10++ Money laundering firm wide risk assessment info

Home » money laundering Info » 10++ Money laundering firm wide risk assessment infoYour Money laundering firm wide risk assessment images are available in this site. Money laundering firm wide risk assessment are a topic that is being searched for and liked by netizens today. You can Get the Money laundering firm wide risk assessment files here. Download all free images.

If you’re looking for money laundering firm wide risk assessment images information connected with to the money laundering firm wide risk assessment keyword, you have pay a visit to the right blog. Our website always gives you hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

Money Laundering Firm Wide Risk Assessment. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Do we carry out transactions for clients in high-risk industries eg. If criminals were going to target you for money laundering where would you be vulnerable. As well as meeting your regulatory requirement to The Regulations the a firm wide risk assessment will help you.

Anti Money Laundering Financial Crime Pideeco From pideeco.be

Anti Money Laundering Financial Crime Pideeco From pideeco.be

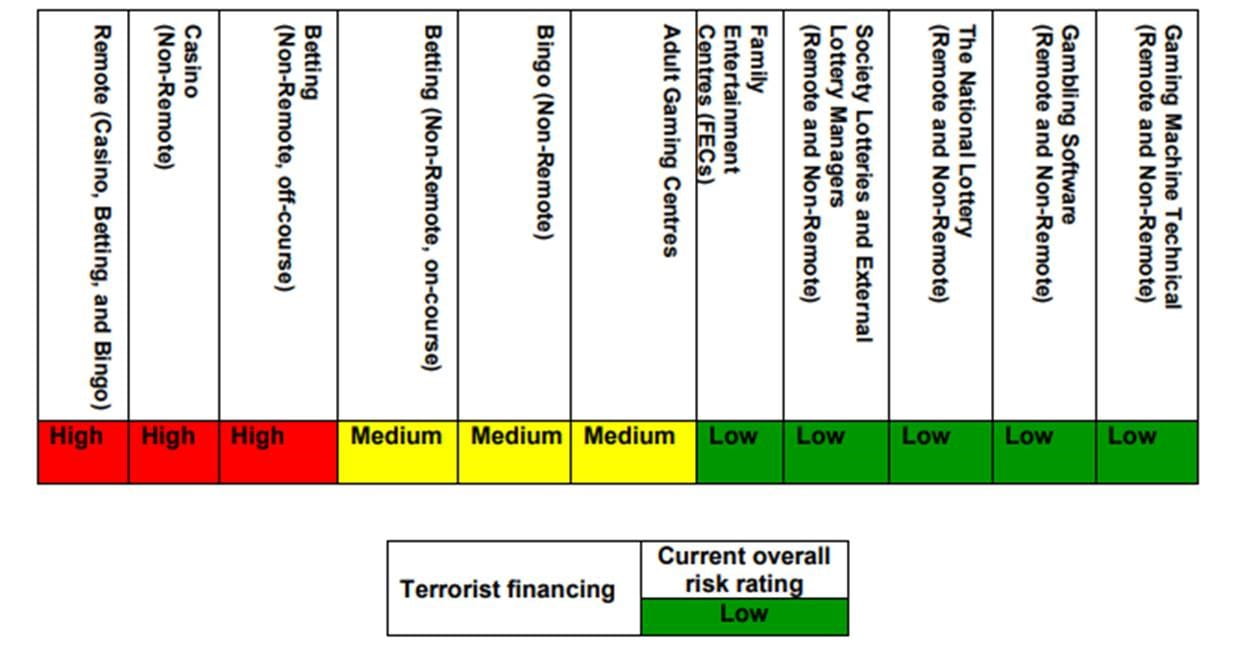

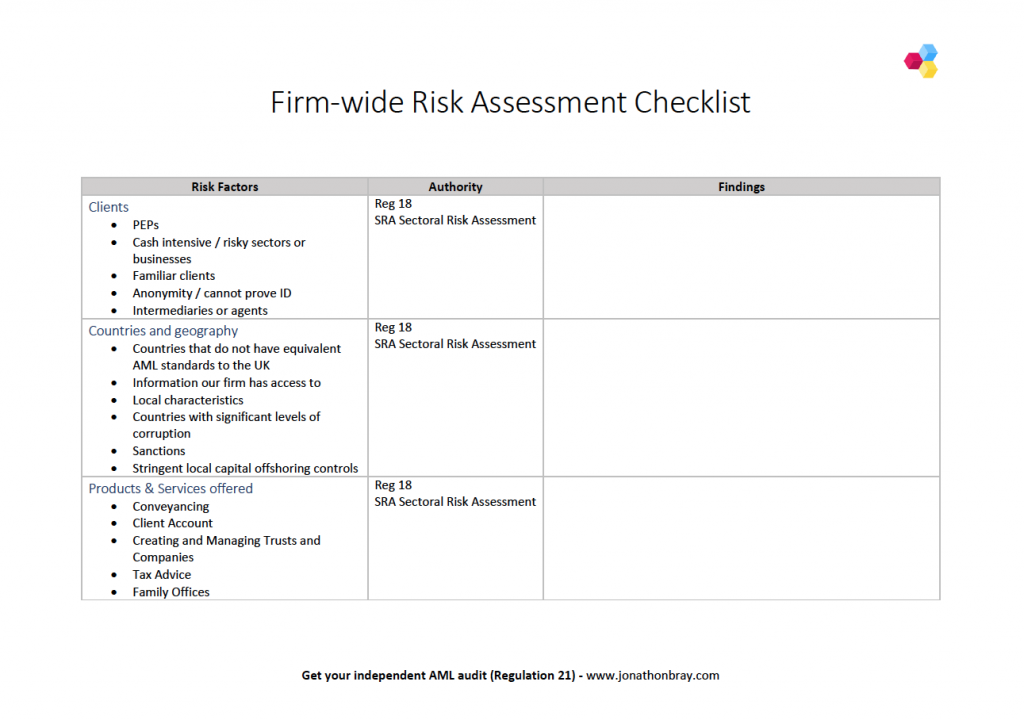

Management structure of the firm and the seriousness of the risk. Conducting Firm-wide AML Risk Assessments Regulation 18 of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 requires insolvency practitioners to have conducted a firm-wide risk assessment of the money laundering and terrorist financing risks that are presented within their business. CCABIs Anti-Money Laundering Guidance For The Accountancy Sector AIs Anti-Money Laundering Guidance For The Accountancy Sector AMLGAS. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. After all if your firm is ever involved in a money laundering situation this assessment will play a central role in ensuring your compliance. Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment.

