19++ Money laundering punishment australia info

Home » money laundering Info » 19++ Money laundering punishment australia infoYour Money laundering punishment australia images are ready in this website. Money laundering punishment australia are a topic that is being searched for and liked by netizens today. You can Get the Money laundering punishment australia files here. Download all free photos.

If you’re looking for money laundering punishment australia pictures information linked to the money laundering punishment australia interest, you have come to the right site. Our site always provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

Money Laundering Punishment Australia. The Anti-Money Laundering and Counter-Terrorism Financing Act which came into force in 2006 forms the basis of the anti-money laundering regime in Australia. A critical risk to Australia. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. These businesses are known as high-risk institutions that have money laundering risk.

Pdf The Anti Money Laundering Activities Of The Central Banks Of Australia And Ukraine From researchgate.net

Pdf The Anti Money Laundering Activities Of The Central Banks Of Australia And Ukraine From researchgate.net

The maximum penalties for these are outlined in section 4003 4008 of the Criminal Code Act. It is a process by which soiled money is transformed into clean cash. For bodies corporate the maximum penalty for the same offence is a fine of A2220000 see Crimes Act 1914 section 4B. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. AUSTRAC and Westpac agree to proposed 13bn penalty 24 Sep 2020 Westpac and AUSTRAC have today agreed to a 13 billion dollar proposed penalty over Westpacs breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act.

Money laundering is a serious crime in most countries.

Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. It is a process by which soiled money is transformed into clean cash. The statutory scheme has a graduated series of offences. The Commonwealth Bank agrees to pay a record 700 million fine for breaches of anti-money laundering and counter-terrorism financing laws. New anti -money laundering and counter -terrorism financing laws. The maximum penalties for these are outlined in section 4003 4008 of the Criminal Code Act.

Source: accountancydaily.co

Source: accountancydaily.co

New anti -money laundering and counter -terrorism financing laws. Continuing bank involvement in this activity raises questions about the severity of punishment banks receive and if the reward of the criminal activity is greater than the risk of the punishment. AUSTRAC and Westpac agree to proposed 13bn penalty 24 Sep 2020 Westpac and AUSTRAC have today agreed to a 13 billion dollar proposed penalty over Westpacs breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act. The sources of the money in actual are prison and the cash is invested in a manner that makes it look like clean. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders.

Source: iclg.com

Source: iclg.com

AUSTRAC and Westpac agree to proposed 13bn penalty 24 Sep 2020 Westpac and AUSTRAC have today agreed to a 13 billion dollar proposed penalty over Westpacs breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act. The maximum penalties for these are outlined in section 4003 4008 of the Criminal Code Act. It is a process by which soiled money is transformed into clean cash. These businesses are known as high-risk institutions that have money laundering risk. The sources of the money in actual are prison and the cash is invested in a manner that makes it look like clean.

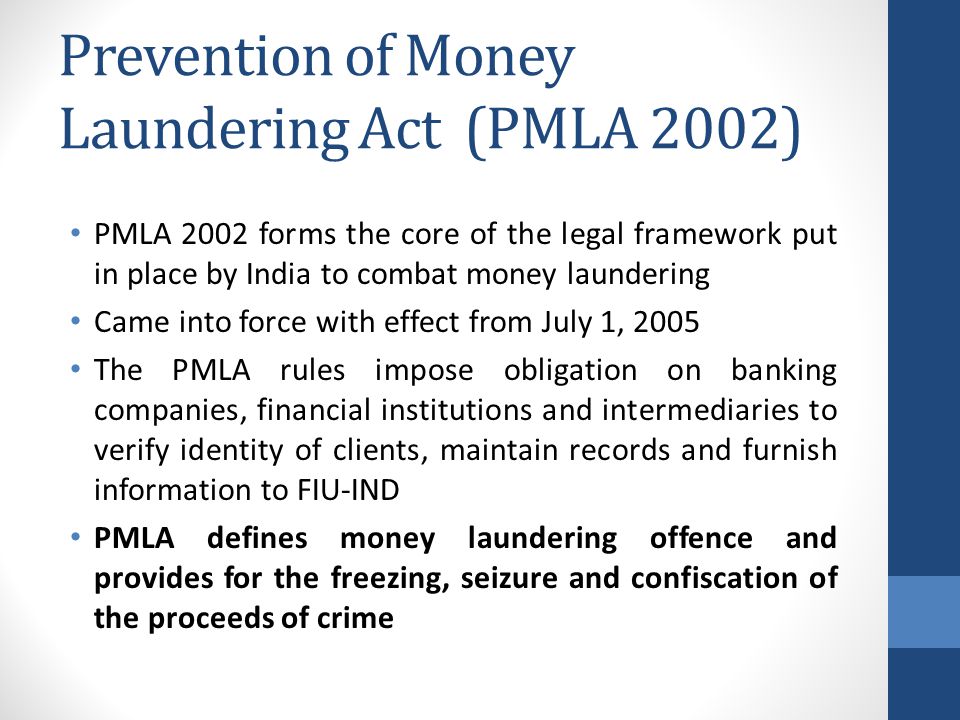

Source: slideplayer.com

Source: slideplayer.com

The penalties are categorized by intention reckless and negligent by the value of money as per the table below. The Commonwealth Bank agrees to pay a record 700 million fine for breaches of anti-money laundering and counter-terrorism financing laws. THE PLAYERS Commonwealth Bank of Australia. For bodies corporate the maximum penalty for the same offence is a fine of A2220000 see Crimes Act 1914 section 4B. When a court is sentencing for any of these offences the relevant statutory provisions are of particular importance.

