12++ Money laundering high risk products information

Home » money laundering idea » 12++ Money laundering high risk products informationYour Money laundering high risk products images are ready. Money laundering high risk products are a topic that is being searched for and liked by netizens today. You can Get the Money laundering high risk products files here. Find and Download all royalty-free images.

If you’re searching for money laundering high risk products images information related to the money laundering high risk products keyword, you have come to the right site. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

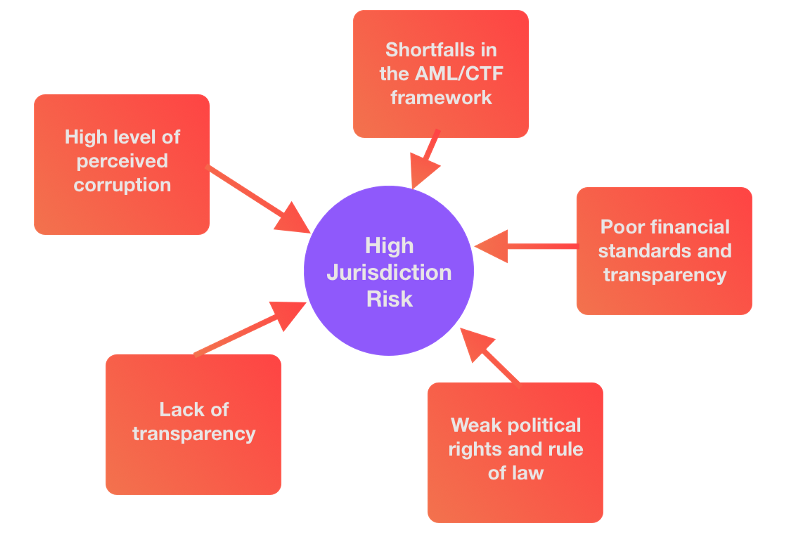

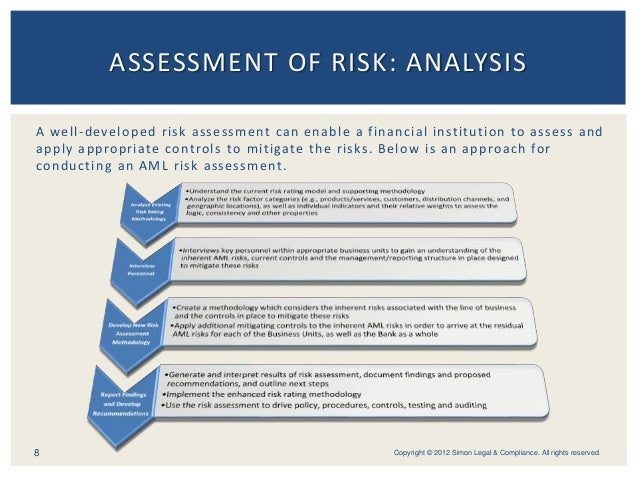

Money Laundering High Risk Products. Application of the risk variables described above plays an important part in this determination. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Higher Risk Customers are those who are engaged in certain professions or avail the banking products and services where money laundering possibilities are high. As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities products is starting to emerge.

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium From medium.com

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium From medium.com

As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities products is starting to emerge. Application of the risk variables described above plays an important part in this determination. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Your firm where there might be high risk of money laundering or terrorist financing. Inherently high risk for money laundering. Customers The following may suggest a high risk of money laundering or terrorist financing.

Money laundering is driven by criminal activities and conceals the true source ownership or use of funds.

Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. Inherently high risk for money laundering. Application of the risk variables described above plays an important part in this determination. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Customers The following may suggest a high risk of money laundering or terrorist financing. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers.

Source: bi.go.id

Source: bi.go.id

Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. The Joint Money Laundering Steering Group guidance for example recognises that the provision of banking and investment services to high net worth clients may carry an enhanced money laundering risk. Inherently high risk for money laundering. Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. Customers The following may suggest a high risk of money laundering or terrorist financing.

Source: taxguru.in

Source: taxguru.in

Money laundering is driven by criminal activities and conceals the true source ownership or use of funds. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018. Your firm where there might be high risk of money laundering or terrorist financing. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items. Customers The following may suggest a high risk of money laundering or terrorist financing.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. Money laundering is driven by criminal activities and conceals the true source ownership or use of funds. What are considered higher risk customer types for money laundering.

