15++ Money laundering fines europe information

Home » money laundering idea » 15++ Money laundering fines europe informationYour Money laundering fines europe images are ready in this website. Money laundering fines europe are a topic that is being searched for and liked by netizens today. You can Get the Money laundering fines europe files here. Download all royalty-free images.

If you’re looking for money laundering fines europe pictures information connected with to the money laundering fines europe interest, you have come to the right site. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

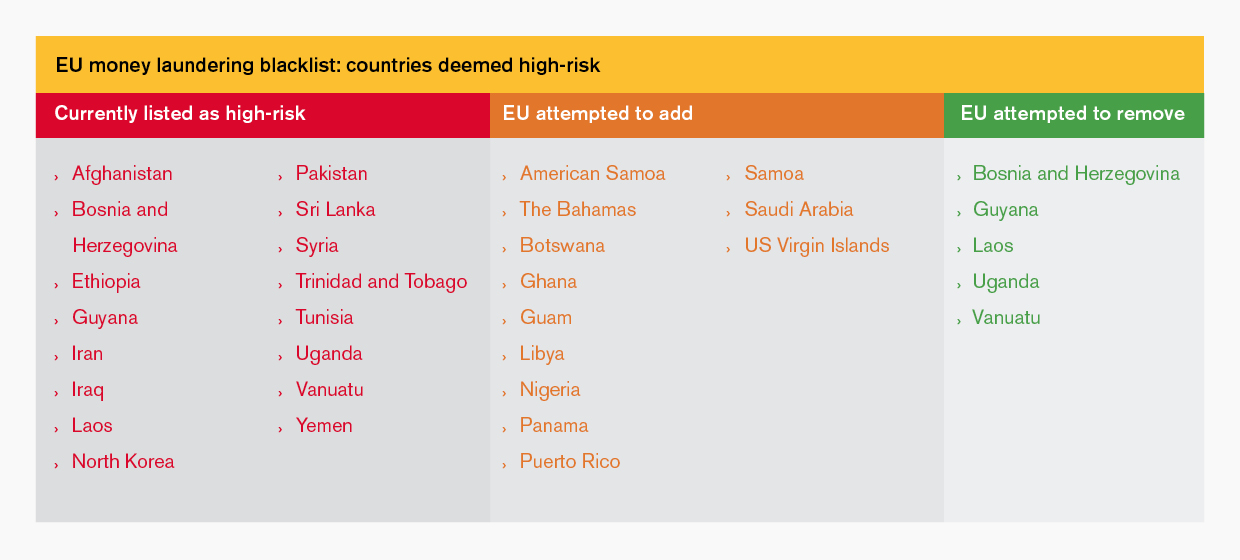