Murray Deakin and Sara Liu. New anti -money laundering and counter -terrorism financing laws. Estimating how much money is actually laundered in any given country or globally is difficult given ts covert and often transnational nature. A critical risk to Australia. Money laundering allows criminals to enjoy the spoils of their crimes and enables corrupt officials to profit from their misconduct.

Source: researchgate.net

Source: researchgate.net

There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. The Commonwealth money laundering offences are found in Ch 10 Pt 102 Div 400 ss 40034009 Criminal Code 1995 Cth. 30 January 2018. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. Westpac and AUSTRAC have today agreed to a 13 billion.

Source: researchgate.net

Source: researchgate.net

The United Nations estimates that the amount of money laundered globally in one year is 2 to 5 per cent of global GDP or US800 billion to US2 trillion. Australian bank Westpac is to pay a record fine of A13bn 722m after admitting more than 23 million breaches of money-laundering laws The penalty has been imposed by AUSTRAC the Australian Transaction Reports and Analysis Centre the agency responsible for detecting deterring and disrupting criminal abuse of the financial system. The penalties are categorized by intention reckless and negligent by the value of money as per the table below. Speak to one of our highly experienced money laundering lawyers in Australia today. When money illegally flows out of countries avoiding tax those countries risk losing money that should contribute to national revenue.

Source: brill.com

Source: brill.com

The Anti-Money Laundering and Counter-Terrorism Financing Act which came into force in 2006 forms the basis of the anti-money laundering regime in Australia. Australian bank Westpac is to pay a record fine of A13bn 722m after admitting more than 23 million breaches of money-laundering laws The penalty has been imposed by AUSTRAC the Australian Transaction Reports and Analysis Centre the agency responsible for detecting deterring and disrupting criminal abuse of the financial system. When money illegally flows out of countries avoiding tax those countries risk losing money that should contribute to national revenue. Speak to one of our highly experienced money laundering lawyers in Australia today. Money laundering is one of the three critical organised crime risks to the Australian community identified in the classified 2010 Organised crime threat assessment and articulated in the unclassified and published Organised crime in Australia 2011.

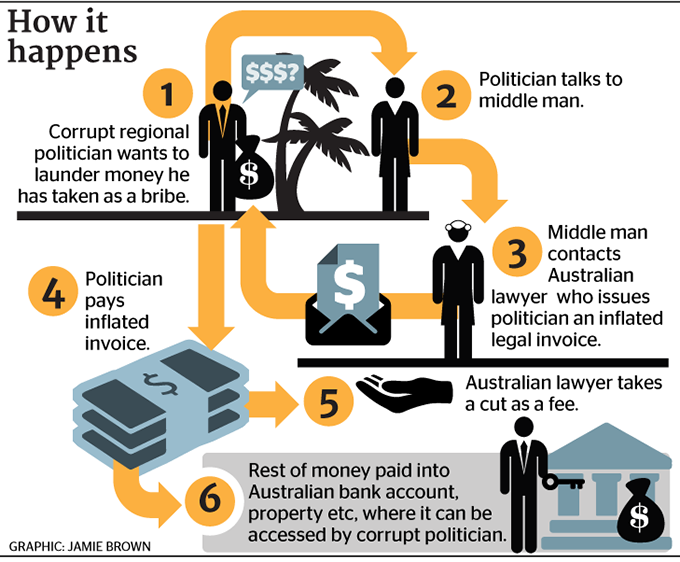

Source: asiapacificreport.nz

Source: asiapacificreport.nz

AUSTRAC and Westpac agree to proposed 13bn penalty 24 Sep 2020 Westpac and AUSTRAC have today agreed to a 13 billion dollar proposed penalty over Westpacs breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act. The name of Pt 102 is Money laundering. These businesses are known as high-risk institutions that have money laundering risk. The statutory scheme has a graduated series of offences. Estimating how much money is actually laundered in any given country or globally is difficult given ts covert and often transnational nature.

For bodies corporate the maximum penalty for the same offence is a fine of A2220000 see Crimes Act 1914 section 4B. When money illegally flows out of countries avoiding tax those countries risk losing money that should contribute to national revenue. 30 January 2018. The statutory scheme has a graduated series of offences. The Commonwealth money laundering offences are found in Ch 10 Pt 102 Div 400 ss 40034009 Criminal Code 1995 Cth.

Source: researchgate.net

Source: researchgate.net

In brief Federal Parliament has made changes to Australias anti-money laundering and counter-terrorism. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. Estimating how much money is actually laundered in any given country or globally is difficult given ts covert and often transnational nature. The sources of the money in actual are prison and the cash is invested in a manner that makes it look like clean. These businesses are known as high-risk institutions that have money laundering risk.

Source: ngm.com.au

Source: ngm.com.au

Money laundering allows criminals to enjoy the spoils of their crimes and enables corrupt officials to profit from their misconduct. When a court is sentencing for any of these offences the relevant statutory provisions are of particular importance. There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. The maximum penalties for these are outlined in section 4003 4008 of the Criminal Code Act. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to.

Source: researchgate.net

Source: researchgate.net

The statutory scheme has a graduated series of offences. Estimating how much money is actually laundered in any given country or globally is difficult given ts covert and often transnational nature. In Australia the most serious offence of laundering over 1 million carries a maximum penalty of 20 years imprisonment. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. Money laundering is a serious crime in most countries.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. The Commonwealth Bank agrees to pay a record 700 million fine for breaches of anti-money laundering and counter-terrorism financing laws. The Anti-Money Laundering and Counter-Terrorism Financing Act which came into force in 2006 forms the basis of the anti-money laundering regime in Australia. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. Speak to one of our highly experienced money laundering lawyers in Australia today.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering punishment australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.