This paper highlights inspection observations and MAS supervisory expectations of effective EWRA frameworks and processes that financial institutions should benchmark themselves against.

After all if your firm is ever involved in a money laundering situation this assessment will play a central role in ensuring your compliance. We also found individual customer risk assessments to be less defined in most firms. Management structure of the firm and the seriousness of the risk. If criminals were going to target you for money laundering where would you be vulnerable. Firm Wide Risk Assessment The firm wide risk assessment is the foundation document on which your Policy control and procedures will be based. Before beginning this exercise you should review the.

Source: pideeco.be

Source: pideeco.be

A matter or client risk assessment is linked to a specific client file and should assess the money laundering risk of that client or client matter. When you assess the risks of money laundering that apply to your business you need to consider. Do we act for entities with a complex or obscure ownership structure. Help Sheet - AML Training. We ask in FCG 325GOngoing monitoring how a firm monitors.

Source: financeandriskblog.accenture.com

Source: financeandriskblog.accenture.com

Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. Risk Assessment Form Individual Firm-wide Risk Identification and Assessment Template Suspicious Activity Report Changes Required to Policies and Procedures under the 2017 Money Laundering Regulations. Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR17 require firms to take the appropriate steps to identify and assess the risk that they could be used for money laundering including terrorist financing. After all if your firm is ever involved in a money laundering situation this assessment will play a central role in ensuring your compliance. 112 Most firms had a financial crime business-wide risk assessment covering money laundering terrorist financing and fraud as noted.