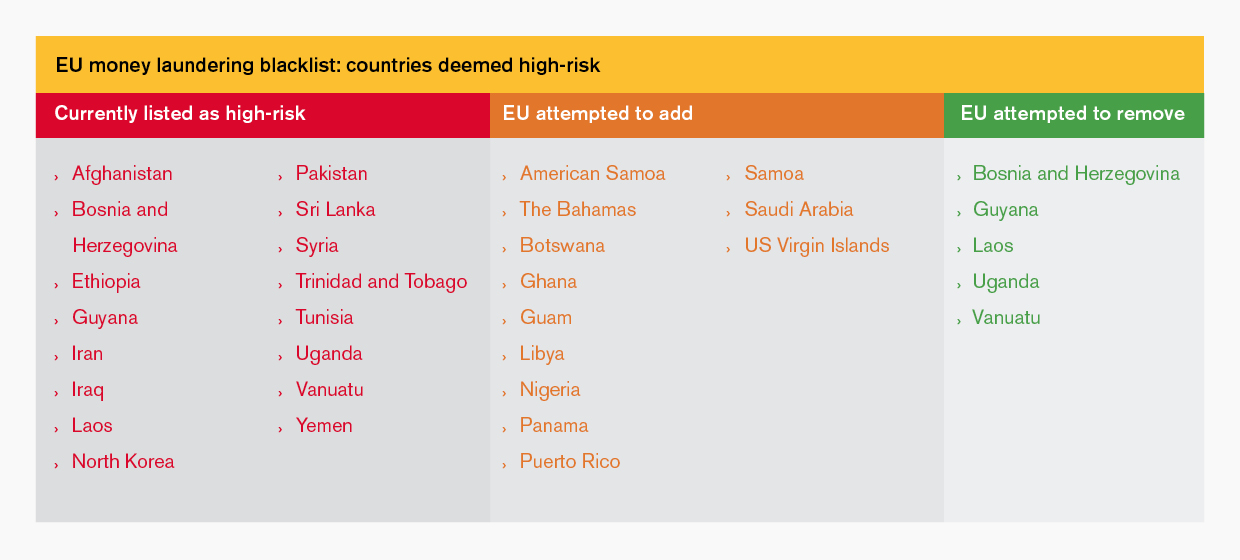

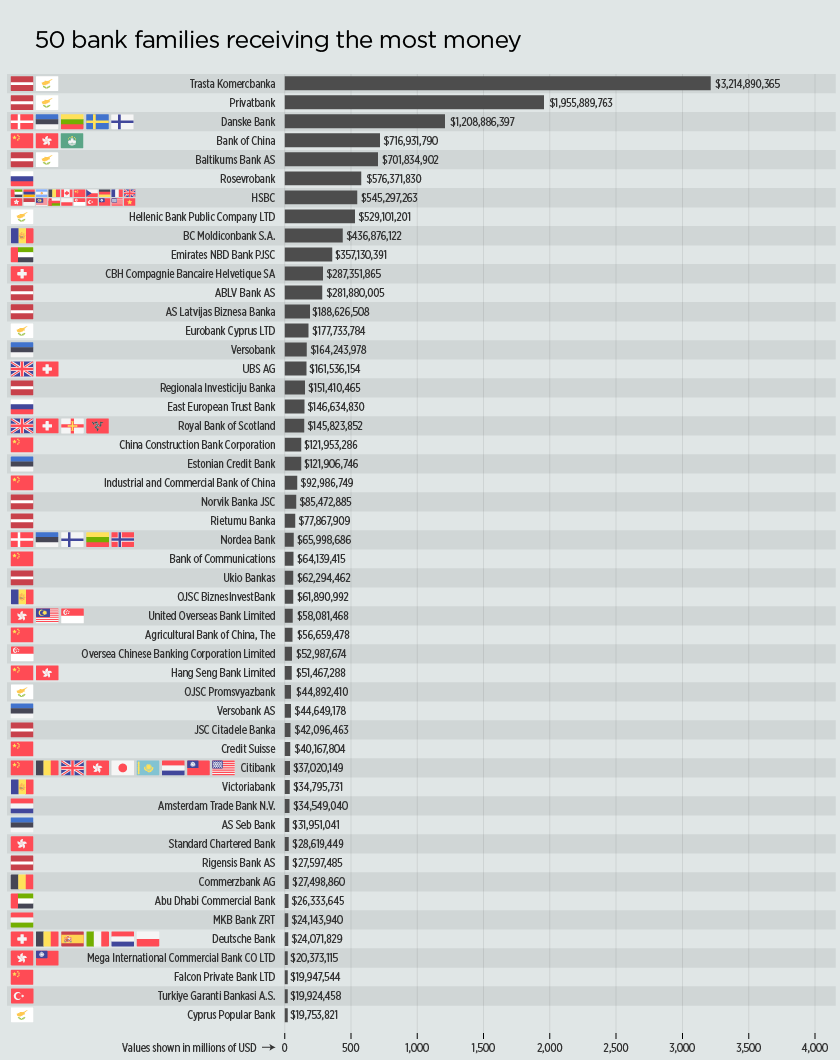

Money Laundering Fines Europe. While regulators in the United States and the United Kingdom were the most active penalties were issued by authorities in jurisdictions around Europe Asia and Oceania. Banks that received the Russian Laundromat money according to OCCRP. New economic crime centre will tackle money-laundering The firm found that at least 18 of the 20 biggest banks in Europe including five UK institutions have been fined for offences relating to. Money laundering is an offence in its own right but it is also closely related to other forms of serious and organised crime as.

