18++ Money laundering register for estate agents ideas

Home » money laundering Info » 18++ Money laundering register for estate agents ideasYour Money laundering register for estate agents images are ready. Money laundering register for estate agents are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering register for estate agents files here. Download all royalty-free vectors.

If you’re searching for money laundering register for estate agents images information related to the money laundering register for estate agents interest, you have visit the ideal site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

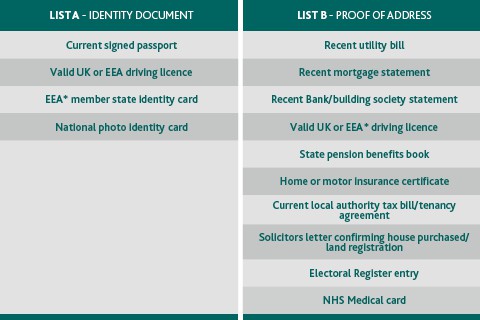

Money Laundering Register For Estate Agents. The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer. Estate agents are an industry where there is a high risk of money laundering. We have a legal duty to obtain identification and proof of address from all our customers who include homeowners seeking to sell their property buyers Landlords who wish to rent out their property and tenants. However there is a lot of uncertainty as to the full scale of money laundering in lettings says ARLA Propertymark.

Anti Money Laundering Implications From content.harcourts.co.nz

Anti Money Laundering Implications From content.harcourts.co.nz

Under the MLR 2017 estate agents must register with their supervisory authority which is currently HMRC. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. Home Decorating Style 2021 for Anti Money Laundering Policy Template For Estate Agents you can see Anti Money Laundering Policy Template For Estate Agents and more pictures for Home Interior Designing 2021 224541 at Resume Example Ideas. As part of the 5th Money Laundering Directive letting agencies are required to register and carry out checks if they let land or property for a month or more at a rent of 10000 equivalent to approximately 8500 or above. Failure to conduct these checks can mean an EAB unwittingly facilitates the laundering of funds. Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF.

Register or renew your money laundering supervision with HMRC - GOVUK.

If they dont they risk being hit with a financial penalty as well as suffering the consequences of any subsequent negative publicity. Registration can be done through the government website. Letting agency services receiving rent of 10000 euros or more per month for the duration of at least one month 10000 euros threshold is per property not per landlord If you are a letting. Business Relationships Regulation 4. Estate agents are regulated by HMRC. All letting agents in the UK who meet the definition of letting agency activity and the rent threshold which is equivalent to or more than 10000 euros per month for the duration of at least one month per property not per landlord must register with HMRC and follow the anti-money laundering.

Source: foxtons.co.uk

Source: foxtons.co.uk

Our agency is subject to the Money Laundering Regulations 2017 which aims to counter money laundering and the financing of terrorism. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. Anti-money laundering legislation to apply to letting agents The Government thinks that the risk of money laundering taking place in estate agency is on the rise especially in high-end lettings the top 5 of lets in value. You can use the Supervised Business Register CSV 505MB to verify that a business is registered with HMRC for supervision under the Money Laundering Regulations. Use the service to apply to register for money laundering supervision renew a registration or to manage your account.

Source: foxtons.co.uk

Source: foxtons.co.uk

The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer. A regulated business must comply with The Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 as amended by The Money Laundering and Terrorist Financing Regulations 2019 which requires estate agents to have a written anti-money laundering policy in place. Youll need to download the CSV. If it is a different company that introduces the parties for salepurchase then this business is classed as an estate agency and must be registered for AML supervision In the early days of anti-money laundering supervision estate agents were told to do due diligence on their customer which many took to mean only the seller who paid them. Generally estate agents are regulated by HMRC but they.

Source: iclg.com

Source: iclg.com

If you are an agency which is required to be regulated in order to operate you must be registered with HM Revenue Customs and you must understand and comply with your obligations set out in AML legislation to avoid being targeted by money launderers and avoid civil and criminal prosecution. As part of the 5th Money Laundering Directive letting agencies are required to register and carry out checks if they let land or property for a month or more at a rent of 10000 equivalent to approximately 8500 or above. The new rules for lettings agents. Estate agents are an industry where there is a high risk of money laundering. The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer.

Source: jagranjosh.com

Source: jagranjosh.com

As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive. As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive. Estate agents are an industry where there is a high risk of money laundering. If you are an agency which is required to be regulated in order to operate you must be registered with HM Revenue Customs and you must understand and comply with your obligations set out in AML legislation to avoid being targeted by money launderers and avoid civil and criminal prosecution. If they dont they risk being hit with a financial penalty as well as suffering the consequences of any subsequent negative publicity.

