11++ Money laundering fines fca information

Home » money laundering Info » 11++ Money laundering fines fca informationYour Money laundering fines fca images are available. Money laundering fines fca are a topic that is being searched for and liked by netizens today. You can Get the Money laundering fines fca files here. Download all free photos and vectors.

If you’re searching for money laundering fines fca images information linked to the money laundering fines fca keyword, you have visit the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Money Laundering Fines Fca. Review shows penalties were imposed for the same shortcomings regulators have been highlighting since 2015. Fines for anti-money laundering failures rise as companies repeat mistakes. The FCA has long pledged to use its criminal money laundering powers but has not done so until now. The fine is one of the largest handed out by the regulator in relation to money-laundering failures.

Highest Fca Fines Of 2020 From skillcast.com

Highest Fca Fines Of 2020 From skillcast.com

The failings were serious and lasted for more than three years. The data comes from freedom of information request by law firm Eversheds Sutherland. Last year HMRC announced a 78 million fine against a London MSB that ignored anti-money laundering regulations. NatWest faces FCA money laundering charge over 365m account NatWest is facing criminal proceedings from the UKs Financial Conduct Authority FCA after it was found in breach of money laundering laws. We have fined the firm 873118. 12 rows This Final Notice refers to Asia Research and Capital Managements failure to notify the FCA and disclose to the public its net short position in Premier Oil in breach of short selling disclosure rules.

In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017.

The FCA has long pledged to use its criminal money laundering powers but has not done so until now. The FCA issued a record number of fines in 2019. The watchdog inherited the powers with which it charged NatWest in 2007. The Financial Conduct Authority FCA fined Commerzbank 38 million for money laundering failures including its out of control system to control customers. The Financial Conduct Authority FCA has fined EFG Private Bank Ltd EFG 42 million for failing to take reasonable care to establish and maintain effective anti-money laundering AML controls for high risk customers. Review shows penalties were imposed for the same shortcomings regulators have been highlighting since 2015.

Source: member.fintech.global

Source: member.fintech.global

NatWest faces FCA money laundering charge over 365m account NatWest is facing criminal proceedings from the UKs Financial Conduct Authority FCA after it was found in breach of money laundering laws. The fine is one of the largest handed out by the regulator in relation to money-laundering failures. The FCA issued a record number of fines in 2019. The Financial Conduct Authority FCA fined Commerzbank 38 million for money laundering failures including its out of control system to control customers. There were no anti-money laundering fines issued by regulators in Asia Africa Latin America or Oceania in 2019.

Source: pymnts.com

Source: pymnts.com

There were no anti-money laundering fines issued by regulators in Asia Africa Latin America or Oceania in 2019. 12 rows This Final Notice refers to Asia Research and Capital Managements failure to notify the FCA and disclose to the public its net short position in Premier Oil in breach of short selling disclosure rules. The FCA issued a record number of fines in 2019. FCA Fine for Anti-Money Laundering Failings Posted on 17 June 2020 The FCA has fined Commerzbank AG London Branch Commerzbank 37805400 for failing to put adequate anti-money laundering AML systems and controls in place between October 2012 and September 2017 the Relevant Period. The Swedish Financial Supervisory Authority FSA fined SEK 1 billion the US 107 million for failing to provide adequate anti-money laundering AML measures at its subsidiaries in the Baltic countries of Swedens SEB bank.

Source: insurancejournal.com

Source: insurancejournal.com

Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations. In March 2021 The Financial Conduct Authority FCA announced that it was launching criminal proceedings against NatWest one of the largest banking groups in the UK for allegedly failing to prevent money laundering in line with Money Laundering Regulations 2007. NatWest faces FCA money laundering charge over 365m account NatWest is facing criminal proceedings from the UKs Financial Conduct Authority FCA after it was found in breach of money laundering laws. The bank has become the first to face criminal proceeding under the UKs 2007 Money Laundering Regulations MLR. Since 2002 Asian regulators have imposed 155 billion in fines and Oceanian regulators have imposed 7001 million but Latin American 337 million and African 13 million regulatory bodies have traditionally lagged behind.

