13++ Money laundering offences and penalties ideas

Home » money laundering Info » 13++ Money laundering offences and penalties ideasYour Money laundering offences and penalties images are available. Money laundering offences and penalties are a topic that is being searched for and liked by netizens now. You can Get the Money laundering offences and penalties files here. Find and Download all free images.

If you’re searching for money laundering offences and penalties images information linked to the money laundering offences and penalties topic, you have pay a visit to the right blog. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

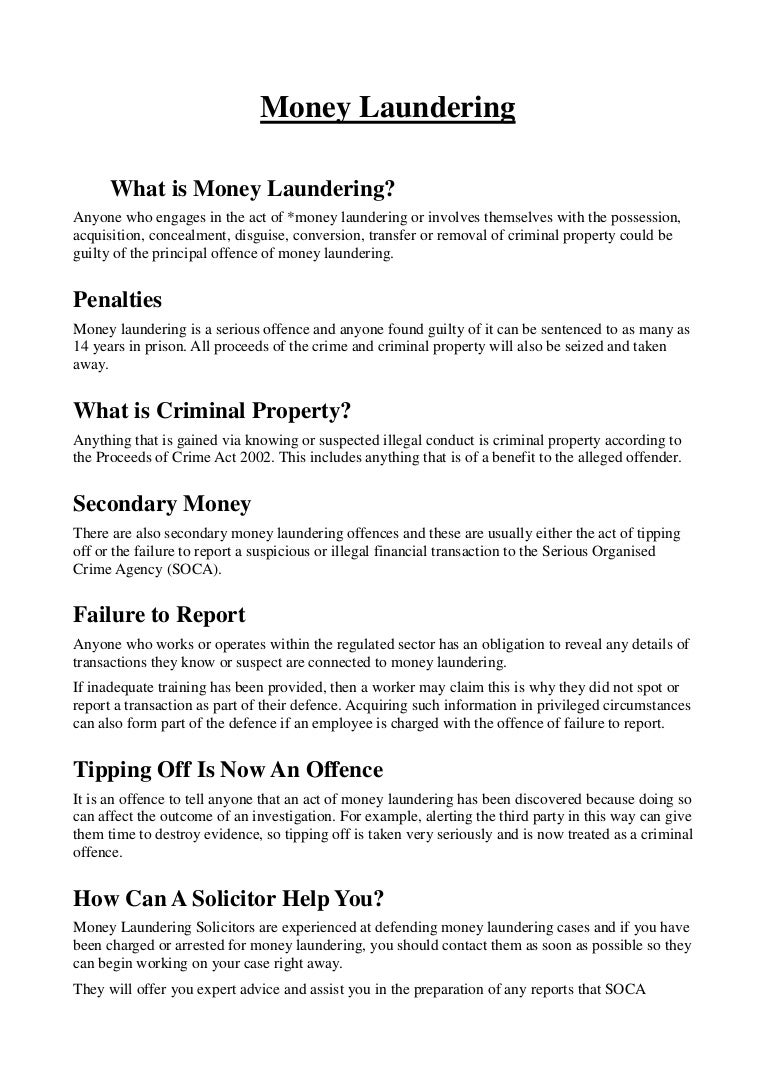

Money Laundering Offences And Penalties. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. Summary convictions in the United Kingdom carry a maximum custodial penalty of six months and convictions on indictment carry a maximum penalty of 14 years imprisonment. Penalties for money laundering offences. The offences of money laundering in the United States carry a maximum custodial sentence of 20 years.

Pdf Anti Money Laundering Regulations And Its Effectiveness From researchgate.net

Pdf Anti Money Laundering Regulations And Its Effectiveness From researchgate.net

The maximum penalty for an offence contrary to section 4009 is 3 years imprisonment if the property is valued at 100000 or more or 2 years imprisonment if the property is valued at less than 100000. 1 A person may be convicted of a money laundering offence notwithstanding the absence of a conviction in respect of a crime which generated the proceeds alleged to have been laundered. Summary convictions in the United Kingdom carry a maximum custodial penalty of six months and convictions on indictment carry a maximum penalty of 14 years imprisonment. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. Offences involving less than 5000 receive a more lenient penalty with those involving more than 5000 potentially invoking a maximum custodial sentence of 2 years. 5 Money Laundering Offences.

Higher penalties apply to public officers and persons employed on contract in the State who fail to disclose knowledge or suspicion of money laundering.

The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. Furthermore a person who deals with proceeds of crime knowing that it is proceeds of crime is guilty of an offence pursuant to section 193 2 of the Crimes Act 1900 NSW. Possibly one of the most well-known tax avoiders in recent years is the famous comedian Jimmy Carr. Charges and offences of money laundering Subject. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. Act on penalties for money laundering offences 2014307 Updated 15 October 2018 Lag 2014307 om straff för penningtvättsbrott.

Source: complyadvantage.com

Source: complyadvantage.com

This Practice Note explains the offences penalties and enforcement provisions contained in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 from 10 January. The maximum penalty for an offence contrary to section 4009 is 3 years imprisonment if the property is valued at 100000 or more or 2 years imprisonment if the property is valued at less than 100000. Spending the proceeds of crime 10 years. Summary convictions in the United Kingdom carry a maximum custodial penalty of six months and convictions on indictment carry a maximum penalty of 14 years imprisonment. For the first group the maximum penalty for a money laundering or terrorism financing offence committed by an entity will be raised from S1 million.

