16++ Money laundering is easy to detect information

Home » money laundering idea » 16++ Money laundering is easy to detect informationYour Money laundering is easy to detect images are available. Money laundering is easy to detect are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering is easy to detect files here. Get all free photos and vectors.

If you’re looking for money laundering is easy to detect pictures information linked to the money laundering is easy to detect keyword, you have visit the ideal site. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

Money Laundering Is Easy To Detect. Since 1990 money laundering itself has been a crimeand its easy to see why. Easy to detect money laundering. Money Laundering is an. It is important for us to understand the origin of the source of funds by having a swift reliable identification verification system to stop offenders in the beginning stages of money laundering.

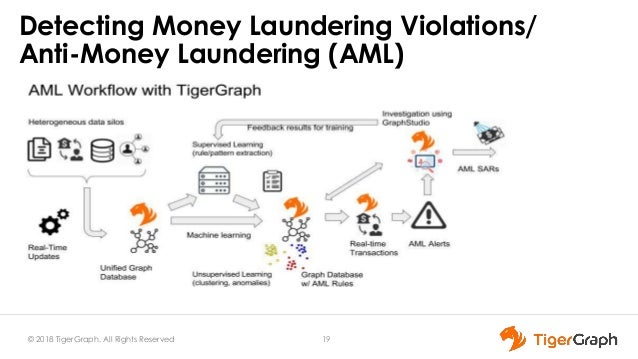

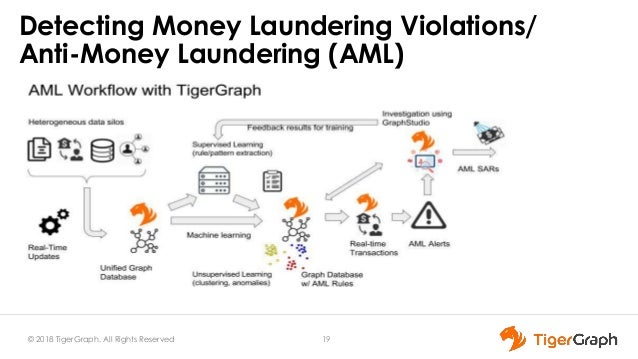

Detecting Fraud And Aml Violations In Real Time For Banking Telecom From slideshare.net

Detecting Fraud And Aml Violations In Real Time For Banking Telecom From slideshare.net

Financial institutions today utilise AI for areas such as customer service risk management fraud detection and anti-money laundering while adhering to regulatory compliance. Response times vary by subject and question complexity. Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. Reluctance to Provide Information. Ans-Combating Financing for Terrorism Monitoring the suspicious transactions Processing. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018.

Money laundering is getting harder to detect and trace due to the changing technology and integration of economies among markets.

Integration stage Ans-Placement stage Layering stage 2Name screening of all the proposed customers to ensure that names are not given in the list given by UN or in regulatory lists helps in. Spotting the warning signs when it comes to money laundering could be make or break for a company depending on how fast you detect and respond to threats. Placement of illegal funds in a legitimate financial institution the layering of illegal and legal funds to obfuscate the origin of the illegal proceeds and integration of funds back to the criminal. 5 Signs of Money Laundering to Look out for. Thats an eye-watering 2 to 5 of the global economy. Money laundering is big business with an estimated 740 billion to 2 trillion laundered each year.

Source: quora.com

Thats an eye-watering 2 to 5 of the global economy. 5 Signs of Money Laundering to Look out for. It is important for us to understand the origin of the source of funds by having a swift reliable identification verification system to stop offenders in the beginning stages of money laundering. Median response time is 34 minutes and may be longer for new subjects. Money Laundering is an.

Source: pinterest.com

Source: pinterest.com

Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018. Ans-Combating Financing for Terrorism Monitoring the suspicious transactions Processing. Thats an eye-watering 2 to 5 of the global economy. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to.

