20+ Money laundering in insurance sector with suitable examples info

Home » money laundering idea » 20+ Money laundering in insurance sector with suitable examples infoYour Money laundering in insurance sector with suitable examples images are available. Money laundering in insurance sector with suitable examples are a topic that is being searched for and liked by netizens today. You can Find and Download the Money laundering in insurance sector with suitable examples files here. Find and Download all royalty-free photos.

If you’re looking for money laundering in insurance sector with suitable examples images information related to the money laundering in insurance sector with suitable examples interest, you have pay a visit to the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Money Laundering In Insurance Sector With Suitable Examples. He acted as follows. Money launders use insurance companies for money laundering by purchasing insurance and then making claims to get insurance funds. Fraud and financial crime in the insurance space has risen sharply in recent years. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance.

The Five Basic Principles Of Insurance From askrida.com

The Five Basic Principles Of Insurance From askrida.com

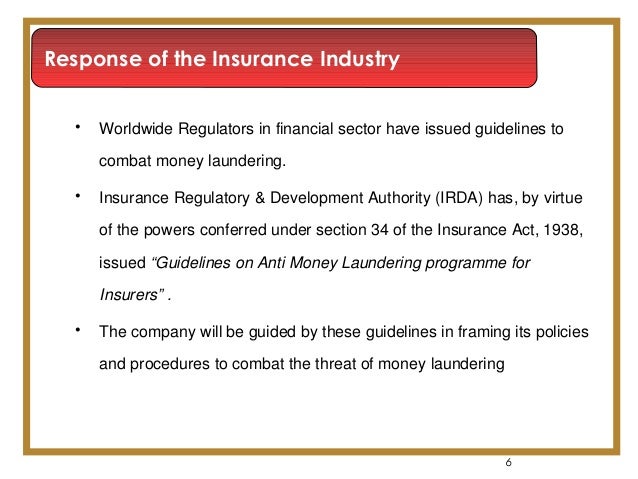

Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and. He contacted an insurance broker and delivered a total amount of USD 250000 in three cash instalments. The insurance industry is open to abuse by criminals including money launderers and terrorist financiers. If one were to take the UK as an example anti-money laundering AML risk management related to capital markets is in its relative infancy. According to PwCs 2018 Global Economic Crime Survey 62 percent of respondents from the global insurance community said their firms. It is washed to make it look clean.

Sometimes they take advantage of investment-structured insurance products such as variable annual income and certain life insurance.

Whilst the insurance industry has been the subject of international and domestic efforts relating to anti-money laundering AML and combating the financing of terrorism CFT for several years there has been no specific international review of the MLTF vulnerabilities specific to this industry and no. According to PwCs 2018 Global Economic Crime Survey 62 percent of respondents from the global insurance community said their firms. FATF stressed the importance for securities providers to pursue a group-level approach to adequately mitigate money laundering and terrorist financing risks. Fraud and financial crime in the insurance space has risen sharply in recent years. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. This illegal money is derived from criminal activities such as the following.

Source: acamstoday.org

Source: acamstoday.org

The insurance broker did not report the. Framework for identifying assessing and understanding MLTF risks within the insurance sector using a riskbased approach. Criminals use insurance companies for money laundering primarily by buying insurance and then submitting claims to retrieve their funds. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and. A securities provider must consider its risks holistically across all its different business units.

Source: slideshare.net

Source: slideshare.net

INSURANCE SECTOR Life insurance policies having a cash surrender value are of particular interest to money launders as they provide attractive a money laundering vehicles. Sometimes they take advantage of investment-structured insurance products such as variable annual income and certain life insurance. Suspected funds totalled approx. Intermediaries case study 19 A person later arrested for drug trafficking made a financial investment life insurance of USD 250000 by means of an insurance broker. Insurance sector to money laundering.

Source: pinterest.com

Source: pinterest.com

Criminals use insurance companies for money laundering primarily by buying insurance and then submitting claims to retrieve their funds. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance. Framework for identifying assessing and understanding MLTF risks within the insurance sector using a riskbased approach. He contacted an insurance broker and delivered a total amount of USD 250000 in three cash instalments.

Source:

Source:

Money laundering in insurance sector with suitable examples. He contacted an insurance broker and delivered a total amount of USD 250000 in three cash instalments. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and. The cash value of policies can be redeemed by a money launderer or may be used as a source of further investment of tainted funds for example by taking out loans against.

Source: pinterest.com

Source: pinterest.com

The individual tries to buy multiple insurance policies to cover the same asset. According to PwCs 2018 Global Economic Crime Survey 62 percent of respondents from the global insurance community said their firms. Fraud and financial crime in the insurance space has risen sharply in recent years. Sometimes they take advantage of investment-structured insurance products such as variable annual income and certain life insurance. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses.

Source: slideshare.net

Source: slideshare.net

Money laundering in insurance sector with suitable examples. It is washed to make it look clean. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value such as an insurance policy bank deposit casino cheque. Insurance sector to money laundering.

Source: pinterest.com

Source: pinterest.com

He acted as follows. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and. The individual tries to buy multiple insurance policies to cover the same asset. The most common form of money laundering that insurance institutions will face is by entering offers in a single premium contract. Suspected funds totalled approx.

Source: slideshare.net

Source: slideshare.net

The lack of understanding about such risks also extends to some AML staff even those with significant experience. Framework for identifying assessing and understanding MLTF risks within the insurance sector using a riskbased approach. Criminals use insurance companies for money laundering primarily by buying insurance and then submitting claims to retrieve their funds. The insurance broker did not report the. There is no one-size-fits-all approach for AML controls due to the complexity of the securities sector.

Source: askrida.com

Source: askrida.com

Suspected funds totalled approx. The insurance industry is open to abuse by criminals including money launderers and terrorist financiers. Criminals use insurance companies for money laundering primarily by buying insurance and then submitting claims to retrieve their funds. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance. He acted as follows.

Source: pinterest.com

Source: pinterest.com

Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Insurance sector to money laundering. Criminals use insurance companies for money laundering primarily by buying insurance and then submitting claims to retrieve their funds. He acted as follows. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check.

Source: pinterest.com

Source: pinterest.com

The lack of understanding about such risks also extends to some AML staff even those with significant experience. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and subsequently withdraw large amounts of cash with a relatively minor reduction in value such as an insurance policy bank deposit casino cheque. In the insurance sector there are a few red flags that might indicate money laundering is taking place. According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses.

Source:

The insurance industry is open to abuse by criminals including money launderers and terrorist financiers. Suspected funds totalled approx. FATF stressed the importance for securities providers to pursue a group-level approach to adequately mitigate money laundering and terrorist financing risks. The insurance industry is open to abuse by criminals including money launderers and terrorist financiers. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance.

Source:

There is no one-size-fits-all approach for AML controls due to the complexity of the securities sector. Most life insurance firms offer highly flexible policies and investment products that offer opportunities for customers to deposit and. Sometimes they take advantage of investment-structured insurance products such as variable annual income and certain life insurance. Money launders use insurance companies for money laundering by purchasing insurance and then making claims to get insurance funds. The lack of understanding about such risks also extends to some AML staff even those with significant experience.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering in insurance sector with suitable examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.