Source: delta-net.com

Source: delta-net.com

1 A person may be convicted of a money laundering offence notwithstanding the absence of a conviction in respect of a crime which generated the proceeds alleged to have been laundered. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Charges and offences of money laundering Subject. AUTHORITY TO FREEZE UNDER ANTI-MONEY LAUNDERING ACT The penalty of imprisonment from six 6 months to four 4 years or a fine of not less than One hundred thousand Philippine pesos Php10000000 but not more than Five hundred thousand Philippine pesos Php50000000 or both shall be imposed on a person who knowing that a covered or suspicious. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec.

Source: iclg.com

Source: iclg.com

This Practice Note explains the offences penalties and enforcement provisions contained in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 from 10 January. The penalties for money laundering are severe. Australia s approach to criminalising money laundering differs from that of many other countries. Penalties for money laundering offences. It carries a maximum penalty of 20 years imprisonment.

Summary convictions in the United Kingdom carry a maximum custodial penalty of six months and convictions on indictment carry a maximum penalty of 14 years imprisonment. Penalties for money laundering offences. Higher penalties apply to public officers and persons employed on contract in the State who fail to disclose knowledge or suspicion of money laundering. The penalty for commission of an offence under this section is imprisonment of up to six months or a fine not exceeding the statutory maximum or both on summary conviction. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering.

Source: researchgate.net

Source: researchgate.net

1 A person may be convicted of a money laundering. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. Penalties for money laundering offences. Youll have to pay a 1500 penalty administration charge as well as the penalty for breaches of the Money Laundering Regulations such as failures for.

Source: researchgate.net

Source: researchgate.net

1 A person may be convicted of a money laundering offence notwithstanding the absence of a conviction in respect of a crime which generated the proceeds alleged to have been laundered. Money laundering offences penalties. 1 A person may be convicted of a money laundering offence notwithstanding the absence of a conviction in respect of a crime which generated the proceeds alleged to have been laundered. However this offence carries a maximum penalty. This is when people use offshore accounts to avoid declaring their full income level and as a result they can avoid paying their full amount in tax.

Charges and offences of money laundering Subject. It carries a maximum penalty of 20 years imprisonment. 1 A person may be convicted of a money laundering. The penalty for commission of an offence under this section is imprisonment of up to six months or a fine not exceeding the statutory maximum or both on summary conviction. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing.

Source: wikiwand.com

Source: wikiwand.com

Spending the proceeds of crime 10 years. This Practice Note explains the offences penalties and enforcement provisions contained in the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 SI 2017692 which came into force on 26 June 2017 as amended by the Money Laundering and Terrorist Financing Amendment Regulations 2019 SI 20191511 from 10 January. The most serious money laundering offences are deemed to be those involving sums of 10 million or more with 30 million given as the starting point for sentencing. Youll have to pay a 1500 penalty administration charge as well as the penalty for breaches of the Money Laundering Regulations such as failures for. The penalty for commission of an offence under this section is imprisonment of up to six months or a fine not exceeding the statutory maximum or both on summary conviction.

Source: in.pinterest.com

Source: in.pinterest.com

It carries a maximum penalty of 20 years imprisonment. Charges and offences of money laundering Subject. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. 31 CFR 1010820 Civil penalties issued under the authority of 31 USC 5321 is the primary penalty regulation for all penalties assessed before August 2 2016. The penalties for money laundering are severe.

Source: researchgate.net

Source: researchgate.net

Money laundering regulations penalty for failure to report. The offences of money laundering in the United States carry a maximum custodial sentence of 20 years. Money laundering offences penalties. Higher penalties apply to public officers and persons employed on contract in the State who fail to disclose knowledge or suspicion of money laundering. 16 What are the maximum penalties applicable to individuals and legal entities convicted of money laundering.

Source: slideshare.net

Source: slideshare.net

Division 400 of the Criminal Code Act 1995 Cth the Criminal Code contains the principal criminal offences of money laundering in Australia. However this offence carries a maximum penalty. 1 A person may be convicted of a money laundering offence notwithstanding the absence of a conviction in respect of a crime which generated the proceeds alleged to have been laundered. Charges and offences of money laundering Subject. On conviction on indictment the penalty is imprisonment of up to five years or a fine or both.

Source: wikiwand.com

Source: wikiwand.com

Spending the proceeds of crime 10 years. Higher penalties apply to public officers and persons employed on contract in the State who fail to disclose knowledge or suspicion of money laundering. Australia s approach to criminalising money laundering differs from that of many other countries. Money laundering regulations penalty for failure to report. Money laundering offences penalties.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

Higher penalties apply to public officers and persons employed on contract in the State who fail to disclose knowledge or suspicion of money laundering. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. On conviction on indictment the penalty is imprisonment of up to five years or a fine or both. However this offence carries a maximum penalty. Charges and offences of money laundering Subject.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering offences and penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.