Source: pinterest.com

Source: pinterest.com

Spotting the warning signs when it comes to money laundering could be make or break for a company depending on how fast you detect and respond to threats. Experts are waiting 247 to provide step-by-step solutions in as fast as 30 minutes. It originates from illegitimate source. AI technology has proven to be reliable especially when it comes to detecting money laundering and is empowering leading financial services to tackle such issues in an increasingly effective manner. Thats an eye-watering 2 to 5 of the global economy.

Source: wikiwand.com

Source: wikiwand.com

The rise of online banking institutions anonymous online payment. Placement of illegal funds in a legitimate financial institution the layering of illegal and legal funds to obfuscate the origin of the illegal proceeds and integration of funds back to the criminal. Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. Spotting the warning signs when it comes to money laundering could be make or break for a company depending on how fast you detect and respond to threats. AI technology has proven to be reliable especially when it comes to detecting money laundering and is empowering leading financial services to tackle such issues in an increasingly effective manner.

Source: academia.edu

Source: academia.edu

Its very easy to define but involves multiple techniques. Placement of illegal funds in a legitimate financial institution the layering of illegal and legal funds to obfuscate the origin of the illegal proceeds and integration of funds back to the criminal. The most commonly used trade-based money laundering techniques are. Since 1990 money laundering itself has been a crimeand its easy to see why. Financial institutions today utilise AI for areas such as customer service risk management fraud detection.

Source: kyc2020.com

Source: kyc2020.com

The rise of online banking institutions anonymous online payment. Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods. Money laundering involves three stages. Easy to detect money laundering. It originates from illegitimate source.

Source: pinterest.com

Source: pinterest.com

Money laundering is big business with an estimated 740 billion to 2 trillion laundered each year. It originates from illegitimate source. Money launderers appear as stakeholders to enter the business ecosystem and place money through the following methods. Reluctance to Provide Information. AI technology has proven to be reliable especially when it comes to detecting money laundering and is empowering leading financial services to tackle such issues in an increasingly effective manner.

Source: pinterest.com

Source: pinterest.com

Money laundering is big business with an estimated 740 billion to 2 trillion laundered each year. Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. Money laundering is a process that disguises the source of criminal money in order to make it appear legal. By overstating or understating the number of items or services provided or in some cases there may be no goods shipped at all money launderers can find. The rise of online banking institutions anonymous online payment.

Source: pinterest.com

Source: pinterest.com

Among the three stages of money laundering ie placement layering and integration money laundering is easiest to detect at the placement stage. Thats an eye-watering 2 to 5 of the global economy. Reluctance to Provide Information. Money Laundering is the process of changing the colors of the money. Money laundering is a process that disguises the source of criminal money in order to make it appear legal.

Source: slideshare.net

Source: slideshare.net

Money Laundering is the process of changing the colors of the money. Financial institutions today utilise AI for areas such as customer service risk management fraud detection. The rise of online banking institutions anonymous online payment. Among the three stages of money laundering ie placement layering and integration money laundering is easiest to detect at the placement stage. Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks.

Source: tookitaki.ai

Source: tookitaki.ai

Financial institutions today utilise AI for areas such as customer service risk management fraud detection and anti-money laundering while adhering to regulatory compliance. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018. Financial institutions today utilise AI for areas such as customer service risk management fraud detection and anti-money laundering while adhering to regulatory compliance. 5 Signs of Money Laundering to Look out for. Money laundering is getting harder to detect and trace due to the changing technology and integration of economies among markets.

Source: shuftipro.com

Source: shuftipro.com

Placement of illegal funds in a legitimate financial institution the layering of illegal and legal funds to obfuscate the origin of the illegal proceeds and integration of funds back to the criminal. Response times vary by subject and question complexity. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. It breaks the funds into small transactions and makes it difficult to detect and find out about the laundering activity. Integration stage Ans-Placement stage Layering stage 2Name screening of all the proposed customers to ensure that names are not given in the list given by UN or in regulatory lists helps in.

Source: shuftipro.com

Source: shuftipro.com

Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. Spotting the warning signs when it comes to money laundering could be make or break for a company depending on how fast you detect and respond to threats. Since 1990 money laundering itself has been a crimeand its easy to see why. 5 Signs of Money Laundering to Look out for. Reluctance to Provide Information.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering is easy to detect by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.