14+ Money laundering in an insurance industry scenario info

Home » money laundering Info » 14+ Money laundering in an insurance industry scenario infoYour Money laundering in an insurance industry scenario images are ready. Money laundering in an insurance industry scenario are a topic that is being searched for and liked by netizens today. You can Download the Money laundering in an insurance industry scenario files here. Download all free photos and vectors.

If you’re looking for money laundering in an insurance industry scenario pictures information linked to the money laundering in an insurance industry scenario interest, you have visit the ideal blog. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Money Laundering In An Insurance Industry Scenario. Those regulations are not only applicable to banking financing money. The agents and brokers are often unaware of the need to screen clients or to question payment methods. Which 3 of the following is an indication of possible money laundering in an insurance industry scenario. Single-premium insurance bonds redeemed at a discount.

Prevention Of Money Laundering And Terrorist Financing 22 From slidetodoc.com

Prevention Of Money Laundering And Terrorist Financing 22 From slidetodoc.com

The AML regulations involve both transaction monitoring and sanctions screening obligation. In some cases such agents and brokers have even joined criminals against insurers to facilitate money laundering. Some of the red flags which may indicate money laundering include. The agents and brokers are often unaware of the need to screen clients or to question payment methods. What is Money Laundering. Single-premium insurance bonds redeemed at a discount.

Ad Download Insurance Industry Reports on 180 countries with Report Linker.

Which 3 of the following is an indication of possible money laundering in an insurance industry scenario. QUESTION 4 Which three of the following is an indication of possible money laundering in an insurance industry scenario. Instant industry overview Market sizing forecast key players trends. By Marcela Blanco and Javier Coronado. Insurance agents supervisor was also charged with violating the money laundering statute. Paying a large top-up into an existing life insurance policy Purchasing a general insurance policy then making a claim soon after A customer who usually.

Source: slidetodoc.com

Source: slidetodoc.com

With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. What is Money Laundering. Some of the red flags which may indicate money laundering include. By Marcela Blanco and Javier Coronado. Which 3 of the following is an indication of possible money laundering in an insurance industry scenario.

Source: slidetodoc.com

Source: slidetodoc.com

Instant industry overview Market sizing forecast key players trends. Instant industry overview Market sizing forecast key players trends. Money Laundering in the Insurance Industry How Does It Happen. This case has shown how money laundering coupled with a corrupt employee can expose an insurance company to negative publicity and possible criminal liability. In other words money laundering in the insurance sector is a growing global problem.

Source: marketsandmarkets.com

Source: marketsandmarkets.com

This case has shown how money laundering coupled with a corrupt employee can expose an insurance company to negative publicity and possible criminal liability. Those regulations are not only applicable to banking financing money. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. In some cases such agents and brokers have even joined criminals against insurers to facilitate money laundering. The insurance industry is generally susceptible to money laundering because of their size complexity of the products they offer and the manner in which their products are segmented and distributed.

Source: slideplayer.com

Source: slideplayer.com

Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. QUESTION 4 Which three of the following is an indication of possible money laundering in an insurance industry scenario. The insurance industry is attractive to money launderers because insurance products are often sold by independent agents or brokers who do not work directly for insurance companies. Ad Download Insurance Industry Reports on 180 countries with Report Linker. Insurance products sold through intermediaries agents or brokers.

Source: infopro.com.my

Source: infopro.com.my

The bond was taken out by Mr. Policyholders who are unconcerned about penalties for early cancellation. Investment type insurance policy the money had come from the sale of a house which was confirmed by a letter from his solicitor. -Single-premium insurance bonds redeemed at a discount -Policyholders who are unconcerned about penalties for early cancellation. Instant industry overview Market sizing forecast key players trends.

