18+ Money laundering internal reporting form ideas

Home » money laundering idea » 18+ Money laundering internal reporting form ideasYour Money laundering internal reporting form images are ready in this website. Money laundering internal reporting form are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering internal reporting form files here. Get all free photos.

If you’re searching for money laundering internal reporting form images information connected with to the money laundering internal reporting form interest, you have visit the right blog. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Money Laundering Internal Reporting Form. These should include staff and principal training client acceptance parameters and internal procedures for reporting money laundering concerns. Is there a disregard for the need for internal control over misappropriation of assets. MLROs should refer to our guidance on suspicious activity reports. Money Laundering Internal Report Report Prepared by Name and Position.

Pdf International Anti Money Laundering Programs From researchgate.net

Pdf International Anti Money Laundering Programs From researchgate.net

314 Are there specific anti-money laundering requirements applied to non-financial institution businesses eg currency reporting. The information contained in it is. Practically this means US Read more. As noted all trades or businesses in the United States unless designated as financial institutions under the BSA are subject to cash reporting Form. Please go to https. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO.

For the report Signed Date of signature To be completed by the MLRO Action Taken Signed Date of signature Attach memoevidnce if necessary Great care must be taken to ensure that this form is not seen by the client at any time.

Internal money laundering reporting. Name of individual suspected. BPI has been engaged in efforts to modernize the US. Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. Reporting institutions are provided with an effective method to detect suspicious transactions more commonly known as the internal red flag criteria under the Standard Guidelines on on Anti-Money Laundering and Counter Financing of Terrorism 13 Standard Guidelines issued by the Central Bank of Malaysia. 01 602 8400 Email.

Source: bi.go.id

Source: bi.go.id

A financial institutions anti-money laundering policy should form part of its wider compliance regime and should be designed to meet the requirements of its legislative environment. Internal money laundering reporting. Stephens Green Dublin 2 D02 HK52. Name of individual suspected. Even sole-practitioners benefit from a file note of procedures which could include having a diary note to attend a course providing money laundering update and a note of the money laundering helpline.

Source: yumpu.com

Source: yumpu.com

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. 01 602 8400 Email. 314 Are there specific anti-money laundering requirements applied to non-financial institution businesses eg currency reporting. Submitting a Suspicious Activity Report to National Crime Agency. If no PSC details have been filed then you are required to make a PSC report.

Source:

As part of the fight against financial crime governments across the world require their financial institutions to put in place anti money laundering compliance programs. For the report Signed Date of signature To be completed by the MLRO Action Taken Signed Date of signature Attach memoevidnce if necessary Great care must be taken to ensure that this form is not seen by the client at any time. Stephens Green Dublin 2 D02 HK52. The special investigation team must then open an investigation and notify the whistleblower of the results of INTERNAL CONTROLS AND ANTI-MONEY LAUNDERING 163 THIS WEB PROOF INFORMATION PACK IS IN DRAFT FORM. Title 31 Anti-Money Laundering.

Source: plianced.com

Source: plianced.com

Please go to https. The information contained in it is. For the report Signed Date of signature To be completed by the MLRO Action Taken Signed Date of signature Attach memoevidnce if necessary Great care must be taken to ensure that this form is not seen by the client at any time. The special investigation team must then open an investigation and notify the whistleblower of the results of INTERNAL CONTROLS AND ANTI-MONEY LAUNDERING 163 THIS WEB PROOF INFORMATION PACK IS IN DRAFT FORM. Please go to https.

Source: researchgate.net

Source: researchgate.net

Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. Date submited to MLRO. Stephens Green Dublin 2 D02 HK52. This guide is for solicitors who are not their practices money laundering reporting officer MLRO or deputy. Money is laundered to conceal illegal activity including the crimes that generate the money itself such.

Source:

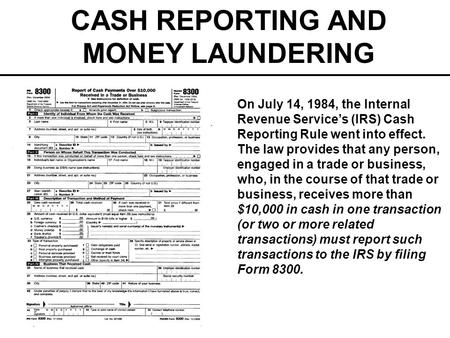

The Form 8300 Report of Cash Payments Over 10000 in a Trade or Business provides valuable information to the Internal Revenue Service and the Financial Crimes Enforcement Network FinCEN in their efforts to combat money laundering. If no PSC details have been filed then you are required to make a PSC report. Money Laundering Internal Report Report Prepared by Name and Position. Even sole-practitioners benefit from a file note of procedures which could include having a diary note to attend a course providing money laundering update and a note of the money laundering helpline. The term Laundering is used to describe the action used by criminals to clean their dirty money without arousing suspicion.