What Does Europe S Anti Money Laundering Overhaul Mean For Trade Finance Global Trade Review Gtr From gtreview.com

What Does Europe S Anti Money Laundering Overhaul Mean For Trade Finance Global Trade Review Gtr From gtreview.com

Identify and verify the identity of clients monitor transactions and report suspicious transactions. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. This week there was an excellent article on EuroMoney highlighting how Europe has fallen behind on the prevention of financial crime and money laundering. FCMC fined Signet Bank of Latvia 906610 Euro for violating anti-money laundering and anti-terrorism financing AML regulatory requirements. Swedbank will now pay a total of SEK466M 457M over twelve annual payments following a review by Nasdaq Stockholm AB Nasdaq the principal securities exchange entity serving the Nordics. ONE OF the largest banks in Sweden has been handed a financial penalty for AML deficiencies that lasted several years and were known to senior management.

In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences.

The trouble surfaced in 2016 when Dutch prosecutors began to investigate Netherlands-based lender ING after identifying a pattern of suspicious transactions from clients dating back to 2007. The reasons for the fines include the Banks inadequate internal control system customer-based risks and violations and. The authority will have direct supervisory powers to crack down on illicit finance across the union. While regulators in the United States and the United Kingdom were the most active penalties were issued by authorities in jurisdictions around Europe Asia and Oceania. Fines for anti-money laundering failures rise as companies repeat mistakes One of the highest-profile enforcement actions involved the London branch of Commerzbank which was fined 38m by the UKs. The fines against the two countries come just after a recent decision by the European Commission to refer Austria Belgium and the Netherlands to the European Court of Justice for failing to implement the same anti-money laundering directive which was first introduced in 2015.

Source: complyadvantage.com

Source: complyadvantage.com

Theres evidence that the level of fines is starting to slow. While regulators in the United States and the United Kingdom were the most active penalties were issued by authorities in jurisdictions around Europe Asia and Oceania. Europe accounts for 7 of global AML fines levied in the last 10 years totalling over 17 billion across 83 separate fines with 17 regulators across 15 countries. Money laundering is one of the EMPACT priorities Europols priority crime areas under the 20182021 EU Policy Cycle. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002.

Source: arachnys.com

Source: arachnys.com

This week there was an excellent article on EuroMoney highlighting how Europe has fallen behind on the prevention of financial crime and money laundering. In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences. The largest part of this money passed through the Estonian branch of Danske Bank Denmarks biggest bank which is in the spotlight for having allowed around 95 million payments from high-risk customers including as part of other money laundering schemes such as the Azerbaijani. Theres evidence that the level of fines is starting to slow. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Money laundering is not only alive and kicking it has also caused some of Europes most significant financial scandals in continental history. Fines for anti-money laundering failures rise as companies repeat mistakes One of the highest-profile enforcement actions involved the London branch of Commerzbank which was fined 38m by the UKs. Almost all criminal activities yield profits often in the form of cash that the criminals then seek to launder through various channels. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. FCMC fined Signet Bank of Latvia 906610 Euro for violating anti-money laundering and anti-terrorism financing AML regulatory requirements.

Source: bankinghub.eu

Source: bankinghub.eu

Theres evidence that the level of fines is starting to slow. While regulators in the United States and the United Kingdom were the most active penalties were issued by authorities in jurisdictions around Europe Asia and Oceania. New economic crime centre will tackle money-laundering The firm found that at least 18 of the 20 biggest banks in Europe including five UK institutions have been fined for offences relating to. The fines against the two countries come just after a recent decision by the European Commission to refer Austria Belgium and the Netherlands to the European Court of Justice for failing to implement the same anti-money laundering directive which was first introduced in 2015. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: pideeco.be

Source: pideeco.be

Money laundering is not only alive and kicking it has also caused some of Europes most significant financial scandals in continental history. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. The authority will have direct supervisory powers to crack down on illicit finance across the union. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

The plans for the AMLA will be unveiled on July 20 next as part of a new legislative package from the European Commission. It added that it would also recommend that these countries face. HONG KONG Reuters - Regulators in the United States and Europe have imposed 342 billion of fines on banks since 2009 for misconduct including violation of anti-money laundering. Banks that received the Russian Laundromat money according to OCCRP. A huge part of the issue according to author Dominic ONeill is that European banks feel far more threatened by the US government than by its own tax authorities.

