14+ Money laundering illegal australia information

Home » money laundering Info » 14+ Money laundering illegal australia informationYour Money laundering illegal australia images are ready. Money laundering illegal australia are a topic that is being searched for and liked by netizens now. You can Download the Money laundering illegal australia files here. Find and Download all free photos and vectors.

If you’re searching for money laundering illegal australia pictures information linked to the money laundering illegal australia topic, you have come to the ideal blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Money Laundering Illegal Australia. Westpac Australias second-largest bank agreed to pay a 13 billion Australian dollar 919 million fine for breaches of anti-money laundering and. Its not surprising that Australia has become a go-to money laundering destination. On May 21 2015 Arslan Shaffi and Salman Khan were arrested by New South Wales Police for money laundering. Some progress has been made and casinos and bullion dealers well-known money laundering venues are now covered alongside the banks and required to report.

Complete Guide On The Law On Money Laundering Offences In Nsw And Across Australia Criminal Defence Lawyers Australia From criminaldefencelawyers.com.au

Complete Guide On The Law On Money Laundering Offences In Nsw And Across Australia Criminal Defence Lawyers Australia From criminaldefencelawyers.com.au

Money is obtained from criminal activity and carefully channelled into legitimate organisations and businesses in order to disguise its. Police found over A3 million in banking receipts in Shaffis and Khans homes many of which were printed by CBA IDMs. Australia should have a public register of all trusts including settlors trustees and ultimate beneficial owners. The penalties for money laundering will increase with the value of the dirty money that has been laundered. A critical risk to Australia. TI Australia has been calling for an overhaul of the AMLCTF laws for years.

HSBC tells Australias financial crime agency that it may have broken anti money-laundering and counter-terrorism financing laws after failing to.

Its not surprising that Australia has become a go-to money laundering destination. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. The maximum penalties here depend on the amount of money involved ranging from at least 1m 100000 50000 10000 1000 or of any other value that is less. As part of ongoing inquiries strike force detectives with assistance from Australian Border Force ABF officers seized 90kg of allegedly illegally imported tobacco in April. Generally money launderers seek to exploit the services offered by mainstream retail banking and larger financial service and gaming providers. The men used 101 CBA accounts to launder nearly A18 million in 255 different transactions.

Source: researchgate.net

Source: researchgate.net

A critical risk to Australia. In the simplest terms money laundering involves the transfer of illegally obtained money into a legal institution ie. Some progress has been made and casinos and bullion dealers well-known money laundering venues are now covered alongside the banks and required to report. Transactions indicate that entities who may be of concern from a foreign interference perspective could be using money held in casino accounts to make political donations with. TI Australia has been calling for an overhaul of the AMLCTF laws for years.

Source: researchgate.net

Source: researchgate.net

The penalties for money laundering will increase with the value of the dirty money that has been laundered. Transactions indicate that entities who may be of concern from a foreign interference perspective could be using money held in casino accounts to make political donations with. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. Tabcorp acknowledged they had not reported information required by Austrac such as when a customer won 100000 in addition to not reporting money laundering and credit card fraud. The men used 101 CBA accounts to launder nearly A18 million in 255 different transactions.

Source: businessinsider.com.au

Source: businessinsider.com.au

Its not surprising that Australia has become a go-to money laundering destination. The Australia federal agency that tracks illegal money flows the Australian Transaction Reports and Analysis Centre or AUSTRAC noted in a December 2020 report that. Money is obtained from criminal activity and carefully channelled into legitimate organisations and businesses in order to disguise its. A person commits a money laundering offence under the Criminal Code if they deal with money or property and the money or property is and the person believes that it is the proceeds of crime or the person intends that the money or property will become an instrument of crime. Generally money launderers seek to exploit the services offered by mainstream retail banking and larger financial service and gaming providers.

