14+ Money laundering low risk category ideas in 2021

Home » money laundering Info » 14+ Money laundering low risk category ideas in 2021Your Money laundering low risk category images are available. Money laundering low risk category are a topic that is being searched for and liked by netizens now. You can Get the Money laundering low risk category files here. Get all royalty-free photos.

If you’re searching for money laundering low risk category images information connected with to the money laundering low risk category topic, you have pay a visit to the ideal site. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

Money Laundering Low Risk Category. Single methodology to apply to these risk categories and the application of these risk categories. Risk to be lower. Obliged entities are divided into four risk categories low medium low medium high and high. Conversely where the measurement of a risk driver is low the risk rating will decrease.

Revised Central Bank Amla Guidelines Anti Money Laundering From yumpu.com

Revised Central Bank Amla Guidelines Anti Money Laundering From yumpu.com

Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. However simplified CDD still requires firms to identify customers prior to commencing a business relationship. The risk-based approach. Assumed as presenting a lower risk of money laundering without the need for a firm to undertake a risk assessment with respect to that client. Ratings of low medium and high can be used when applying a simple risk range whereas more advanced risk ranges extend to very low and very high ratings. The periodicity of such updation should not be less than once in five years in case of low risk category customers and not less than once in two years in case of high and medium risk categories.

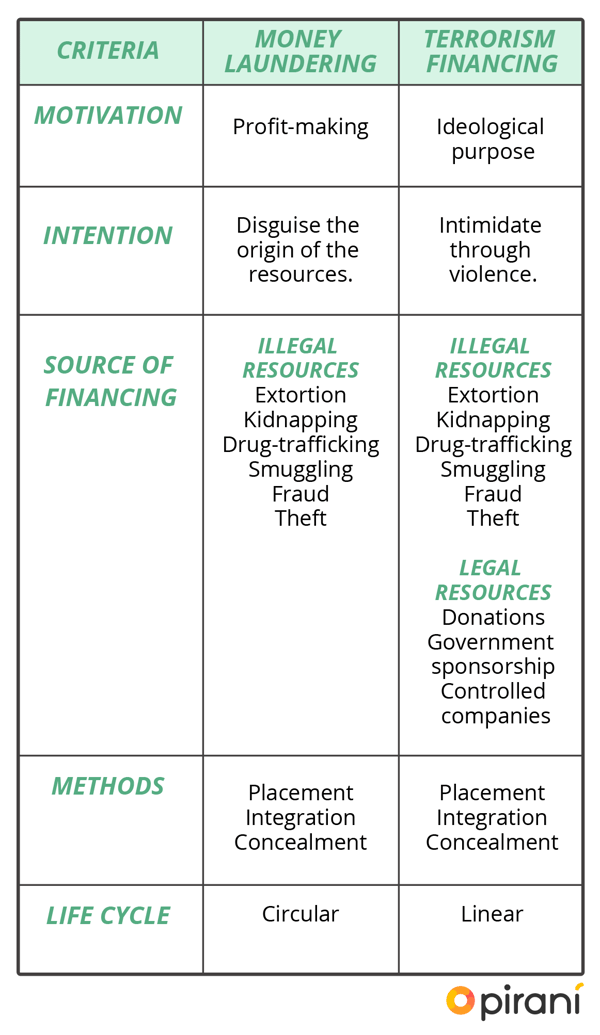

1 products and services 2 customers and entities and 3 geographic location.

Such verification should be done irrespective of whether the account has been transferred from one branch to another and banks are required to also maintain records of transactions as prescribed. An assessment therefore needs to have a risk range. Equally a low risk does not necessarily mean that the customers operations cannot be associated with money laundering or terrorist financing at all. Assumed as presenting a lower risk of money laundering without the need for a firm to undertake a risk assessment with respect to that client. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world. This involves following a number of steps.

Source: actico.com

Source: actico.com

Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. Individual risk assessments are based on information from obliged entities among other things on their risk profile and the FSAs information on the quality of internal controls. Money laundering risks may be measured using various categories which may be modified by risk variables. Russias overall risk score has fallen from 575 to 560 out of 10 where 10 equals the highest assessed risk of MLTF. As an extension of the overall assessment of MLFT risks which must be performed in accordance with Article 16 of the Anti-Money Laundering Law financial institutions are required pursuant to Article 4 of the Anti-Money Laundering Regulation of the NBB to define different risk categories and to apply appropriate due diligence measures specific to each category.

