10++ Money laundering directive beneficial ownership ideas in 2021

Home » money laundering idea » 10++ Money laundering directive beneficial ownership ideas in 2021Your Money laundering directive beneficial ownership images are ready in this website. Money laundering directive beneficial ownership are a topic that is being searched for and liked by netizens now. You can Download the Money laundering directive beneficial ownership files here. Find and Download all royalty-free photos and vectors.

If you’re looking for money laundering directive beneficial ownership images information related to the money laundering directive beneficial ownership keyword, you have pay a visit to the right blog. Our site always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

Money Laundering Directive Beneficial Ownership. Beneficial Ownership of Trusts Regulations 2021 SI. Beneficial Ownership April 2019. The 5th AMLD Directive allows for countries to charge people for access to beneficial ownership information as long as the charge does not exceed the administrative costs of making the information available which in the case of some of the larger fees we. For the purposes of the Fourth Anti -Money Laundering Directive a beneficial owner is an individual or legal entity which ultimately owns or controls more than 25 of a companys shares or voting rights or exercises control over the management of the company.

Ultimate Beneficial Ownership Ubo Checks Lexisnexis Hong Kong From internationalsales.lexisnexis.com

Ultimate Beneficial Ownership Ubo Checks Lexisnexis Hong Kong From internationalsales.lexisnexis.com

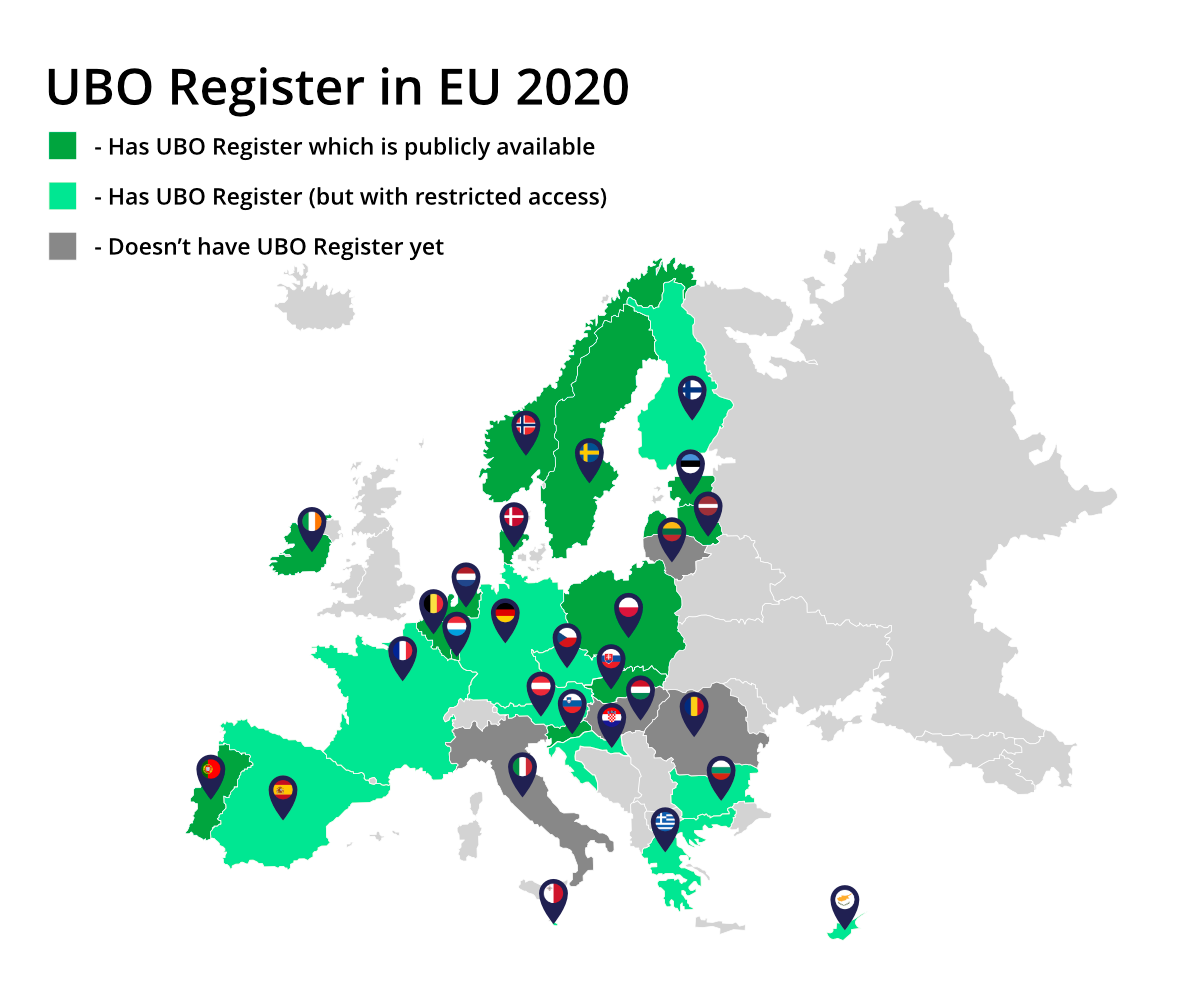

The Panama Papers was a key driver for the 5th Money Laundering Directive 5MLD to include that all EU member states will be required to identify beneficial owners of companies and to maintain public registers of these. The final directive was adopted in Spring 2018 and entered into force on 9 July 2018. Trust corporate service providers are subject to anti-money laundering rules and therefore compelled to. Despite interim discussions to lower the threshold to 10 percent it remains unchanged at 25 percent of the control rights. 50 Germany does not have a domestic trust law but foreign trusts can be administered. Central registers should be interconnected.