Source: brill.com

Source: brill.com

As part of ongoing inquiries strike force detectives with assistance from Australian Border Force ABF officers seized 90kg of allegedly illegally imported tobacco in April. Some progress has been made and casinos and bullion dealers well-known money laundering venues are now covered alongside the banks and required to report. Visible money laundering is. On May 21 2015 Arslan Shaffi and Salman Khan were arrested by New South Wales Police for money laundering. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to.

Source: criminaldefencelawyers.com.au

Source: criminaldefencelawyers.com.au

Police found over A3 million in banking receipts in Shaffis and Khans homes many of which were printed by CBA IDMs. Australia should have a public register of all trusts including settlors trustees and ultimate beneficial owners. As part of ongoing inquiries strike force detectives with assistance from Australian Border Force ABF officers seized 90kg of allegedly illegally imported tobacco in April. A person commits a money laundering offence under the Criminal Code if they deal with money or property and the money or property is and the person believes that it is the proceeds of crime or the person intends that the money or property will become an instrument of crime. Its not surprising that Australia has become a go-to money laundering destination.

Source: michaelwest.com.au

Source: michaelwest.com.au

Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. In Australia the most serious offence of laundering over 1 million carries a maximum penalty of 20 years imprisonment. Two Sydney men accused of laundering tens of millions of dollars for offshore Australian crime figures have been arrested and more than 1 million seized as part of an ongoing joint investigation into a transnational money laundering syndicate. Greater transparency of information on private trusts including their income who controls them and who ultimately benefits is essential for both tax integrity and to expose money laundering. Commonwealth Bank accused of money laundering and terrorism-financing breaches Australias financial intelligence agency suing bank for 53700.

Source: researchgate.net

Source: researchgate.net

Commonwealth Bank accused of money laundering and terrorism-financing breaches Australias financial intelligence agency suing bank for 53700. Visible money laundering is. Two Sydney men accused of laundering tens of millions of dollars for offshore Australian crime figures have been arrested and more than 1 million seized as part of an ongoing joint investigation into a transnational money laundering syndicate. TI Australia has been calling for an overhaul of the AMLCTF laws for years. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to.

Source: researchgate.net

Source: researchgate.net

The Australia federal agency that tracks illegal money flows the Australian Transaction Reports and Analysis Centre or AUSTRAC noted in a December 2020 report that. Generally money launderers seek to exploit the services offered by mainstream retail banking and larger financial service and gaming providers. TI Australia has been calling for an overhaul of the AMLCTF laws for years. According to the Australian Crime Commission more and more organised crime groups in Australia are becoming involved in money laundering so they can enjoy their illicit profits or reinvest the proceeds of. In Australia the most serious offence of laundering over 1 million carries a maximum penalty of 20 years imprisonment.

Source: slideplayer.com

Source: slideplayer.com

According to the Australian Crime Commission more and more organised crime groups in Australia are becoming involved in money laundering so they can enjoy their illicit profits or reinvest the proceeds of. In Australia the most serious offence of laundering over 1 million carries a maximum penalty of 20 years imprisonment. Indeed the amount of money laundering in Australia was estimated to range between A2-3 billion per year11 generated by a number of key activities. Money laundering is the processing of these proceeds of crime to conceal their illegal origin – turning dirty cash into clean money. TI Australia has been calling for an overhaul of the AMLCTF laws for years.

Source: researchgate.net

Source: researchgate.net

A person commits a money laundering offence under the Criminal Code if they deal with money or property and the money or property is and the person believes that it is the proceeds of crime or the person intends that the money or property will become an instrument of crime. The Australia federal agency that tracks illegal money flows the Australian Transaction Reports and Analysis Centre or AUSTRAC noted in a December 2020 report that. Money laundering is one of the three critical organised crime risks to the Australian community identified in the classified 2010 Organised crime threat assessment and articulated in the unclassified and published Organised crime in Australia 2011. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. Commonwealth Bank accused of money laundering and terrorism-financing breaches Australias financial intelligence agency suing bank for 53700.