Source:

314 Are there specific anti-money laundering requirements applied to non-financial institution businesses eg currency reporting. The special investigation team must then open an investigation and notify the whistleblower of the results of INTERNAL CONTROLS AND ANTI-MONEY LAUNDERING 163 THIS WEB PROOF INFORMATION PACK IS IN DRAFT FORM. As part of the fight against financial crime governments across the world require their financial institutions to put in place anti money laundering compliance programs. Businesses that appear on this list have been identified as reporting entities supervised by the Department of Internal Affairs under section 5 of the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 the Act. 314 Are there specific anti-money laundering requirements applied to non-financial institution businesses eg currency reporting.

Source: slideplayer.com

Source: slideplayer.com

FinCEN develops answers to Frequently Asked Questions to assist in complying with the responsibilities under the Bank Secrecy Act BSA. Anti-Money Laundering Compliance Unit Department of Justice 51 St. If no PSC details have been filed then you are required to make a PSC report. In general Money Laundering refers to any and every act that changes or disguises the criminal nature or location relating to the proceeds of a crime. These should include staff and principal training client acceptance parameters and internal procedures for reporting money laundering concerns.

Source: bi.go.id

Source: bi.go.id

FAQs regarding Title 31 Anti-Money Laundering Insights into the intent of Title 31 and information on the reporting and recordkeeping requirements for casinos. Money Laundering Internal Report Report Prepared by Name and Position. For the report Signed Date of signature To be completed by the MLRO Action Taken Signed Date of signature Attach memoevidnce if necessary Great care must be taken to ensure that this form is not seen by the client at any time. Anti-money laundering countering the financing of terrorism AMLCFT regime for almost half a decade and worked closely with Senate and House leadership throughout the introduction and final passage of the Anti-Money Laundering Act of 2020 AML Act. Anti-Money Laundering Form Page 1 Client Details.

Source:

Practically this means US Read more. If you think youve identified signs of money laundering you may need to report your suspicions to comply with anti-money. As part of the fight against financial crime governments across the world require their financial institutions to put in place anti money laundering compliance programs. Report any suspicions to the Money Laundering Reporting Officer. FAQs regarding Title 31 Anti-Money Laundering Insights into the intent of Title 31 and information on the reporting and recordkeeping requirements for casinos.

Source: researchgate.net

Source: researchgate.net

Report any suspicions to the Money Laundering Reporting Officer. As part of the fight against financial crime governments across the world require their financial institutions to put in place anti money laundering compliance programs. Internal money laundering reporting. The Form 8300 Report of Cash Payments Over 10000 in a Trade or Business provides valuable information to the Internal Revenue Service and the Financial Crimes Enforcement Network FinCEN in their efforts to combat money laundering. Stephens Green Dublin 2 D02 HK52.

Source: researchgate.net

Source: researchgate.net

FAQs regarding Title 31 Anti-Money Laundering Insights into the intent of Title 31 and information on the reporting and recordkeeping requirements for casinos. Money Laundering Internal Report Report Prepared by Name and Position. The term Laundering is used to describe the action used by criminals to clean their dirty money without arousing suspicion. The Form 8300 Report of Cash Payments Over 10000 in a Trade or Business provides valuable information to the Internal Revenue Service and the Financial Crimes Enforcement Network FinCEN in their efforts to combat money laundering. FAQs regarding Title 31 Anti-Money Laundering Insights into the intent of Title 31 and information on the reporting and recordkeeping requirements for casinos.

Source:

Anti-money laundering countering the financing of terrorism AMLCFT regime for almost half a decade and worked closely with Senate and House leadership throughout the introduction and final passage of the Anti-Money Laundering Act of 2020 AML Act. 314 Are there specific anti-money laundering requirements applied to non-financial institution businesses eg currency reporting. In general Money Laundering refers to any and every act that changes or disguises the criminal nature or location relating to the proceeds of a crime. Internal money laundering reporting. Practically this means US Read more.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering internal reporting form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.