10++ Money laundering country risk ratings ideas in 2021

Home » money laundering Info » 10++ Money laundering country risk ratings ideas in 2021Your Money laundering country risk ratings images are available in this site. Money laundering country risk ratings are a topic that is being searched for and liked by netizens now. You can Get the Money laundering country risk ratings files here. Find and Download all royalty-free images.

If you’re searching for money laundering country risk ratings pictures information related to the money laundering country risk ratings topic, you have come to the right blog. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

Money Laundering Country Risk Ratings. Jurisdiction of citizenship The money laundering risk rating of every country needs to be included in the risk rating methodology used to assess the customers overall risk rating. As of October 2018 the FATF has reviewed over 80 countries and. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The tool can also be used to iteratively observe and analyse the effects of.

Infographic The Countries With The Fastest Internet Fast Internet Infographic Internet From pinterest.com

Infographic The Countries With The Fastest Internet Fast Internet Infographic Internet From pinterest.com

It was deemed Highly effective for 0 and Substantially Effective for 0 of the Effectiveness Technical Compliance ratings. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The tool provides a means to understand sources of vulnerability in a country and how various factors that influence the vulnerability are inter-related. Russias risk level in the Basel AML Index has hit a record low following a December 2019 Financial Action Task Force FATF assessment that rated the countrys anti-money laundering and counter terrorist financing AMLCFT systems as reasonably effective. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. Only countries with sufficient data to calculate a reliable MLTF risk score are included in the Public Edition of the Basel AML Index.

Working Group members also get hands-on training on the Risk Assessment Tool.

The Expert Edition which is free for academic public and supervisory institutions and non-profit organisations contains a more detailed overview of all 203 countries and their risk scores based on the available data. Financial transparency and standards 326. Its biggest shortcoming is the quality of AML CFT frames. Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. KnowYourCountry Limited has achieved ISO 90012015 Certification for the provision of on-line information of money laundering and sanction information on a country by country basis.

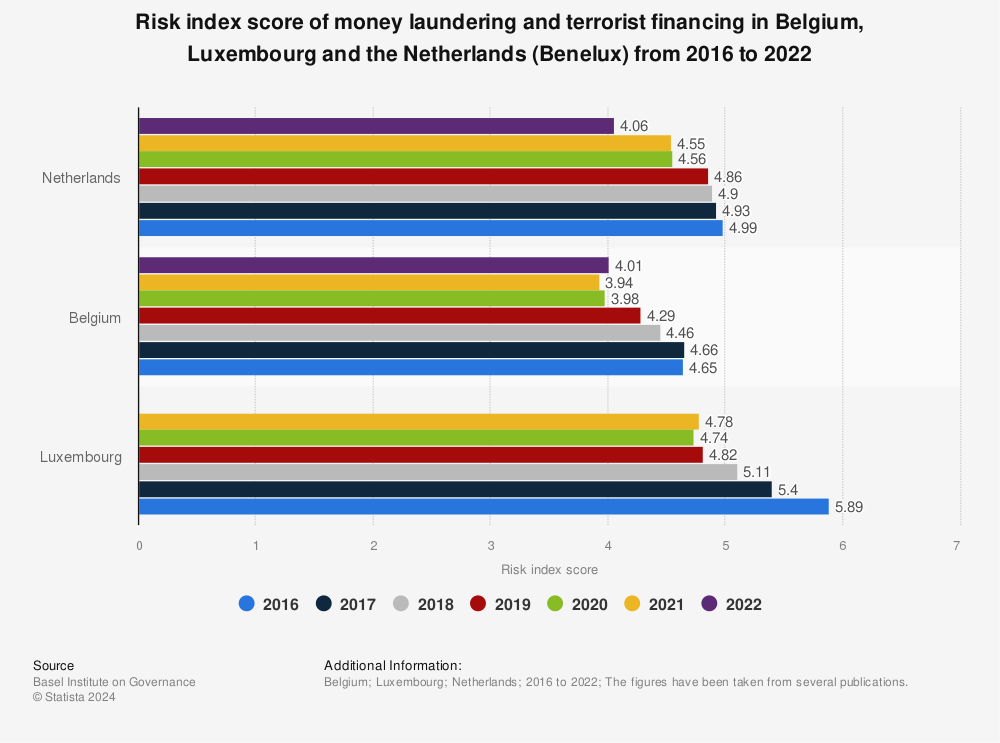

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. The Expert Edition which is free for academic public and supervisory institutions and non-profit organisations contains a more detailed overview of all 203 countries and their risk scores based on the available data. The assessment process starts during the workshop and usually continues for 5. In this region countries money laundering risk rating generally is a lower risk than the global average.

Source: pinterest.com

Source: pinterest.com

The tool can also be used to iteratively observe and analyse the effects of. Financial transparency and standards 326. The country has high risks relating to the poor quality of its AMLCFT framework Domain 1 scoring 912 out of 10. Bribery and corruption 316. In fact only six countries improved their scores by more than one point.