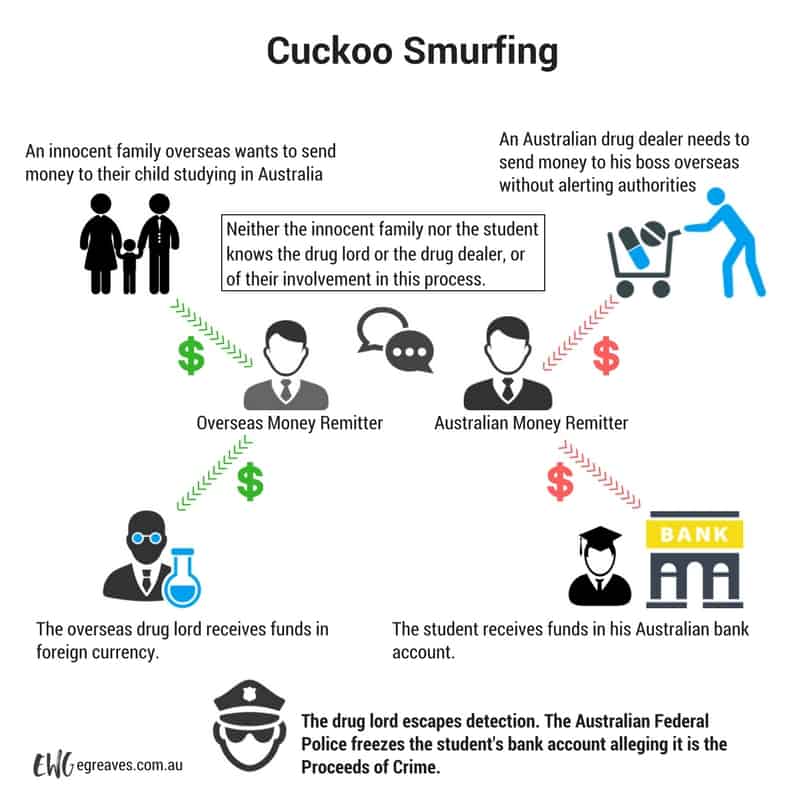

Source: egreaves.com.au

Source: egreaves.com.au

The penalties for money laundering will increase with the value of the dirty money that has been laundered. In the simplest terms money laundering involves the transfer of illegally obtained money into a legal institution ie. Applicable across all Australian states and territories the Commonwealth law in Part 102 of the Criminal Code Act 1995 Cth prescribes heavy maximum penalties for money laundering offenders. Money laundering is the processing of these proceeds of crime to conceal their illegal origin – turning dirty cash into clean money. Visible money laundering is.

Source: iclg.com

Source: iclg.com

According to the Australian Crime Commission more and more organised crime groups in Australia are becoming involved in money laundering so they can enjoy their illicit profits or reinvest the proceeds of. Australia needs stronger anti-money laundering laws. Both of these reports were developed by the Australian Crime Commission the Commonwealth agency established to. Money laundering is one of the three critical organised crime risks to the Australian community identified in the classified 2010 Organised crime threat assessment and articulated in the unclassified and published Organised crime in Australia 2011. Its not surprising that Australia has become a go-to money laundering destination.

Source: slideplayer.com

Source: slideplayer.com

On May 21 2015 Arslan Shaffi and Salman Khan were arrested by New South Wales Police for money laundering. HSBC tells Australias financial crime agency that it may have broken anti money-laundering and counter-terrorism financing laws after failing to. Commonwealth Bank accused of money laundering and terrorism-financing breaches Australias financial intelligence agency suing bank for 53700. Some progress has been made and casinos and bullion dealers well-known money laundering venues are now covered alongside the banks and required to report. Money is obtained from criminal activity and carefully channelled into legitimate organisations and businesses in order to disguise its.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering illegal australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.