14++ Money laundering geographic risk info

Home » money laundering Info » 14++ Money laundering geographic risk infoYour Money laundering geographic risk images are available. Money laundering geographic risk are a topic that is being searched for and liked by netizens now. You can Find and Download the Money laundering geographic risk files here. Download all royalty-free vectors.

If you’re searching for money laundering geographic risk pictures information linked to the money laundering geographic risk keyword, you have visit the right site. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

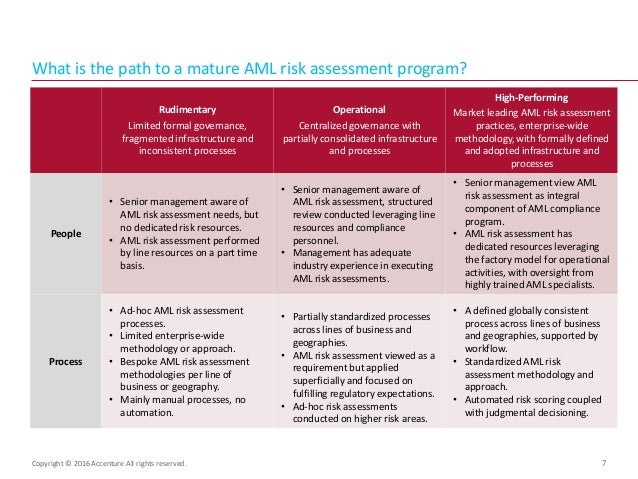

Money Laundering Geographic Risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. Geographic risk is an important component to leverage when assessing customer and transaction anti-money laundering AML risk. This course aims to describe and explain the Risk-Based Approach RBA procedures so that the firms focus their efforts on those areas where the risk of ML and TF appears to be higher.

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

The first is the idea of geographic risk. What is IBM Financial Crimes Geographic Risk Insight. Border risks are important for interpreting real risks. This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. Risk Based Approach RBA to Anti Money Laundering. The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk.

Risk Based Approach RBA to Anti Money Laundering.

There are circumstances where the risk of money laundering or terrorist financing is higher and enhanced CDD measures have to be taken. Border risks are important for interpreting real risks. Geographical anti-money laundering risk is an ever changing landscape. What is high risk. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. The first thing that matters is that the propertys location matches the buyer and sellers location.

Source: bi.go.id

Source: bi.go.id

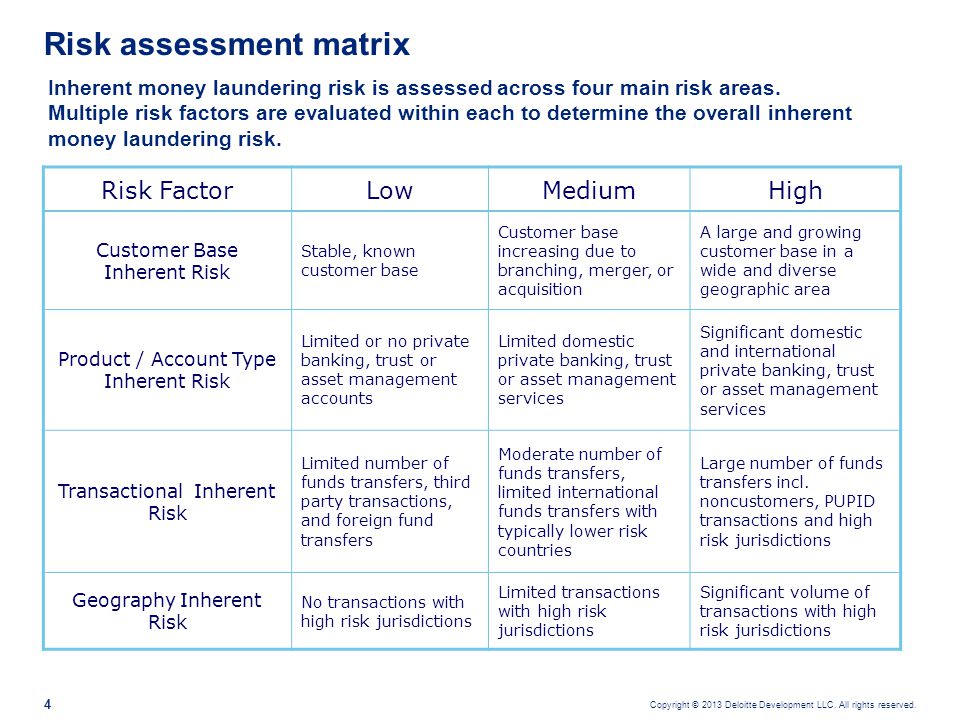

National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Risk Based Approach RBA to Anti Money Laundering. The report warns that criminals when moving their illicit funds have taken advantage of the varying stages of implementation by jurisdictions on the revised FATF Standards on VAs and. Factors influencing the level of money-laundering risk associated with a business relationship include customer risk country or geographic risk and product or financial instrument risks. The issue of risk of money laundering in the European banking system was presented in the article.