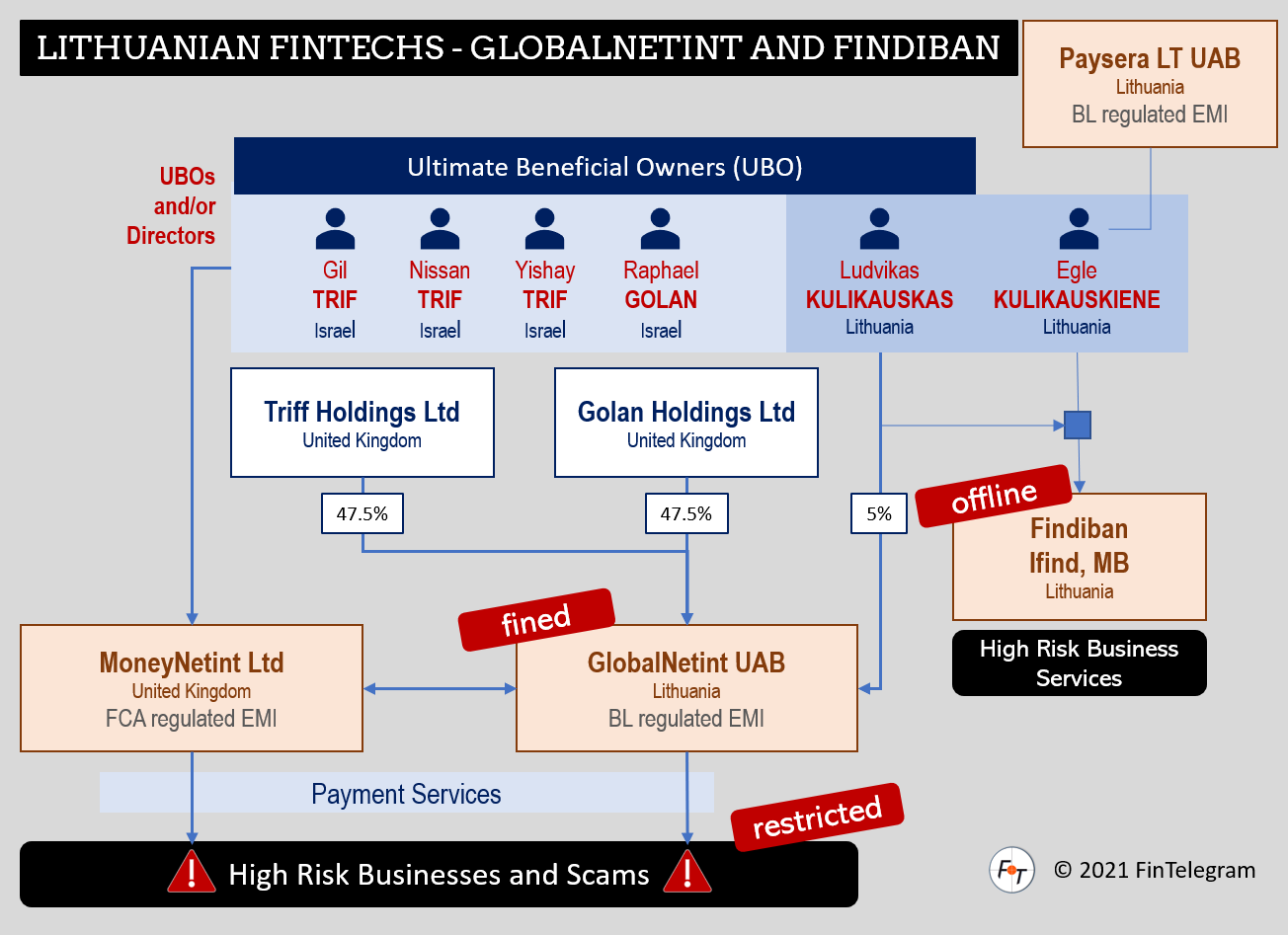

Source: fintelegram.com

Source: fintelegram.com

12 rows This Final Notice refers to Asia Research and Capital Managements failure to notify the FCA and disclose to the public its net short position in Premier Oil in breach of short selling disclosure rules. It shows the regulator stopping seven of its 14 investigations into money laundering since January. NatWest faces FCA money laundering charge over 365m account NatWest is facing criminal proceedings from the UKs Financial Conduct Authority FCA after it was found in breach of money laundering laws. Any fines paid by the lender would go to. In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017.