Source: infinitysolutions.com

Source: infinitysolutions.com

The new rules for lettings agents. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. The new rules for lettings agents. As part of the 5th Money Laundering Directive letting agencies are required to register and carry out checks if they let land or property for a month or more at a rent of 10000 equivalent to approximately 8500 or above. Home Decorating Style 2021 for Anti Money Laundering Policy Template For Estate Agents you can see Anti Money Laundering Policy Template For Estate Agents and more pictures for Home Interior Designing 2021 224541 at Resume Example Ideas.

Source: napier.ai

Source: napier.ai

Letting agency services receiving rent of 10000 euros or more per month for the duration of at least one month 10000 euros threshold is per property not per landlord If you are a letting. Conducting customer due diligence checks on both the buyers and sellers of properties as required by the Money Laundering Regulations MLRs collects important information on the beneficial owner of properties and their source of funds. Letting agency services receiving rent of 10000 euros or more per month for the duration of at least one month 10000 euros threshold is per property not per landlord If you are a letting. If it is a different company that introduces the parties for salepurchase then this business is classed as an estate agency and must be registered for AML supervision In the early days of anti-money laundering supervision estate agents were told to do due diligence on their customer which many took to mean only the seller who paid them. Youll need to download the CSV.

Source:

A regulated business must comply with The Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 as amended by The Money Laundering and Terrorist Financing Regulations 2019 which requires estate agents to have a written anti-money laundering policy in place. If you are an agency which is required to be regulated in order to operate you must be registered with HM Revenue Customs and you must understand and comply with your obligations set out in AML legislation to avoid being targeted by money launderers and avoid civil and criminal prosecution. The new rules for lettings agents. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. Generally estate agents are regulated by HMRC but they.

Source: cea.gov.sg

Source: cea.gov.sg

Estate agents are regulated by HMRC. Our agency is subject to the Money Laundering Regulations 2017 which aims to counter money laundering and the financing of terrorism. You can use the Supervised Business Register CSV 505MB to verify that a business is registered with HMRC for supervision under the Money Laundering Regulations. Letting agency services receiving rent of 10000 euros or more per month for the duration of at least one month 10000 euros threshold is per property not per landlord If you are a letting. We have a legal duty to obtain identification and proof of address from all our customers who include homeowners seeking to sell their property buyers Landlords who wish to rent out their property and tenants.

Source: government.se

Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer. Business Relationships Regulation 4. If they dont they risk being hit with a financial penalty as well as suffering the consequences of any subsequent negative publicity. Registration can be done through the government website.

Source: content.harcourts.co.nz

Source: content.harcourts.co.nz

Youll need to download the CSV. Failure to conduct these checks can mean an EAB unwittingly facilitates the laundering of funds. Letting agency services receiving rent of 10000 euros or more per month for the duration of at least one month 10000 euros threshold is per property not per landlord If you are a letting. The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls.

Source: cea.gov.sg

Source: cea.gov.sg

Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF. Home Decorating Style 2021 for Anti Money Laundering Policy Template For Estate Agents you can see Anti Money Laundering Policy Template For Estate Agents and more pictures for Home Interior Designing 2021 224541 at Resume Example Ideas. You can use the Supervised Business Register CSV 505MB to verify that a business is registered with HMRC for supervision under the Money Laundering Regulations. Our agency is subject to the Money Laundering Regulations 2017 which aims to counter money laundering and the financing of terrorism. However there is a lot of uncertainty as to the full scale of money laundering in lettings says ARLA Propertymark.

Source: cea.gov.sg

Source: cea.gov.sg

Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. However there is a lot of uncertainty as to the full scale of money laundering in lettings says ARLA Propertymark. If they dont they risk being hit with a financial penalty as well as suffering the consequences of any subsequent negative publicity. A regulated business must comply with The Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 as amended by The Money Laundering and Terrorist Financing Regulations 2019 which requires estate agents to have a written anti-money laundering policy in place.

Source: cea.gov.sg

Source: cea.gov.sg

Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls. You can use the Supervised Business Register CSV 505MB to verify that a business is registered with HMRC for supervision under the Money Laundering Regulations. As of 10 th January this year any UK letting agent managing properties residential or commercial that yield an income of 10000 Euros or more per month must comply with updated money laundering regulations under the Fifth Money Laundering Directive. Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF. A regulated business must comply with The Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 as amended by The Money Laundering and Terrorist Financing Regulations 2019 which requires estate agents to have a written anti-money laundering policy in place.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering register for estate agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.