16+ Money laundering penalties in florida ideas in 2021

Home » money laundering idea » 16+ Money laundering penalties in florida ideas in 2021Your Money laundering penalties in florida images are ready in this website. Money laundering penalties in florida are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering penalties in florida files here. Find and Download all free photos.

If you’re searching for money laundering penalties in florida pictures information connected with to the money laundering penalties in florida topic, you have come to the right site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

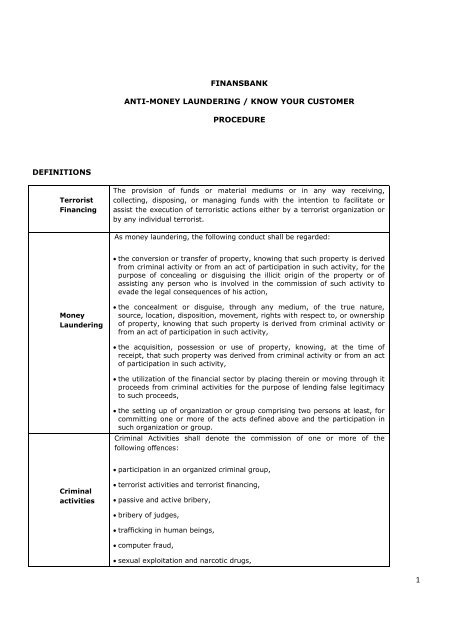

Money Laundering Penalties In Florida. Financial transactions exceeding 300 but less than 20000 in any 12-month period are considered third-degree felonies. Report of the Legislative Task Force Page 3 The Legislature should rank these felony violations in levels 7-9 under the sentencing code based upon their felony degree and thereby significantly increasing the penalties for convicted money launderers. Florida Statute 896101 sets out the possible penalties for money laundering. A second-degree felony if the transaction values total between 20001 and 100000 within a twelve.

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data From researchgate.net

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data From researchgate.net

The amount of the fine depends on whichever amount is greater. Florida Statute 896101 sets out the possible penalties for money laundering. Penalties for Money Laundering Conviction The charges and sentencing for money laundering depend upon the value of the financial transaction or series of transactions. The Financial Crimes Enforcement Network FinCEN today assessed a 300000 civil money penalty against North Dade Community Development Federal Credit Union in Miami Gardens Florida for significant Bank Secrecy Act BSA violations. 68 The couple could also face supplemental civil RICO. For transactions over 300 but less than 20000 it is a third-degree felony punishable by up to 5 years in prison.

For financial transactions that are more than 300 but less than 20000 the.

Value exceeds 100000 within a 12-month period. Brewer 44 Winter Park has pleaded guilty to wire fraud bank fraud and to launder money He faces a maximum penalty of 20 years in federal prison for the wire fraud count up to 30 years imprisonment for the bank fraud count and up to 10 years imprisonment for the money laundering count. 896101 Florida Money Laundering Act. If the defendant has a prior conviction for money laundering the fine can increase to 500000 or five times the total amount of the financial transactions. Currency more than 10000 received in trade or business. 896 1997 is also liable for a civil penalty of not more than the greater of the value of the financial transaction involved or 25000 not to exceed 100000.

Source: idmerit.com

Source: idmerit.com

The amount of the fine depends on whichever amount is greater. Money laundering is a felony and the level of the charge depends on the amount of money or value of the property involved. The actual penalty depends on the value of the financial transactions involved and the severity of the charges against the defendant. 775084 a person who has been found guilty of or who has pleaded guilty or nolo contendere to having violated this section may be sentenced to pay a fine not exceeding 250000 or twice the value of the financial transactions whichever is greater except that for a second or subsequent violation of this section the fine may be. Penalties for Money Laundering Conviction The charges and sentencing for money laundering depend upon the value of the financial transaction or series of transactions.

Source: yumpu.com

Source: yumpu.com

For transactions over 300 but less than 20000 it is a third-degree felony punishable by up to 5 years in prison. Florida Statute 896101 sets out the possible penalties for money laundering. Jail time is up to five years in a state prison. For less than 20000 you will face a maximum sentence of five years. The offense applies whenever funds are generated through any felony prohibited by Florida or federal law.

Source: researchgate.net

Source: researchgate.net

Orlando Florida Bryan L. Under Florida law the severity of the charge and penalties for laundering depend upon the amount of money laundered in a given year. The offense applies whenever funds are generated through any felony prohibited by Florida or federal law. 775084 a person who has been found guilty of or who has pleaded guilty or nolo contendere to having violated this section may be sentenced to pay a fine not exceeding 250000 or twice the value of the financial transactions whichever is greater except that for a second or subsequent violation of this section the fine may be. For financial transactions that are more than 300 but less than 20000 the.