Source: complyadvantage.com

Source: complyadvantage.com

Markets-based money laundering has increased due to the increase in the availability of higher risk products such as micro-cap investments increased participation by retail investors and overall increased volumes of trades as well as the introduction of better controls against money laundering in the retail space driving criminals to seek out. Customers The following may suggest a high risk of money laundering or terrorist financing. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. Cash based businesses. Potential money laundering harm from E-Money 21 The NRA 20152 assessed the money laundering risk of e-money as medium and the terrorist financing risk as low but this was revised to a medium risk rating by the NRA 2017.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

First Recommendation 12 requires a reporting entity to have òappropriate ó risk management systems in place to determine whether the customer or. Potential money laundering harm from E-Money 21 The NRA 20152 assessed the money laundering risk of e-money as medium and the terrorist financing risk as low but this was revised to a medium risk rating by the NRA 2017. Markets-based money laundering has increased due to the increase in the availability of higher risk products such as micro-cap investments increased participation by retail investors and overall increased volumes of trades as well as the introduction of better controls against money laundering in the retail space driving criminals to seek out. Inherently high risk for money laundering. The International Monetary Fund has stated that the aggregate size of money laundering in the world.

Source: medium.com

Source: medium.com

Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items. Markets-based money laundering has increased due to the increase in the availability of higher risk products such as micro-cap investments increased participation by retail investors and overall increased volumes of trades as well as the introduction of better controls against money laundering in the retail space driving criminals to seek out. The NRA 2015 section 97 recognised that open loop3 prepaid cards had the potential to be high risk. Higher Risk Customers are those who are engaged in certain professions or avail the banking products and services where money laundering possibilities are high. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks.

Source:

National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items. The NRA 2015 section 97 recognised that open loop3 prepaid cards had the potential to be high risk. Inherently high risk for money laundering. Money laundering is driven by criminal activities and conceals the true source ownership or use of funds.

Source: bi.go.id

Source: bi.go.id

As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities products is starting to emerge. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Unsurprisingly a nagging challenge for most firms is detecting and assessing their money laundering risks. What are considered higher risk customer types for money laundering.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

There is no universal consensus as to which customers pose a higher risk but the below listed characteristics of customers have been identified with potentially higher money laundering risks. The Joint Money Laundering Steering Group guidance for example recognises that the provision of banking and investment services to high net worth clients may carry an enhanced money laundering risk. Understanding risk within the Recommendation 12 context is important for two reasons. Application of the risk variables described above plays an important part in this determination. Money laundering is driven by criminal activities and conceals the true source ownership or use of funds.

Source: slideshare.net

Source: slideshare.net

What are considered higher risk customer types for money laundering. Money laundering is the criminal practice of filtering ill-gotten gains or dirty money through a series of transactions so that the funds are cleaned to look like proceeds from legal activities. The NRA 2015 section 97 recognised that open loop3 prepaid cards had the potential to be high risk. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

The International Monetary Fund has stated that the aggregate size of money laundering in the world. Your firm where there might be high risk of money laundering or terrorist financing. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018. Markets-based money laundering has increased due to the increase in the availability of higher risk products such as micro-cap investments increased participation by retail investors and overall increased volumes of trades as well as the introduction of better controls against money laundering in the retail space driving criminals to seek out. The NRA 2015 section 97 recognised that open loop3 prepaid cards had the potential to be high risk.

Source: medium.com

Source: medium.com

Activities do not pose a higher risk of money laundering. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. The NRA 2015 section 97 recognised that open loop3 prepaid cards had the potential to be high risk. Application of the risk variables described above plays an important part in this determination. Inherently high risk for money laundering.

Source: acamstoday.org

Source: acamstoday.org

What are considered higher risk customer types for money laundering. As the number and value of enforcement actions increase worldwide knowledge around money laundering through securities products is starting to emerge. The Joint Money Laundering Steering Group guidance for example recognises that the provision of banking and investment services to high net worth clients may carry an enhanced money laundering risk. Anti-money laundering AML was the number one cause of FINRA fines in 2016 2017 and 2018. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering high risk products by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.