Source: euronews.com

Source: euronews.com

The largest part of this money passed through the Estonian branch of Danske Bank Denmarks biggest bank which is in the spotlight for having allowed around 95 million payments from high-risk customers including as part of other money laundering schemes such as the Azerbaijani. The reasons for the fines include the Banks inadequate internal control system customer-based risks and violations and. A huge part of the issue according to author Dominic ONeill is that European banks feel far more threatened by the US government than by its own tax authorities. EU banks payed over 16 billion in fines between 2012 and 2018 because of lax money-laundering checks rating agency Moodys said in a report. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: gtreview.com

Source: gtreview.com

The trouble surfaced in 2016 when Dutch prosecutors began to investigate Netherlands-based lender ING after identifying a pattern of suspicious transactions from clients dating back to 2007. The plans for the AMLA will be unveiled on July 20 next as part of a new legislative package from the European Commission. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Theres evidence that the level of fines is starting to slow. While regulators in the United States and the United Kingdom were the most active penalties were issued by authorities in jurisdictions around Europe Asia and Oceania.

It added that it would also recommend that these countries face. The fines against the two countries come just after a recent decision by the European Commission to refer Austria Belgium and the Netherlands to the European Court of Justice for failing to implement the same anti-money laundering directive which was first introduced in 2015. In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences. Money laundering is not only alive and kicking it has also caused some of Europes most significant financial scandals in continental history. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: acfcs.org

Source: acfcs.org

Money laundering is not only alive and kicking it has also caused some of Europes most significant financial scandals in continental history. A huge part of the issue according to author Dominic ONeill is that European banks feel far more threatened by the US government than by its own tax authorities. EU banks payed over 16 billion in fines between 2012 and 2018 because of lax money-laundering checks rating agency Moodys said in a report. This week there was an excellent article on EuroMoney highlighting how Europe has fallen behind on the prevention of financial crime and money laundering. Money laundering is an offence in its own right but it is also closely related to other forms of serious and organised crime as.

Source: irishtimes.com

Source: irishtimes.com

In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences. Money laundering is an offence in its own right but it is also closely related to other forms of serious and organised crime as. And like Danske Bank and HSBC have forked out 321 billion since 2008 on money-laundering fines estimates the Boston Consulting Group. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. HONG KONG Reuters - Regulators in the United States and Europe have imposed 342 billion of fines on banks since 2009 for misconduct including violation of anti-money laundering.

Source: paymentscardsandmobile.com

Source: paymentscardsandmobile.com

The largest part of this money passed through the Estonian branch of Danske Bank Denmarks biggest bank which is in the spotlight for having allowed around 95 million payments from high-risk customers including as part of other money laundering schemes such as the Azerbaijani. EU banks payed over 16 billion in fines between 2012 and 2018 because of lax money-laundering checks rating agency Moodys said in a report. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. A huge part of the issue according to author Dominic ONeill is that European banks feel far more threatened by the US government than by its own tax authorities. In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences.

Source: voices.transparency.org

Source: voices.transparency.org

The reasons for the fines include the Banks inadequate internal control system customer-based risks and violations and. EUROPES new anti-financial crime agency will be known as the Anti-Money Laundering Authority AMLA it has been confirmed. This week there was an excellent article on EuroMoney highlighting how Europe has fallen behind on the prevention of financial crime and money laundering. In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences. The plans for the AMLA will be unveiled on July 20 next as part of a new legislative package from the European Commission.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title money laundering fines europe by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.