Source: nejamelaw.com

Source: nejamelaw.com

For financial transactions that are more than 300 but less than 20000 the. A violation of 18 USC. 896 1997 is also liable for a civil penalty of not more than the greater of the value of the financial transaction involved or 25000 not to exceed 100000. The amount of the fine depends on whichever amount is greater. Orlando Florida Bryan L.

For financial transactions that are more than 300 but less than 20000 the. Value exceeds 100000 within a 12-month period. Under Florida law the severity of the charge and penalties for laundering depend upon the amount of money laundered in a given year. Report of the Legislative Task Force Page 3 The Legislature should rank these felony violations in levels 7-9 under the sentencing code based upon their felony degree and thereby significantly increasing the penalties for convicted money launderers. The Financial Crimes Enforcement Network FinCEN today assessed a 300000 civil money penalty against North Dade Community Development Federal Credit Union in Miami Gardens Florida for significant Bank Secrecy Act BSA violations.

Source: legaljobs.io

Source: legaljobs.io

775084 a person who has been found guilty of or who has pleaded guilty or nolo contendere to having violated this section may be sentenced to pay a fine not exceeding 250000 or twice the value of the financial transactions whichever is greater except that for a second or subsequent violation of this section the fine may be. Floridas money laundering laws execute the following penalties for money laundering. Jail time is up to five years in a state prison. Financial transactions exceeding 300 but less than 20000 in any 12-month period are considered third-degree felonies. Florida Statute 896101 sets out the possible penalties for money laundering.

Source: idmerit.com

Source: idmerit.com

Currency more than 10000 received in trade or business. Money Laundering Penalties The penalties for money laundering are harsh and vary depending upon the amount of money processed. The offense applies whenever funds are generated through any felony prohibited by Florida or federal law. Florida Money Laundering Act. 560123 65550 or Ch.

Source: yumpu.com

Source: yumpu.com

896101 Florida Money Laundering Act. Money laundering is a felony and the level of the charge depends on the amount of money or value of the property involved. Financial transactions exceeding 300 but less than 20000 in any 12-month period are considered third-degree felonies. 896103 Transaction which constitutes separate offense. Florida Statute 896101 sets out the possible penalties for money laundering.

Source: researchgate.net

Source: researchgate.net

For transactions over 300 but less than 20000 it is a third-degree felony punishable by up to 5 years in prison. 896101 Florida Money Laundering Act. Jail time is up to five years in a state prison. Money Laundering in Florida. If you are charged with money laundering under the Florida statute the penalties for a conviction will depend on the amount of money you are alleged to have laundered.

Source: researchgate.net

Source: researchgate.net

Financial transactions exceeding 300 but less than 20000 in any 12-month period are considered third-degree felonies. Essentially any movement of illegal proceeds from the illegal source to a legal source is money laundering. Currency more than 10000 received in trade or business. Under Florida law the severity of the charge and penalties for laundering depend upon the amount of money laundered in a given year. For financial transactions that are more than 300 but less than 20000 the.

Source: researchgate.net

Source: researchgate.net

Florida Money Laundering Act. 560123 65550 or Ch. 6 In addition to the penalties authorized by s. Transaction which constitutes separate offense. If the defendant has a prior conviction for money laundering the fine can increase to 500000 or five times the total amount of the financial transactions.

Source: yumpu.com

Source: yumpu.com

Under the Money Transmitter Code 66 and the Florida Control of Money Laundering in Financial Institutions Act 67 Any person who willfully violates any provision of FS. The actual penalty depends on the value of the financial transactions involved and the severity of the charges against the defendant. Money laundering is a felony and the level of the charge depends on the amount of money or value of the property involved. Florida Statute 896101 sets out the possible penalties for money laundering. A third-degree felony if the transaction values total between 300 and 20000 within a twelve-month period.

Source: slideshare.net

Source: slideshare.net

775084 a person who has been found guilty of or who has pleaded guilty or nolo contendere to having violated this section may be sentenced to pay a fine not exceeding 250000 or twice the value of the financial transactions whichever is greater except that for a second or subsequent violation of this section the fine may be. 68 The couple could also face supplemental civil RICO. 896102 Currency more than 10000 received in trade or business. The offense applies whenever funds are generated through any felony prohibited by Florida or federal law. Florida Statute 896101 sets out the possible penalties for money laundering.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering penalties in florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.