you provide accountancy services book-keeping or tax advice and you are not a member of a Supervisory body recognised under the regulations you must register your business with HMRC. Trust and company service providers.

Source: pinterest.com

Source: pinterest.com

Or related services such as tax advice audit or insolvency to be supervised for AML purposes by HMRC or by one of the specified professional bodies. If you provide accountancy services book-keeping or tax advice and you are not a member of a Supervisory body recognised under the regulations you must register your business with HMRC. They have been convicted of. The Money Laundering Regulations 2017 require all firms that provide accountancy services. HMRC also expect many others to play a role too.

Source: pinterest.com

Source: pinterest.com

Trust and company service providers. Also include those working for Financial Conduct Authority supervised banks. Are not used to further a criminal purpose. Further evidence of how seriously AML compliance needs to be taken by accountants comes from The Financial Conduct Authority and The National Crime Agency. HMRC have extended the Accountancy Service Provider exemption from anti-money laundering registration to.

Source: pinterest.com

Source: pinterest.com

This emphasises the need for accountants to assess every situation for possible signs of money laundering. The Government advise on their website that trading while not registered is a criminal offence and may result in a penalty or prosecution. The Regulations impose a statutory duty on accountants auditors and tax advisors to report any knowledge or suspicion of money laundering to the authorities to make an authorised disclosure under ss338 of POCA. 1942021 Chartered Accountants Ireland can accept no responsibility for the content on any site that is linked tofrom the Institute website. They have been convicted of.

Source: jagranjosh.com

Source: jagranjosh.com

Where a business carries on a business activity that is covered by the Money Laundering Regulations it is a legal requirement to register with the supervisor who regulates that industry sector. If you provide accountancy services book-keeping or tax advice and you are not a member of a Supervisory body recognised under the regulations you must register your business with HMRC. They have been convicted of. 1942021 Chartered Accountants Ireland can accept no responsibility for the content on any site that is linked tofrom the Institute website. Beneficial Ownership of Trusts Regulations 2021 SI.

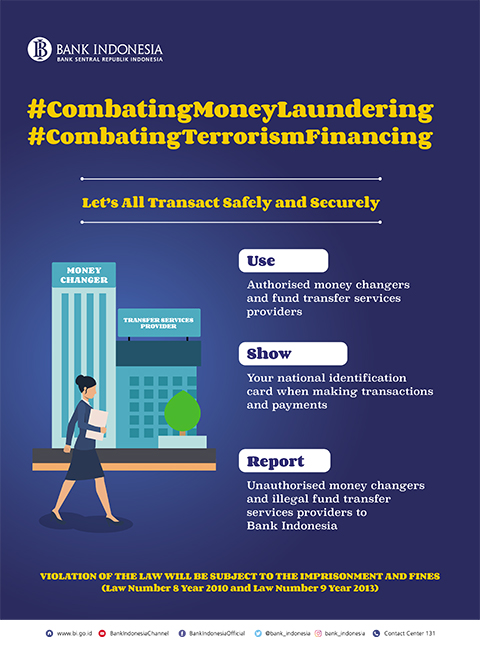

Source: bi.go.id

Source: bi.go.id

Auditors insolvency practitioners external accountants and tax advisers. AML Rules for Lawyers. Since the 1st April 2015 all firms registering under these Regulations have had to pay an application fee of 100 in addition to the premises fee. They have been convicted of. HMRC have extended the Accountancy Service Provider exemption from anti-money laundering registration to.

Source: bi.go.id

Source: bi.go.id

The Regulations impose a statutory duty on accountants auditors and tax advisors to report any knowledge or suspicion of money laundering to the authorities to make an authorised disclosure under ss338 of POCA. Trust and company service providers. This guidance is based on the law and regulations as of 26 June 2017. Under the Money Laundering Regulations certain businesses need to register with HMRC and these businesses will have to complete and submit form MLR100. The Money Laundering Terrorist Financing Amendment Regulations 2019 came into force in January introducing a rule that lettings agents whose landlords earn more than 10000 a month per property must register with HMRC and conduct AML checks.

Source: pinterest.com

Source: pinterest.com

AML Rules for Lawyers. Under Money Laundering Regulations accountancy service providers are. The Regulations impose a statutory duty on accountants auditors and tax advisors to report any knowledge or suspicion of money laundering to the authorities to make an authorised disclosure under ss338 of POCA. You may have to register with HMRC if your business operates as an accountancy service provider. Are not used to further a criminal purpose.

Source: pinterest.com

Source: pinterest.com

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017692 replaced the Money Laundering Regulations 2007 with effect from. Money Laundering Regulations. This guidance is based on the law and regulations as of 26 June 2017. Further evidence of how seriously AML compliance needs to be taken by accountants comes from The Financial Conduct Authority and The National Crime Agency. It is intended to.

Source: pinterest.com

Source: pinterest.com

It covers the prevention of money laundering and the countering of terrorist financing. The Money Laundering Terrorist Financing Amendment Regulations 2019 came into force in January introducing a rule that lettings agents whose landlords earn more than 10000 a month per property must register with HMRC and conduct AML checks. This emphasises the need for accountants to assess every situation for possible signs of money laundering. The Government advise on their website that trading while not registered is a criminal offence and may result in a penalty or prosecution. HMRC have extended the Accountancy Service Provider exemption from anti-money laundering registration to.

Source: pinterest.com

Source: pinterest.com

Or related services such as tax advice audit or insolvency to be supervised for AML purposes by HMRC or by one of the specified professional bodies. It can be easy to overlook some of these but you are reminded that it is a legal requirement to be registered for anti-money laundering AML supervision if you are acting in the course of business as any of the following. Its not just accountancy firms and tax officials who have obligations in relation to money laundering. Are not used to further a criminal purpose. The Money Laundering Terrorist Financing Amendment Regulations 2019 came into force in January introducing a rule that lettings agents whose landlords earn more than 10000 a month per property must register with HMRC and conduct AML checks.

Source: planetcompliance.com

Source: planetcompliance.com

This emphasises the need for accountants to assess every situation for possible signs of money laundering. Beneficial Ownership of Trusts Regulations 2021 SI. We are also obligated to report suspicious activity to the relevant authorities. Under Money Laundering Regulations accountancy service providers are. Estimates are that serious organised crime enabled by money laundering costs the UK 37bn every year and 90bn is illegally laundered through Companies House registered shell firms.

Trust and company service providers. Further evidence of how seriously AML compliance needs to be taken by accountants comes from The Financial Conduct Authority and The National Crime Agency. Links are provided in good faith for. The Regulations impose a statutory duty on accountants auditors and tax advisors to report any knowledge or suspicion of money laundering to the authorities to make an authorised disclosure under ss338 of POCA. Its not just accountancy firms and tax officials who have obligations in relation to money laundering.

Source: pinterest.com

Source: pinterest.com

Also include those working for Financial Conduct Authority supervised banks. To date it has not been necessary for members to be registered for anti-money laundering AML supervision when providing all of. Under Money Laundering Regulations accountancy. Money Laundering Regulations. Your accountant is expected to be able to identify potential money laundering situations.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering registration for accountants by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.