Source: coforgetech.com

Source: coforgetech.com

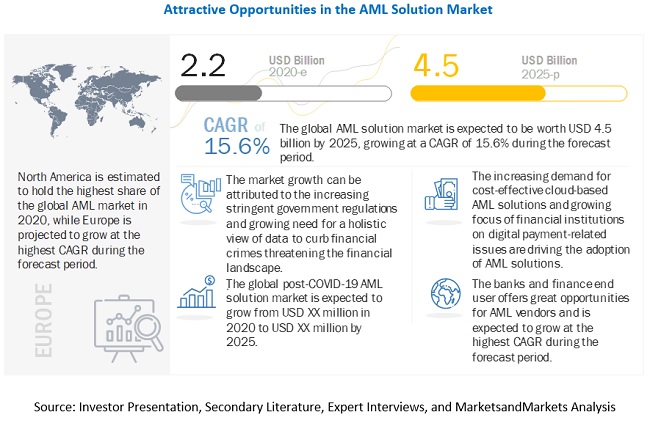

To counter the persistence of the crimes global anti-money laundering AML regulations have been forced to adapt faster than ever before. Which 3 of the following is an indication of possible money laundering in an insurance industry scenario. What is Money Laundering. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Ad Download Insurance Industry Reports on 180 countries with Report Linker.

Source: transparencymarketresearch.com

Source: transparencymarketresearch.com

This case has shown how money laundering coupled with a corrupt employee can expose an insurance company to negative publicity and possible criminal liability. The AML regulations involve both transaction monitoring and sanctions screening obligation. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. Customs officials in Country X initiated an investigation which identified a narcotics. To counter the persistence of the crimes global anti-money laundering AML regulations have been forced to adapt faster than ever before.

Source:

In other words money laundering in the insurance sector is a growing global problem. Some of the red flags which may indicate money laundering include. Investment type insurance policy the money had come from the sale of a house which was confirmed by a letter from his solicitor. Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. Ad Download Insurance Industry Reports on 180 countries with Report Linker.

Source: elibrary.imf.org

Source: elibrary.imf.org

The bond was taken out by Mr. The Warning Signs There are a number of ways that launderers can use insur-ance products. QUESTION 4 Which three of the following is an indication of possible money laundering in an insurance industry scenario. Some of the red flags which may indicate money laundering include. Insurance agents supervisor was also charged with violating the money laundering statute.

Source: slidetodoc.com

Source: slidetodoc.com

Insurance regulations only apply to insurance companies excluding agents and brokers from the requirements. What is Money Laundering. AS an illustration of money laundering using life-insurance products the first known case of money laundering using insurance was reported in the New York Times on December 6 2002. Those regulations are not only applicable to banking financing money. In other words money laundering in the insurance sector is a growing global problem.

Source: infopro.com.my

Source: infopro.com.my

-Single-premium insurance bonds redeemed at a discount -Policyholders who are unconcerned about penalties for early cancellation. Money laundering through insurance sector - international case study. Instant industry overview Market sizing forecast key players trends. What is Money Laundering. Insurance companies that issue or underwrite covered products that may pose a higher risk of money laundering must comply with Bank Secrecy Actanti-money laundering BSAAML program requirements.

Source: rsmus.com

Source: rsmus.com

Instant industry overview Market sizing forecast key players trends. Investment type insurance policy the money had come from the sale of a house which was confirmed by a letter from his solicitor. Insurance agents supervisor was also charged with violating the money laundering statute. The money having come direct from the solicitors client account. Money Laundering in the Insurance Industry How Does It Happen.

Source: slideshare.net

Source: slideshare.net

Insurance products sold through intermediaries agents or brokers. Government enforcement actions against executives of insurance companies for their alleged involvement in the laundering of ill-gotten funds including the proceeds of corruption highlight the exposure that the insurance industry has to money laundering risks and the importance of implementing compliance programs that are effective. Those regulations are not only applicable to banking financing money. The agents and brokers are often unaware of the need to screen clients or to question payment methods. In other words money laundering in the insurance sector is a growing global problem.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering in an insurance industry scenario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.