The vulnerability to money laundering threats that countries face at a national level. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Which are types of risk associated with money laundering. Money laundering geographical risk suspicious transactions risk based approach rule based approach Abstract. The first thing that matters is that the propertys location matches the buyer and sellers location.

Source: bi.go.id

Identifying Risk The filers enable risk identification through individual country risk selection or alternatively risk can be analysed at a global risk level identifying all countries in that risk category. Identifying Risk The filers enable risk identification through individual country risk selection or alternatively risk can be analysed at a global risk level identifying all countries in that risk category. The report warns that criminals when moving their illicit funds have taken advantage of the varying stages of implementation by jurisdictions on the revised FATF Standards on VAs and. Those seeking to undertake money laundering and the financing of terrorism can form offshore business entities to allow transactions to appear business related. When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular.

Source: slideplayer.com

Source: slideplayer.com

Residency or principal places of business incorporation citizenship origination destination of funds location of primary customers Status as or relationship with other high-risk individuals entities eg. The solution assesses risk and rates countries according to money laundering and terrorist financing risks. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. FATF Red Flag Indicators Related to Geographical Risks for Virtual Assets In September 2020 FATF released their Virtual Assets Red Flag Indicators of Money Laundering and Terrorist Financing Report. The first thing that matters is that the propertys location matches the buyer and sellers location.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

The number of geographic risk indicators cited by regulators and other governmental bodies have increased significantly over the years and are subject to change. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Geographical anti-money laundering risk is an ever changing landscape. Resources should be efficiently invested and applied where they are most required. Activities as an evaluating factor for determining country or geography risk may be appropriate Countries identified by credible sources as having significant levels.

Source: slideplayer.com

Source: slideplayer.com

Resources should be efficiently invested and applied where they are most required. The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. The solution assesses risk and rates countries according to money laundering and terrorist financing risks.

Source: slideshare.net

Source: slideshare.net

Which are types of risk associated with money laundering. The report warns that criminals when moving their illicit funds have taken advantage of the varying stages of implementation by jurisdictions on the revised FATF Standards on VAs and. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues. Offshore transactions increase ML riskThe product and customer types of an offshore business increase ML FT riskGeography risk for place of incorporation and operations should also be examinedAMLCFT risks. What is high risk.

Source: bi.go.id

Source: bi.go.id

Geographic risk is important for both the property and the buyer. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. Each of these risks will be discussed below. Geographic risk is an important component to leverage when assessing customer and transaction anti-money laundering AML risk. Risk Based Approach RBA to Anti Money Laundering.

Source: dataderivatives.com

Source: dataderivatives.com

Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. The first is the idea of geographic risk. The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk. Offshore transactions increase ML riskThe product and customer types of an offshore business increase ML FT riskGeography risk for place of incorporation and operations should also be examinedAMLCFT risks. Geographical anti-money laundering risk is an ever changing landscape.

Source: bi.go.id

Source: bi.go.id

Which are types of risk associated with money laundering. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Non-financial institution companies have unique anti-money laundering risk profiles. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. Those seeking to undertake money laundering and the financing of terrorism can form offshore business entities to allow transactions to appear business related.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Money laundering risks may be measured using various categories which may be modified by. Identifying Risk The filers enable risk identification through individual country risk selection or alternatively risk can be analysed at a global risk level identifying all countries in that risk category. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Activities as an evaluating factor for determining country or geography risk may be appropriate Countries identified by credible sources as having significant levels. The vulnerability to money laundering threats that countries face at a national level.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

The issue of risk of money laundering in the European banking system was presented in the article. Jurisdictions are put on high risk lists jurisdictions are taken off high risk lists. Identifying Risk The filers enable risk identification through individual country risk selection or alternatively risk can be analysed at a global risk level identifying all countries in that risk category. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Offshore transactions increase ML riskThe product and customer types of an offshore business increase ML FT riskGeography risk for place of incorporation and operations should also be examinedAMLCFT risks.

Source: aml360software.com

Source: aml360software.com

Geographic risk is important for both the property and the buyer. Geographical anti-money laundering risk is an ever changing landscape. The first thing that matters is that the propertys location matches the buyer and sellers location. Jurisdictions are put on high risk lists jurisdictions are taken off high risk lists. The number of geographic risk indicators cited by regulators and other governmental bodies have increased significantly over the years and are subject to change.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering geographic risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.