Source: actico.com

Source: actico.com

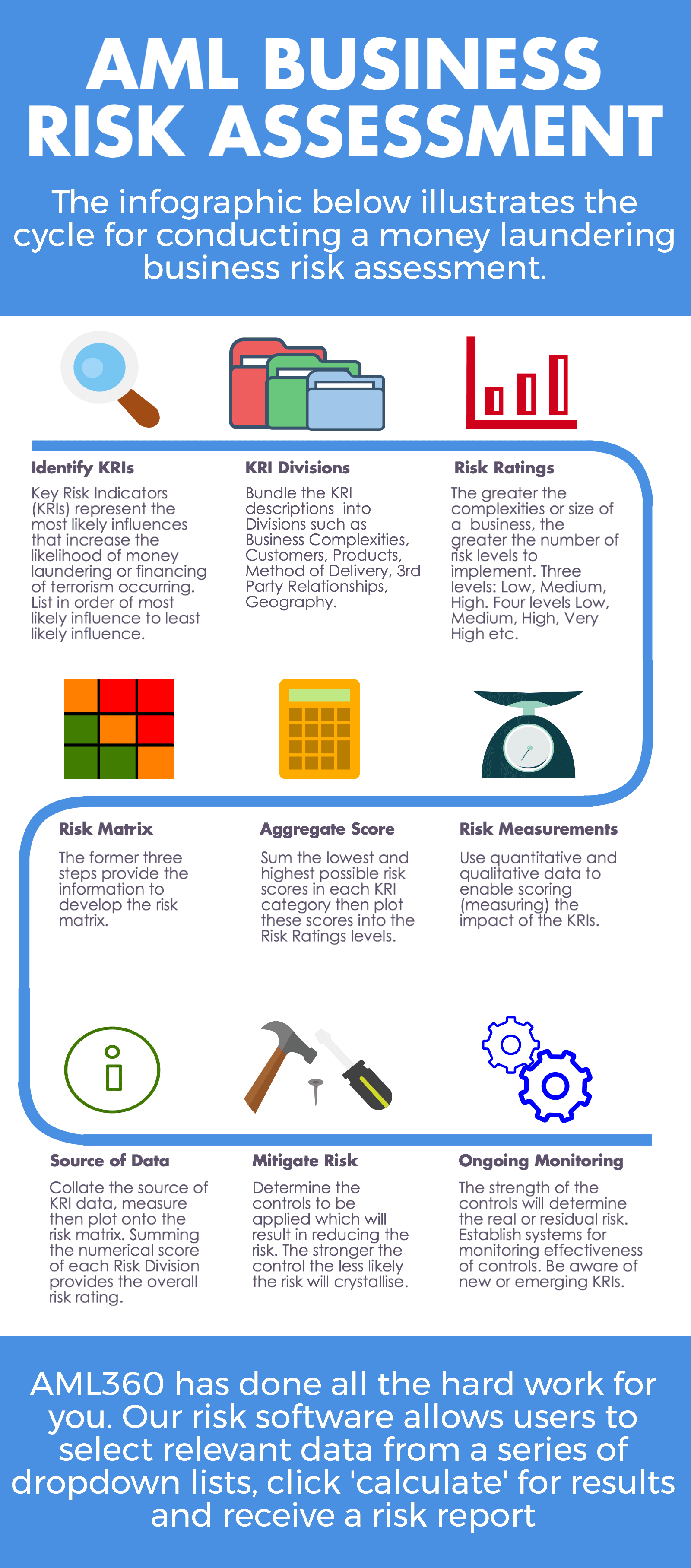

However simplified CDD still requires firms to identify customers prior to commencing a business relationship. Key Risk Drivers There are a variety of Key Risk Drivers KRI that businesses should consider when conducting a money laundering risk. The risk-based approach. To ensure completeness consistency and accuracy of the assessment of MLTF risks this MLTF risk assessment methodology forms part of the AML Program. Ratings of low medium and high can be used when applying a simple risk range whereas more advanced risk ranges extend to very low and very high ratings.

Source: researchgate.net

Source: researchgate.net

Equally a low risk does not necessarily mean that the customers operations cannot be associated with money laundering or terrorist financing at all. What is money laundering risk assessment. Obliged entities are divided into four risk categories low medium low medium high and high. Businesses that are covered by the Money Laundering Regulations have to use a risk-based approach to prevent money laundering. Key Risk Drivers There are a variety of Key Risk Drivers KRI that businesses should consider when conducting a money laundering risk.

Source: aml360software.com

Source: aml360software.com

Risk to be lower. Equally a low risk does not necessarily mean that the customers operations cannot be associated with money laundering or terrorist financing at all. In other words that the person. The most commonly used risk criteria are. An assessment therefore needs to have a risk range.