The concept of cash laundering is essential to be understood for those working in the monetary sector.

The EU Money Laundering Regulation harmonises provisions on issues such as CDD identity verification and identifying beneficial owners. The main changes to the Anti-Money Laundering Directive in relation to beneficial ownership. The Directive EU 2018843 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing AML 5 1 entered into force on July 9 2018. Despite interim discussions to lower the threshold to 10 percent it remains unchanged at 25 percent of the control rights. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership. Trust corporate service providers are subject to anti-money laundering rules and therefore compelled to.

Source:

194 of 2021 apply a designated person shall ascertain that information concerning the beneficial ownership of the customer is entered in the relevant trusts beneficial ownership register or in the Central Register of Beneficial Ownership. The 5th EU Anti-Money Laundering Directive does not contain any amendments regarding the participation threshold for determining the beneficial owner. Despite interim discussions to lower the threshold to 10 percent it remains unchanged at 25 percent of the control rights. 5th anti money laundering directive beneficial ownership. The Beneficial Ownership Register UBO Register.

Source: pinterest.com

Source: pinterest.com

The Panama Papers was a key driver for the 5th Money Laundering Directive 5MLD to include that all EU member states will be required to identify beneficial owners of companies and to maintain public registers of these. Text of the proposal for a regulation on AMLCFT. The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership. 50 Germany does not have a domestic trust law but foreign trusts can be administered. The Panama Papers was a key driver for the 5th Money Laundering Directive 5MLD to include that all EU member states will be required to identify beneficial owners of companies and to maintain public registers of these.

Source:

The Panama Papers was a key driver for the 5th Money Laundering Directive 5MLD to include that all EU member states will be required to identify beneficial owners of companies and to maintain public registers of these. Beneficial Ownership April 2019. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership. Through the 5th Anti-Money Laundering Directive the EU introduced some significant and important changes to the requirements related to beneficial ownership transparency. The Directive states that EU member states should set up beneficial ownership registers for corporate and other legal entities by 10 January 2020 and for trusts and similar legal arrangements by 10 March 2020.

Source:

In Denmark it is already mandatory to report owners with. 194 of 2021 apply a designated person shall ascertain that information concerning the beneficial ownership of the customer is entered in the relevant trusts beneficial ownership register or in the Central Register of Beneficial Ownership. The EU Money Laundering Regulation harmonises provisions on issues such as CDD identity verification and identifying beneficial owners. The 5th EU Anti-Money Laundering Directive does not contain any amendments regarding the participation threshold for determining the beneficial owner. 5th Money Laundering Directive Beneficial Ownership on August 09 2021 Get link.

