10++ Money laundering offenses and penalties ideas in 2021

Home » money laundering idea » 10++ Money laundering offenses and penalties ideas in 2021Your Money laundering offenses and penalties images are available. Money laundering offenses and penalties are a topic that is being searched for and liked by netizens today. You can Download the Money laundering offenses and penalties files here. Get all free photos and vectors.

If you’re searching for money laundering offenses and penalties images information related to the money laundering offenses and penalties keyword, you have visit the ideal blog. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

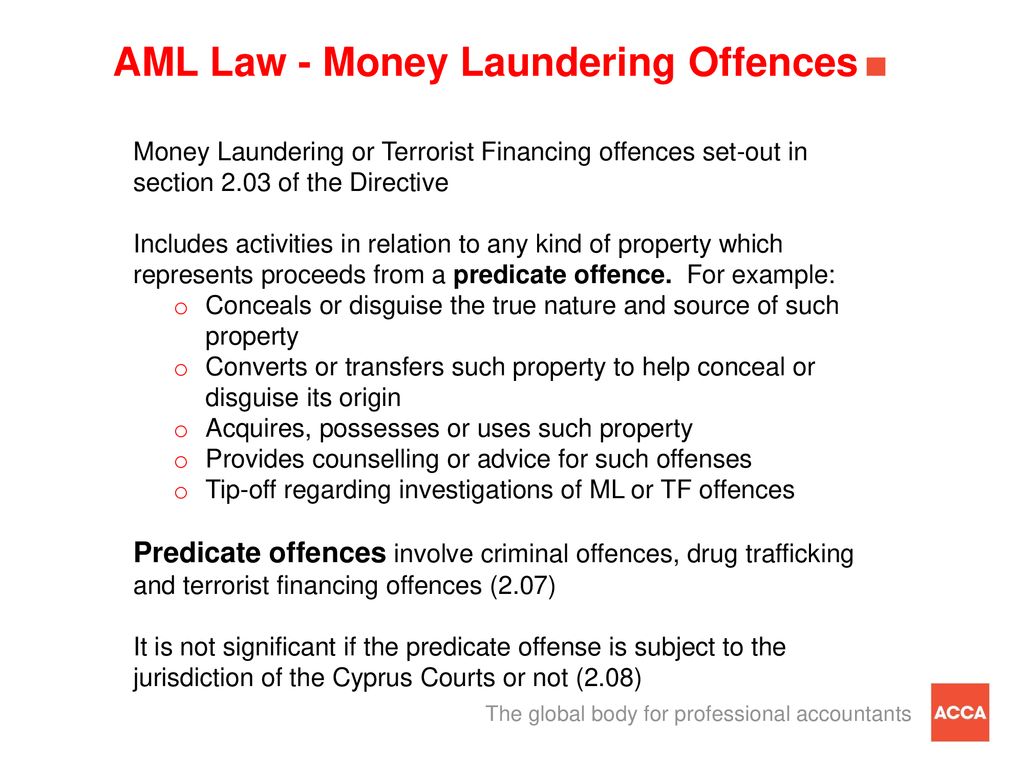

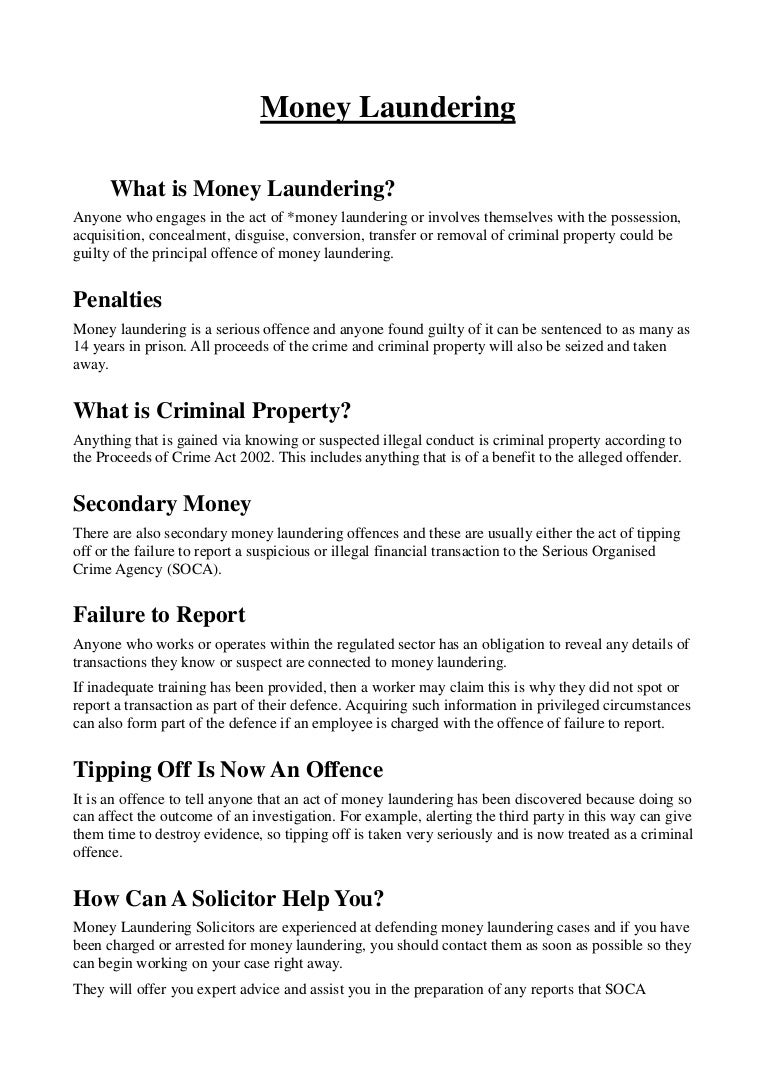

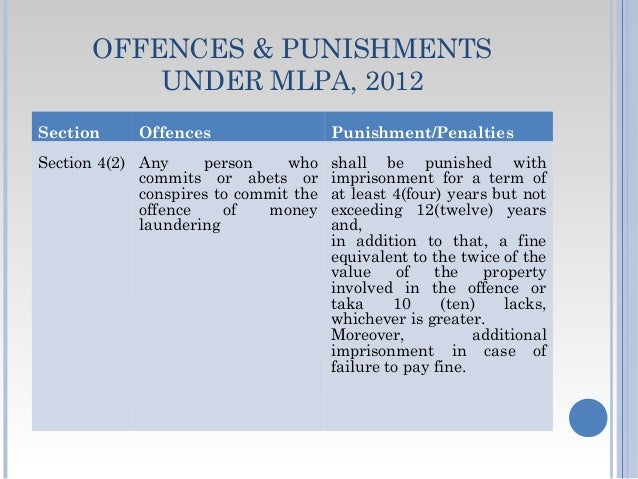

Money Laundering Offenses And Penalties. Possibly one of the most well-known tax avoiders in recent years is the famous comedian Jimmy Carr. Money Laundering Penalties Money laundering is considered a serious crime with severe federal charges issued for perpetrators of these illegal activities. Money laundering is broadly defined in the UK. In Pennsylvania money laundering is prosecuted as a first-degree felony.

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download From slideplayer.com

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download From slideplayer.com

Notable Cases Of Money Laundering Activities And Estimated Amounts Involved Download Table. In addition a convicted individual can be sentenced to as long as 20 years in prison. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. 255 were convicted of an offense carrying a mandatory minimum penalty. Money laundering offences are found in Part 7 of Proceeds of Crime Act 2002 POCA. These serious crimes can involve the maximum prison sentence of 14 years.

Fines for money laundering can reach as high as half a million dollars depending on the kind of things involved in the laundering transaction.

New York classifies money laundering offenses from the first degree to the fourth degree with the degree depending on the total of the financial transaction s. This is when people use offshore accounts to avoid declaring their full income level and as a result they can avoid paying their full amount in tax. Money laundering charges and penalties. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. Money laundering offences are found in Part 7 of Proceeds of Crime Act 2002 POCA. It is also possible to receive a community order as a punishment for money laundering.

Source: slideplayer.com

Source: slideplayer.com

In any money laundering case if theres more than one individual involved it can be expected that the government will also seek conspiracy charges. 1956 can result in a sentence of up to 20 years in prison. It is also possible to receive a community order as a punishment for money laundering. 5 Money Laundering Offences. Section 1957 carries a maximum penalty of ten years in prison and maximum fine of 250000 or twice the value of the transaction.