Source: shuftipro.com

Source: shuftipro.com

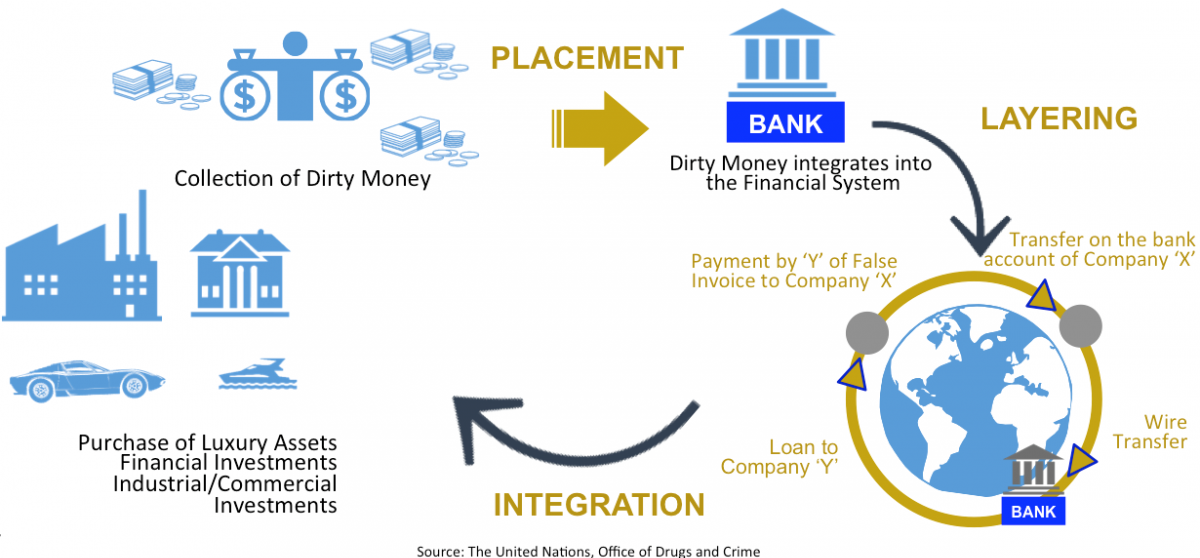

High-risk industries include for example cash-intensive businesses or. Obliged entities are divided into four risk categories low medium low medium high and high. Such verification should be done irrespective of whether the account has been transferred from one branch to another and banks are required to also maintain records of transactions as prescribed. 1 products and services 2 customers and entities and 3 geographic location. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products.

Source: gov.si

Source: gov.si

Money laundering risks may be measured using various categories which may be modified by risk variables. The periodicity of such updation should not be less than once in five years in case of low risk category customers and not less than once in two years in case of high and medium risk categories. In other words that the person. Indeed Recommendation 1 considers a risk-based approach to be an òessential foundation ó to any AML regime. MLTF risk assessment is a process of assessing an organisations risk of and vulnerabilities to being used by money launderers and terrorist financiers.

Source: dpnsee.org

Source: dpnsee.org

As general risk because general risk is still higher than low risk provided in. High-risk industries include for example cash-intensive businesses or. Industries that are exposed to money laundering risks defined by the bank. In a situation where at least one risk category can be qualified as high the risk level of money laundering or terrorist financing cannot usually be low. The Basel AML Index is the only independent data-based index of the risk of money laundering and terrorist financing MLTF around the world.

Source: researchgate.net

Source: researchgate.net

Listed in category a pose a low risk of ML. In a situation where at least one risk category can be qualified as high the risk level of money laundering or terrorist financing cannot usually be low. Risk to be lower. The periodicity of such updation should not be less than once in five years in case of low risk category customers and not less than once in two years in case of high and medium risk categories. 1 products and services 2 customers and entities and 3 geographic location.

Source: ec.europa.eu

Source: ec.europa.eu

What are the 3 main factors to consider in determining AML risk. Money laundering risks may be measured using various categories which may be modified by risk variables. Risk to be lower. Inherent BSAAML risk falls into three main categories. What are the 3 main factors to consider in determining AML risk.

Source: pideeco.be

Source: pideeco.be

Inherent BSAAML risk falls into three main categories. Obliged entities are divided into four risk categories low medium low medium high and high. What are the 3 main factors to consider in determining AML risk. Assumed as presenting a lower risk of money laundering without the need for a firm to undertake a risk assessment with respect to that client. Such verification should be done irrespective of whether the account has been transferred from one branch to another and banks are required to also maintain records of transactions as prescribed.

Source:

Single methodology to apply to these risk categories and the application of these risk categories. The risk-based approach. Assumed as presenting a lower risk of money laundering without the need for a firm to undertake a risk assessment with respect to that client. Money laundering ML or terrorist financing TF risk is the risk that an organisation or a product or service offered by an organisation may be used to facilitate MLTF. What are the 3 main factors to consider in determining AML risk.

Source: piranirisk.com

Source: piranirisk.com

Equally a low risk does not necessarily mean that the customers operations cannot be associated with money laundering or terrorist financing at all. It is unrealistic that an organisation would operate in a completely risk-free environment in terms. Assumed as presenting a lower risk of money laundering without the need for a firm to undertake a risk assessment with respect to that client. In other words that the person. Industries that are exposed to money laundering risks defined by the bank.

Source: yumpu.com

Source: yumpu.com

Customers as lower risk within an overall risk based approach. Russias overall risk score has fallen from 575 to 560 out of 10 where 10 equals the highest assessed risk of MLTF. Conversely where the measurement of a risk driver is low the risk rating will decrease. The periodicity of such updation should not be less than once in five years in case of low risk category customers and not less than once in two years in case of high and medium risk categories. As general risk because general risk is still higher than low risk provided in.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering low risk category by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.