Source: pinterest.com

Source: pinterest.com

KnowYourCountry Limited has achieved ISO 90012015 Certification for the provision of on-line information of money laundering and sanction information on a country by country basis. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring. Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships. The overall risk score is 401.

Source: ar.pinterest.com

Source: ar.pinterest.com

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Singapore was undertaken in 2019. Jurisdiction of citizenship The money laundering risk rating of every country needs to be included in the risk rating methodology used to assess the customers overall risk rating. The Expert Edition which is free for academic public and supervisory institutions and non-profit organisations contains a more detailed overview of all 203 countries and their risk scores based on the available data. The country has high risks relating to the poor quality of its AMLCFT framework Domain 1 scoring 912 out of 10. Its biggest shortcoming is the quality of AML CFT frames.

Source: gr.pinterest.com

Source: gr.pinterest.com

A domicile may have one of three country money laundering risks. The tool provides a means to understand sources of vulnerability in a country and how various factors that influence the vulnerability are inter-related. You should have risk-based systems and controls in place for. Its biggest shortcoming is the quality of AML CFT frames. The assessment process starts during the workshop and usually continues for 5.

Source: bi.go.id

Source: bi.go.id

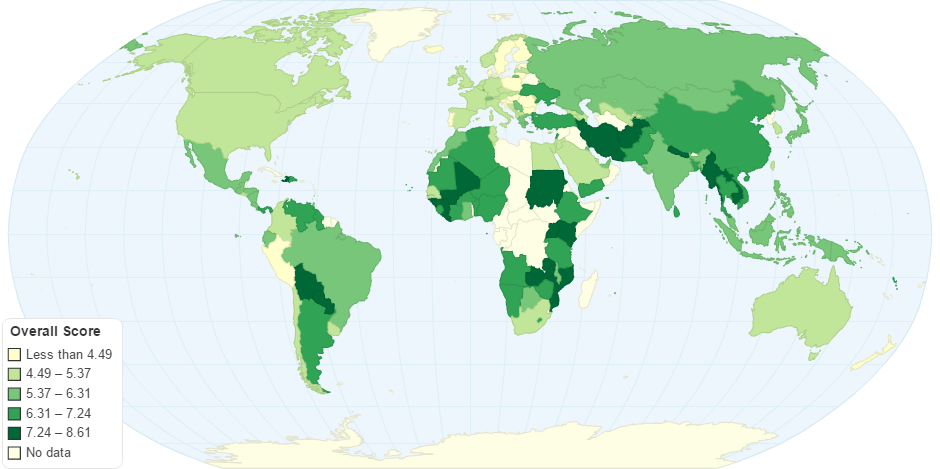

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The average MLTF risk score across all 141 countries in the 2020 Public Edition of the Basel AML Index remains unacceptably high at 522 out of 10 where 10 equals maximum risk. The Expert Edition which is free for academic public and supervisory institutions and non-profit organisations contains a more detailed overview of all 203 countries and their risk scores based on the available data. The overall risk score is 401.

Source: bi.go.id

Source: bi.go.id

The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. US Department of State Money Laundering assessment INCSR Cayman Islands is categorised by the US State Department as a CountryJurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes. Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships. The overall risk score is 401.

Source: pinterest.com

Source: pinterest.com

The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The average MLTF risk score across all 141 countries in the 2020 Public Edition of the Basel AML Index remains unacceptably high at 522 out of 10 where 10 equals maximum risk. Quality of AML CFT framework is 46. Assist decision-makers to assess and analyse money laundering risk in a jurisdiction. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process.

Source: pinterest.com

Source: pinterest.com

As of October 2018 the FATF has reviewed over 80 countries and. Laos has an overall score of 821 and continues to face a high risk of money laundering despite leaving the FATFs list of jurisdictions with strategic deficiencies in 2017. A domicile may have one of three country money laundering risks. Only countries with sufficient data to calculate a reliable MLTF risk score are included in the Public Edition of the Basel AML Index. Financial transparency and standards 326.

Source: pinterest.com

Source: pinterest.com

Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. A domicile may have one of three country money laundering risks. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. The overall risk score is 401. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year.

Source: baselgovernance.org

Source: baselgovernance.org

Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. 35 countries went backwards. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year.

Source: statista.com

Source: statista.com

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Singapore was undertaken in 2019. Financial transparency and standards 326. KnowYourCountry Limited has achieved ISO 90012015 Certification for the provision of on-line information of money laundering and sanction information on a country by country basis. This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. The tool can also be used to iteratively observe and analyse the effects of.

Source: pinterest.com

Source: pinterest.com

According to that Evaluation Bahrain was deemed Compliant for 8 and Largely Compliant for 26 of the FATF 40 Recommendations. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring. The 24 high-risk third countries are. Based upon data collected from many international and government agencies we have subjectively weighted the findings to provide a free rating tool that is predominantly focused on money laundering and. KnowYourCountry Limited has achieved ISO 90012015 Certification for the provision of on-line information of money laundering and sanction information on a country by country basis.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title money laundering country risk ratings by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.