Source: slideplayer.com

Source: slideplayer.com

Federal Money Laundering Penalties In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. Money laundering is a serious crime under federal law. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. 889 of money laundering offenders were sentenced to prison. In addition a convicted individual can be sentenced to as long as 20 years in prison.

Source: slideplayer.com

Source: slideplayer.com

In addition a convicted individual can be sentenced to as long as 20 years in prison. Penalties include a fine of as much as 100000 or twice the value of any financial transactions that were involved in the crime. It is also possible to receive a community order as a punishment for money laundering. In addition a convicted individual can be sentenced to as long as 20 years in prison. Notable Cases Of Money Laundering Activities And Estimated Amounts Involved Download Table.

Source: slideplayer.com

Source: slideplayer.com

And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. In addition a convicted individual can be sentenced to as long as 20 years in prison. The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. Another violation may see the person imprisoned for ten years.

Source: slideplayer.com

Source: slideplayer.com

1957 can result in. And for a violation of 18 USC 1956 a 3 an undetermined fine or imprisonment of up to 20 years or both. A violation of 18 USC. In discussing the elements of the Money Laundering Control Act this article provides an overview of the offenses covered under the act analyzes elements of the offenses describes defenses that may be mounted against charges under the act and discusses criminal and civil penalties that attach to offenses. The average sentence for money laundering offenders was 70months.

Source: researchgate.net

Source: researchgate.net

There is no civil penalty provision. Wwwusscgov pubaffairsusscgov theusscgov. The criminal penalty for a violation of 18 USC 1956 a 1 and 2 is a fine of up to 500000 or twice the value of the monetary instruments involved whichever is greater or imprisonment of up to 20 years or both. Of those 370 were relieved of that penalty. 5 Money Laundering Offences.

Source: delta-net.com

Source: delta-net.com

In addition a convicted individual can be sentenced to as long as 20 years in prison. Section 1957 carries a maximum penalty of ten years in prison and maximum fine of 250000 or twice the value of the transaction. The offender might have to pay the greater of 500000 or twice the value of. New York State Laws. This is when people use offshore accounts to avoid declaring their full income level and as a result they can avoid paying their full amount in tax.

Source: slideshare.net

Source: slideshare.net

The most significant difference from 1956 prosecutions is the intent requirement. This is when people use offshore accounts to avoid declaring their full income level and as a result they can avoid paying their full amount in tax. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. 889 of money laundering offenders were sentenced to prison. Notable Cases Of Money Laundering Activities And Estimated Amounts Involved Download Table.

Source: slideplayer.com

Source: slideplayer.com

Money laundering is broadly defined in the UK. Money laundering is considered a serious crime with severe federal charges issued for perpetrators of these illegal activities. Money Laundering Penalties Money laundering is considered a serious crime with severe federal charges issued for perpetrators of these illegal activities. Penalties include a fine of as much as 100000 or twice the value of any financial transactions that were involved in the crime. 889 of money laundering offenders were sentenced to prison.

Source: slideshare.net

Source: slideshare.net

Of those 370 were relieved of that penalty. This is when people use offshore accounts to avoid declaring their full income level and as a result they can avoid paying their full amount in tax. Second-degree felony Up to 15 years in prison. Money laundering is considered a serious crime with severe federal charges issued for perpetrators of these illegal activities. New York State Laws.

Source: researchgate.net

Source: researchgate.net

In a situation like that the government can seek to have a penalty of up to ten years in prison. Of those 370 were relieved of that penalty. There is no civil penalty provision. Another violation may see the person imprisoned for ten years. That could net a.

Source: wikiwand.com

Source: wikiwand.com

The length of imprisonment when charged with money laundering also depends on the severity of the case but it can reach up to 20 years. There is no civil penalty provision. 255 were convicted of an offense carrying a mandatory minimum penalty. Money laundering offences are found in Part 7 of Proceeds of Crime Act 2002 POCA. It is also possible to receive a community order as a punishment for money laundering.

Source: shuftipro.com

Source: shuftipro.com

Money Laundering Penalties Money laundering is considered a serious crime with severe federal charges issued for perpetrators of these illegal activities. 1957 can result in. Federal Money Laundering Penalties In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. Of those 370 were relieved of that penalty. The average sentence for money laundering offenders was 70months.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering offenses and penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.