Source: shuftipro.com

Source: shuftipro.com

The watchdog inherited the powers with which it charged NatWest in 2007. The lender could face unlimited fines if it is found guilty of breaching the FCAs anti-money laundering rules which have yet to be tested in UK courts. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of. Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations. The bank has become the first to face criminal proceeding under the UKs 2007 Money Laundering Regulations MLR.

The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. Since 2002 Asian regulators have imposed 155 billion in fines and Oceanian regulators have imposed 7001 million but Latin American 337 million and African 13 million regulatory bodies have traditionally lagged behind. The Swedish Financial Supervisory Authority FSA fined SEK 1 billion the US 107 million for failing to provide adequate anti-money laundering AML measures at its subsidiaries in the Baltic countries of Swedens SEB bank. Standard Chartered was fined 102m by the FCA in April 2019 for similar issues although that. The watchdog inherited the powers with which it charged NatWest in 2007.

Source: skillcast.com

Source: skillcast.com

The FCA has long pledged to use its criminal money laundering powers but has not done so until now. The bank has become the first to face criminal proceeding under the UKs 2007 Money Laundering Regulations MLR. The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. We have fined the firm 873118. Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations.

Source: fsmatters.com

Source: fsmatters.com

Review shows penalties were imposed for the same shortcomings regulators have been highlighting since 2015. Any fines paid by the lender would go to. The Swedish Financial Supervisory Authority FSA fined SEK 1 billion the US 107 million for failing to provide adequate anti-money laundering AML measures at its subsidiaries in the Baltic countries of Swedens SEB bank. The FCA has long pledged to use its criminal money laundering powers but has not done so until now. Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations.

Source: planetcompliance.com

Source: planetcompliance.com

Any fines paid by the lender would go to. There were no anti-money laundering fines issued by regulators in Asia Africa Latin America or Oceania in 2019. Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations. The Financial Conduct Authority FCA has halted half of its money laundering investigations in 2020. The Financial Conduct Authority FCA has fined EFG Private Bank Ltd EFG 42 million for failing to take reasonable care to establish and maintain effective anti-money laundering AML controls for high risk customers.

Source: international-adviser.com

Source: international-adviser.com

There were no anti-money laundering fines issued by regulators in Asia Africa Latin America or Oceania in 2019. The Swedish Financial Supervisory Authority FSA fined SEK 1 billion the US 107 million for failing to provide adequate anti-money laundering AML measures at its subsidiaries in the Baltic countries of Swedens SEB bank. The Financial Conduct Authority FCA has fined EFG Private Bank Ltd EFG 42 million for failing to take reasonable care to establish and maintain effective anti-money laundering AML controls for high risk customers. The FCA has long pledged to use its criminal money laundering powers but has not done so until now. The bank has become the first to face criminal proceeding under the UKs 2007 Money Laundering Regulations MLR.

Source: sumsub.com

The watchdog inherited the powers with which it charged NatWest in 2007. The FCA has long pledged to use its criminal money laundering powers but has not done so until now. Last year HMRC announced a 78 million fine against a London MSB that ignored anti-money laundering regulations. 22 rows This contains information about fines published during the calendar year. NatWest faces FCA money laundering charge over 365m account NatWest is facing criminal proceedings from the UKs Financial Conduct Authority FCA after it was found in breach of money laundering laws.

Source: skillcast.com

Source: skillcast.com

Last year HMRC announced a 78 million fine against a London MSB that ignored anti-money laundering regulations. In March 2021 The Financial Conduct Authority FCA announced that it was launching criminal proceedings against NatWest one of the largest banking groups in the UK for allegedly failing to prevent money laundering in line with Money Laundering Regulations 2007. The watchdog inherited the powers with which it charged NatWest in 2007. FCA said the German business bank failed to meet money laundering controls despite three separate warnings for. The lender could face unlimited fines if it is found guilty of breaching the FCAs anti-money laundering rules which have yet to be tested in UK courts.

Source: cityam.com

Source: cityam.com

The FCA has long pledged to use its criminal money laundering powers but has not done so until now. The Financial Conduct Authority FCA has halted half of its money laundering investigations in 2020. Over the last 12 months we have seen a number of record fines imposed by the FCA and HMRC for non-compliance with money laundering regulations. Since 2002 Asian regulators have imposed 155 billion in fines and Oceanian regulators have imposed 7001 million but Latin American 337 million and African 13 million regulatory bodies have traditionally lagged behind. Any fines paid by the lender would go to.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering fines fca by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.