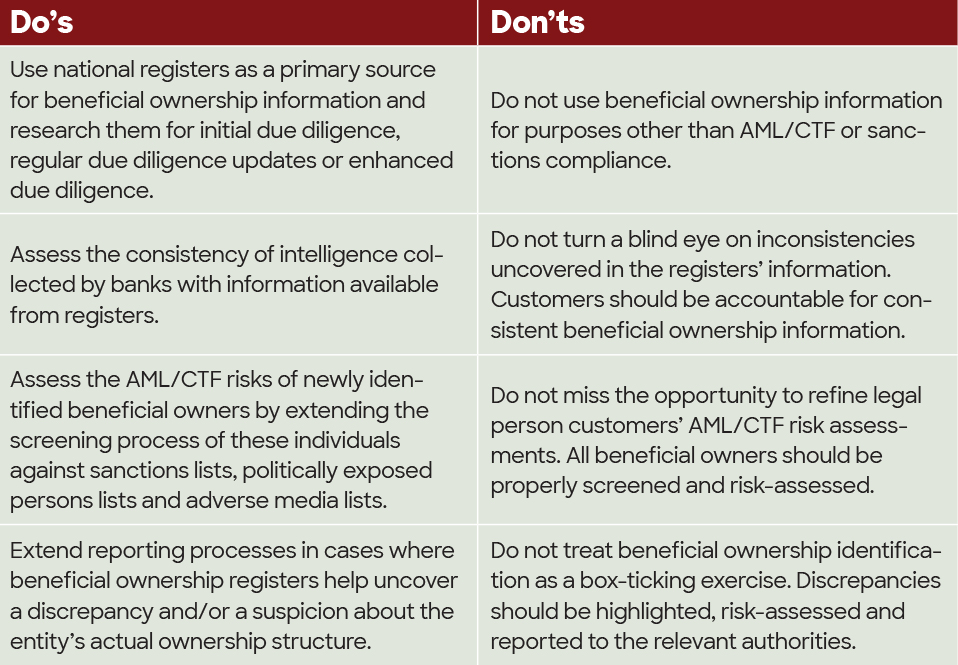

Source: acamstoday.org

Source: acamstoday.org

The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership. In Denmark it is already mandatory to report owners with. In 2017 4MLD introduced a focus on ultimate beneficial ownership UBO for the purposes of risk mitigation and money laundering prevention. The Directive EU 2018843 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing AML 5 1 entered into force on July 9 2018. 5th Money Laundering Directive Beneficial Ownership on August 09 2021 Get link.

Source: credas.co.uk

Source: credas.co.uk

Central registers should be interconnected. Its a process by which soiled cash is converted into clean cash. Text of the proposal for a regulation on AMLCFT. It also includes the setting up of an EU-wide limit of 10000 to large cash payments. The Directive states that EU member states should set up beneficial ownership registers for corporate and other legal entities by 10 January 2020 and for trusts and similar legal arrangements by 10 March 2020.

Source: medium.com

Source: medium.com

The Directive states that EU member states should set up beneficial ownership registers for corporate and other legal entities by 10 January 2020 and for trusts and similar legal arrangements by 10 March 2020. Beneficial Ownership of Trusts Regulations 2021 SI. The 5th AMLD Directive allows for countries to charge people for access to beneficial ownership information as long as the charge does not exceed the administrative costs of making the information available which in the case of some of the larger fees we. Member States should also ensure that other persons who are able to demonstrate a legitimate interest with respect to money laundering terrorist financing and the associated predicate offences such as corruption tax crimes and fraud are granted access to beneficial ownership information in accordance with data protection rules. 5MLD builds on those steps introducing the following measures.

Source: vinciworks.com

Source: vinciworks.com

The Panama Papers was a key driver for the 5th Money Laundering Directive 5MLD to include that all EU member states will be required to identify beneficial owners of companies and to maintain public registers of these. 5MLD builds on those steps introducing the following measures. The Panama Papers was a key driver for the 5th Money Laundering Directive 5MLD to include that all EU member states will be required to identify beneficial owners of companies and to maintain public registers of these. The sixth EU Money Laundering Directive includes certain requirements in regard to national central registers of beneficial ownership information central registers. 5AMLD 5th Anti-Money Laundering Directive.

Source: complyadvantage.com

Source: complyadvantage.com

UBO lists drawn up under 4MLD are to be made publicly accessible. The final directive was adopted in Spring 2018 and entered into force on 9 July 2018. 5MLD builds on those steps introducing the following measures. The 5th AMLD Directive allows for countries to charge people for access to beneficial ownership information as long as the charge does not exceed the administrative costs of making the information available which in the case of some of the larger fees we. Beneficial Ownership April 2019.

Source: mhc.ie

Source: mhc.ie

The 5th EU Anti-Money Laundering Directive does not contain any amendments regarding the participation threshold for determining the beneficial owner. Beneficial Ownership April 2019. 3A Prior to the establishment of a business relationship with a customer to which the European Union Anti-Money Laundering. The main changes to the Anti-Money Laundering Directive in relation to beneficial ownership. The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

5th anti money laundering directive beneficial ownership. Directive on Anti-Money Laundering approved in May 2015 which foresees the existence of a beneficial ownership registry. The Directive EU 2018843 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing AML 5 1 entered into force on July 9 2018. Beneficial Ownership April 2019. The 5th EU Anti-Money Laundering Directive does not contain any amendments regarding the participation threshold for determining the beneficial owner.

Source: exsusinternational.com

Source: exsusinternational.com

In Denmark it is already mandatory to report owners with. The 5th EU Anti-Money Laundering Directive does not contain any amendments regarding the participation threshold for determining the beneficial owner. The new regulation will contain directly applicable rules including in the areas of customer due diligence and beneficial ownership. Fifth EU Money Laundering Directive - Beneficial Ownership Transparency 18 November 2019 Welcome to the third of our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. For the purposes of the Fourth Anti -Money Laundering Directive a beneficial owner is an individual or legal entity which ultimately owns or controls more than 25 of a companys shares or voting rights or exercises control over the management of the company.

Source: internationalsales.lexisnexis.com

Source: internationalsales.lexisnexis.com

Its a process by which soiled cash is converted into clean cash. 50 Germany does not have a domestic trust law but foreign trusts can be administered. Fifth EU Money Laundering Directive - Beneficial Ownership Transparency 18 November 2019 Welcome to the third of our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. The leak ultimately brought to the forefront the lack of transparency surrounding shell companies. 5AMLD 5th Anti-Money Laundering Directive.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering directive beneficial ownership by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.