Source: lexology.com

Source: lexology.com

A firm-wide risk assessment should evaluate the money laundering risk that your whole business is exposed to. As well as meeting your regulatory requirement to The Regulations the a firm wide risk assessment will help you. What is a firm wide risk assessment. A matter or client risk assessment is linked to a specific client file and should assess the money laundering risk of that client or client matter. This risk assessment document becomes the cornerstone of your fight against financial crime.

Source: branddocs.com

Source: branddocs.com

CCABIs Anti-Money Laundering Guidance For The Accountancy Sector AIs Anti-Money Laundering Guidance For The Accountancy Sector AMLGAS. This risk assessment document becomes the cornerstone of your fight against financial crime. We ask in FCG 325GOngoing monitoring how a firm monitors. Help Sheet - AML Training. CCABIs Anti-Money Laundering Guidance For The Accountancy Sector AIs Anti-Money Laundering Guidance For The Accountancy Sector AMLGAS.

Source: pideeco.be

Source: pideeco.be

MAS conducted thematic inspections on enterprise-wide risk assessment on money laundering and terrorism financing EWRA in 2020. After all if your firm is ever involved in a money laundering situation this assessment will play a central role in ensuring your compliance. If criminals were going to target you for money laundering where would you be vulnerable. What is a firm wide risk assessment. Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment.

Source: mdpi.com

Source: mdpi.com

In some firms this was only in draft and had not been approved or challenged at Board level. In some firms this was only in draft and had not been approved or challenged at Board level. We also found individual customer risk assessments to be less defined in most firms. This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. Before beginning this exercise you should review the.

Source: thepaypers.com

Source: thepaypers.com

The conclusion should include a short narrative in support of the conclusion. What is a firm wide risk assessment. 112 Most firms had a financial crime business-wide risk assessment covering money laundering terrorist financing and fraud as noted. The types of customer you have. The draft LSAG AML Guidance for.

Source: pinterest.com

Source: pinterest.com

This risk assessment document becomes the cornerstone of your fight against financial crime. Help Sheet - AML Training. The draft LSAG AML Guidance for. The conclusion should include a short narrative in support of the conclusion. FCG 3 Money laundering and terroristfinancing 31 Introduction 32 Themes.

Source: government.se

This paper highlights inspection observations and MAS supervisory expectations of effective EWRA frameworks and processes that financial institutions should benchmark themselves against. If criminals were going to target you for money laundering where would you be vulnerable. This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR17 require firms to take the appropriate steps to identify and assess the risk that they could be used for money laundering including terrorist financing. FCG 3 Money laundering and terroristfinancing 31 Introduction 32 Themes.

Source: researchgate.net

Source: researchgate.net

Do we act for entities with a complex or obscure ownership structure. What is a firm wide risk assessment. Do we act for clients who have connections with countries which are high risk for money laundering. CCABIs Anti-Money Laundering Guidance For The Accountancy Sector AIs Anti-Money Laundering Guidance For The Accountancy Sector AMLGAS. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm.

Source: worldbank.org

Source: worldbank.org

Risk Assessment Form Individual Firm-wide Risk Identification and Assessment Template Suspicious Activity Report Changes Required to Policies and Procedures under the 2017 Money Laundering Regulations. Apply a risk based approach to detecting and preventing money laundering. The types of customer you have. We ask in FCG 325GOngoing monitoring how a firm monitors. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm.

Source: researchgate.net

Source: researchgate.net

This paper highlights inspection observations and MAS supervisory expectations of effective EWRA frameworks and processes that financial institutions should benchmark themselves against. When you assess the risks of money laundering that apply to your business you need to consider. Help Sheet - AML Training. Management structure of the firm and the seriousness of the risk. FCG 3 Money laundering and terroristfinancing 31 Introduction 32 Themes.

Source: lexology.com

Source: lexology.com

After all if your firm is ever involved in a money laundering situation this assessment will play a central role in ensuring your compliance. MAS conducted thematic inspections on enterprise-wide risk assessment on money laundering and terrorism financing EWRA in 2020. Apply a risk based approach to detecting and preventing money laundering. Before beginning this exercise you should review the. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering firm wide risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.